- BTC appreciated by 10.38% on the month-to-month charts

- Analysts are eyeing an additional rally citing the historic relationship between MVRV and SMA 365

During the last 30 days, Bitcoin [BTC] has seen a big rebound on its value charts after 2 months of maximum volatility. In reality, since hitting a excessive of $70,016 in July, BTC has declined considerably, even falling to an area low of $49k.

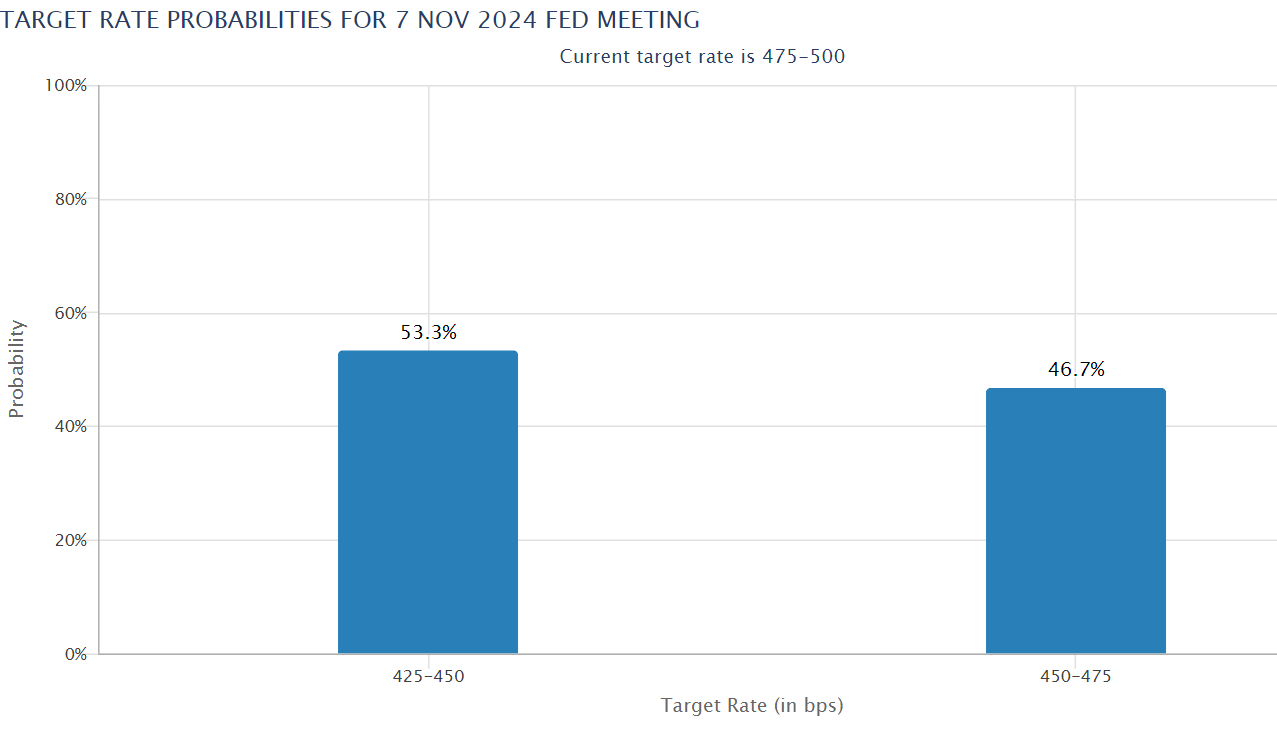

Nonetheless, for the reason that Fed price cuts per week in the past, BTC has made notable positive aspects. On the time of writing, Bitcoin was buying and selling at $65,839. This marked a ten.38% hike on the month-to-month charts, with an extension to the bullish pattern by a 4.47% hike in 24 hours.

Will the king coin proceed its rally?

This current surge has caught the eye of the crypto group, leaving analysts speaking. One in all them is Cryptoquant analyst Burak Kesmeci, who urged {that a} long-term rally may maintain itself, citing the MVRV metric.

In line with Kesmeci, the Bitcoin MVRV Metric is now flashing a bullish sign once more, with the MVRV pricing above its SMA 365. After analyzing the historic relationship between the MVRV and the 365-day shifting common, the analyst decided that BTC normally data a rally after the MVRV rises above SMA365.

At press time, the MVRV was at 2.04, sitting above its SMA 365 at 2.02. Thus, the analyst interpreted this as a robust bullish sign, positing that bulls have the market to lose.

