Coinspeaker

Ethereum (ETH) Value Skyrockets In a single day: Is $4,000 Goal in Sight?

Ethereum worth

ETH

$3 391

24h volatility:

1.7%

Market cap:

$408.06 B

Vol. 24h:

$30.83 B

shot up 4.26% final evening to create a bullish engulfing candle and full a morning star sample. At present, the ETH token is buying and selling at a worth of $3,398, difficult the 50-day EMA line because it bounces off from the 100-day EMA.

Because it prepares for a reversal run, the hourly chart displays an impending breakout able to sign an entry level for worth motion merchants.

Ethereum Value Evaluation

Within the 1-hour worth chart, the Ethereum worth motion showcases a resistance trendline fashioned over the latest correction. This completes a triangle sample with final evening’s restoration run, and it prepares for and teases a triangle breakout rally.

Moreover, the ETH worth motion additionally varieties an Adam and Eve sample because it varieties a V-shaped restoration and a rounding backside reversal. The neckline of the Adam and Eve sample coincides with the 38.20% Fibonacci stage at $3,477.

Therefore, the bullish breakout of the triangle sample will conclude the short-term pullback part and improve the possibilities of a bullish sample breakout. As per the Fibonacci ranges, this breakout rally might attain the $4,000 psychological mark earlier than the top of 2024.

Establishments Assist Ethereum Reversal Probabilities

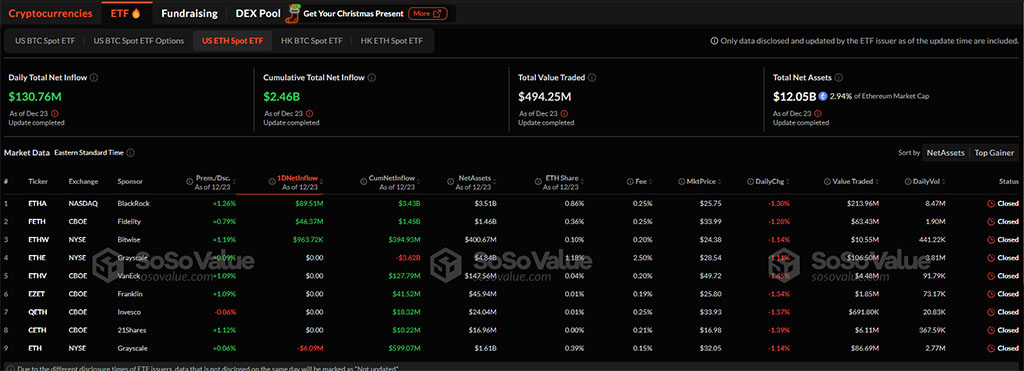

Regardless of the US spot Bitcoin ETFs registering a detrimental influx of $226 million, the institutional demand for Ethereum has resurged. With a each day web influx of $130.76 million on December 23, the overall web property have crossed the $12 billion mark.

It dominates 2.94% of the Ethereum market cap and reaches a cumulative complete web circulation of $2.46 billion.

Main the bullish pack, BlackRock bought $89.51 million price of ETH, adopted by Constancy, capturing $46.37 million. Bitwise captured a cumulative $963.72k price of ETH, and Grayscale remained the one outflowing ETF price $6.09 million.

On-chain Insights Sign Purchase ETH

As institutional demand for Ethereum grows with altering technical insights, Ethereum’s community progress additionally indicators a bullish path forward. In a latest tweet by Cryptoquant, a number of key metrics of Ethereum are showcased, giving bullish indicators.

“These factors point to a possessive bullish outlook for Ethereum as market participants appear ready to maintain and potentially increase their exposure to the asset,” mentioned Egyhashx, a technical on-chain analyst on Cryptoquant.

