Coinspeaker

Crypto Funds See $321 Million Inflows amid Dovish FOMC Feedback

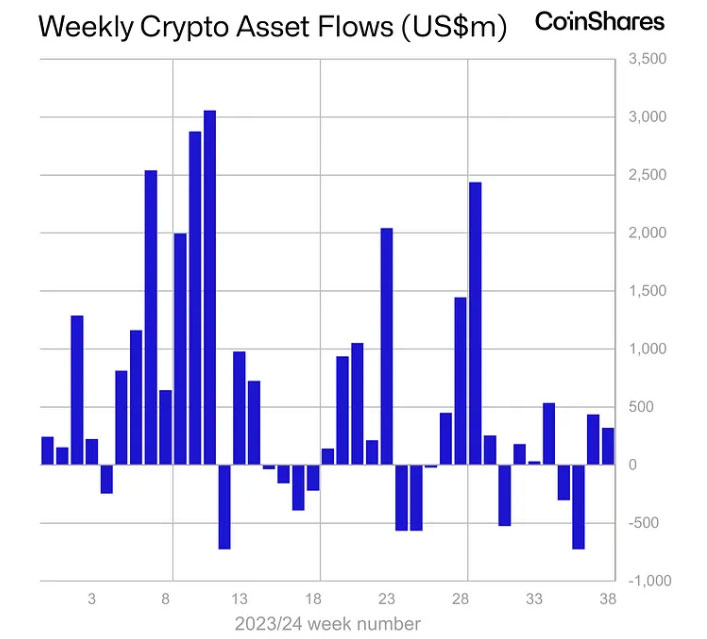

The worldwide crypto funding market skilled a notable restoration final week, with web inflows reaching $321 million throughout varied digital asset merchandise. This vital rebound adopted two consecutive weeks of outflows, signaling renewed investor confidence within the crypto sector.

Asset managers giants corresponding to BlackRock, Constancy, Bitwise, and Grayscale have been key contributors to the surge. Their involvement exhibits the rising institutional curiosity in digital belongings. The restoration can be tied to latest developments from the Federal Open Market Committee (FOMC), which adopted a extra cautious method than anticipated.

In accordance to CoinShares Head of Analysis James Butterfill, the FOMC’s determination to chop rates of interest by 50 foundation factors final Wednesday performed an important position in boosting market sentiment, making a extra favorable atmosphere for traders, and inspiring capital circulate into crypto merchandise.

Picture: CoinShares

Consequently, complete belongings below administration (AUM) in crypto funds rose by 9%, reaching $9.5 billion. Buying and selling volumes additionally noticed a 9% enhance in comparison with the earlier week, additional highlighting the market’s strengthening momentum.

Bitcoin Dominates the Surge

Bitcoin-based merchandise led the cost, accounting for $284 million of the online inflows. The bullish momentum in Bitcoin not solely attracted long-term traders but in addition led to a notable inflow of $5.1 million into short-bitcoin merchandise, reflecting a various market sentiment.

Whereas Bitcoin

BTC

$62 836

24h volatility:

-1.5%

Market cap:

$1.24 T

Vol. 24h:

$29.84 B

maintained its dominance, Solana-based funds additionally noticed continued good points, with $3.2 million in inflows throughout the identical week. The bulletins made on the Solana Breakpoint convention in Singapore performed a pivotal position in bolstering these investments.

In the meantime, Ether merchandise prolonged their decline with web outflows of $29 million, marking the fifth straight week of losses. Throughout this era, Ether funds have seen complete outflows attain $187.7 million. Notably, Grayscale’s ETHE fund, identified for its excessive charges, continues to be the biggest contributor to those losses. Regardless of this, US spot Ethereum ETFs, launched in July, have attracted $2.2 billion in inflows.

Regional Variations in Fund Flows

Geographically, US-based funds have been on the forefront, securing the lion’s share of inflows with $277 million. Switzerland emerged as a powerful contender, registering its second-largest weekly influx of the yr with $63 million. In distinction, funding merchandise in Germany, Sweden, and Canada skilled outflows, amounting to $9.5 million, $7.8 million, and $2.3 million, respectively.

This regional disparity underscores the various investor sentiment throughout international markets. Whereas the U.S. and Switzerland noticed renewed curiosity in crypto investments, different areas continued to exhibit warning amid fluctuating market circumstances.

As the worldwide crypto market navigates this restoration section, it stays to be seen whether or not these inflows can maintain momentum or if upcoming macroeconomic components will as soon as once more mood investor optimism. Nevertheless, the continuing market restoration serves as a testomony to the resilience of the crypto area and its capacity to adapt to shifting regulatory and monetary landscapes.

Crypto Funds See $321 Million Inflows amid Dovish FOMC Feedback