When the MVRV and SMA 365 are set like this, it implies that the long-term pattern is strengthening. Particularly as BTC’s present market worth is increased than its common realized worth over the previous 12 months. This upward motion is an indication of rising confidence amongst long-term holders and traders.

Subsequently, primarily based on this commentary, Bitcoin could also be seeing increased demand, one thing that is perhaps driving costs up.

What do the charts say?

Whereas the metric highlighted by Kesmeci offered a constructive outlook, the query is what do different fundamentals say?

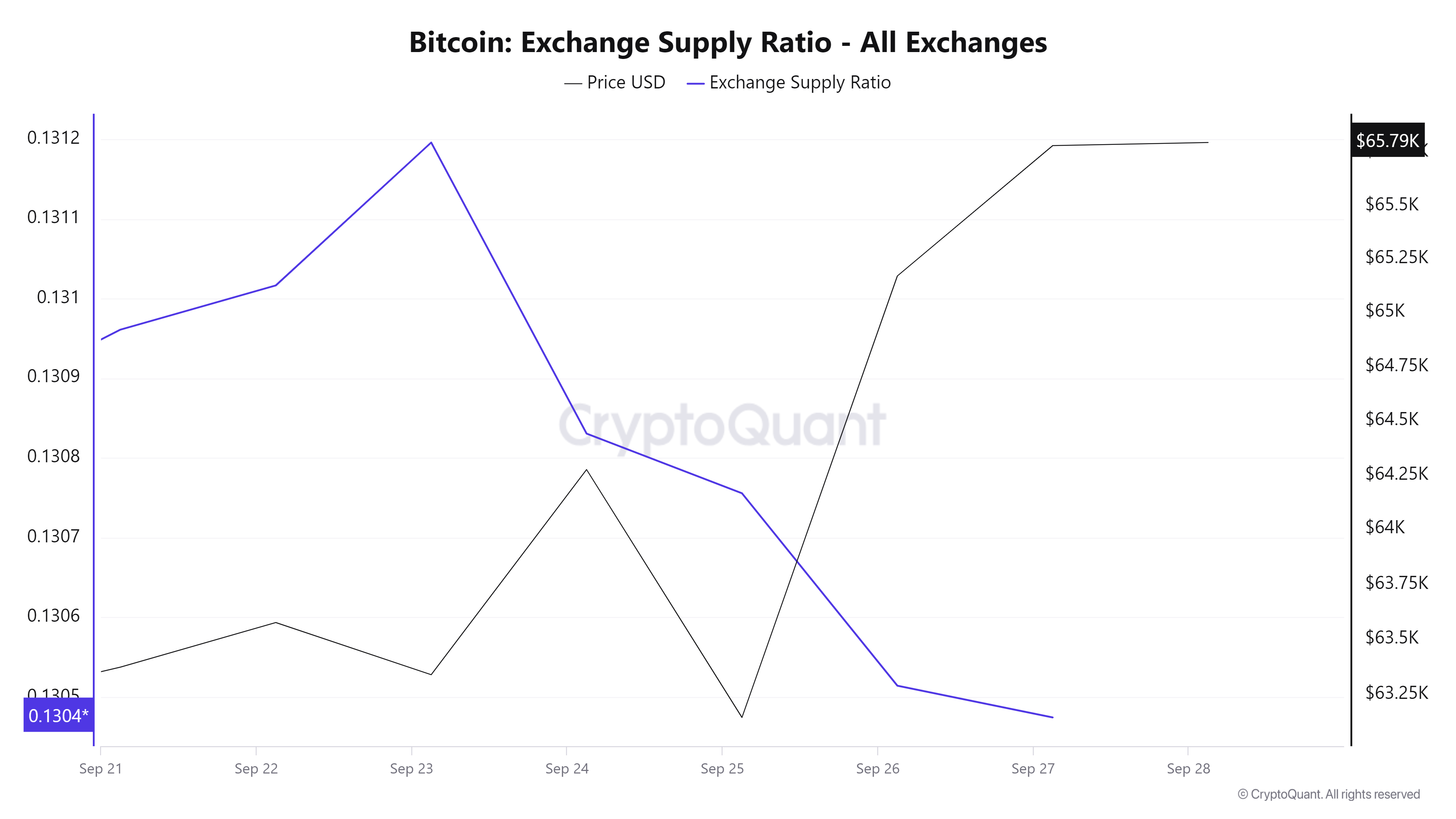

For starters, Bitcoin’s Change Provide ratio registered a sustained decline over the previous week. Over this era, the change provide ratio declined from 0.1311 to 0.1304.

