- Bitcoin surged to over $64K after the Fed’s charge lower, exhibiting a 2.8% enhance in 24 hours.

- Analysts warning that regardless of bullish indicators, sure indicators counsel a potential worth reversal forward.

Bitcoin [BTC] has shifted its trajectory from a interval of accumulation and decline to a noticeable restoration part.

Over the previous 24 hours, the asset surged to as excessive as $64,000 earlier than retracing barely to commerce at $63,786 on the time of writing, marking a 2.8% enhance.

This rally comes within the wake of the U.S. Federal Reserve’s announcement of a charge lower, which has triggered constructive market sentiment throughout danger property, together with Bitcoin.

Is a reversal forward?

Whereas this worth enhance has sparked optimism, analysts are cautiously inspecting Bitcoin’s fundamentals to find out the sustainability of this rally.

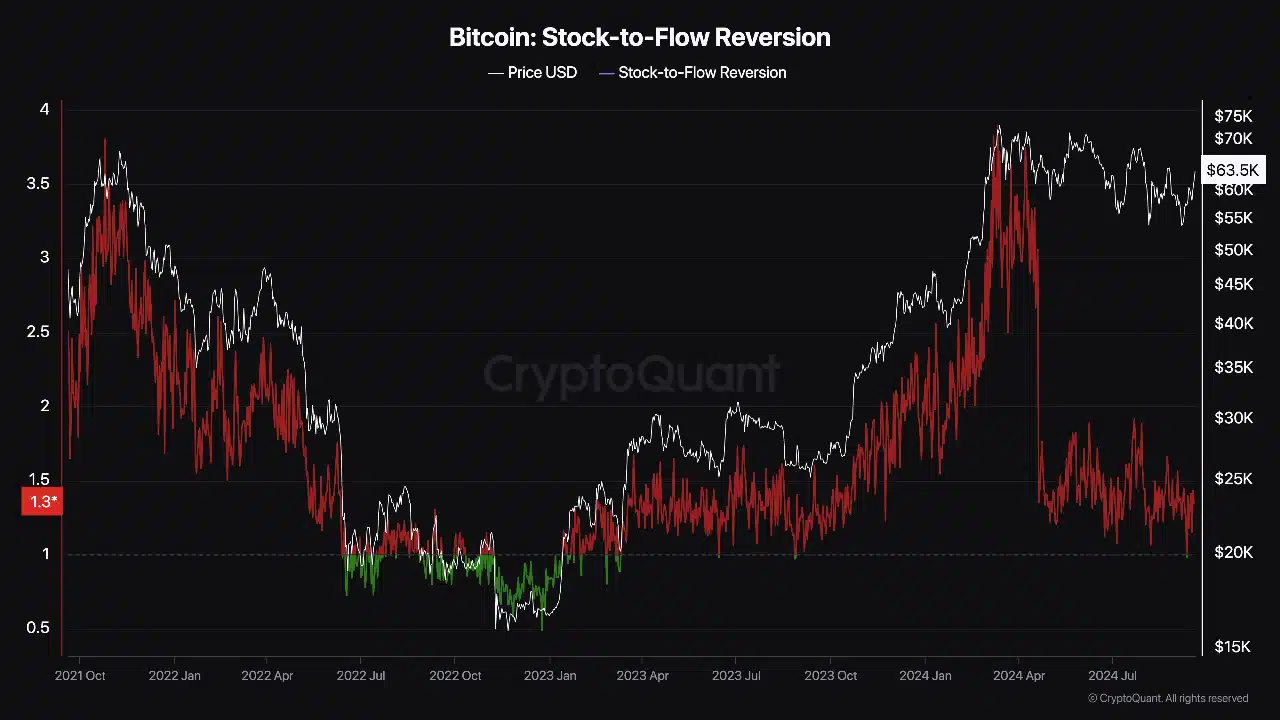

A CryptoQuant analyst, utilizing the pseudonym ‘Darkfost,’ highlighted a possible crimson flag. Darkfost pointed to the Inventory-to-Movement (S2F) reversion chart, signaling a potential reversal.

The S2F mannequin is commonly used to forecast Bitcoin’s worth actions by evaluating the provision of latest BTC coming into the market (movement) with the whole present provide (inventory).

In keeping with Darkfost, the S2F ratio is presently in a inexperienced zone, signaling a shopping for alternative as Bitcoin touched this threshold and commenced its restoration.

Nevertheless, the analyst warned that the final time this occurred, in September and June 2023, the asset skilled a big pullback.

This raises whether or not the present rally has sufficient momentum to maintain itself, or if one other retracement is on the horizon.

