- Bitcoin merchants’ exercise has declined as value consolidation persists.

- Bitwise cited traditionally weak summer time and September seasons because the trigger for BTC weak spot.

Since early August’s large sell-off, Bitcoin [BTC] has struggled to remain above $60K. The muted value motion has persevered within the first half of September.

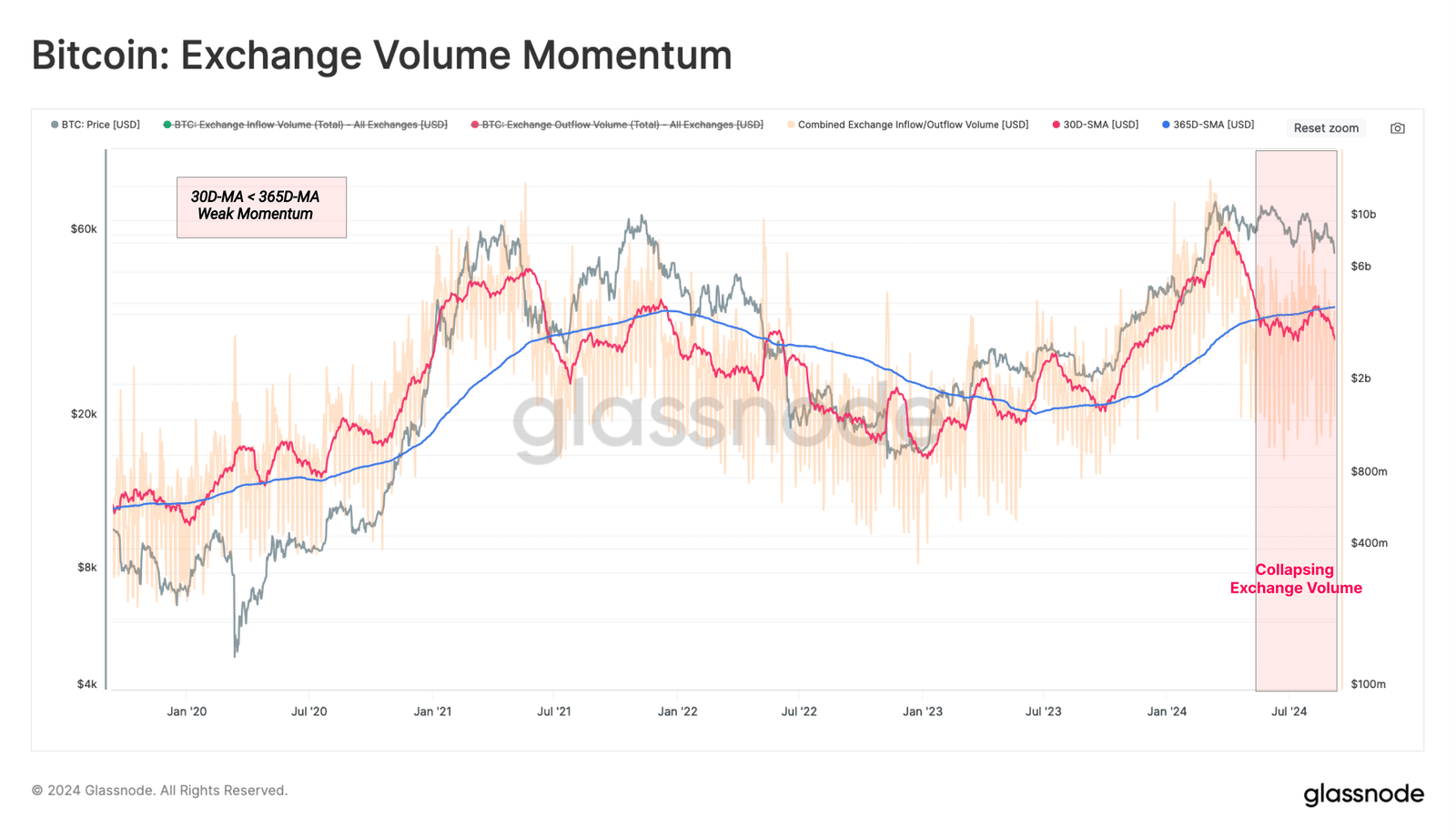

In keeping with a Glassnode report, this weak value motion has led to a “reduced trading appetite” from BTC merchants. A part of its newest report cited low crypto change volumes and skim,

“We can see that the monthly average volume has fallen well below the yearly. This underscores a decline in investor demand and less trading by speculators within the current price range.”