This decline displays traders’ holding habits as they maintain their property in chilly wallets, somewhat than on exchanges. This can be a bullish sign, one which means traders’ confidence sooner or later values as long-term holders count on the crypto’s value to rise.

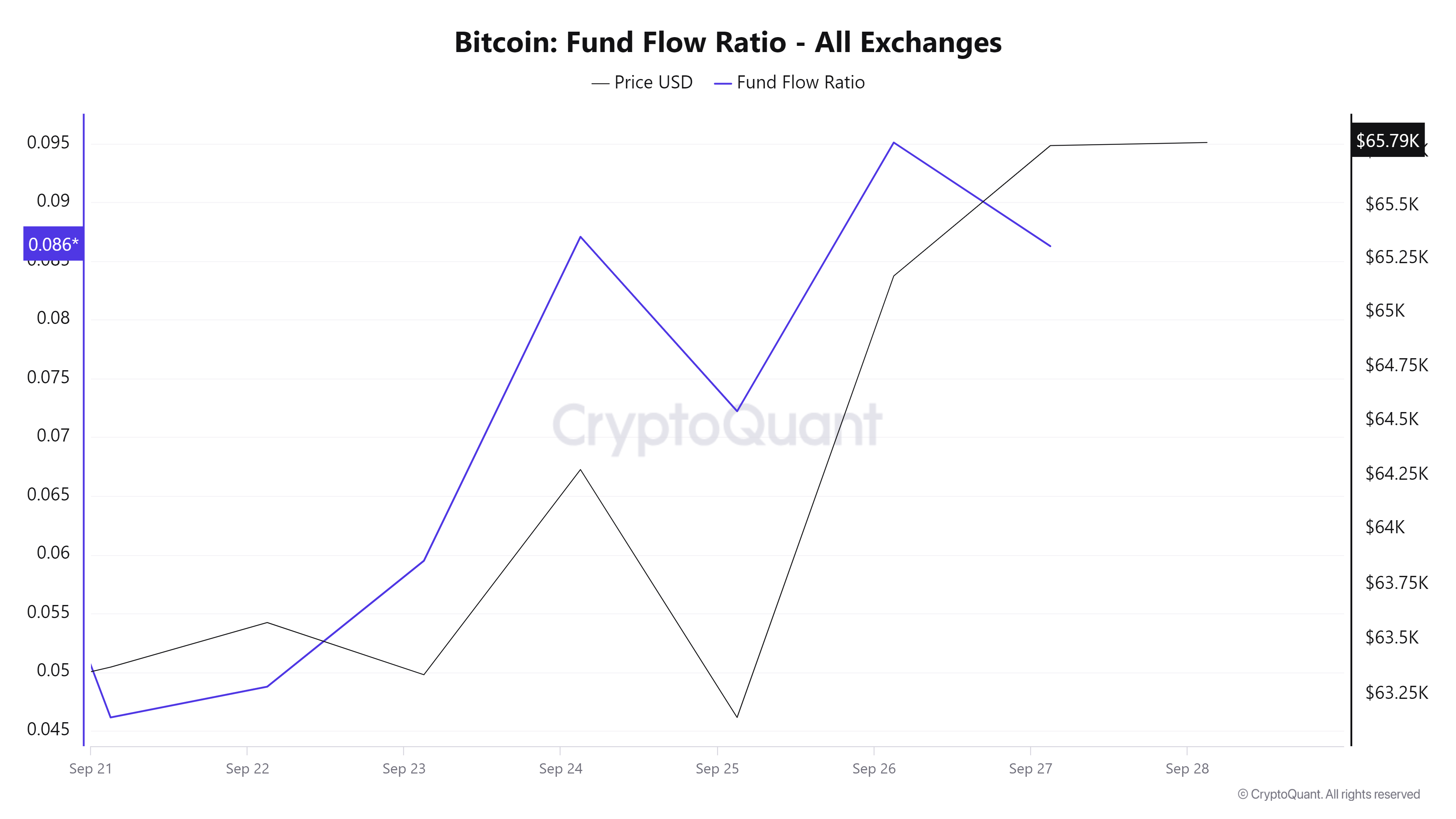

Moreover, Bitcoin’s fund circulation ratio has been on an uptrend over the previous week. FFR elevated from 0.04 to 0.086 during the last 7 days.

This can be a signal of better funds inflows into BTC. By extension, this displays rising confidence amongst traders. Below this market situation, traders usually tend to purchase BTC anticipating future positive aspects.

