Coinspeaker

Ethereum Institutional Demand: Why CME Futures Surge Alerts New Period for ETH

Ethereum

ETH

$3 642

24h volatility:

0.8%

Market cap:

$438.79 B

Vol. 24h:

$16.53 B

lagged behind Bitcoin

BTC

$98 973

24h volatility:

1.3%

Market cap:

$1.96 T

Vol. 24h:

$29.21 B

in 2024, however this might change in 2025 amid a pretty 17% yield alternative that would drive institutional demand.

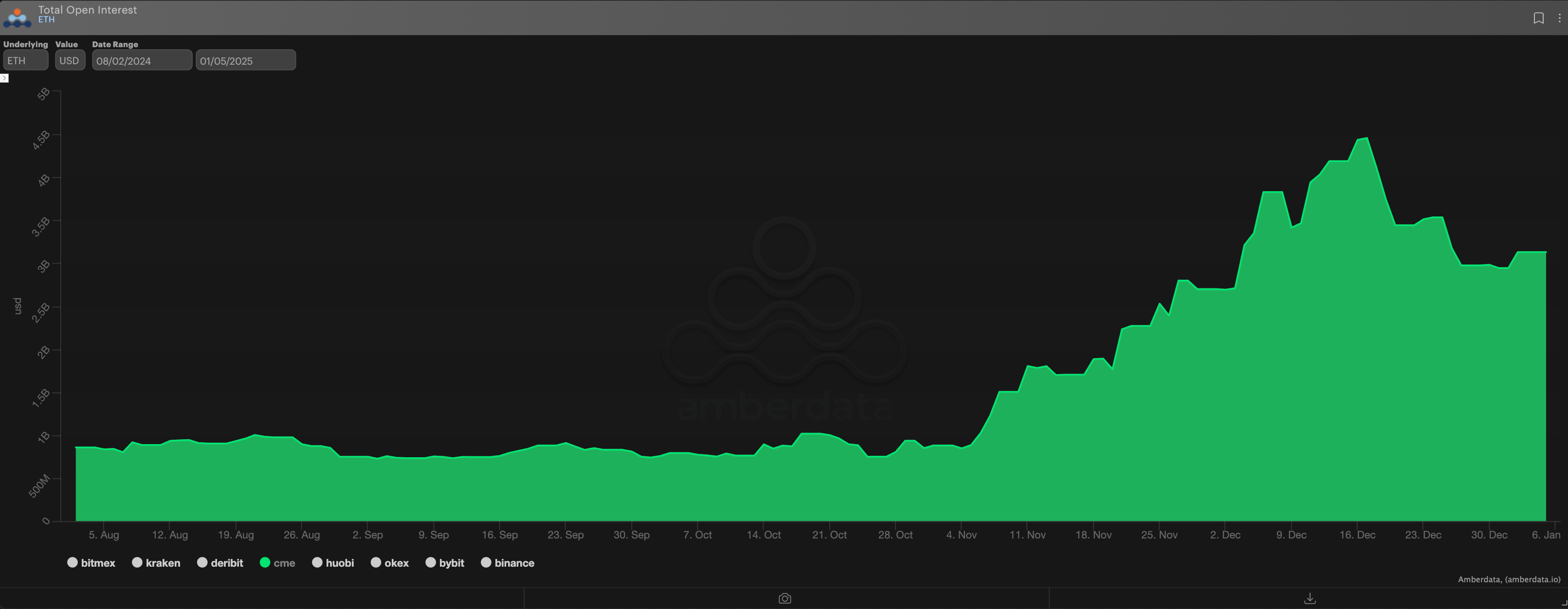

In a latest publication, Greg Magadini, director of derivatives at Amberdata, cited a surge in ETH CME Futures OI (open curiosity) as an indication of renewed institutional curiosity within the good contract platform.

“We’re finally seeing an OI buildup in the Ethereum CME futures complex… which might be signaling that US institutions are paying attention to ETH finally,” wrote Magadini.

The ETH CME Futures surge started after the November US election, underlying the bullish expectations for the asset and DeFi sector throughout the brand new Trump administration. Over the identical interval, the entire OI rose from $1.5B to over $4.5B.

Ethereum’s 17% Yield Alternative

Nevertheless, Magadini famous {that a} potential ETF staking is probably the most bullish catalyst for ETH’s institutional demand and value.

“What’s very interesting, however, is the potential for an ETH ETF that distributes staking rewards to ETF holders. This product would set up a fascinating trade opportunity,” added Magadini.

