Coinspeaker

Ethereum Shorter Scores Large $1.1M Win in Simply 2 Days

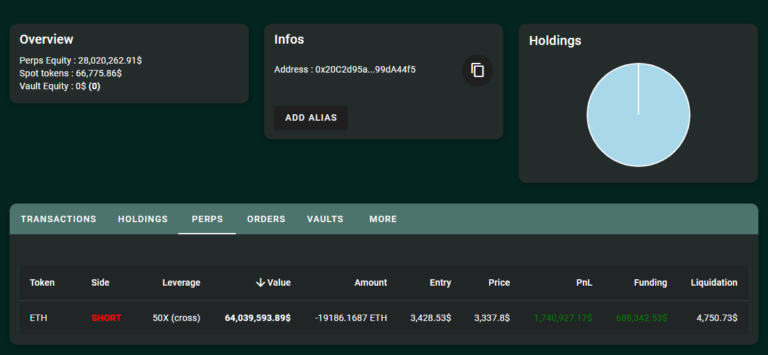

A crypto dealer lately pocketed over $1.1 million in simply two days by executing a brief, high-stakes place on Ether (ETH). The place, opened on December 24, concerned a large 50x leverage, permitting the dealer to quick 19,186 Ether—value over $64.5 million on the time Ether was buying and selling at $3,428, in accordance to blockchain knowledge from Hypurrscan.

On-chain analytics platform Lookonchain revealed that regardless of the preliminary place displaying a lack of $1.2 million on its first day, the tides turned dramatically, rewarding the dealer with not solely substantial unrealized income but additionally $680,000 in funding charges. The quick place’s liquidation value was set above $4,750, indicating the high-risk nature of the commerce.

-

- Supply: hypurrscan

- Whereas such trades can yield extraordinary returns, additionally they carry immense danger. Leveraged buying and selling typically magnifies losses, as evidenced by a dealer in January 2024 who misplaced $161,000 on a single overleveraged place.

Hey @rafal_zaorski can I get a small mortgage of 100k$ I promise to offer it again with curiosity in lower than 3-6 months 😭

— Tarded Degen Gambler (@0xTDG) January 4, 2024

2024 Payoffs Huge Crypto’s Wins

2024 has witnessed a mixture of high-stakes trades and vital milestones within the cryptocurrency market. Bitcoin crossed the $100,000 threshold on December 6, marking a historic second for the main cryptocurrency. Alongside, merchants have capitalized on the meteoric rise of memecoins like Pepe (PEPE), the place one investor turned $27 into $52 million over 600 days.

Earlier in Might, one other dealer made headlines by reworking a $3,000 funding into $46 million, using the surge in Pepe’s valuation. These success tales underscore crypto investments’ unpredictable nature, which may result in windfall income or catastrophic losses.

Ethereum at Historic Cycle — Q1 2025 Rally Coming?

Traditionally, Ethereum has demonstrated vital rallies following Bitcoin halving occasions. As an illustration, in Q1 2021, Ether soared over 300% in simply three months, outperforming Bitcoin. Equally, early 2017 noticed a outstanding 900% rise, attributed to rising enthusiasm round decentralized finance and NFTs.

Regardless of these promising patterns, Ethereum at present lacks a transparent bullish catalyst. Whereas its common Q1 returns stand at a formidable 90%, skepticism persists relating to its skill to duplicate previous efficiency. Traders like James Fickel, who wager closely on Ethereum outperforming Bitcoin, suffered substantial losses, with 49 million worn out this yr.

Ethereum, nonetheless, has struggled to maintain tempo with its friends. This yr, the ETH/BTC pair has slumped by 35%, reflecting waning investor confidence within the altcoin.