- 5.1 million addresses stay underwater regardless of latest Bitcoin’s rally.

- BTC has surged by 9.99% over the previous week.

Bitcoin [BTC] has skilled a robust upswing on its worth charts during the last week. Though BTC began September on a unfavourable notice, the latest features have outweighed the month-to-month losses.

In truth, as of this writing, BTC was buying and selling at $63,668. This marked a 9.99% surge over the previous week.

Additionally, on month-to-month charts, it has made appreciable features surging by 6.99%. Since making decrease lows, of $52546 on sixth September, it has recovered from all of the earlier losses.

Regardless of the latest uptick, Bitcoin nonetheless stays considerably under its latest excessive of $70016 recorded on twenty ninth of July. Subsequently, the sudden worth motion has left analysts speaking.

Inasmuch, IntoTheBlock analysts stays skeptical of the latest rally citing 5.1 million addresses that stay underwater.

5.1 million BTC addresses stay underwater

In keeping with IntoTheBlock, though BTC is making a robust effort to interrupt via $63k resistance, many traders stay at a loss. Primarily based on this evaluation, there are 5.1 million addresses which might be in loss on the present market worth.

What this merely means is that 5.1 million wallets are holding BTC at a loss suggesting they bought at a better worth than present charges. This suggests that the investments haven’t but recovered.

Such situation suggests {that a} vital variety of traders are ready for costs to rise additional earlier than breaking even or making a revenue. When the market is like this, traders can both promote at a loss to keep away from additional losses or maintain till they understand the revenue.

In the event that they determined to promote, these addresses might create promoting stress. It’s attainable to promote as soon as they get well their losses thus slowing down the upward momentum. Subsequently, they’ll maintain additional anticipating extra features.

Prevailing market sentiment

Whereas the metric highlighted by IntoTheBlock provides causes to fret over the latest rally, the broader market has proven resilience over the previous week.

