- Bitcoin hit a brand new all-time excessive, boosting crypto at this time to $3.2 trillion.

- Giant liquidations impacted merchants, whereas macroeconomic elements drove optimism.

Whereas the efficiency of crypto at this time has seen a notable uptick in valuation, it has additionally registered a slight lower.

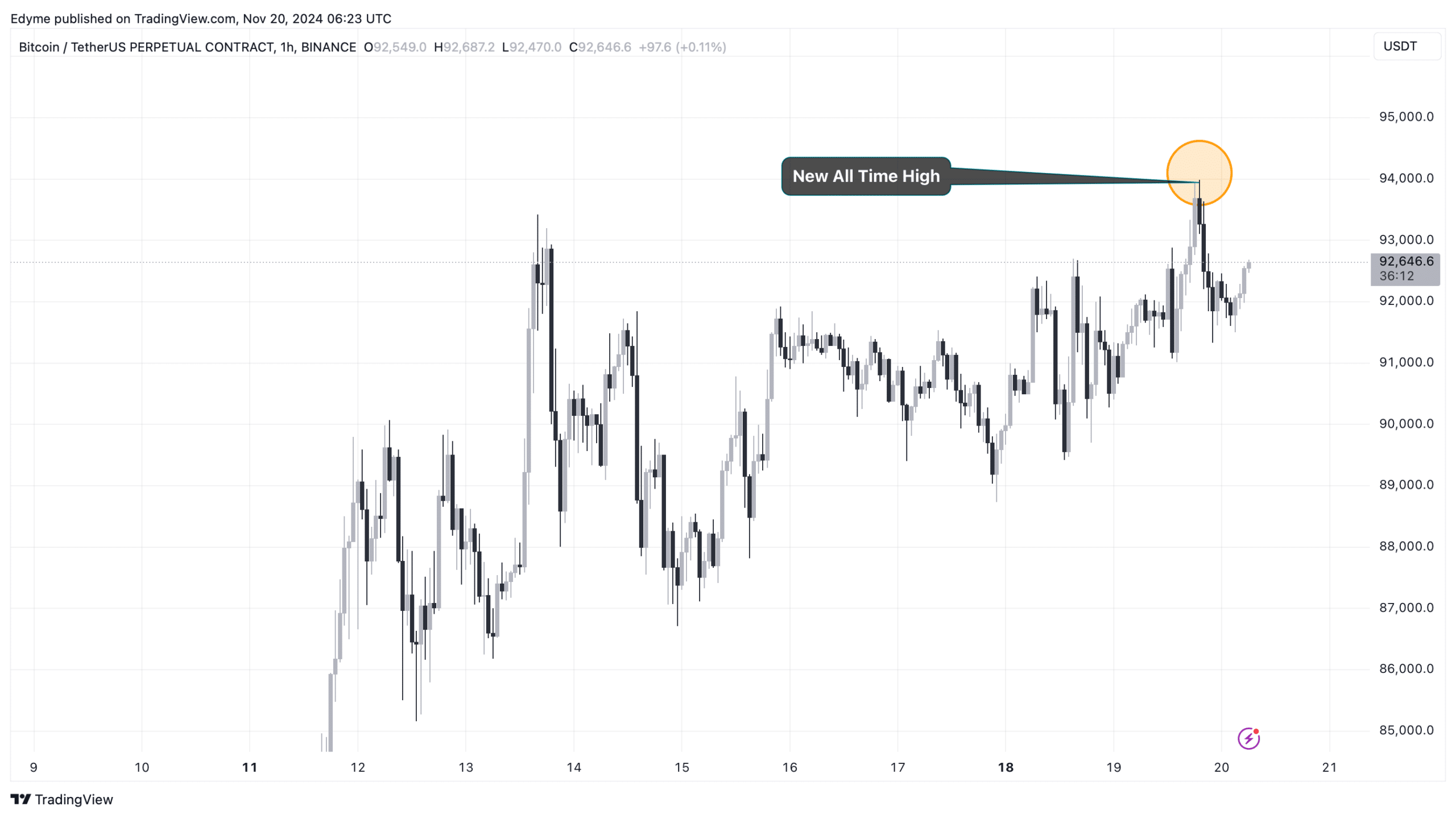

CoinGecko information confirmed that the worldwide crypto market has surged to as excessive as $3.227 trillion in valuation earlier within the day, when Bitcoin hit a brand new all-time excessive of $94,000.

