Coinspeaker

Ethereum Sentiment Turns Detrimental: Will ETH Value Sink Decrease?

Buyers have not too long ago grow to be much less optimistic about Ethereum

ETH

$2 527

24h volatility:

0.1%

Market cap:

$304.30 B

Vol. 24h:

$16.70 B

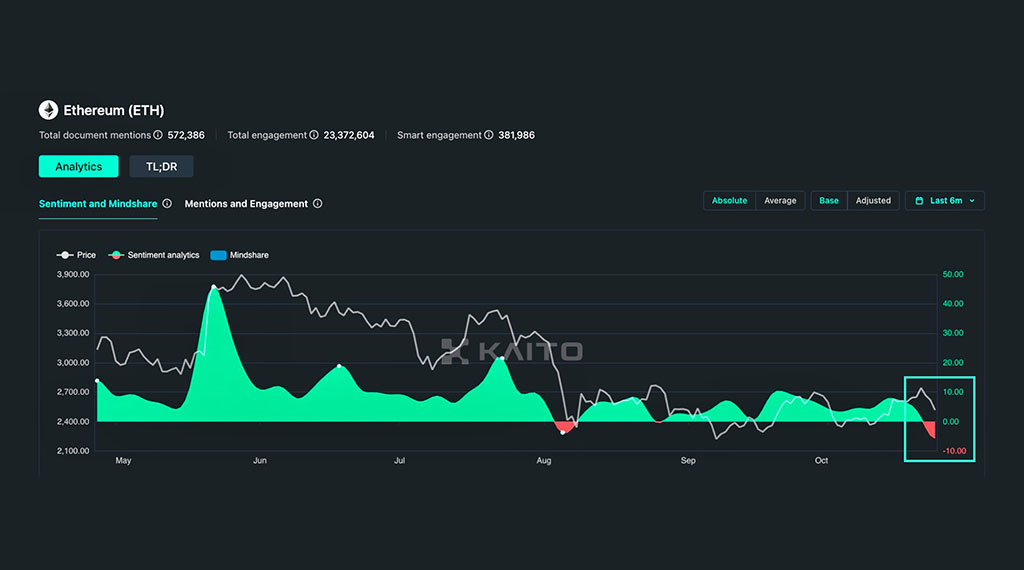

value prospects, as seen by adverse market sentiment. In line with Kaito knowledge, ETH market sentiment turned adverse past August ranges.

Kaito knowledge

It’s price noting that the August weakening occurred throughout a broader market sell-off. Nonetheless, the current weak sentiment was linked to the continuing FUD on the altcoin’s underperformance in opposition to Solana

SOL

$171.1

24h volatility:

0.4%

Market cap:

$80.47 B

Vol. 24h:

$4.42 B

and Bitcoin

BTC

$67 583

24h volatility:

1.0%

Market cap:

$1.34 T

Vol. 24h:

$31.81 B

.

ETH Underperforms SOL and BTC

This mid-recovery noticed ETH decline additional as SOL and BTC rose, a pattern that has grow to be obvious since early 2024. In reality, the SOL/ETH ratio, which tracks SOL’s relative worth in opposition to ETH, hit a brand new all-time excessive (ATH) of 0.070 this week. That meant SOL outperformed ETH.

Supply: CoinMarketCap

Reacting to the SOL outperformance, Andrew Kang, co-founder of crypto VC Mechanism Capital, acknowledged that the pattern may proceed and drive ETH sell-off.

“Long Solana hedged with BTC or ETH has been one of the best risk-adjusted positions you could have put on with major size this year. With new entrants choosing Solana and OGs slowly selling off their ETH, I see no reason for this trend to change,” Kang wrote.

ETH Value Motion

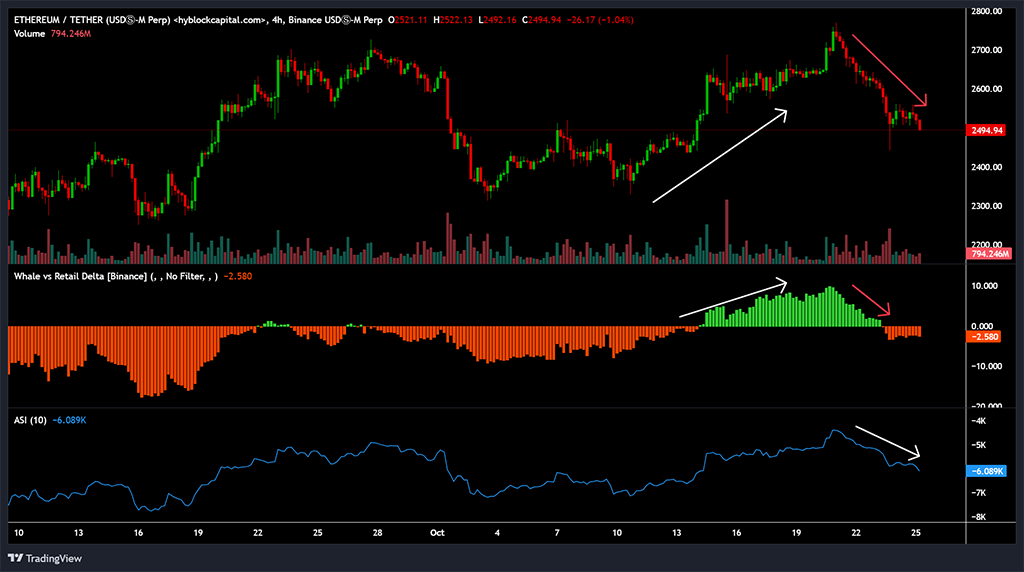

Supply: Hyblock

The current ETH value decline was additionally notable as whales appeared much less within the altcoin, as proven by the adverse Whales vs. Retail Delta. This meant that whales weren’t going lengthy on the asset relative to retail. The diminished whale publicity at all times precedes value declines.

Nonetheless, the ETH value may see reduction if whale curiosity improves. For context, a surge in whale positions in mid-October triggered an ETH value rally above $2.7K. So, except whale demand improves, ETH pullback might lengthen within the brief time period.

Supply: ETH/USDT, TradingView

On the value charts, ETH slipped beneath $2500 on the time of writing. It was down 10% from its current excessive of $2.76K. Ought to the decline lengthen, the trendline help and demand zone above $2.3K could possibly be key ranges to look at within the brief time period.

The diminished demand amongst US spot ETH ETFs may be a problem for the altcoin’s value. The merchandise started the week with $20.8 million outflows on Monday.

Between Tuesday and Thursday, the merchandise managed to web over $15 million in inflows, translating to a complete weekly outflow of about $5 million, unique of Friday’s knowledge. In brief, the demand was web adverse as of press time and will delay a robust value reversal.

Ethereum Sentiment Turns Detrimental: Will ETH Value Sink Decrease?