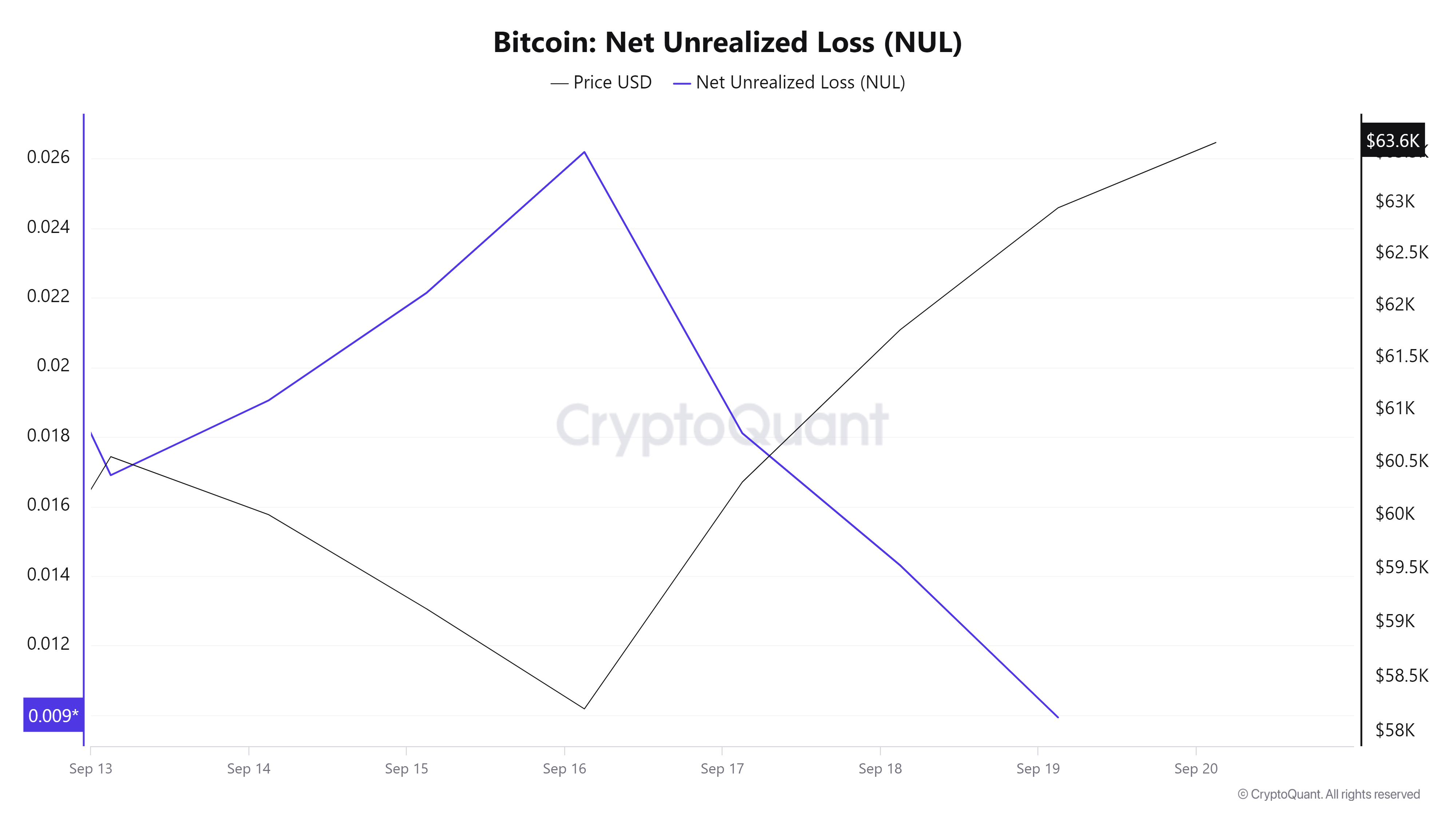

Over this era, Bitcoin has skilled a major decline in Web unrealized loss. NUL has declined from 0.026 to 0.009 this means that the market is recovering and plenty of contributors are seeing their holdings method break even or flip to profitability.

It is a bullish signal because the market is shifting from a interval of decline to a interval of worth restoration thus reducing the hole between present charges and buy costs.

Supply: Cryptoquant

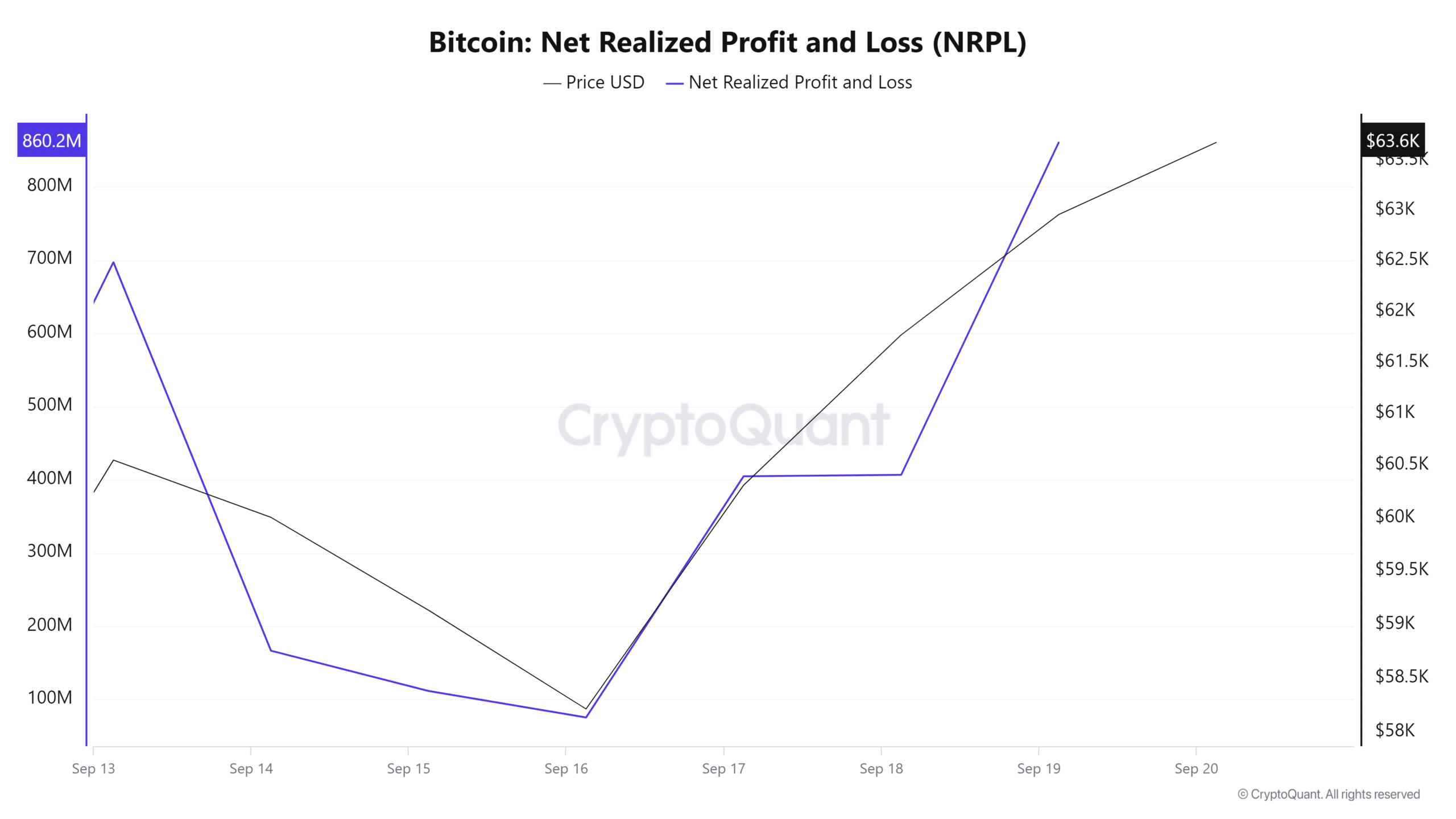

Moreover, Bitcoin’s Web Realized Revenue/loss has been rising from a low of $75.5 million to $860.2 million over the previous week.

