Coinspeaker

CCData: Stablecoin Market Hits Report $190B in Put up-Election Crypto Rally

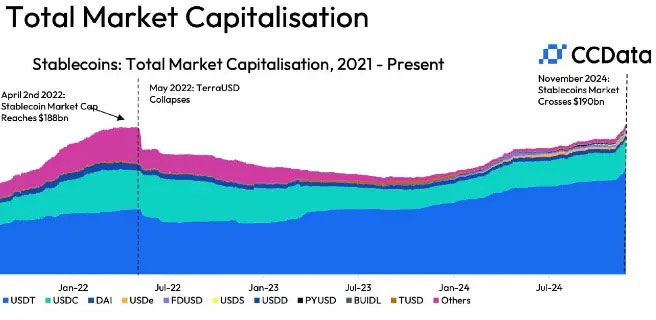

Stablecoins have emerged as a silent powerhouse, quietly reshaping the cryptocurrency ecosystem. Current information from CCData reveals a groundbreaking milestone: the stablecoin market has rocketed to a exceptional $190 billion, surpassing its earlier peak and signaling a exceptional transformation within the stablecoin market.

Photograph: CCData

The surge comes towards a backdrop of serious political and financial shifts, with Bitcoin and Solana reaching document highs, whereas stablecoins profit from the renewed optimism. These property, designed to take care of steady values usually pegged to conventional currencies just like the US greenback, have grow to be integral to cryptocurrency buying and selling and funding methods.

Tether’s USDT stands on the forefront of this growth, commanding a formidable 69.9% market share and reaching a brand new zenith of $132 billion. Circle’s USDC has additionally demonstrated sturdy development, increasing to just about $39 billion and representing 20.5% of the stablecoin market panorama.

Ethena’s Artificial Greenback Soars 42%

The stablecoin ecosystem has witnessed a rare proliferation of modern tokenized merchandise. Past conventional choices, platforms like BlackRock’s BUIDL and Ethena’s USDe have launched novel approaches to digital asset stability. Ethena’s artificial greenback, as an example, has seen a exceptional 42% improve, reaching $3.8 billion in November and providing an eye catching 25% annualized yield by leveraging subtle buying and selling methods.

Photograph: CCData

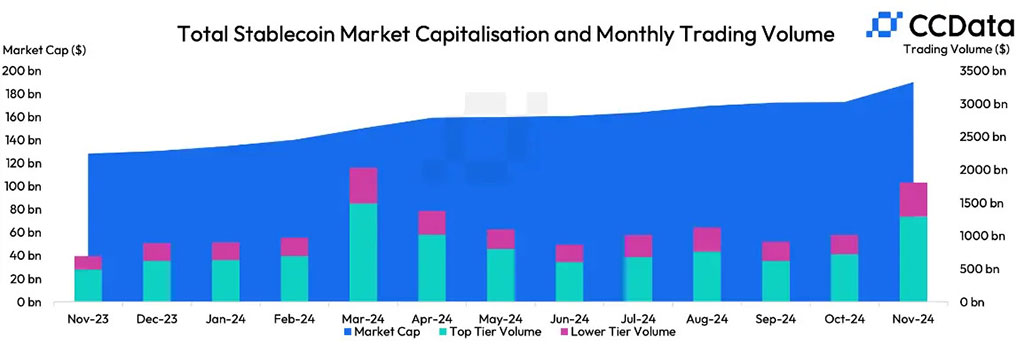

The market’s growth displays extra than simply numerical development. It demonstrates a classy evolution in cryptocurrency infrastructure, with stablecoins serving as essential liquidity mechanisms for merchants and buyers. The flexibility to take care of worth whereas offering flexibility has positioned these digital property as important instruments within the fashionable monetary toolkit.

Buying and selling volumes have correspondingly surged, with stablecoin pairs on centralized exchanges leaping 77% month-over-month to succeed in $1.8 trillion. Tether continues to dominate, accounting for about 83% of those volumes, adopted by First Digital’s FDUSD and USDC.

