- Bitcoin whale to probably face liquidation of $28M WBTC.

- The value motion reveals value is ready for additional decline.

Bitcoin’s [BTC] latest value motion continued to frustrate merchants as uncertainty loomed over the “king of crypto.”

Whereas different cryptocurrencies confronted comparable declines, BTC was particularly affected by whale exercise.

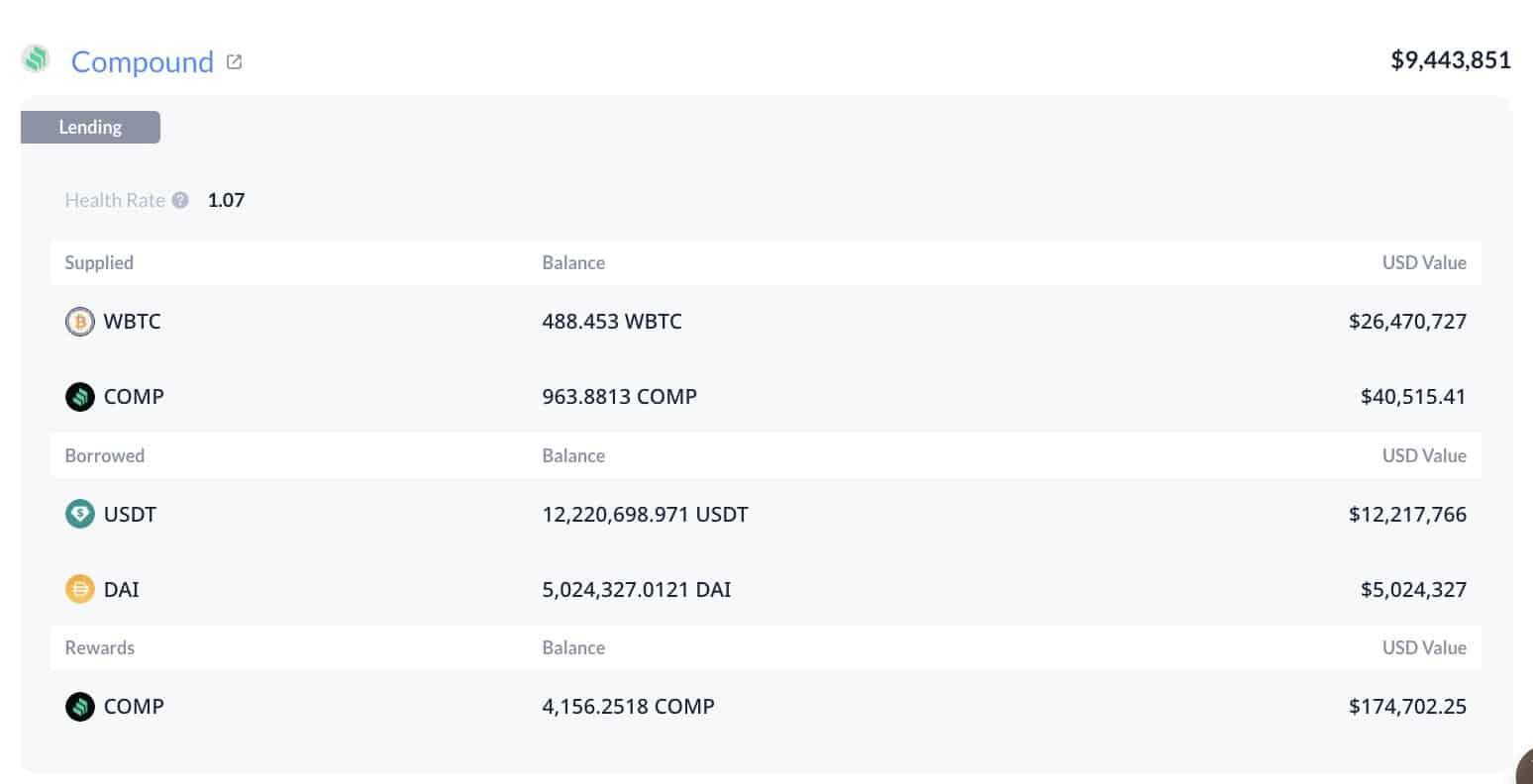

One outstanding whale dangers liquidation of 488.45 WBTC, price $28M, on Compound [COMP], with a well being charge of 1.07 and a liquidation value at $50,429.