When NRPL will increase, it displays constructive market sentiment with a major variety of contributors realizing income. This additional reinforces the arrogance that costs will proceed to rise thus attracting extra patrons.

Supply: CryptoQuant

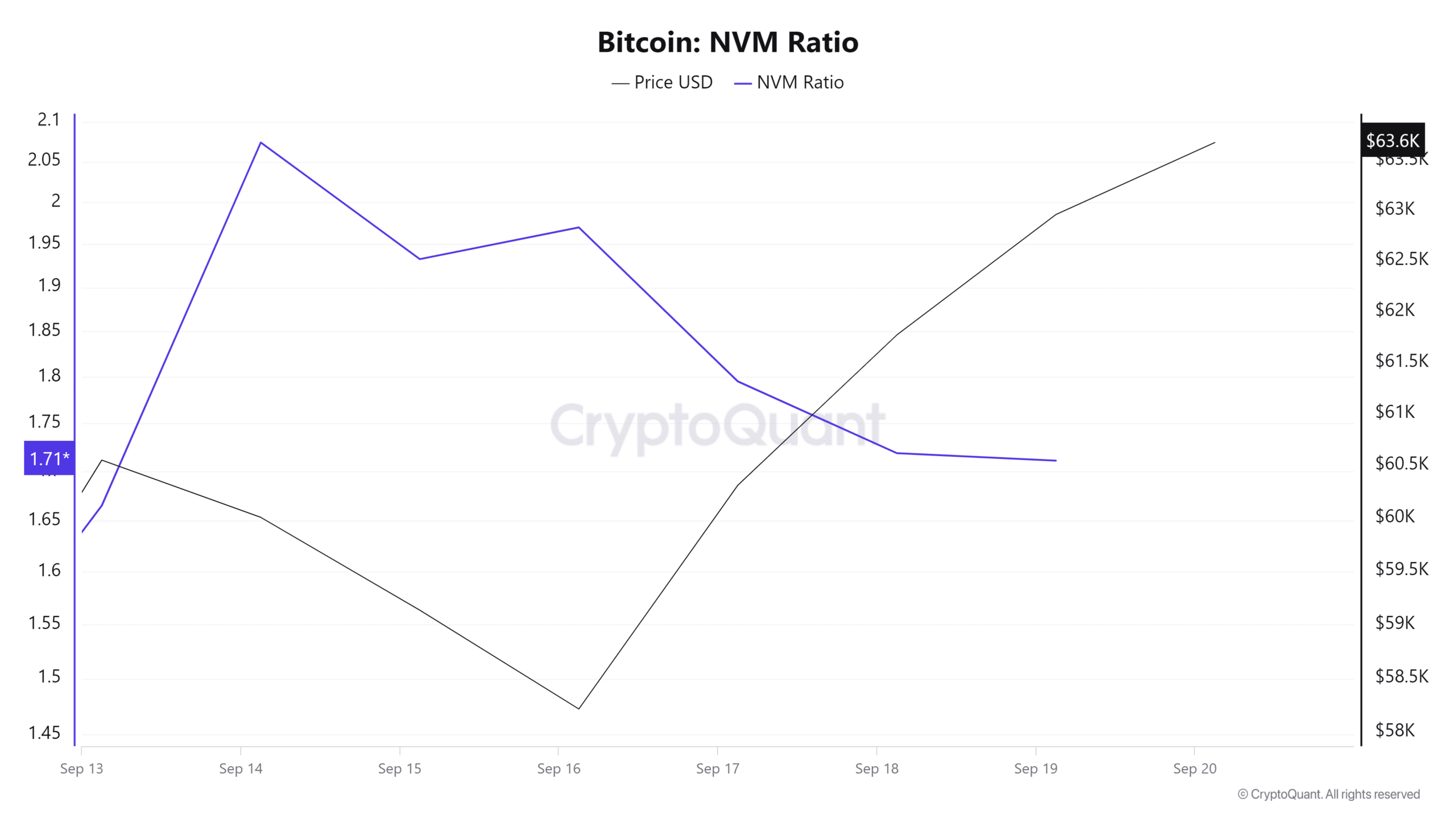

Lastly, Bitcoin’s NVM ratio has been declining over the previous few days. This exhibits that the community is having fun with greater engagement whereas the market has but to catch up. This suggests that costs have the potential for future worth progress.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Merely put, though there are 5.1 million addresses nonetheless at a loss as noticed by IntoTheBlock, BTC market sentiment has shifted from bearish to constructive. Subsequently, the present market sentiments set Bitcoin for additional features.

As such, if the prevailing market sentiment holds, BTC will try $64727 resistance stage within the quick time period.