The Ethereum worth efficiency was fairly disappointing within the ultimate weeks of 2024, struggling beneath the $3,500 degree. This end-of-the-year blues considerably flowed into the altcoin’s motion within the first month of 2025, because it didn’t construct any critical momentum within the first 30 days of the yr.

Unsurprisingly, this sluggish worth motion has led to the panic of a number of Ethereum traders, with a portion of the market pondering if to promote their tokens. A well-liked crypto analyst on the social media platform X has come ahead with an in-depth evaluation of the ETH worth over the following few months.

What Does The Future Maintain For ETH Worth?

In a Jan. 31 publish on X, crypto pundit Ali Martinez tried to reply the “Is it time to sell Ethereum and move on?” query whereas breaking down its current worth motion and on-chain motion. Based on the analyst, the longer term seems considerably bleak for the worth of ETH, because it stands on the danger of a deep correction within the quick time period.

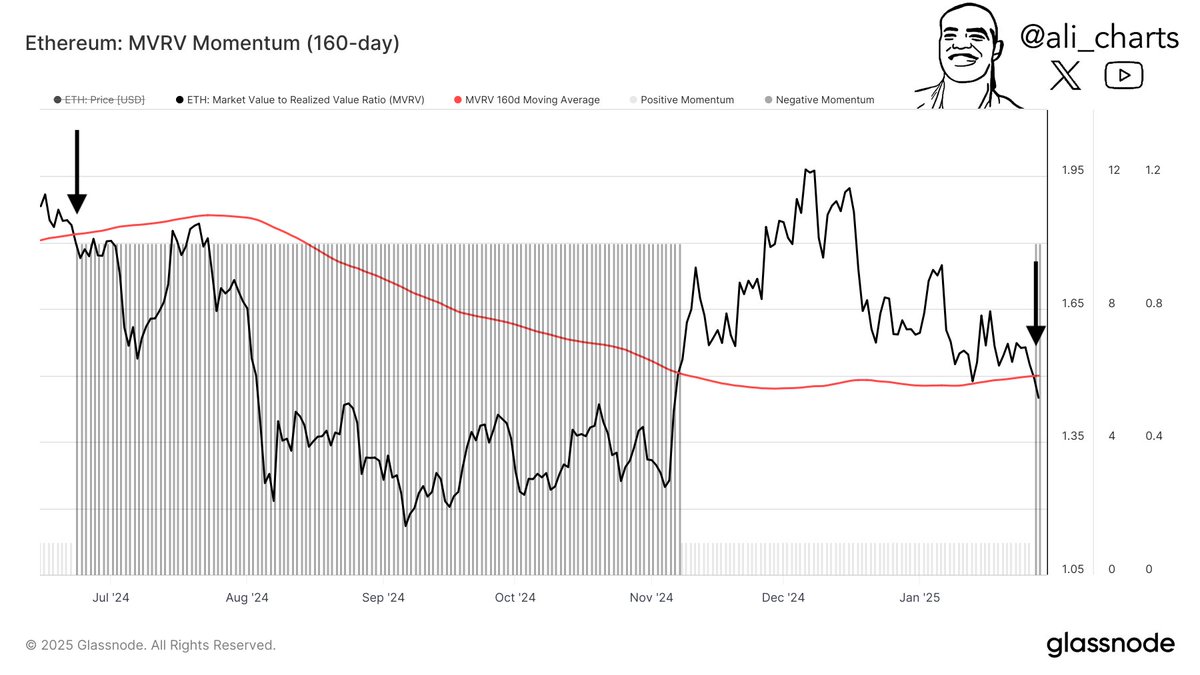

That is primarily based on the MVRV Ratio (160-day shifting common), which tracks the ratio between a coin’s market cap and the realized cap. It helps to judge whether or not a cryptocurrency (Ethereum, on this situation) is overvalued. Based on Martinez, the ETH worth lately fell beneath the MVRV (160D-MA), an incidence that led to a 40% correction the final time.

Supply: Ali_charts/X

The potential of a extreme worth pullback has resulted in a shift in investor sentiment, with a selected investor cohort exhibiting some degree of tension out there. Information from Glassnode exhibits that long-term Ethereum holders are starting to dump a few of their cash, strengthening the percentages of a worth correction.

Within the case of a correction, sure on-chain worth ranges might be essential to the long-term well being of the ETH worth. One such worth area is between $2,230 and $2,610 (the place almost 12 million wallets purchased 62.27 million ETH), which may act as a serious help zone in opposition to additional decline.

From a technical worth evaluation standpoint, the ETH worth seems to be forming an inverse head-and-shoulders sample, with a serious help degree between $2,800 and $3,000. Based on Martinez, the Ethereum worth may make a play for the sample’s neckline at $4,000 if this help area holds.

Supply: Ali_charts/X

Whereas the $4,000 degree has acted as a serious resistance degree for 4 years, current whale accumulation will increase the Ethereum worth’s probabilities of breaking this significant area. The most recent on-chain information exhibits that whales purchased over 100,000 ETH (value over $340 million) in the previous few days.

Martinez famous that if the Ethereum worth efficiently breaks above the $4,000 mark, it may journey as excessive as $6,770 primarily based on the MVRV pricing bands. This could signify an over 100% rally from the present worth level.

Ethereum Worth At A Look

As of this writing, the worth of Ethereum stands at round $3,315, reflecting over 2% bounce prior to now 24 hours.

The Ethereum worth loses the $3,300 degree on the day by day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from iStock, chart from TradingView