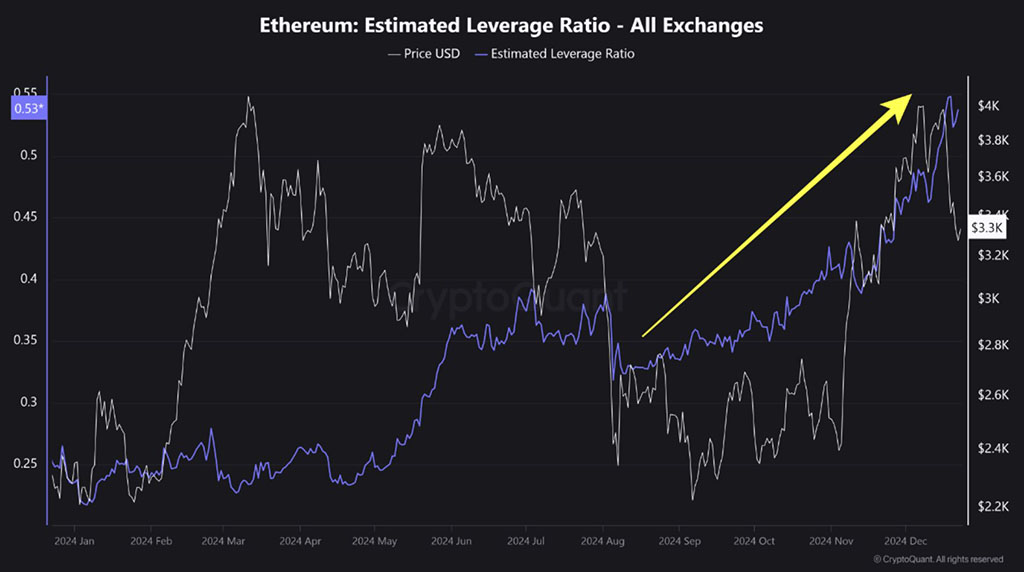

The highlighted metrics embrace Ethereum’s estimated leverage ratio, which has elevated considerably over the previous few months, rising from 0.35 in August to just about 0.5 in December. This highlights the rise in leverage buying and selling within the derivatives market throughout all Ethereum exchanges.

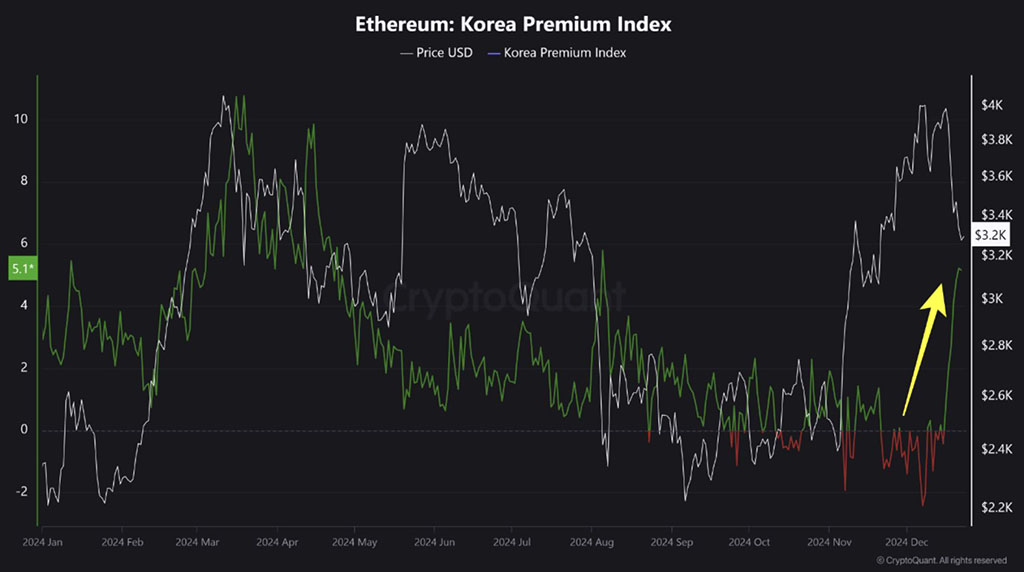

Moreover, the fund holding on Ethereum of all symbols has reached 3.6 million in comparison with lower than 3 million in late October. The funding charges stay constructive total, with the Korean premium index skyrocketing in December.

The premium elevated from -2 to five.1 at its peak in late December. This marks the best Korean premium index for Ethereum since September.

Therefore, the rising demand for Ethereum in establishments and the rising curiosity within the Korean markets are anticipated to spice up the value of the most important altcoins.

Ethereum (ETH) Value Skyrockets In a single day: Is $4,000 Goal in Sight?