- El Salvador’s strongman has doubled down on BTC regardless of low adoption stats

- Bukele nonetheless assured in Bitcoin’s future

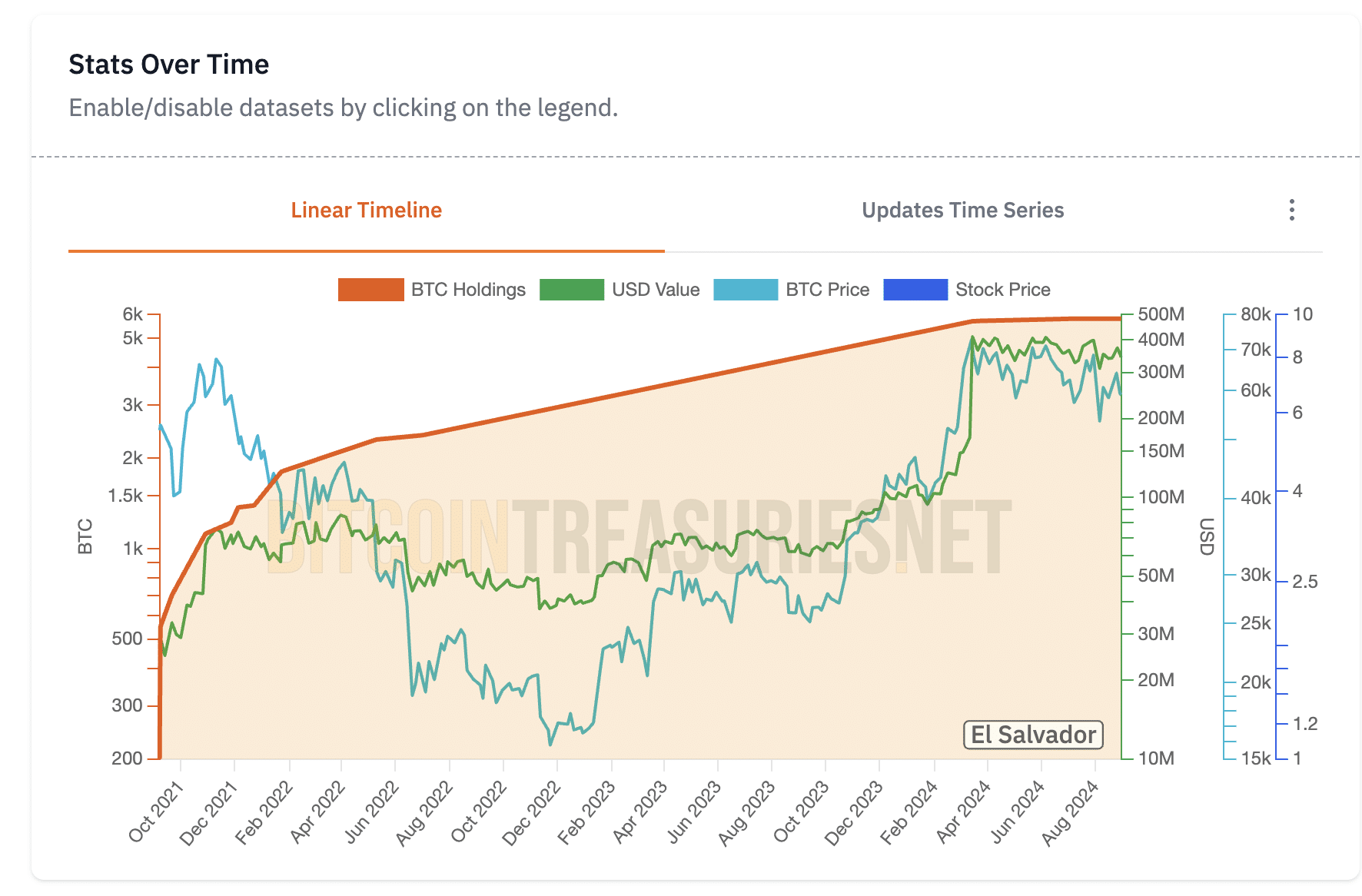

El Salvador’s Nayib Bukele got here in for lots of criticism when he acknowledged Bitcoin as authorized tender throughout the nation. Particularly from the likes of the Worldwide Financial Fund and the World Financial institution. 3 years since, nevertheless, the nation now has $400 million in BTC reserves, with its determination to carry the cryptocurrency as a reserve asset seeming like an excellent thought.

This was the gist of a part of Bukele’s newest interview with TIME. Based on El Salvador’s President, whereas the experiment hasn’t been a whole success, “the positives have so far outweighed the negatives.”

Low adoption, however nonetheless a “net positive”

Why does the statesman assume so although? Nicely, adoption hasn’t been as excessive as initially anticipated, with Bukele underlining the identical throughout the aforementioned interview. Even so, he believes that Bitcoin is a forex with a future, even when it will not be the “currency of the future.”

In reality, El Salvador’s President believes that the most important success related to the nation’s adoption of BTC has to do with the truth that adoption was fully voluntary. He stated,

“The positive aspect is that it is voluntary; we have never forced anyone to adopt it. We offered it as an option, and those who chose to use it have benefited from the rise in Bitcoin.”

Regardless of the lower than anticipated adoption charges although, Bukele believes there’s “still time to make some improvements.” In reality, on the entire, the nation’s foray into Bitcoin has been a “net positive,” with the identical underlined by the truth that its Bitcoin treasury holdings are value virtually $400 million now.

Supply: Bitcoin Treasuries

All the opposite advantages

Exterior of the financial advantages, El Salvador has additionally been on the proper finish of numerous branding, investments, tourism, and a spotlight. The anticipated inauguration of a “Bitcoin City” is a working example, with many establishments, each personal and state-owned, following the nation’s result in dive into this asset class fully. In lots of approach, El Salvador had the “First Mover” benefit over different international locations doing the identical with Bitcoin.

He added,

“The fact that major Wall Street companies are now engaging in it—something that seemed unthinkable three years ago when we did it—shows its impact. Some countries already hold reserves in Bitcoin or are investing in Bitcoin and Bitcoin mining.”

Right here, the importance of what he’s stating must be pressured, particularly since cryptocurrencies as an asset class are an necessary challenge within the upcoming U.S elections. Former President Trump, as an illustration, has already accomplished his pivot in the direction of cryptos, even accepting them within the type of donations. Quite the opposite although, Vice President Harris has been extra circumspect, one thing which may work towards her in November.

These often is the explanation why El Salvador’s President remains to be doubling down on Bitcoin, with the nation anticipated to purchase extra BTC for its treasury quickly. In reality, such has been its impression that regardless of preliminary misgivings, the IMF final 12 months launched a report which claimed that “the risks of Bitcoin in El Salvador have not materialized.”