- BTC’s worth has been in a consolidation part throughout the previous couple of days.

- A lot of the on-chain metrics regarded bullish on the coin.

After a worth rise above $66k, Bitcoin [BTC] as soon as once more began to consolidate because the king coin’s worth dropped underneath that mark. Nonetheless, there was extra to the story.

Bitcoin may simply be on the point of retest its all-time excessive. If issues fall into place, then anticipating a brand new ATH wouldn’t be too formidable.

Bitcoin’s secret plan

The final 24 hours have been fairly unstable for the king coin because it witnessed worth actions in each instructions. However this volatility didn’t enable the coin to interrupt previous the $66k psychological resistance once more.

The truth is, AMBCrypto reported earlier {that a} bearish divergence appeared on Bitcoin’s worth chart, which advised a worth drop. At press time, BTC was buying and selling at $65,692.70.

As per IntoTheBlock’s information, 46.54 million addresses have been in revenue, which accounted for over 86% of BTC’s complete variety of BTC addresses.

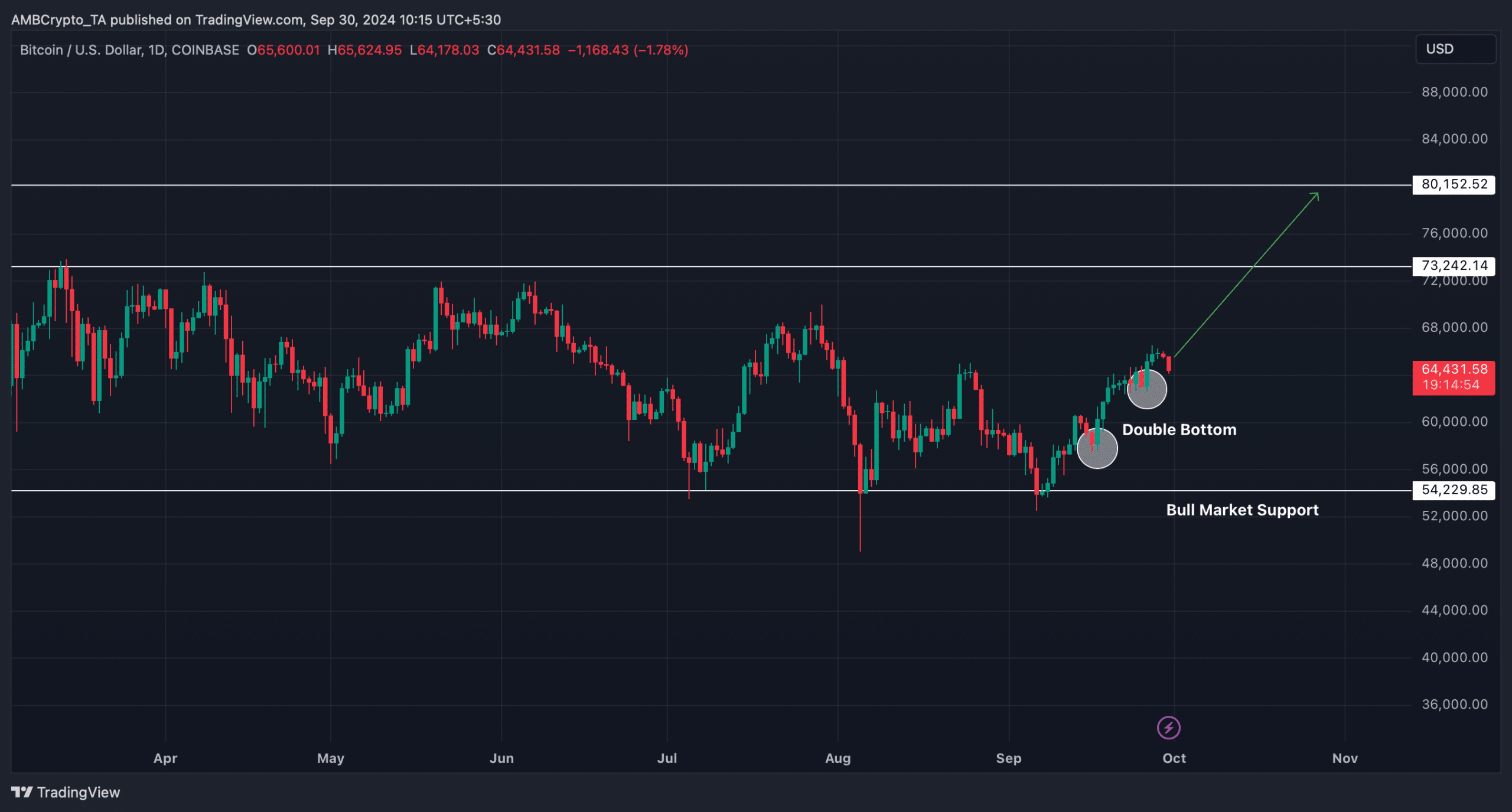

Nonetheless, AMBCrypto’s evaluation revealed an fascinating growth. We discovered that BTC efficiently examined the bull market help a number of days in the past. After that, the coin displayed a double backside sample.

At any time when that occurs, it normally suggests that there have been probabilities of a bull rally. If the sample assessments, then Bitcoin may quickly retest its all-time excessive.