This whale was liquidated thrice in the course of the 2022 crash, totaling 74,426 cWBTC price $32.82M. The present liquidation orders under $50,429 may drive the Bitcoin value towards this stage.

Extra BTC ranges to be liquidated

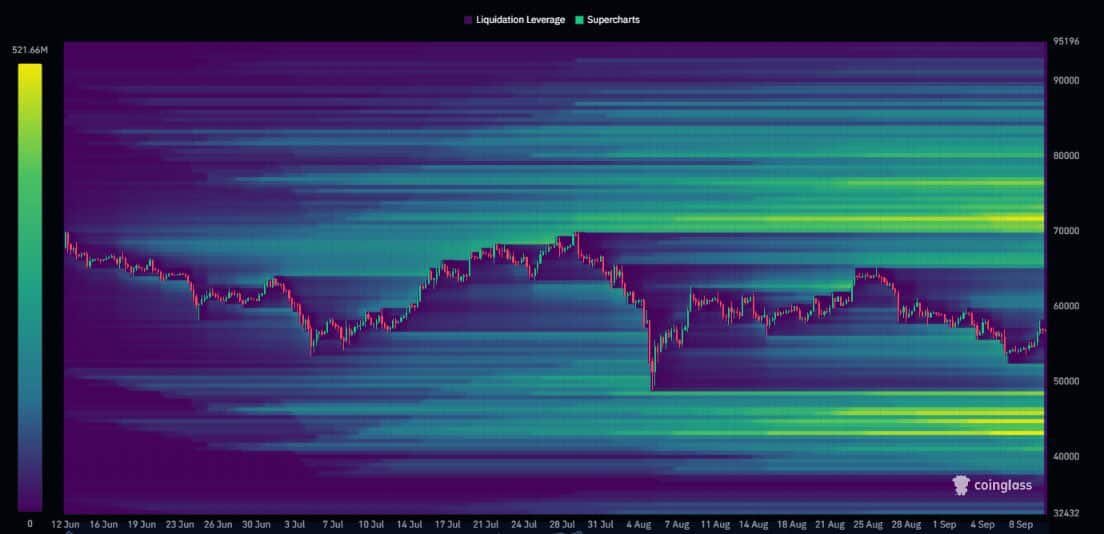

The broader Bitcoin market is vulnerable to additional liquidation. Notably, sell-side liquidations are projected to hit $1.07B across the $50K mark, with an additional $500 million anticipated under $55,000.

A 3-month heatmap revealed excessive liquidity ranges on either side of the market, with lengthy liquidations close to $45K and quick liquidations round $72K.

Merchants ought to keep away from leveraged positions because the market may transfer sharply in both route to seize liquidity.

After rejecting the $60K stage, Bitcoin’s value could decline additional, probably choosing up liquidity under $50K earlier than making a reversal to the upside.

What’s subsequent for BTC?

On the 4-hour timeframe, Bitcoin has repeatedly failed to interrupt above the 200-day exponential transferring common (EMA) in latest weeks.

This prompt that BTC may face further downward strain. Costs are sometimes drawn to liquidity resting above or under key ranges.

Whether or not BTC trades above or under its transferring averages affords perception into market energy or weak point.

Bulls have to reclaim these transferring averages to set off a bounce, however sentiment signifies that the value would possibly drop additional as extra liquidity is concentrated on the psychological $50K stage.