The report added {that a} crypto change is heart of value discovery and hypothesis exercise. So, a contracting quantity on this entrance signaled weak demand from BTC merchants and buyers.

BTC promoting strain intensifies

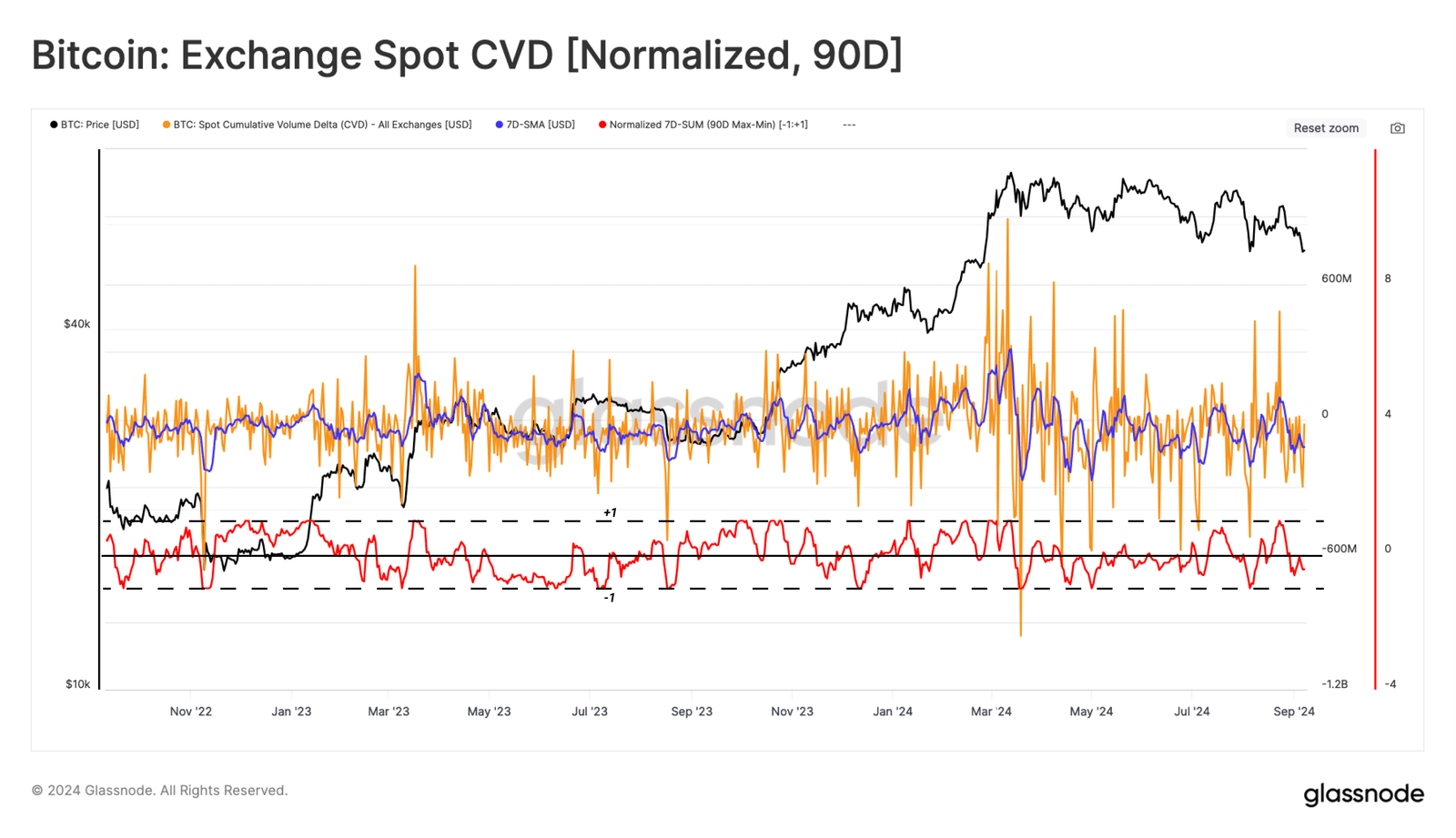

Glassode additionally famous that the spot market witnessed total promote strain in August and your entire quarter.

Utilizing the spot CVD (Cumulative Quantity Delta), which tracks the web stability between purchase and promote volumes, the metric was overwhelmingly adverse in Q3.

