- Analysts predict peak cycle for Bitcoin and Ethereum amid regulatory uncertainty.

- Regulatory debates and SEC allegations intensify unfavourable sentiment towards Ethereum.

As Bitcoin [BTC], the main cryptocurrency, dips under the $60,000 threshold, analysts recommend that BTC could have reached its peak for this cycle.

Ethereum [ETH] appears to be mirroring the actions of Bitcoin, as each cryptocurrencies are at present experiencing a downward pattern.

Commenting on the distinctiveness of this crypto cycle, crypto veteran Alex Krüger mentioned,

“The crypto cycle has been almost entirely driven by the bitcoin ETF.”

He additional added,

“ETH has been a major disappointment, but it has performed well overall for stakers and airdrop farmers.”

Why is Ethereum shedding its limelight?

Undoubtedly, Bitcoin achieved exceptional efficiency by reaching new document highs on this cycle. Nevertheless, Ethereum’s place has declined, falling under Solana by way of product-market match and retail dealer reputation.

This raises a query: Can Ethereum’s value plummet to $2500 inside the subsequent 7 days?

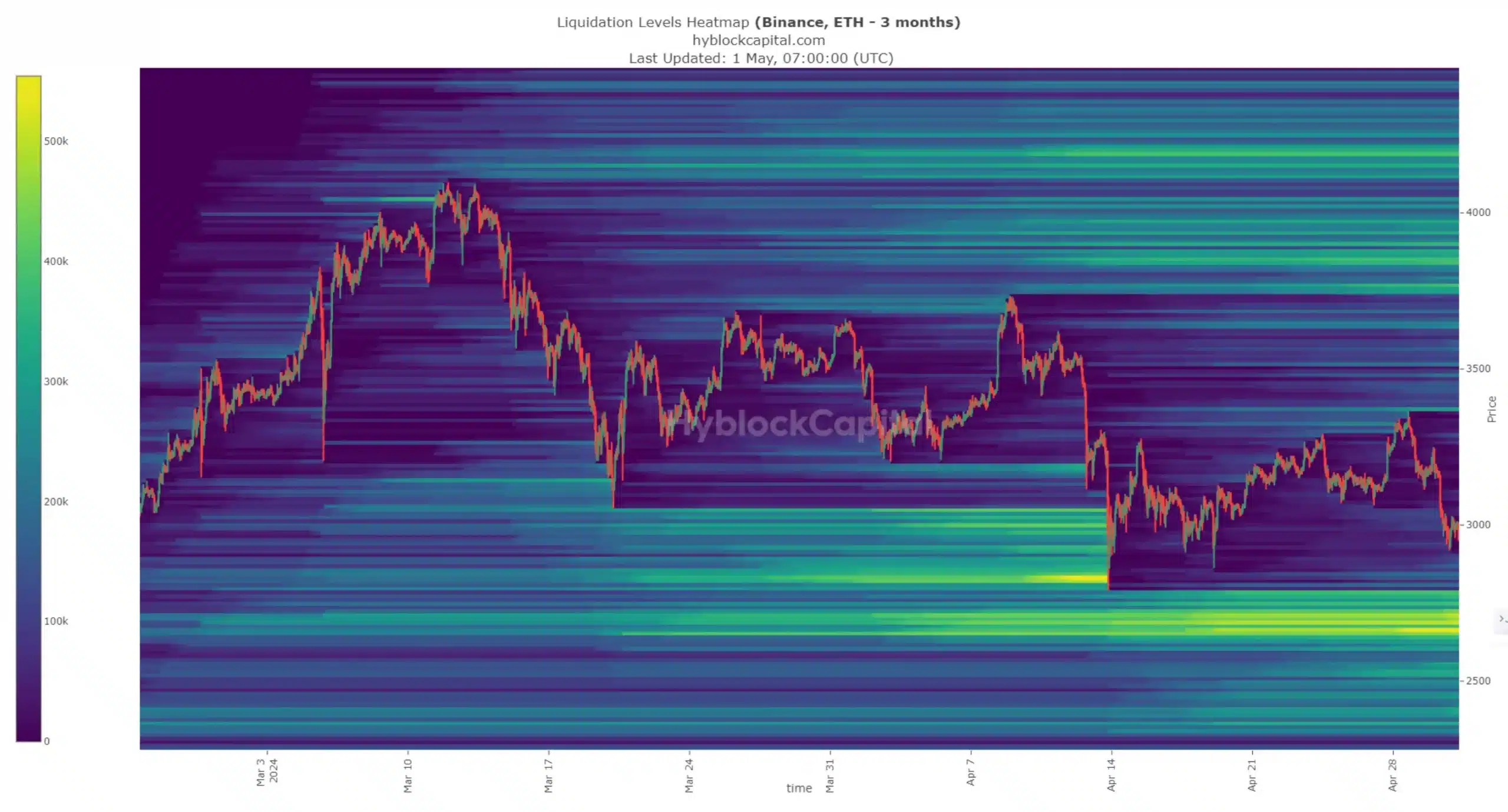

Effectively, to reply this, AMBcrytpo analyzed the liquidation ranges for ETH.