Stablecoin’s Testomony to Resilience

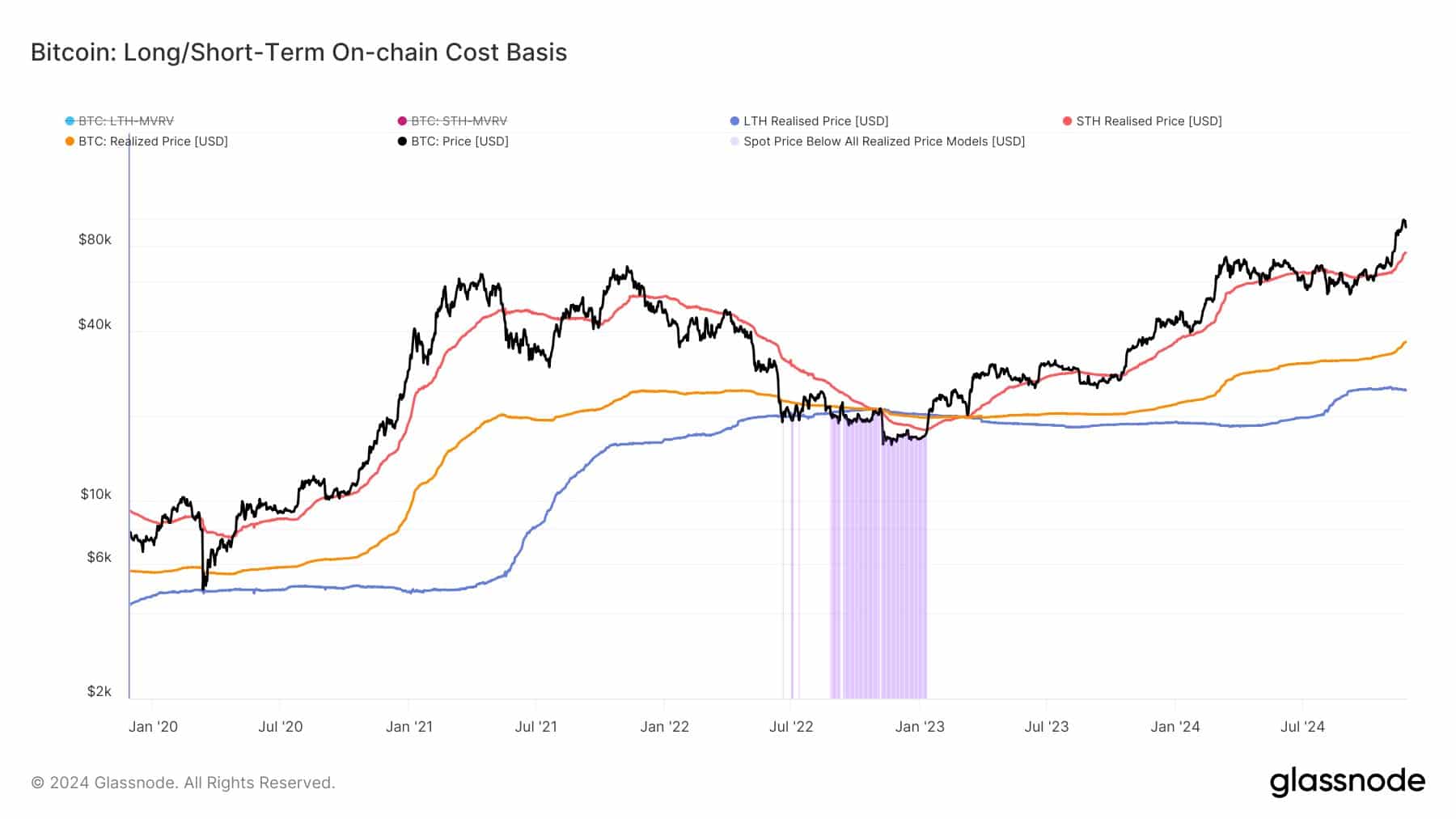

The present market capitalization of $190 billion is especially vital when contrasted with the sector’s historic challenges. Simply two years in the past, the Terra-Luna collapse despatched shockwaves by the cryptocurrency world, creating what many known as the “crypto winter.” But, the stablecoin market has not solely recovered however thrived, showcasing exceptional resilience and flexibility.

The variety of stablecoin choices has been key to this renaissance. The market has expanded past easy one-to-one greenback representations, from tokens pegged to conventional currencies to extra complicated devices involving perpetual futures and crypto carry trades. Buyers now have a wealthy ecosystem of choices that present stability, yield, and strategic flexibility.

With 38 tokens monitoring practically 200 digital property reaching all-time excessive provides up to now month, the stablecoin sector demonstrates an unprecedented dynamism. It’s a transparent indication that digital property are now not a fringe monetary experiment however a classy, evolving asset class with real financial significance.

CCData: Stablecoin Market Hits Report $190B in Put up-Election Crypto Rally