- ADA was down by greater than 23% during the last seven days.

- Most metrics and indicators supported the opportunity of ADA testing the bull sample.

Much like most cryptos, Cardano [ADA] bears had been main the market because the token’s value charts remained purple. Nonetheless, there have been modifications of a development reversal as a bull sample fashioned on ADA’s chart.

Will this enable ADA to show its charts inexperienced whereas Bitcoin [BTC] undergoes its subsequent halving on the nineteenth of April?

Cardano bulls are waking up

The final week was disastrous for ADA traders because the token’s value declined by a whopping 23%. In keeping with CoinMarketCap, within the final 24 hours, ADA dropped by over 2.5%.

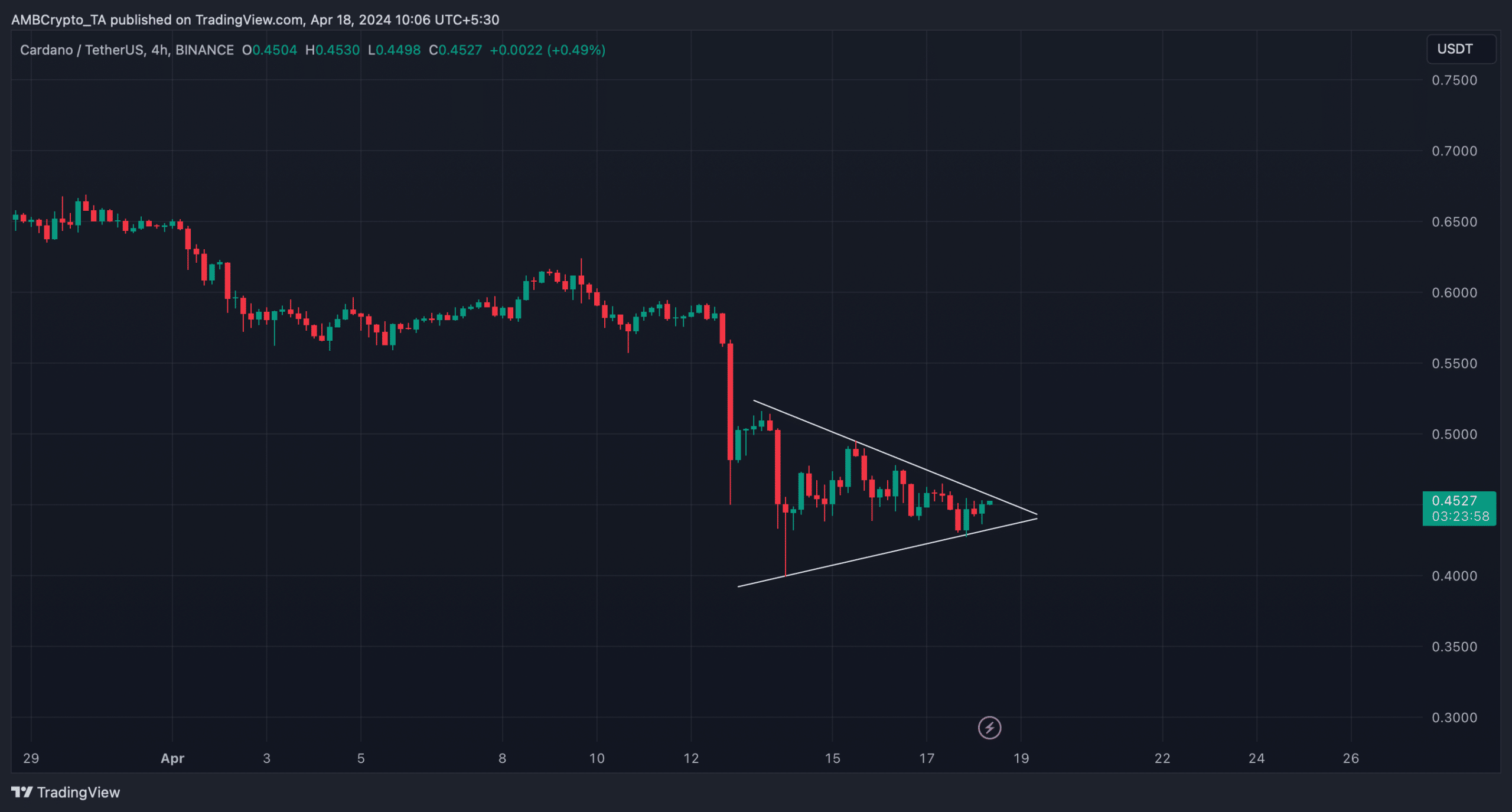

