Ethereum is experiencing a gradual restoration as its worth climbs above $3,100. This marks a 2.3% enhance over the previous day. Nevertheless, the asset stays in a state of total decline, down 3.3% over the week.

Whereas this modest rebound presents some aid, Ethereum remains to be grappling with the consequences of an total bearish development. The continuing worth motion has prompted some analysts to revisit Ethereum’s underlying on-chain metrics to know what might lie forward for the cryptocurrency.

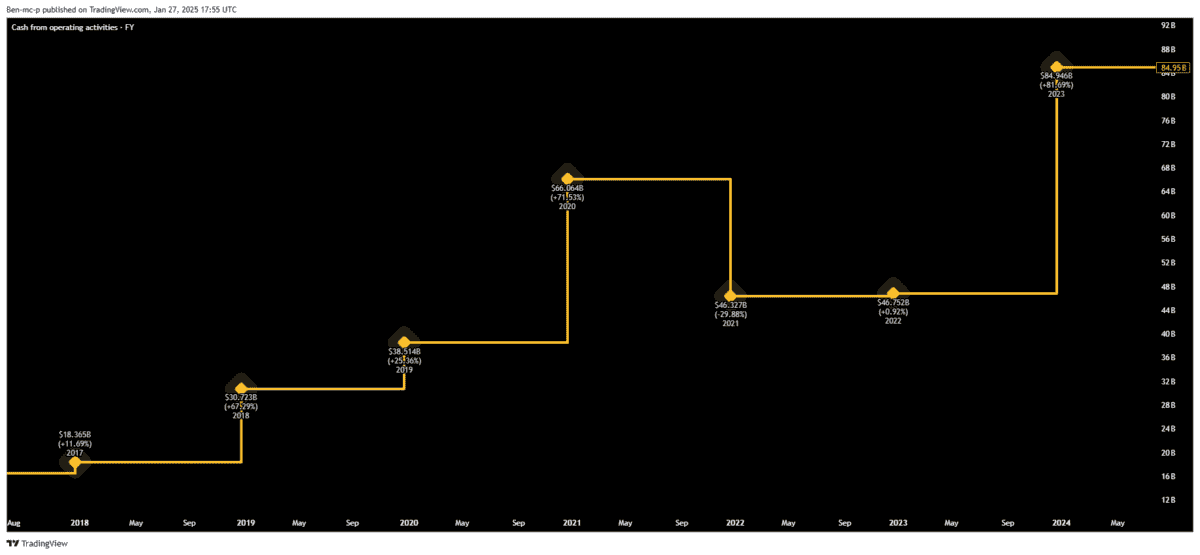

One key space of focus is Ethereum’s spot trade reserves. Based on a latest evaluation by Cryptoavails, a contributor to the CryptoQuant QuickTake platform, the whole reserves of Ethereum held on spot exchanges have been steadily declining. This long-term development factors to a shift in how market contributors are managing their holdings.

Ethereum Spot Change Reserves Pattern

Based on Cryptoavails, Ethereum reserves on spot exchanges have gone by vital modifications over time. In the course of the 2017-2018 bull market, reserves reached their peak, pushed by a surge in investor curiosity.

The 2020-2021 interval noticed one other substantial enhance, fueled by the rise of the DeFi ecosystem and Ethereum-based tasks. Nevertheless, beginning in late 2021, reserves started a pointy decline as giant withdrawals from exchanges turned extra frequent.

By 2023, reserve ranges hit a low level, and by 2024, these diminished ranges persevered, signaling a possible provide scarcity. This discount in reserves typically signifies that holders are withdrawing Ethereum from exchanges for long-term storage, reasonably than leaving it obtainable for instant buying and selling.

Consequently, the diminished provide on exchanges can create upward stress on costs. Cryptoavails famous that from 2022 onward, as reserves decreased, Ethereum’s worth began to stabilize at increased ranges. This sample means that low reserve ranges may assist additional worth will increase, probably triggering a brand new upward development.

Technical Evaluation Of ETH

From a technical standpoint, Ethereum has proven patterns that analysts interpret as bullish. A number of outstanding figures within the crypto group have shared their insights.

One famend analyst often called Crypto Ceaser lately highlighted a bounce in Ethereum’s worth as a major alternative, expressing a view that the cryptocurrency is undervalued and could also be poised to achieve new all-time highs.

$ETH – #Ethereum bounced as anticipated. This was an enormous alternative. Ship it.

For my part Ethereum is closely undervalued. I believe we are going to see new ATH’s quickly. pic.twitter.com/ljMa1lEpJO

— Crypto Caesar (@CryptoCaesarTA) January 28, 2025

Nevertheless, not all analyses paint a uniformly optimistic image. Anup Dhungana, one other crypto analyst, identified a divergence between Bitcoin and Ethereum’s market habits.

Whereas Bitcoin has maintained a gradual uptrend, Ethereum’s efficiency in opposition to Bitcoin has been much less strong, with the ETH/BTC pair forming decrease lows. This divergence displays diminished investor curiosity in Ethereum relative to different belongings.

Based on Dhungana, the subsequent technical assist stage for ETH/BTC might lie between 0.028 and 0.026. A rebound from this stage may probably revive broader curiosity in Ethereum and altcoins, paving the best way for one more part of progress.

Featured picture created with DALL-E, Chart from TradingView