The excellent news was {that a} breakout above that degree might push the coin in direction of $80k within the coming weeks.

Odds of BTC reaching $80k

AMBCrypto then checked the king coin’s on-chain information to see whether or not in addition they help the potential for a worth enhance.

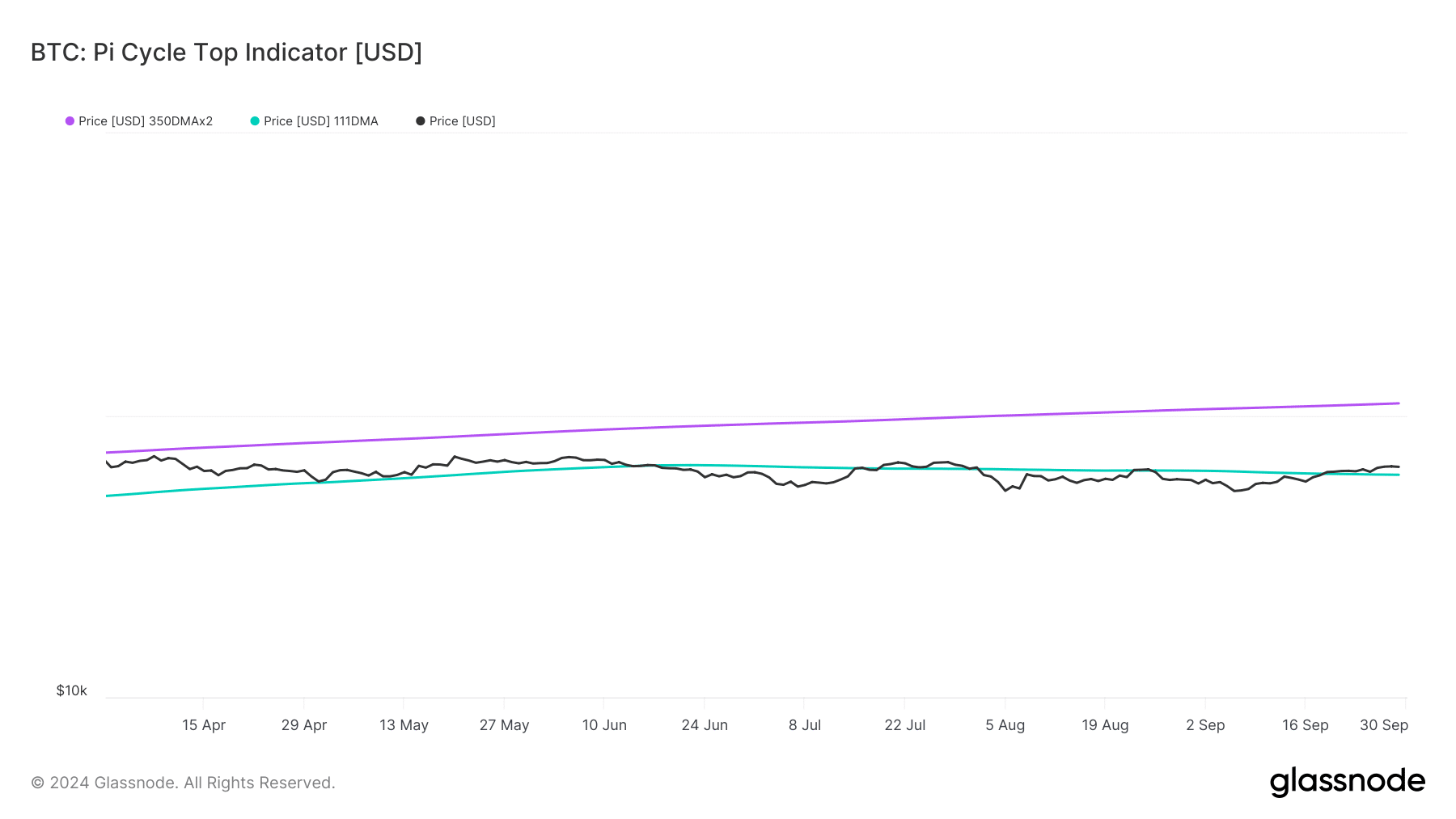

Our evaluation of BTC’s Pi Cycle Prime indicator revealed that BTC had lastly jumped above its potential market backside of $61k.

If the metric is to be believed, then this bounce might end in BTC touching its doable market prime of $110k, which regarded a bit formidable.

The Bitcoin Rainbow Chart additionally regarded fairly optimistic. BTC’s worth was within the “BUY” zone, that means that this was the suitable alternative for buyers to build up earlier than the coin’s worth skyrockets.

One other bullish metric was the lengthy/brief ratio because it moved up. An increase within the metric signifies that there are extra lengthy positions available in the market than brief positions, suggesting an increase in bullish sentiment round an asset.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Since most metrics regarded bullish, AMBCrypto checked Hyblock Capital’s information to search out out whether or not there have been any resistance ranges forward. We discovered {that a} substantial quantity of BTC shall be liquidated on the $66k mark.

Due to this fact, it will likely be essential for BTC to finish its consolidation part and go above that mark. A bounce above $66k might propel the king coin to new highs.