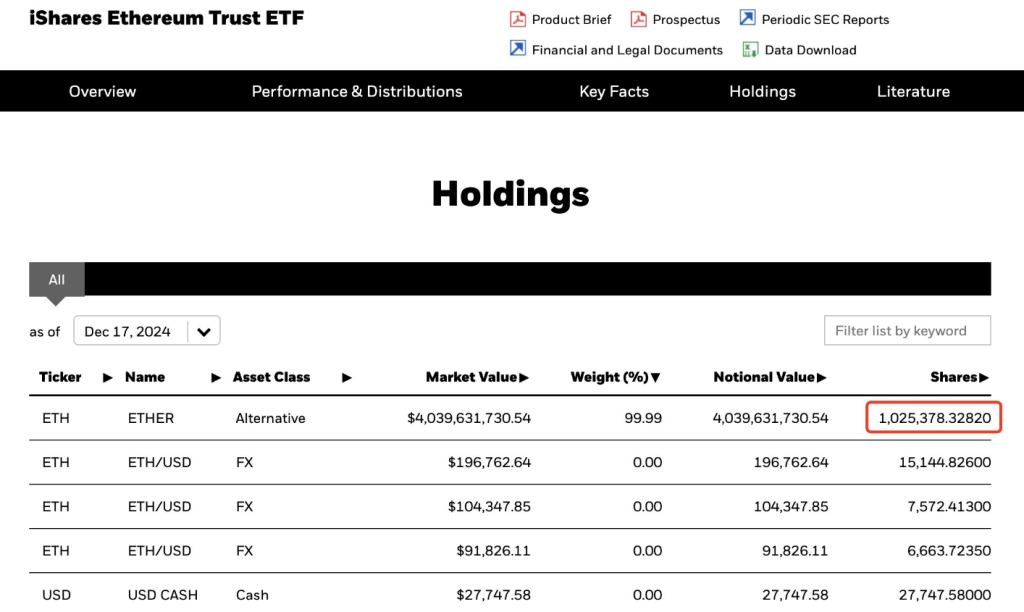

BlackRock’s iShares Ethereum Belief ETF (ETHA) has reached 1 million ETH in holdings, value greater than $4 billion. This milestone, attained on December 18, 2024, is a exceptional feat for the fund, which was based solely six months earlier in July.

As institutional curiosity in cryptocurrencies grows, this ETF emerges as a frontrunner amongst newly launched Ethereum merchandise.

Institutional Curiosity On The Rise

BlackRock’s rising holdings in Ethereum ETFs are a part of a much bigger development of huge firms investing in cryptocurrencies. In 2024, billions of {dollars} had been invested in new Bitcoin and Ethereum exchange-traded funds.

Based on blockchain tracker Lookonchain, ETHA now has 1,025,378 ETH, making it the primary new Ethereum ETF to succeed in this milestone. As compared, Grayscale’s Ethereum ETF accommodates roughly 476,000 ETH.

BREAKING: #BlackRock’s iShares Ethereum Belief ETF now holds over 1M $ETH, totaling 1,025,378 $ETH($4.04B).https://t.co/sefS6WTlHz pic.twitter.com/kvd7KY24zQ

— Lookonchain (@lookonchain) December 18, 2024

The rise in property below administration (AUM) is very spectacular given the preliminary difficulties skilled by Ethereum ETFs at launch. Many merchandise skilled minimal inflows as they competed with bigger funds equivalent to Grayscale’s ETHE.

Starting in September 2024, a considerable shift has occurred. Subsequent to political occasions like Donald Trump’s electoral triumph, market sentiment has considerably enhanced. Experiences point out that internet inflows to Ether ETFs surpassed $850 million within the earlier week.

A Promising Future For Ethereum

Consultants really feel that rising curiosity might point out a brilliant future for Ethereum. Juan Leon, a senior funding strategist at Bitwise Asset Administration, believes Ether is because of rebound in 2025. He says that the marketplace for real-world property might produce greater than $100 billion in annual charges for ETH, a lot past its present earnings.

The present inflow of capital into Ethereum ETFs displays institutional buyers’ newfound confidence. CoinGlass information reveals that these merchandise have lately acquired important investments, with whole property throughout a number of Ethereum ETFs topping $14 billion. This development reveals that extra buyers wish to get hold of publicity to Ether with out the trouble of managing their very own wallets.

Trying Forward

The Head of Digital Belongings Analysis at BlackRock warns that it would take a while for Ethereum merchandise to catch as much as their Bitcoin counterparts, regardless of this encouraging development. Because the market and regulatory surroundings modifications, the trail forward can nonetheless be tough.

Nonetheless, with rising institutional assist and growing curiosity from conventional finance entities, the outlook for BlackRock’s Ether ETF and the broader cryptocurrency market seems promising as we transfer into 2025.

Featured picture from DALL-E, chart from TradingView