The market intelligence platform IntoTheBlock has revealed how Ethereum has constructed up sturdy on-chain demand zones that ought to hold it afloat above $4,000.

Ethereum Has Two Main Help Facilities Simply Under Present Value

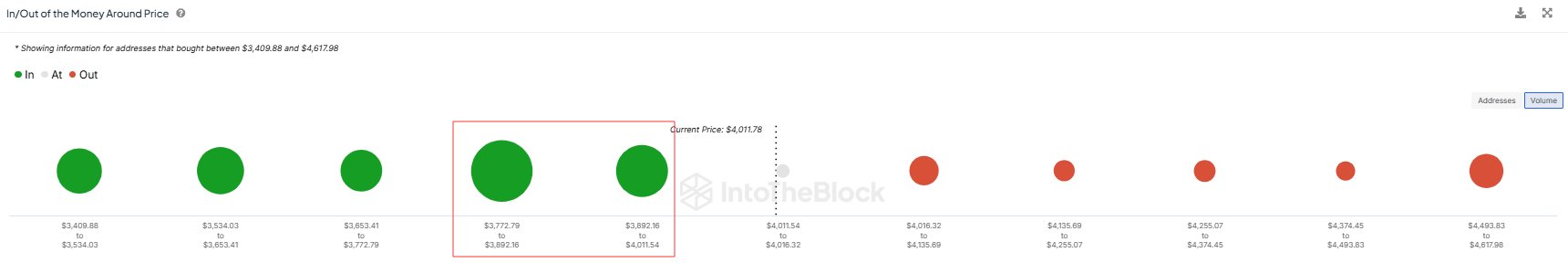

In a brand new publish on X, IntoTheBlock has mentioned about how the on-chain demand zones for Ethereum are wanting proper now. Under is the chart shared by the analytics agency that reveals the quantity of provide that the buyers purchased on the worth ranges close to the present spot ETH worth.

As is seen within the graph, the Ethereum worth ranges up forward have solely small dots related to them, which means not a lot of the availability was final bought at these ranges.

It’s totally different for the value ranges beneath, nevertheless, with the $3,772 to $3,892 and $3,892 to $4,011 ranges particularly internet hosting the price foundation of a big quantity of addresses. In complete, the buyers bought 7.2 million ETH (price nearly $28.4 billion on the present alternate fee) at these ranges.

Associated Studying

Demand zones are thought-about vital in on-chain evaluation because of how investor psychology tends to work out. For any holder, their value foundation is a crucial degree, to allow them to be extra more likely to make a transfer when a retest of it happens.

When this retest happens from above (that’s, the investor was in revenue previous to it), the holder may resolve to buy extra, considering that the extent can be worthwhile once more within the close to future. Equally, buyers who have been in loss simply earlier than the retest may concern one other decline, so they might promote at their break-even.

Naturally, these results don’t matter for the market when only some buyers take part within the shopping for and promoting, however seen fluctuations can seem when a considerable amount of holders are concerned.

The aforementioned worth ranges fulfill this situation, so it’s potential that Ethereum retesting them would produce a sizeable shopping for response available in the market, which might find yourself offering assist to the cryptocurrency.

In the course of the previous day, Ethereum has seen a slight dip into this area, so it now stays to be seen whether or not the excessive demand can push again the coin above $4,000 or not.

Associated Studying

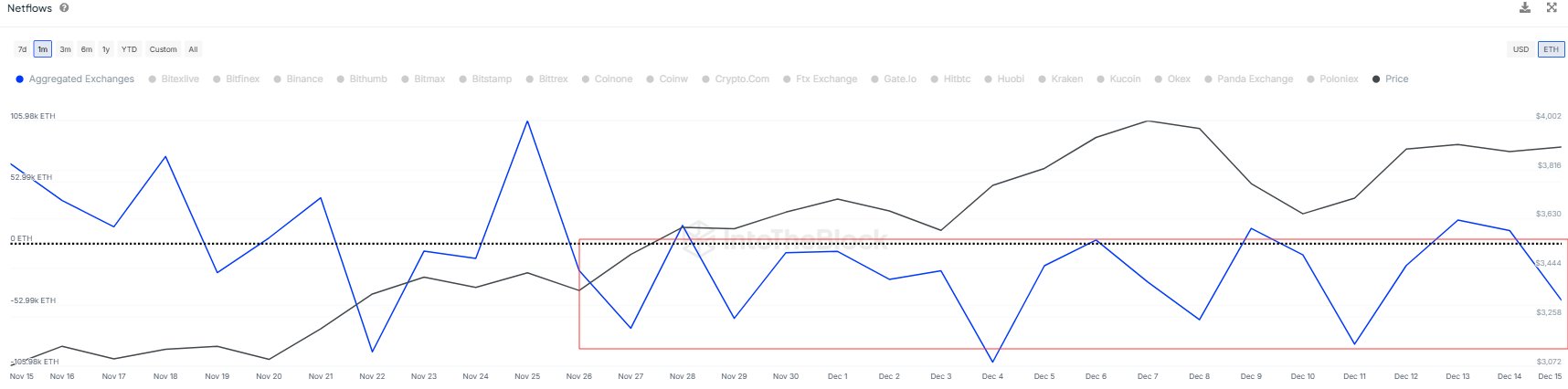

In another information, the Ethereum Trade Netflow has been destructive for the reason that starting of this month, as IntoTheBlock has identified in one other X publish.

The Trade Netflow is an on-chain indicator that retains monitor of the online quantity of Ethereum that’s flowing into or out of the wallets related to centralized exchanges. “Over 400k ETH have flowed out since December 1st, suggesting a trend of accumulation,” notes the analytics agency.

ETH Value

On the time of writing, Ethereum is buying and selling round $3,950, up 10% during the last week.

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com