However there was extra to the story, as ADA’s value was consolidating inside a bullish symmetrical triangle sample at press time, which hinted at a bull rally.

AMBCrypto’s evaluation of ADA’s 4-hour chart revealed that if the token’s value breaks above the $0.454 resistance degree, then it would witness a robust bull rally as BTC undergoes its fourth halving course of.

The opportunity of ADA testing the sample appeared excessive, because the token’s value had elevated by 1.15% within the final 60 minutes.

At press time, it was buying and selling at $0.4498 with a market capitalization of over $16 billion, making it the tenth largest crypto.

ADA heading in the right direction

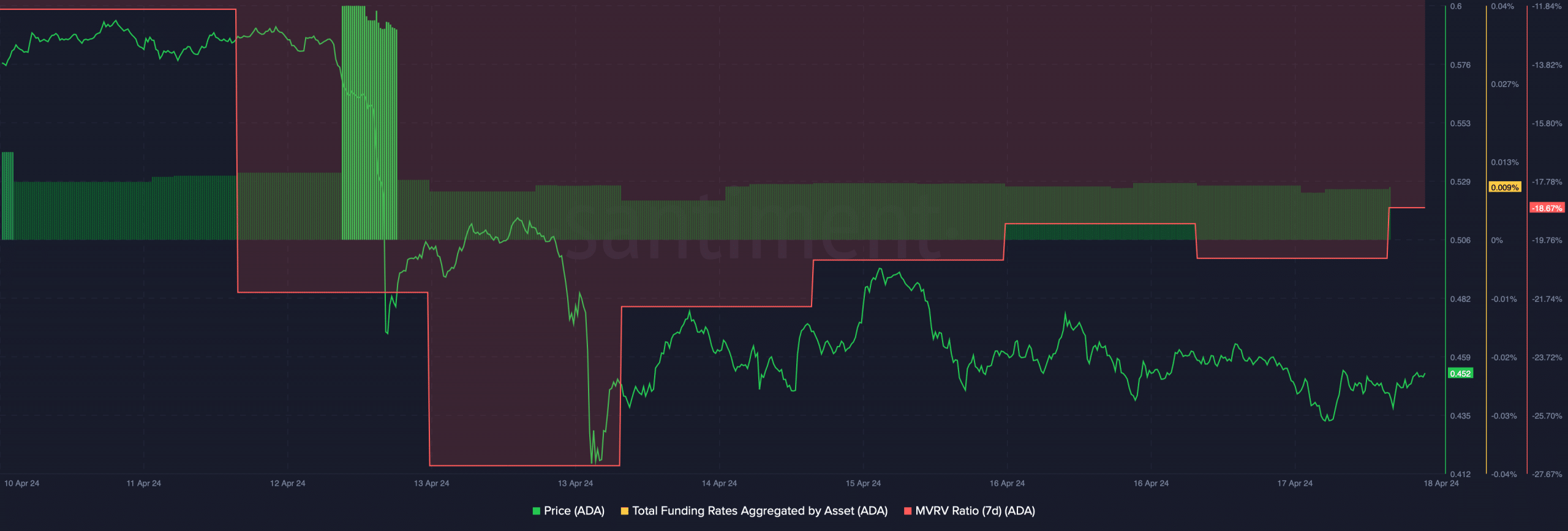

Other than value motion, a number of of the metrics additionally regarded bullish. AMBCrypto’s test on Santiment’s knowledge identified that ADA’s 7-day MVRV ratio improved over the previous couple of days.