Bitcoin fundamentals present power

Regardless of issues of a possible reversal, Bitcoin’s fundamentals are exhibiting indicators of power that will help additional upward motion.

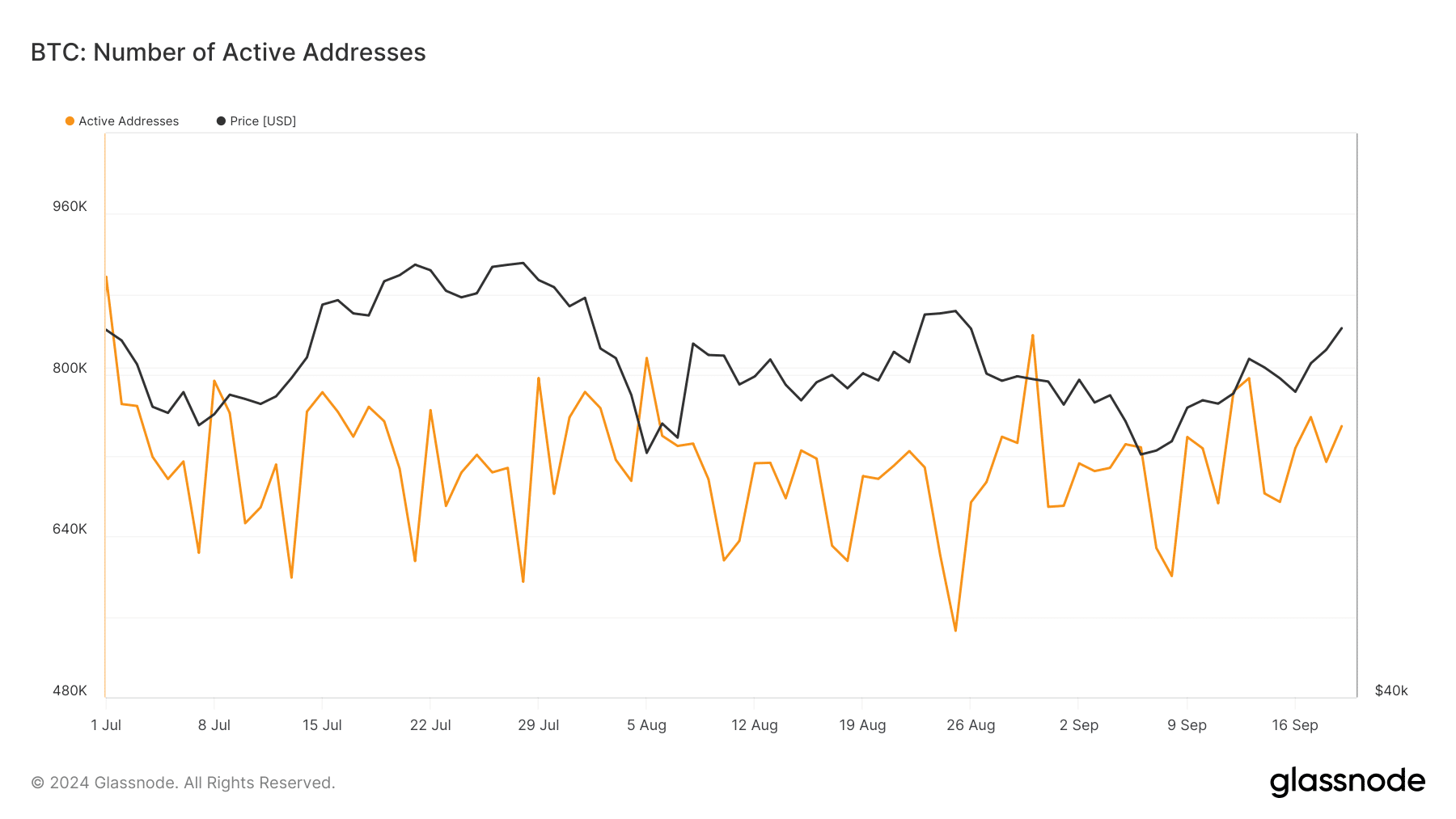

One key metric is the restoration of Bitcoin’s energetic addresses, which serves as an indicator of retail curiosity within the asset.

Earlier this month, the variety of energetic Bitcoin addresses dipped to round 600,000, information from Glassnode reveals.

Nevertheless, this determine has since climbed to greater than 700,000 as of at present. The rise in energetic addresses means that extra customers are partaking with the community, a constructive signal for demand.

Sometimes, when retail curiosity will increase, it displays rising confidence in Bitcoin, which may bolster worth momentum.

