- The crypto worry and greed index just lately hit 74, indicating excessive market greed.

- Bitcoin miner income soared over the previous month.

The rally that Bitcoin [BTC] noticed over the previous few weeks, induced the worth to surge and stagnate on the $68,000 stage. Nevertheless, new knowledge indicated that the urge for food of the bulls continued to extend.

Crypto worry and greed index tells you…

Knowledge from Various.com showcased that the crypto worry and greed index was at 74, implying that the market was extraordinarily grasping. Throughout this era, the danger urge for food for merchants and holders will increase as they’re extra more likely to accumulate extra BTC.

Despite the fact that BTC is near its all-time excessive (ATH), the rising greed of merchants signifies that there’s an expectation for BTC to succeed in its beforehand attained ATH and even surpass it sooner or later.

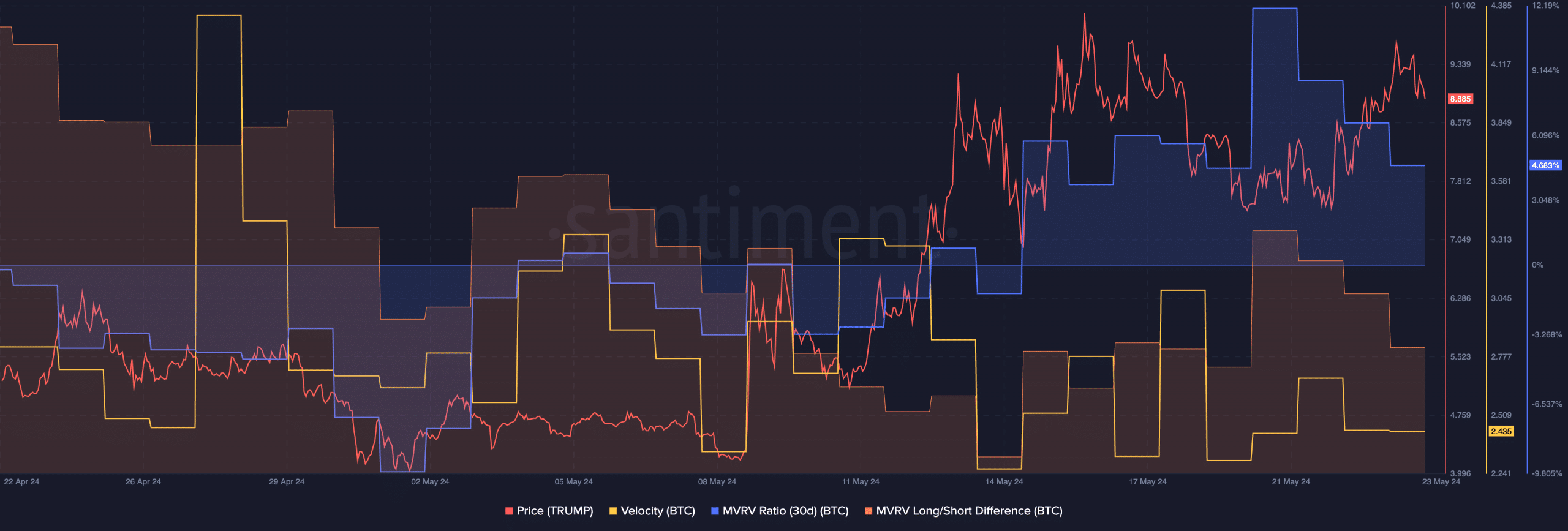

At press time, BTC was buying and selling at $68,385.79. It might want an uptick of seven.21% to succeed in its earlier ATH. The speed at which BTC was buying and selling at declined materially, implying that the majority addresses had been eager on holding their BTC.

The MVRV ratio was comparatively excessive, indicating that the majority holders had been worthwhile on the time of writing.

Excessive profitability generally is a double-edged sword for BTC. On one hand, profitability may also help enhance sentiment round BTC.

Then again, some addresses possibly incentivized to take pleasure in revenue taking inflicting promoting stress on BTC. The conduct of holders can present an perception on whether or not these holders resolve to promote their holdings.

The Lengthy/Quick distinction declined over the previous few days, suggesting that the presence of short-term holders (STH) was rising. These STHs usually tend to promote their BTC for income which might trigger volatility for the king coin in the long term.