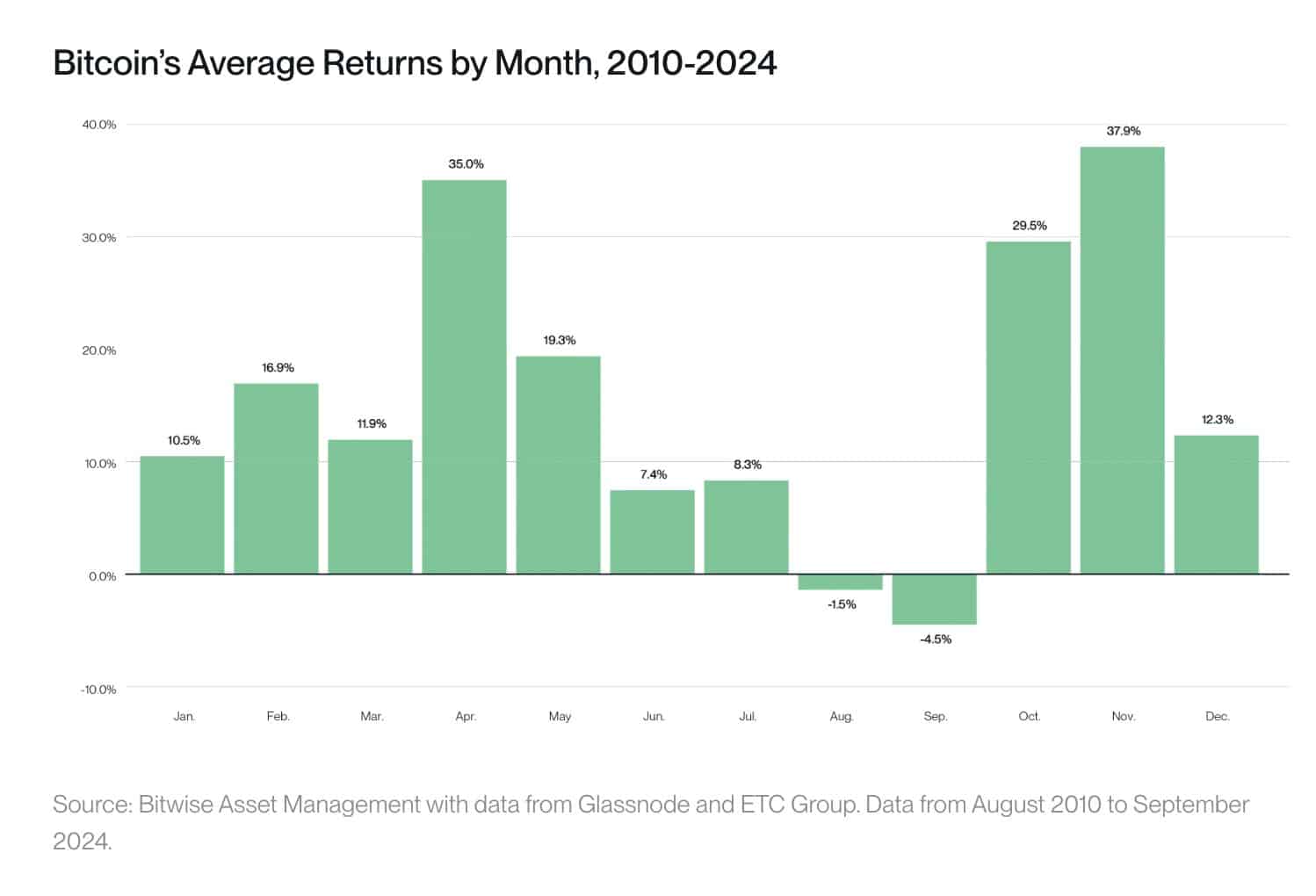

On its half, Bitwise cited seasonality as a possible consider BTC’s weak efficiency and sentiment in Q3, significantly in September.

The asset supervisor illustrated that BTC has traditionally posted adverse returns in August and September.

Nonetheless, the agency famous a basic development of poor summer time efficiency throughout all belongings, as buyers undertake the ‘sell in May and go away’ mantra.

That mentioned, October has traditionally been an incredible month for BTC, with a mean return of almost 30%.

If the development repeats, this may sign a powerful rebound for BTC in This fall. Nonetheless, in accordance with crypto buying and selling agency QCP Capital, there’s one caveat.

Per QCP Capital, the latest Trump-Harris debate confirmed no robust lead among the many candidates and will set off a risk-off occasion.

“The absence of a clear frontrunner in this election, coupled with the murky policy stances from both parties, heightens the possibility of a risk-off move in risk assets as we approach Election Day.”

At press time, BTC traded at $57k, a couple of hours earlier than the US August CPI (Client Worth Index) knowledge.