- BitMEX co-founder envisioned Bitcoin rising to $1 million.

- Arthur Hayes believed that BTC’s deflationary nature made it a sexy hedge towards inflation.

Amid the newest bull run, analysts have launched a sequence of Bitcoin [BTC] value predictions. The newest forecast comes from Arthur Hayes, co-founder of BitMEX.

In his new essay titled, “Black or White?”, the exec delved into the elements that would drive the king coin to a seven-figure valuation.

His prediction centered across the future financial panorama below the returning Donald Trump administration and its potential influence on conventional monetary markets, inflation, and the U.S. greenback.

Trump’s insurance policies and financial influence

Within the essay, Hayes steered that the Trump administration will doubtless have interaction in quantitative easing (QE).

For the uninitiated, QE is a central financial institution coverage the place the financial institution buys authorities bonds to inject money into the financial system, reducing rates of interest and inspiring lending and spending.

This technique of credit score creation, geared toward strengthening U.S. manufacturing and industrial sectors, is predicted to have inflationary results. Thus, resulting in a depreciation of the greenback.

The BitMEX co-founder likened this debt-driven mannequin to points of China’s financial development technique, dubbing it,

“American Capitalism with Chinese Characteristics.”

Hayes’ $1 million Bitcoin goal

However how will that influence BTC? Properly, Hayes argued that if inflation surpasses conventional returns, buyers could more and more flip to belongings like Bitcoin.

In contrast to fiat currencies, which will be printed to answer financial pressures, Bitcoin has a capped provide of 21 million, making it inherently deflationary.

This shortage and independence from central banks improve Bitcoin’s enchantment as a retailer of worth. He added,

“As the freely traded supply of bitcoin dwindles, the most fiat money in history will be chasing a safe haven from not just Americans but Chinese, Japanese, and Western Europeans. Get long, and stay long.”

Highlighting Bitcoin’s potential as a hedge towards fiat devaluation, Hayes famous its spectacular 400% development since 2020.

He additional defined that decreasing the debt-to-GDP ratio from its present 132% to 115% would require round $4 trillion, whereas returning to pre-2008 ranges (round 70%) would necessitate $10.5 trillion.

Such credit score growth, the exec steered, would gas BTC’s development, stating,

“This is how Bitcoin goes to $1 million.”

BTC market state

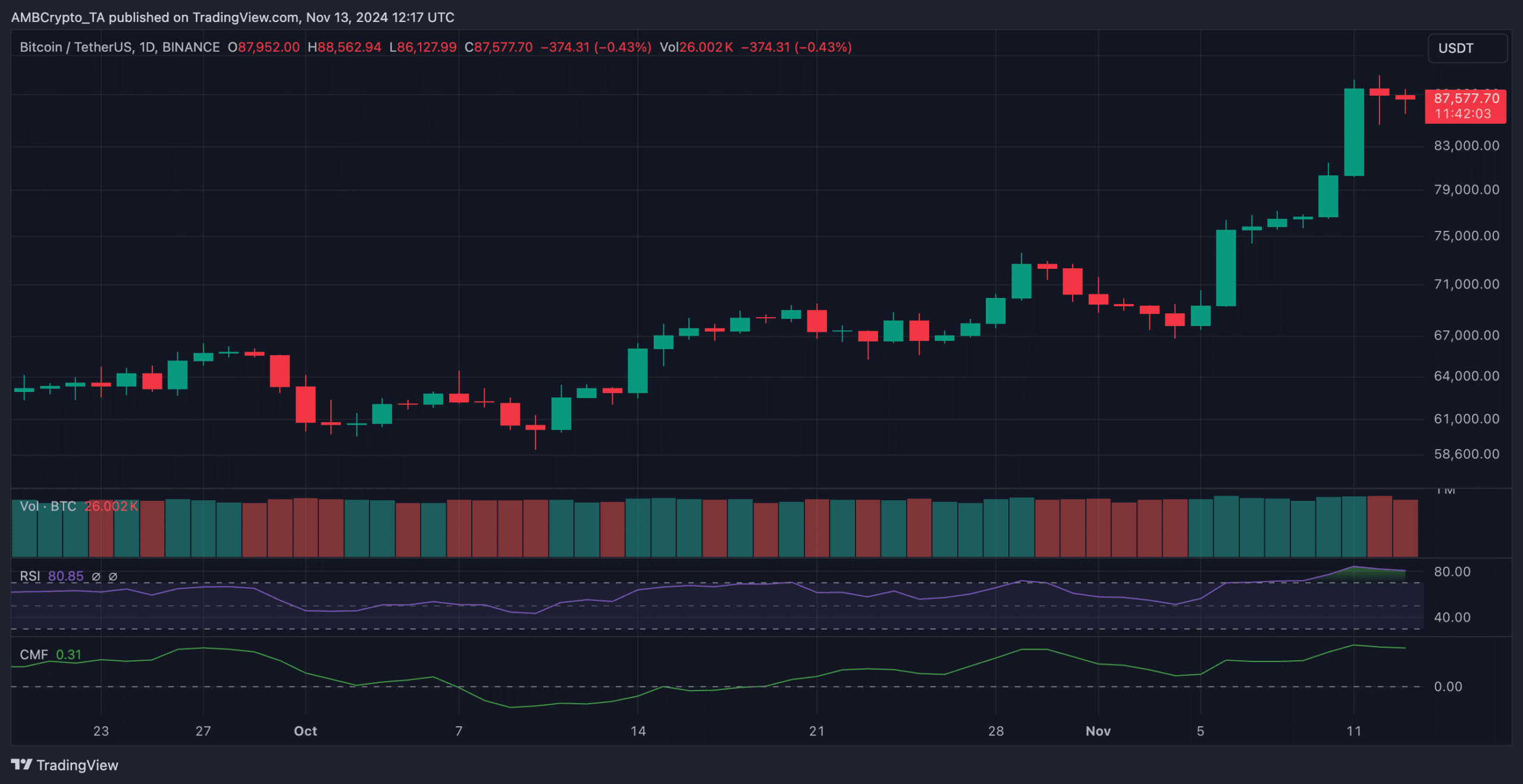

In the meantime, after inching nearer to the $90,000 mark, the king coin has dipped. At press time, it traded at $87,577. This represented a depreciation of two.63% from the newest ATH of $89,940.

Information from CoinMarketCap confirmed a 0.17% enhance in BTC’s value over the past 24 hours, with weekly positive factors holding regular at round 17%.

Nevertheless, technical indicators sign a possible cooldown. The RSI fell from yesterday’s excessive of 84.51 to 80.85, suggesting that bullish momentum could also be easing.

The CMF additionally dipped, although it remained optimistic at 0.31, indicating diminished capital inflows in comparison with current days.

Collectively, these indicators pointed to a possible short-term slowdown or minor correction as some buyers take earnings following Bitcoin’s robust weekly rally. Nonetheless, the general bullish development for BTC appeared strong.