Its Funding Fee had additionally dropped. Since costs have a tendency to maneuver the opposite method than the funding fee, there was a chance of ADA registering a value uptick quickly.

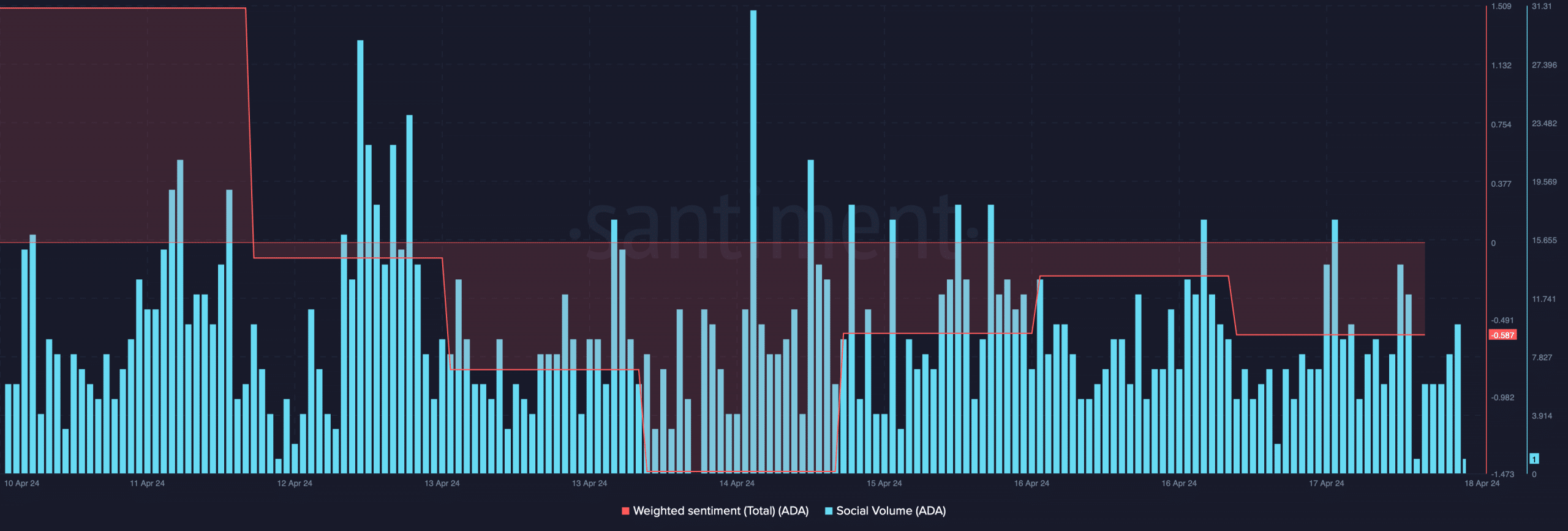

The token’s social quantity remained comparatively excessive all through the final week, with a considerable spike on the 14th of April. The rise in social quantity clearly mirrored Cardano’s recognition within the crypto area.

Furthermore, its Weighted Sentiment rose final week after dropping on the 14th of April, suggesting that bearish sentiment across the token began to say no.