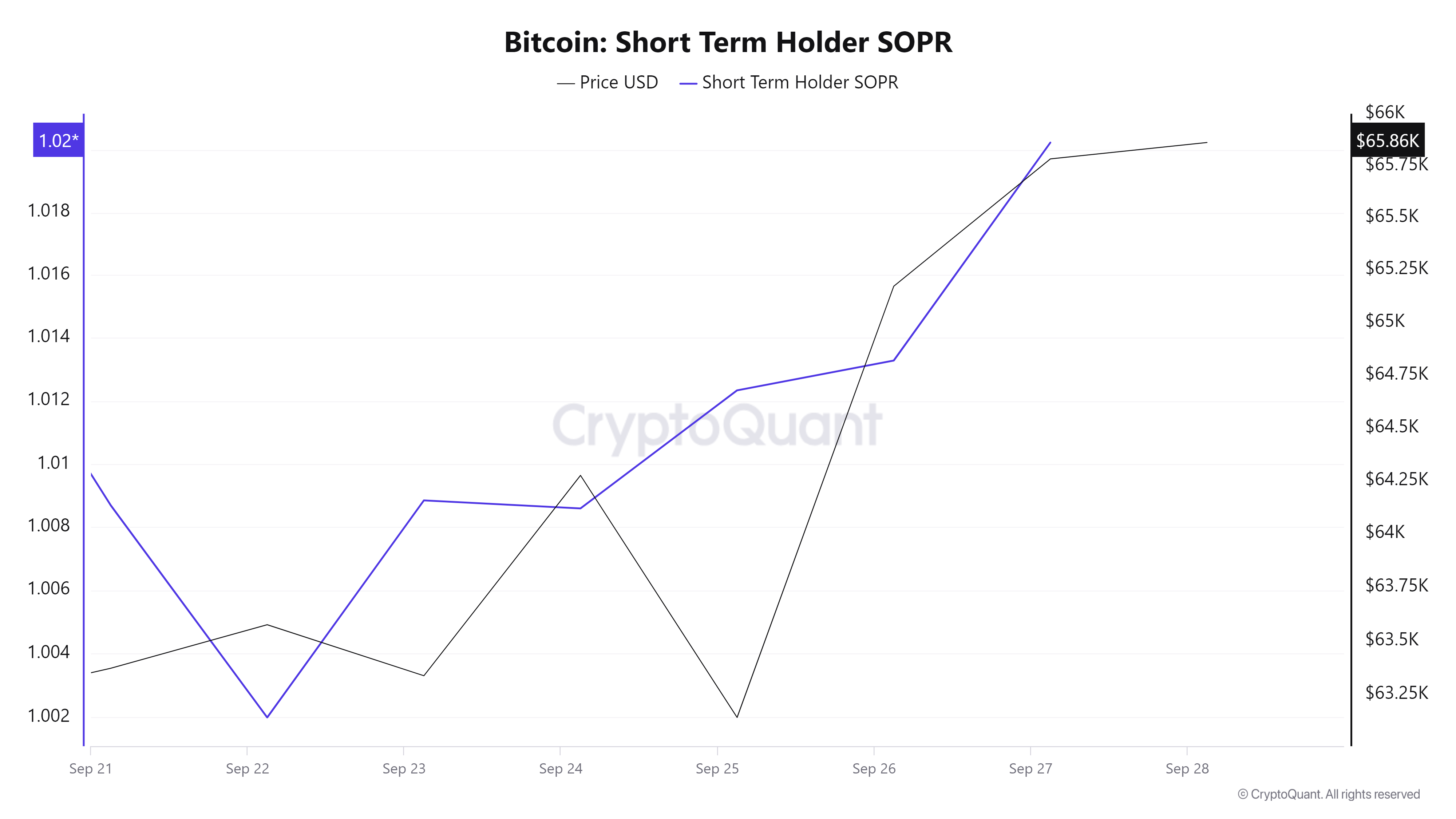

Lastly, Bitcoin’s Quick-term holder SOPR has additionally been rising over the previous week. A rising short-term SOPR throughout an uptrend reveals that the market is robust. Thus, though the short-term holder is promoting at a revenue, the demand can also be excessive sufficient to soak up the promoting stress with out leading to a decline. This implies the uptrend is more likely to proceed.

Merely put, BTC is experiencing a constructive market sentiment and mountain climbing investor favourability. If these market circumstances maintain, BTC will try to breach the $68,240 resistance stage.