Nonetheless, on the time of writing, this valuation had since diminished by 1.7% to remain at $3.21 trillion at press time.

Out of different elements that led to this increase within the world market of crypto at this time, essentially the most specific one is Bitcoin itself.

As earlier talked about, BTC, the most important cryptocurrency asset by market cap, has registered a brand new ATH bringing its 7-day efficiency to a rise of 5.9%.

On the time of writing, Bitcoin traded at a worth of $92,460 up by 1% previously day. The continual enhance in BTC’s worth now attracts it nearer to a market capitalization of $2 trillion.

For context, as of at this time, the asset’s market cap is at a valuation of $1.8 trillion, which nonetheless places the asset as one of many largest belongings on the planet.

In the meantime, BTC’s each day buying and selling quantity has additionally seen a notable increase in valuation, rising from beneath $50 billion earlier this week to at present at $77.11 billion.

Market impression and liquidations in crypto at this time

Whereas the efficiency of crypto at this time has typically been optimistic, it has not been useful for all members.

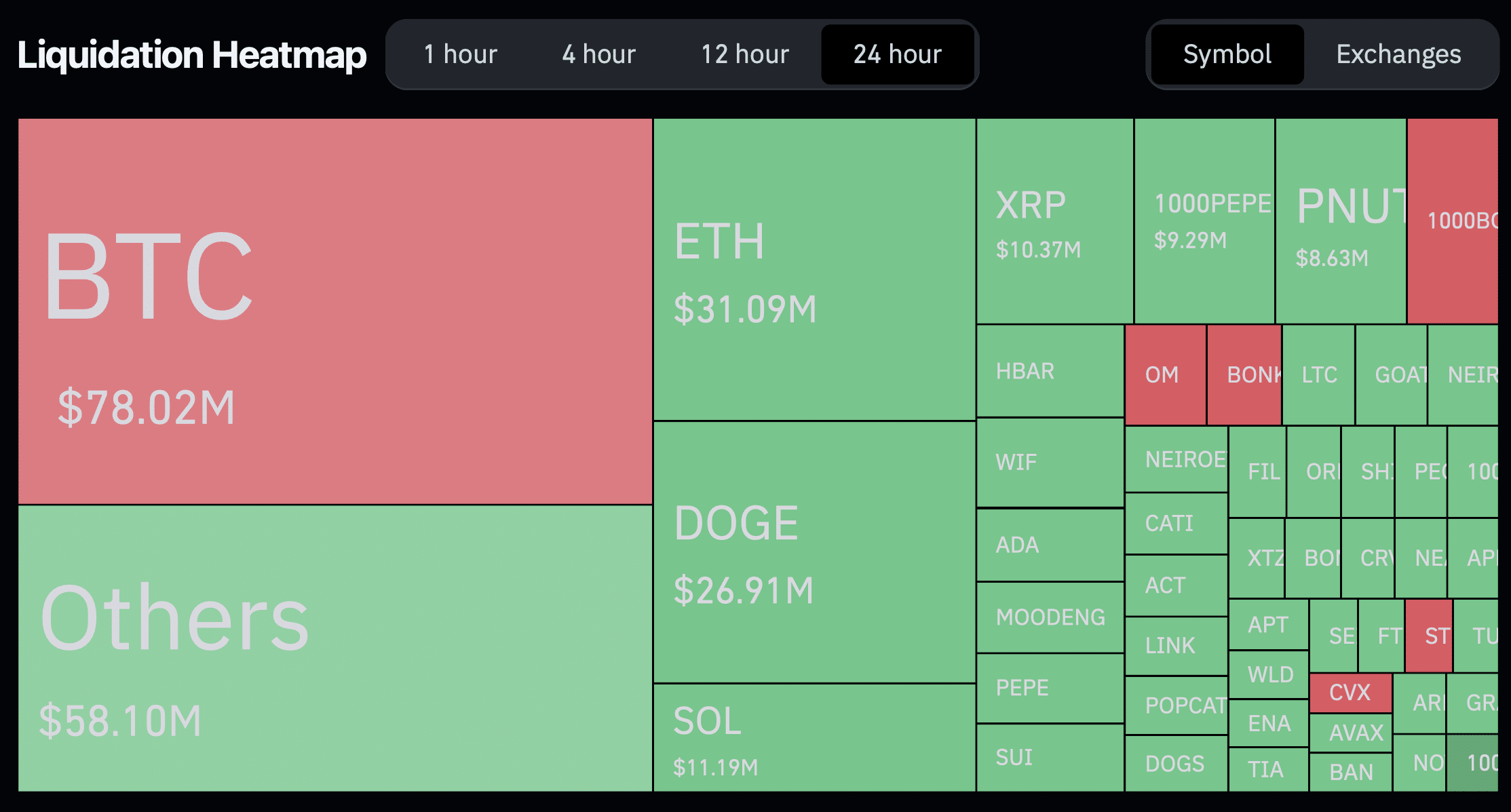

Knowledge from Coinglass indicated that within the final 24 hours, 119,717 merchants confronted liquidation, with a complete worth of roughly $317.33 million.

Liquidation happens when a dealer’s place is forcibly closed by an alternate resulting from inadequate funds to keep up a leveraged place.

This usually occurs throughout excessive market volatility when costs transfer towards the place a dealer has taken.

Out of the whole liquidations, $78 million have been attributed to Bitcoin, with quick merchants bearing the brunt of it, accounting for $47 million.

