Coinspeaker

Ethereum Layer-2s Hit Document Highs with $13.5B in Stablecoins Locked

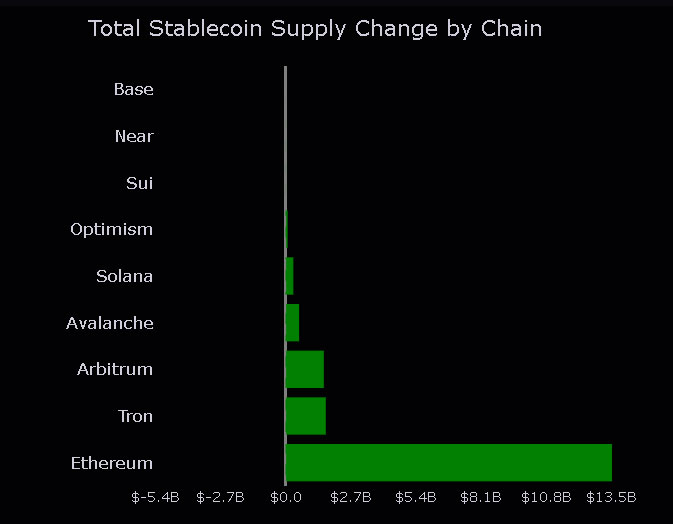

The stablecoin ecosystem is hitting new milestones, with Ethereum layer-2 networks on the middle of the motion. As of December 20, stablecoins price $13.5 billion are locked on Ethereum’s layer-2 platforms amid rising adoption in crypto funds and remittances, in accordance to Tie Terminal’s newest information.

Photograph: The TIE Terminal

Arbitrum One and Base have emerged as key contributors to this improvement. Information from DefiLlama signifies that Arbitrum accounts for $6.73 billion in stablecoin worth, whereas Base holds $3.56 billion. Collectively, these networks have bolstered the general stablecoin circulation, which now boasts a mixed market capitalization of $205 billion throughout all blockchains.

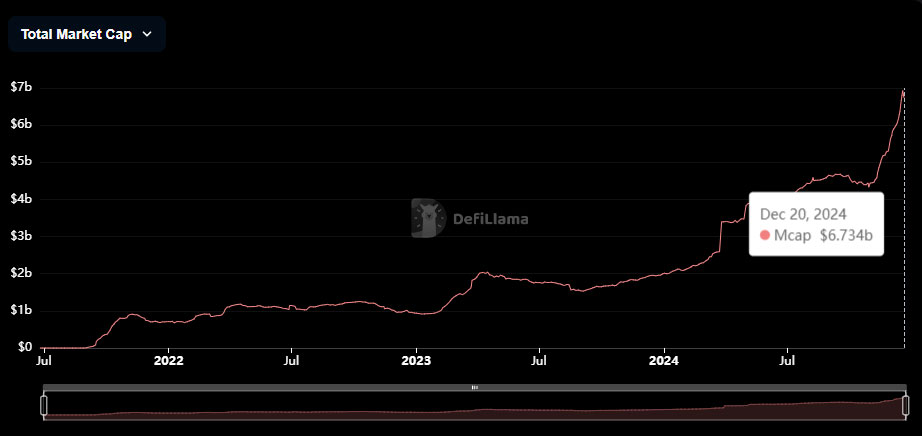

Photograph: DefiLlama

The rising adoption of stablecoins highlights their significance within the present cryptocurrency cycle. Based on Matthias Seidl, co-founder of growthepie.xyz, stablecoins have develop into one of the impactful use circumstances, with layer-2 platforms attaining report ranges of locked worth.

Considered one of cryptos killer use-cases on this cycle are Stablecoins. Layer 2s simply reached a brand new ATH in stables locked on them.

Virtually $12B is now used on all Layer 2s mixed.

For perspective:

– BSC has $6.6B

– Solana has $4.7B

– Avalanche has $2.3B pic.twitter.com/7CcYHGTNAD

— matze | growthepie.xyz 🥧📏 (@web3_data) December 16, 2024

Tether (USDT) Surpasses $140 Billion by 12 months Finish

Among the many leaders, Tether

USDT

$1.00

24h volatility:

0.2%

Market cap:

$139.80 B

Vol. 24h:

$64.54 B

dominates the stablecoin house. Beginning 2024 with a $91.7 billion market cap, USDT grew steadily month by month to surpass $140.88 billion by December 19. In the meantime, Circle’s USD Coin

USDC

$1.00

24h volatility:

0.1%

Market cap:

$42.94 B

Vol. 24h:

$5.66 B

reached its peak for 2024 at $42 billion. Regardless of this, it stays removed from its all-time excessive of $55.8 billion in June 2022.

Photograph: DefiLlama

The regular rise in stablecoin adoption was famous after November 7, when the worldwide market capitalization sat at $123 billion. Since then, an upward pattern has continued, signaling rising confidence in stablecoins as a dependable medium of trade throughout the crypto ecosystem.

Ethereum’s broader ecosystem additionally acquired a lift as stablecoins more and more play a task in real-world purposes. From remittances to world transactions, their utility displays why these digital property are very important to the crypto house.

Ethereum Upgrades Shift Exercise to Layer-2 Networks

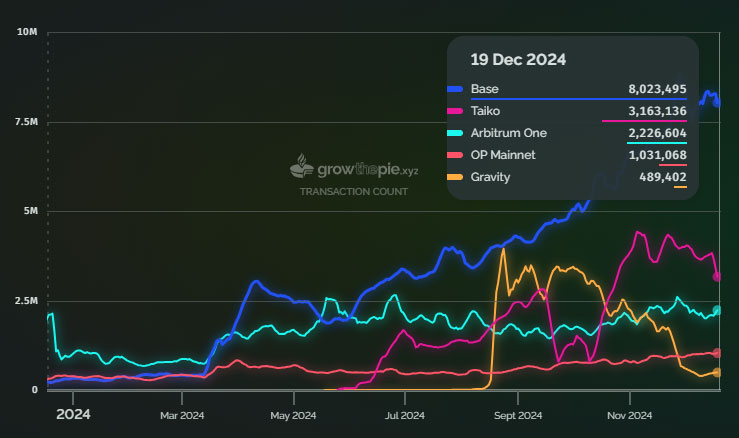

Layer-2 options have seen a pointy rise in utilization following Ethereum’s Dencun improve earlier this 12 months, which diminished transaction prices and boosted roll-up exercise. Base now logs over 8 million each day transactions, in comparison with simply 400,000 in March. Taiko additionally recorded over 3 million each day transactions, underscoring its momentum, in response to Growthepie.

Photograph: Growthepie

In distinction, Linea has seen a worrying decline, falling to 200,000 each day transactions from its earlier highs of over 800,000. Regardless of this, Layer-2 rollups are driving Ethereum’s exercise, serving to to quickly flip ETH provide deflationary. Blob utilization, launched within the Dencun improve, has performed a key position, burning over 1,200 ETH since its implementation.

Arbitrum continues to steer in stablecoin market share, trailed by Base and Optimism. The introduction of Blobs, which quickly shops information to decrease prices, has additional cemented Layer-2’s significance in Ethereum’s roadmap. Vitalik Buterin, Ethereum’s founder, views this as a medium-term purpose for sustaining ETH deflation.

Ethereum Layer-2s Hit Document Highs with $13.5B in Stablecoins Locked