Coinspeaker

Ethereum Q3 Charges Hit Lowest Stage Since 2020

Ethereum

ETH

$2 611

24h volatility:

1.1%

Market cap:

$314.36 B

Vol. 24h:

$14.70 B

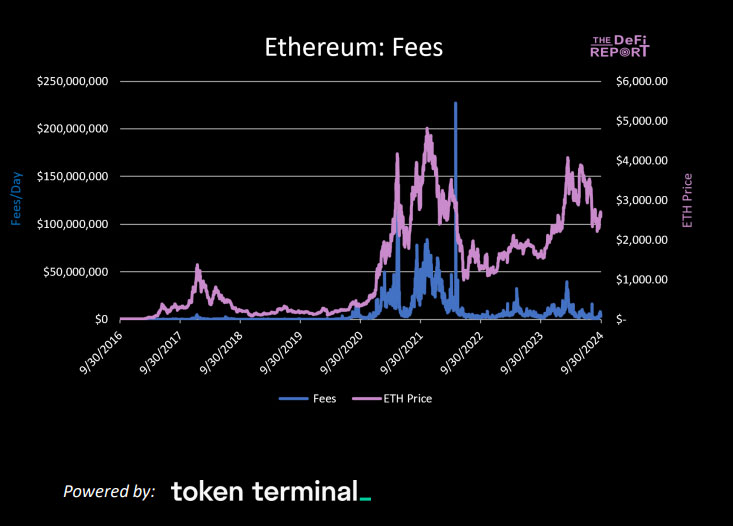

skilled a pointy decline within the third quarter of 2024, incomes $261 million in community charges. This represents a 47% drop from the earlier quarter, the bottom since late 2020. The decline has triggered debates over what’s driving Ethereum’s struggles.

Photograph: The DeFi Report

A latest DeFi report “The ETH Report: Q3-24” revealed on October 16, factors to the speedy rise of layer 2 networks as a key motive for the drop in charges. The adoption of Ethereum Enchancment Proposal 4844 and fewer new cryptocurrency customers through the quarter have additionally contributed. These components have created a tough scenario for Ethereum’s important community.

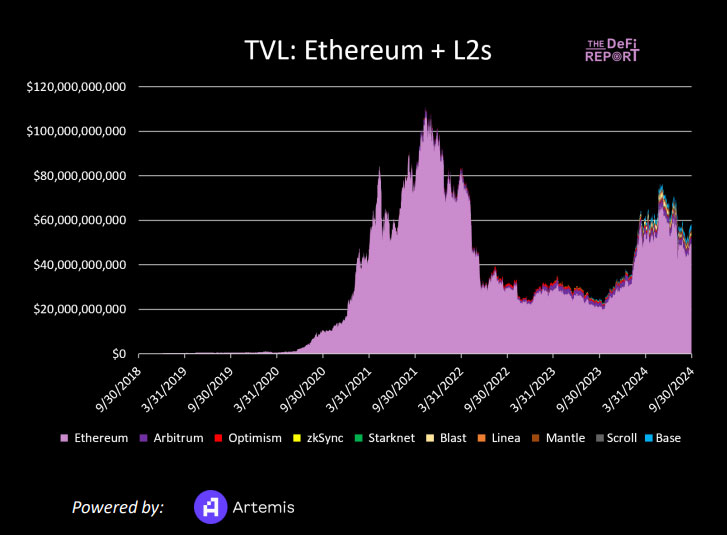

Apart from decrease charges, the report exhibits Ethereum’s Complete Worth Locked (TVL) fell by 14% this quarter. But, TVL has grown 133% over the previous 12 months, displaying long-term progress regardless of short-term declines. In the meantime, the ETH coin dropped 21% this quarter, partly on account of extra tokens being issued than burned, placing additional strain on its worth.

Photograph: The DeFi Report

Ethereum Charge Decline Linked to A number of Elements

The DeFi Report attributes Ethereum’s charge decline to a number of components. The EIP4844 replace focuses on enhancing scalability and reducing prices, nevertheless it shifts among the transaction load to layer 2 options. Moreover, the rise of modular knowledge availability networks, similar to Celestia, together with cheaper alternate options, has additionally drawn exercise away from Ethereum’s mainnet.

Uniswap Labs’ latest introduction of its layer 2 resolution, Unichain, poses one other problem to Ethereum’s charge income. Controlling 20% of fuel charges directed to Ethereum validators, Uniswap’s transfer to develop its personal layer 2 may trigger vital monetary losses for the community. With charges falling, inflation rising, and Uniswap transferring to layer 2, Ethereum’s ecosystem faces potential disruption.

Michael Nadeau, founding father of the DeFi Report, believes Ethereum validators can tackle these hurdles. By boosting transactions and burning extra tokens via diminished charges, they will drive token demand and enhance profitability for the community. He sees this as helpful for app builders, customers, and ETH validators.

Nevertheless, he warns that as layer 2 options develop, validator revenues would possibly decline briefly till new use instances emerge to fill the extra block area.

Ethereum Faces Potential $368M Loss to Uniswap

Earlier this week, Nadeau warned on X that Ethereum validators and token holders would possibly lose round $368 million in settlement charges on account of Uniswap launching Unichain. As a substitute of flowing to Ethereum, these funds may shift to Uniswap Labs and UNI token holders. Consequently, ETH burning would possibly lower, and the redistribution may negatively have an effect on ETH holders, undermining Ethereum’s worth.

. @Uniswap generated practically $1.3b of buying and selling and settlement charges throughout 5 main chains during the last 12 months.

The protocol and token holders captured $0 of that worth.

[100% went to Liquidity Providers, Ethereum Validators, MEV bots, and the L2 sequencers]

However with the launch… pic.twitter.com/vgpn7xjFky

— Michael Nadeau (@JustDeauIt) October 13, 2024

This drop in charges, coupled with Uniswap’s strategic selections, highlights shifts in blockchain. Layer 2 options, whereas providing higher scalability and decrease prices, create competitors for Ethereum’s mainnet. Adapting to those challenges can be key for Ethereum to retain its lead in decentralized finance (DeFi).