Nonetheless, lengthy merchants weren’t totally spared, contributing $31 million to Bitcoin’s whole liquidations.

This development prolonged to different cryptocurrencies, the place main belongings like Ethereum [ETH] witnessed extra lengthy positions being liquidated.

Such liquidations recommend that whereas Bitcoin’s surge has been a standout, not all belongings available in the market have skilled parallel beneficial properties.

Regardless of the challenges confronted by some, sure cryptocurrencies managed to carry out properly. Cardano [ADA] recorded a 4.8% enhance, whereas Pepe [PEPE] and Bonk [BONK] noticed beneficial properties of 1.1% and 12.5%, respectively.

Macroeconomic drivers

A number of macroeconomic elements have contributed to the efficiency of crypto at this time.

Notably, MicroStrategy, led by Michael Saylor, made its largest Bitcoin acquisition to this point, buying practically 52,000 BTC valued at over $4.6 billion.

Such high-profile acquisitions usually propel market confidence, reinforcing Bitcoin’s standing as a key asset.

Moreover, curiosity in crypto at this time acquired a lift from Rumble, a competitor to YouTube.

The platform’s CEO hinted at exploring the potential for including Bitcoin to Rumble’s steadiness sheet, which may additional propel mainstream adoption.

As of the third quarter’s finish, Rumble held $131 million in money and money equivalents, highlighting its capability to make important investments in cryptocurrency.

Regardless of widespread optimism, analysts have urged warning. Cypress Demanincor, a market analyst on X (previously Twitter), shared insights on the broader crypto market chart, warning:

“A break below the $3-$2.9 trillion threshold and a daily close below would likely signal a shift, potentially triggering profit-taking and a “risk-off” pull again or correction of this most up-to-date bullish transfer.”