Historical past reveals a return to a stability zone

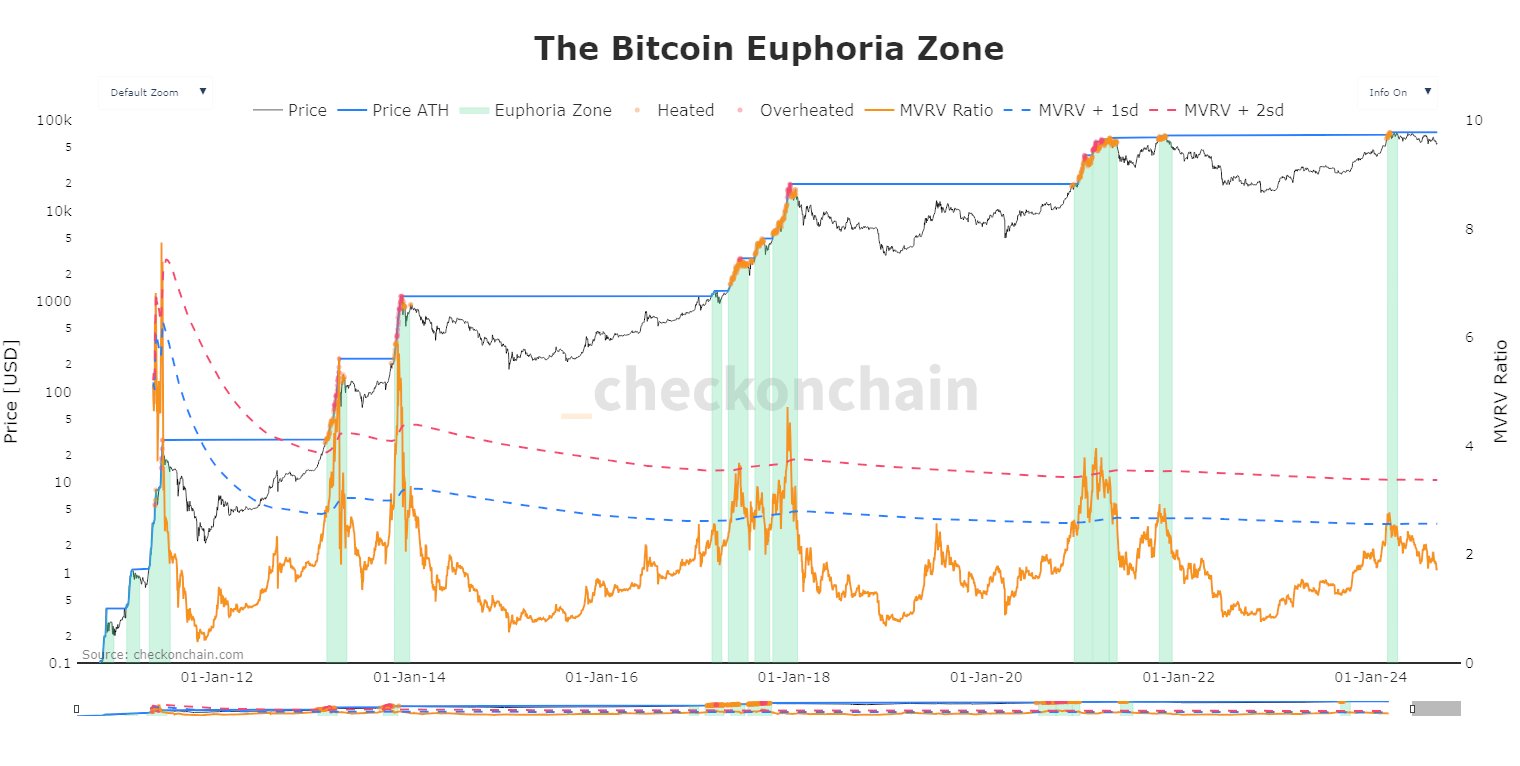

Traditionally, Bitcoin tends to return to a stability zone, providing potential for future value progress.

The Euphoria Zone metric means that the ATH of the earlier cycle sometimes turns into the low for the subsequent rally.

Different metrics just like the market worth/realized worth (MVRV) ratio present BTC is heading towards a stability zone, a important stage from which value traditionally bounces.

Though Bitcoin hasn’t reached these ranges but, analysts predict BTC may dip under $50K, collect liquidity, after which rise to new highs, probably by late This fall 2024 or early Q1 2025.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Bitcoin’s value motion and ongoing liquidations level to potential volatility within the close to future. As liquidity builds under key ranges, BTC may decline additional earlier than experiencing a considerable rebound.

Nevertheless, if Bitcoin follows historic patterns, it’ll probably rebound, setting the stage for the next value surge as liquidity strengthens.