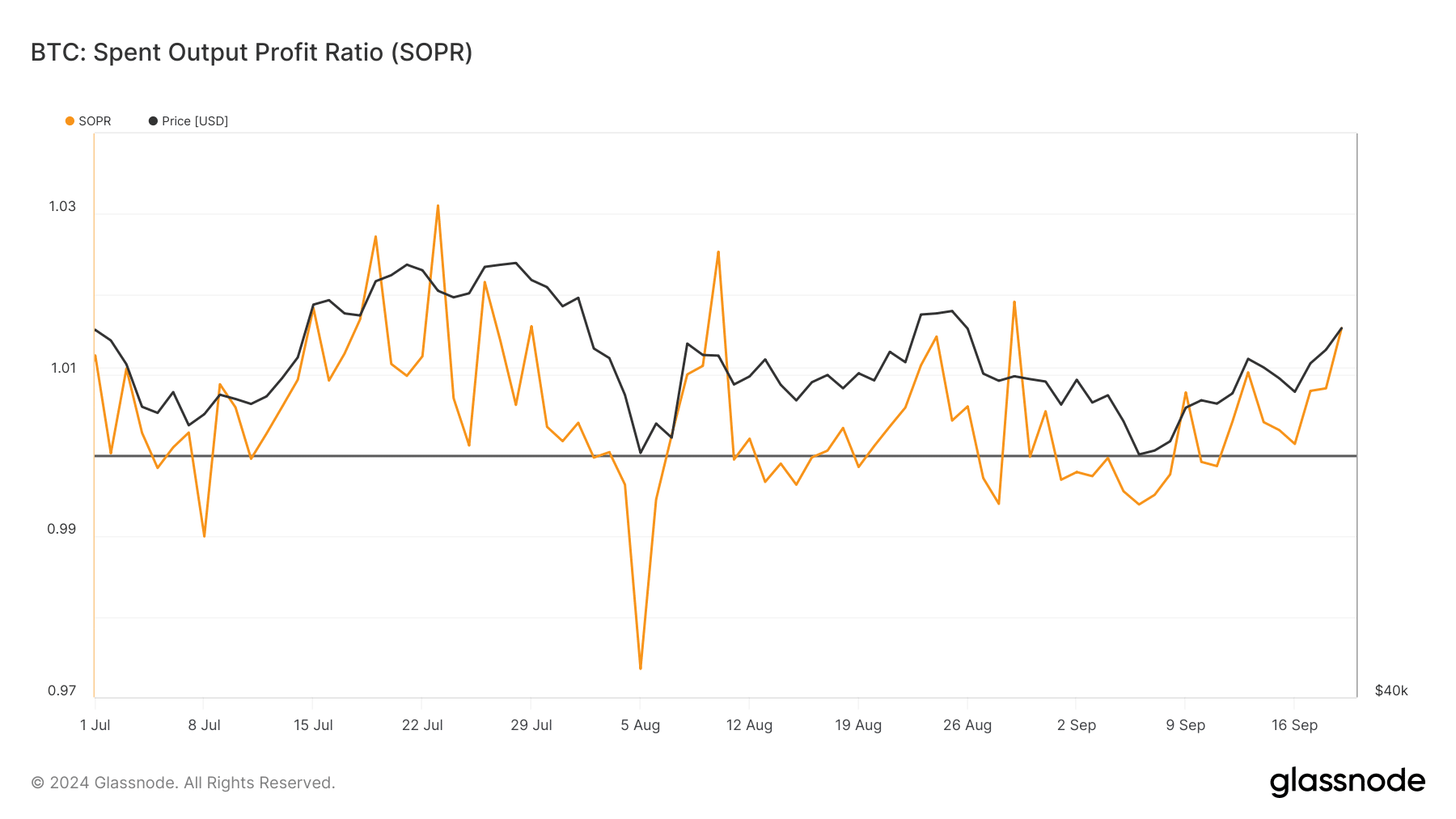

One other vital metric to think about is Bitcoin’s Spent Output Revenue Ratio (SOPR), which measures whether or not buyers are promoting their Bitcoin at a revenue or a loss.

A SOPR worth above 1 signifies that holders are promoting at a revenue, whereas a price under 1 suggests they’re promoting at a loss. As of at present, Bitcoin’s SOPR sits at 1.01, up from 0.994 in late August.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

This slight enhance signifies that extra buyers are realizing earnings on their Bitcoin holdings, signaling a more healthy market sentiment.

A rising SOPR typically aligns with intervals of upward worth motion, as buyers achieve confidence out there and really feel extra inclined to take earnings with out worry of a pointy downturn.