In line with the evaluation, the Ethereum market has a cluster of liquidation ranges between $2640 and $2750, attracting merchants as a consequence of excessive liquidity. Moreover, this value vary aligns with a bullish order block noticed on the vary highs, additional reinforcing its significance.

This underlines that Ethereum’s value is predicted to say no to this liquidity pocket earlier than a possible reversal.

The issues encompass ETH’s classification as a safety

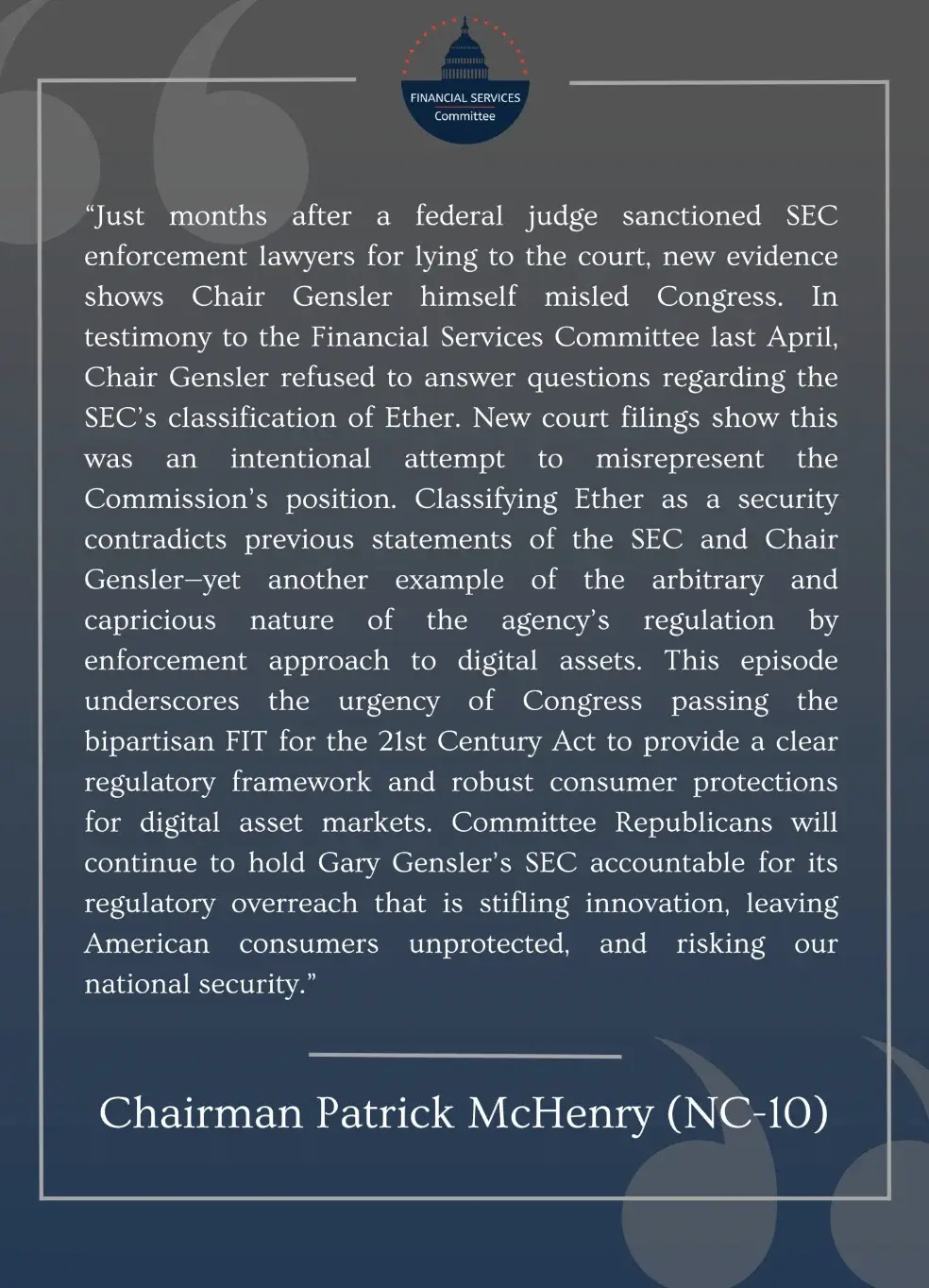

Furthermore, the continuing debate surrounding whether or not ETH is a safety has intensified unfavourable investor sentiment towards Ethereum.

Amidst these metrics, a brand new growth additionally befell whereby Rep. Patrick McHenry, the chairman of the Home Monetary Companies Committee famous,

“New court filings indicate that @SECGov Chair Gary Gensler knowingly misled Congress when pressed on the classification of #ETH at a @FinancialCmte hearing to conduct oversight of his agency.”

This highlights the rising uncertainty surrounding Ethereum’s regulatory standing and its influence on investor sentiment.

Echoing related sentiments, @TheDustyBC, a content material creator, took to X (Previously Twitter) and mentioned,

“Ethereum not being kind on the feelings today.”

Method ahead

Nevertheless, now with the hawkish stance on the Federal Open Market Committee (FOMC) assembly on the first of Might. And, the Hong Kong ETFs being a significant disappointment, the execs are nonetheless ready for the tables to show. Evidently, Krüger claims,

“The cycle is not over.”