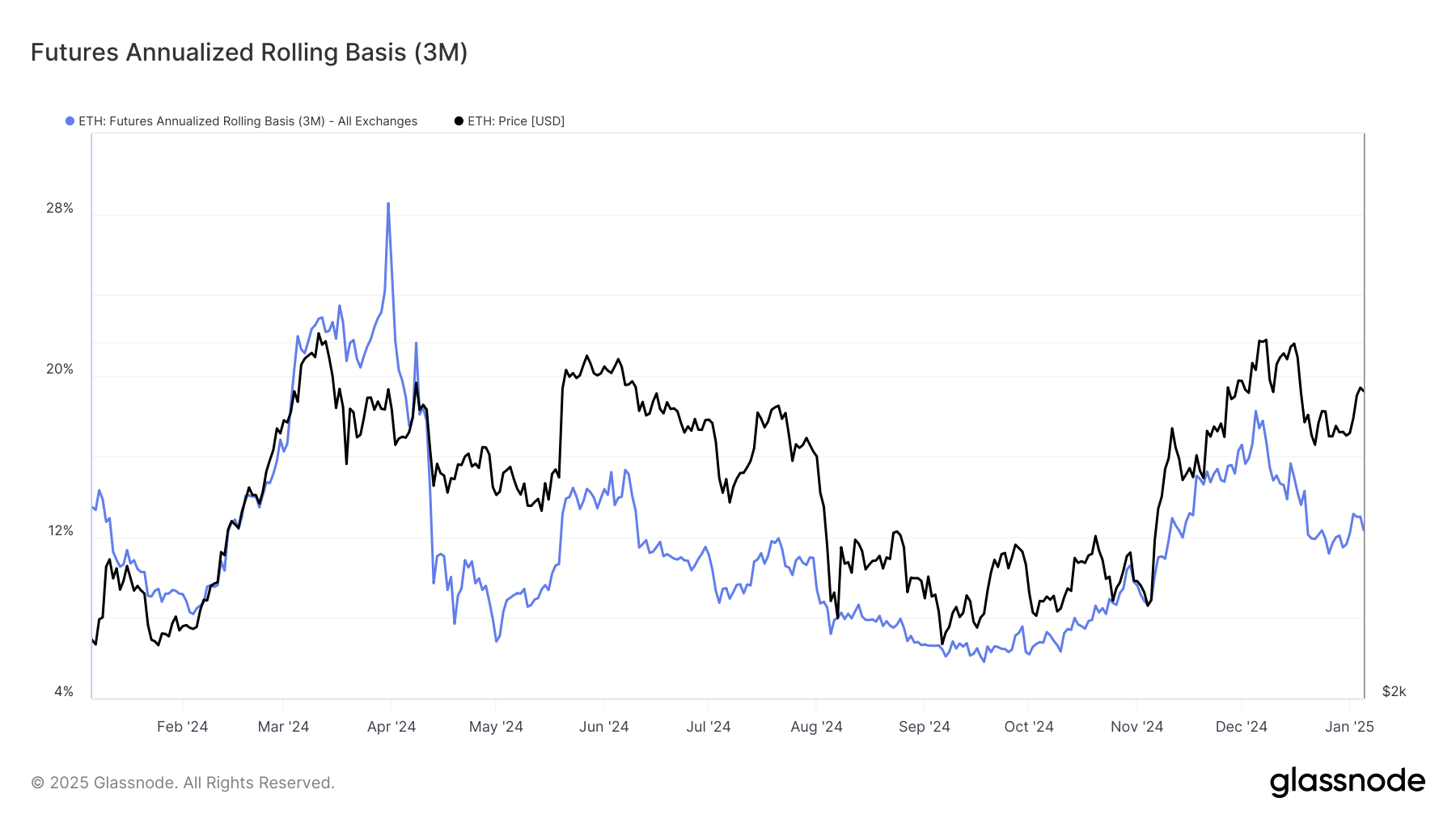

Presently, staking ETH, delegating your token to validators to safe the community, earns a few 3.5% yield per 12 months. Aside from this, buyers can earn an additional 14.5% annualized yield by means of ETH’s foundation commerce as curiosity for CME Futures soar.

For the unfamiliar, ETH’s ‘basis trade’ refers back to the premium collected when merchants purchase spot ETH ETF and concurrently brief the CME Futures. This technique yielded as a lot as 18% APY (annualized share yield) in early December however has eased to 13% as of this writing.

Collectively, the general ETH foundation yield and staking rewards could possibly be engaging to institutional gamers, as famous by Magadini.

“Trades could gain the +14% APY basis yield AND the 3.5% PoS yield. Together the total yield is about 17% in regulated tradFi products with delta-neutral exposure…If regulation permits Staking Reward distributions, given a new SEC direction, this could be a great income opportunities in 2025.”

If that’s the case, the demand for ETH might soar, driving its worth greater. As of this writing, the king altcoin was valued at $3.6K, with Deribit choices merchants eyeing $5K and $6K targets for the end-March expiry.

That mentioned, ETH’s strongest efficiency at all times occurred within the first half of the 12 months. CoinGlass information confirmed that Q1 and Q2 delivered 83% and 66% returns on common, respectively. If the seasonality traits repeat, ETH might file explosive development within the subsequent few months.

Ethereum Institutional Demand: Why CME Futures Surge Alerts New Period for ETH