Miners rejoice

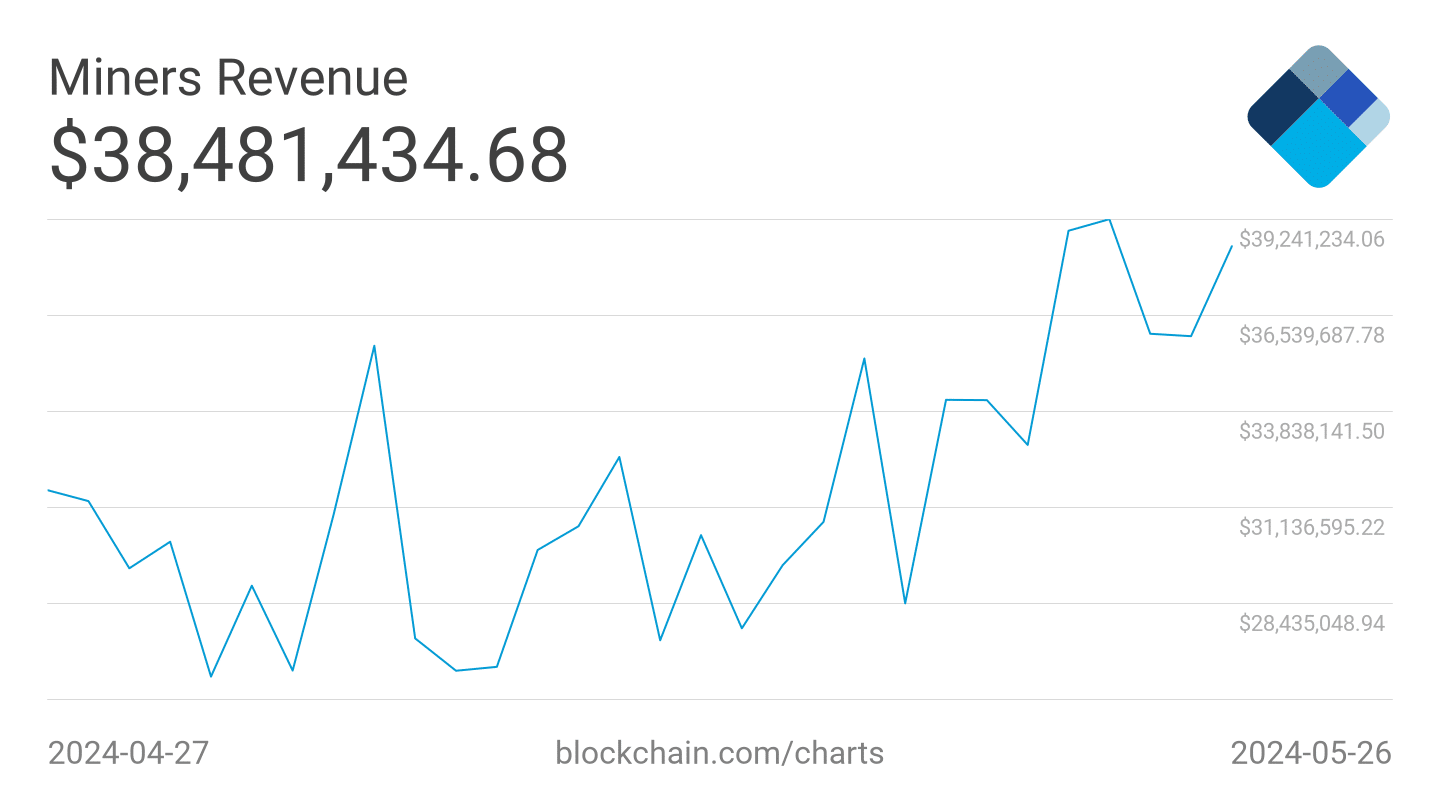

One other issue that may deeply affect promoting stress on BTC can be the state of miners. If miner revenues decline, miners are pressured to promote their holdings to stay worthwhile which might trigger issues for the worth of BTC.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

On the time of writing, issues seemed optimistic for miners. AMBCrypto’s evaluation of Blockchain.com’s knowledge revealed that every day miner income soared from $28,435,048 to $39,241,234 over the previous few days.

Contemplating these components, the possibilities of a BTC correction are low.