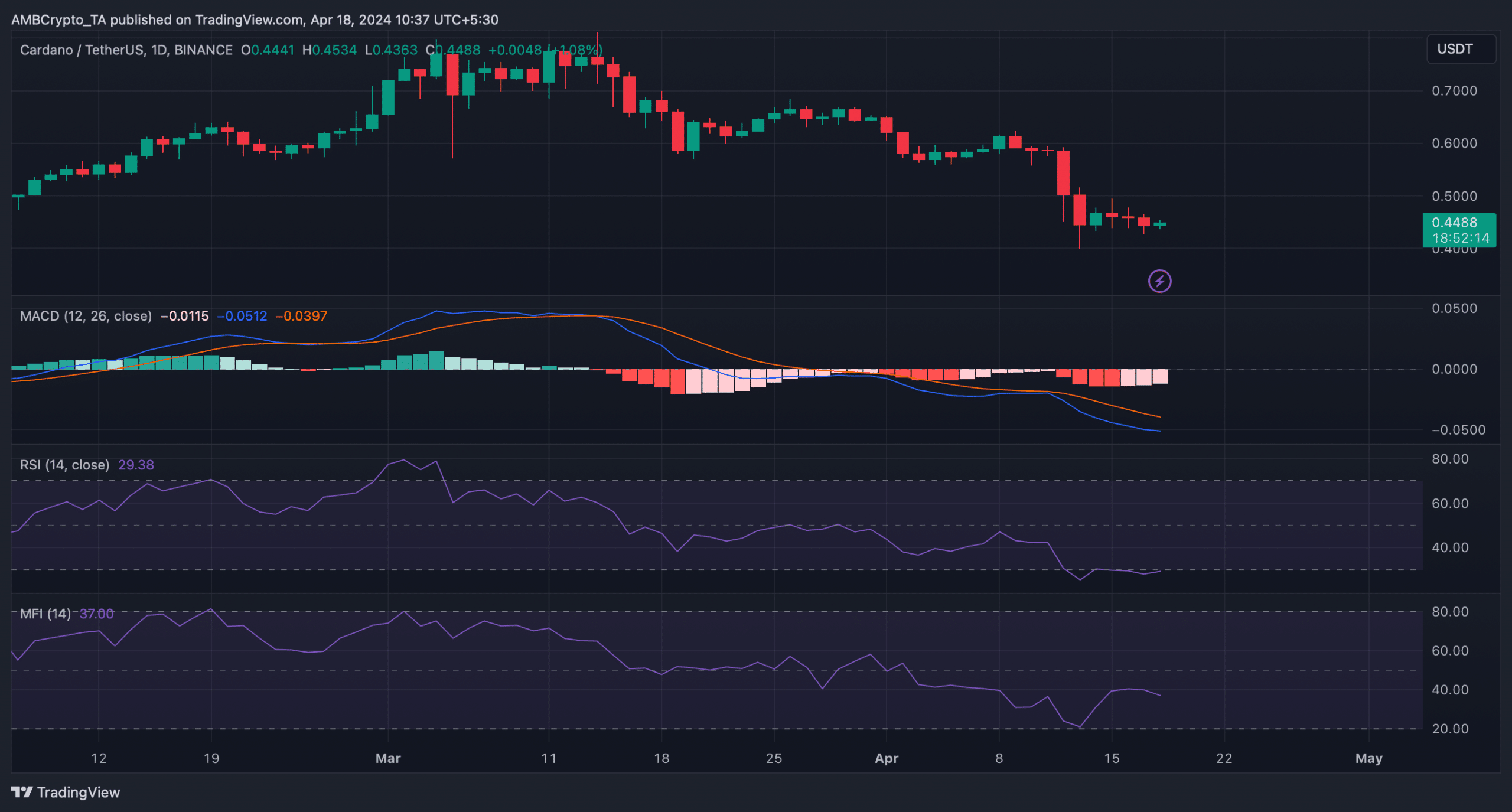

To higher perceive whether or not ADA will handle to go above the $0.454 resistance degree, we then took a take a look at its every day chart. We discovered that Cardano’s Relative Energy Index (RSI) was within the oversold zone.

Learn Cardano’s [ADA] Value Prediction 2024-25

This indicated that purchasing strain on the token would possibly improve quickly, leading to a value improve. Nonetheless, the MACD displayed a bearish benefit out there.

The Cash Circulation Index (MFI) additionally declined, which hinted that ADA would possibly take extra time to show bullish.