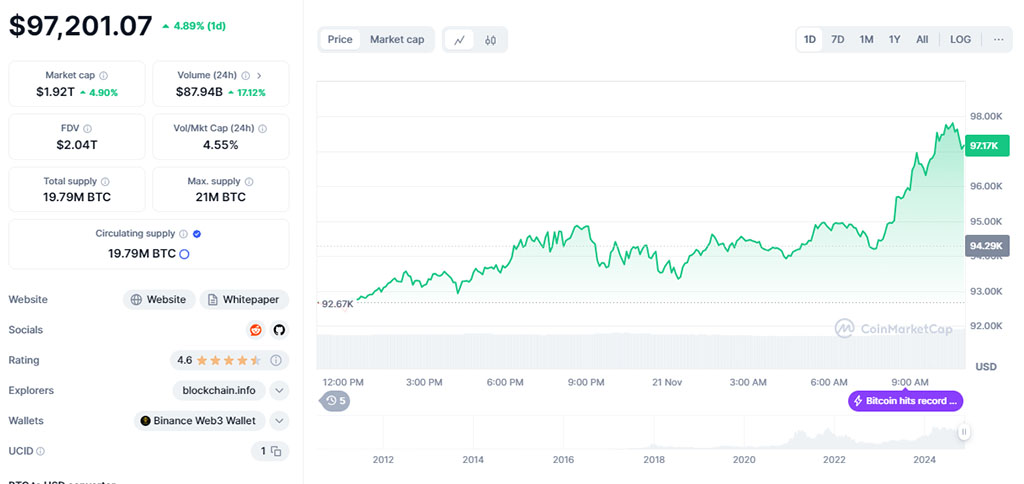

Bitcoin Crosses $95,000 for the First Time

On Wednesday evening, Bitcoin reached a record-breaking $95,000. Traders appear to be taking into consideration the opportunity of a second Donald Trump administration. The flagship crypto rose an additional 3% to $97,646.68, based mostly on CoinGecko statistics. It made a fleeting look at $97,788 earlier within the session. This extraordinary improve demonstrates the super hope that establishments and merchants have for Bitcoin’s future.

Supply: CoinGecko

Associated shares additionally benefited from the rise within the value of Bitcoin. In extended buying and selling, MicroStrategy‘s shares, a Bitcoin proxy, elevated by 3%. Consistent with this, mining shares elevated by 4%, together with Mara Holdings.Further blockchain-related companies noticed a growth as Bitcoin’s attraction unfold all through the bigger crypto ecosystem. The efficiency of those shares demonstrates rising belief in Bitcoin’s long-term sustainability and its affect on standard markets.

The rationale for Bitcoin’s steady new efficiency this month is the assumption of traders {that a} “golden age” for crypto may very well be sparked by Trump’s attainable return to authorities. Each the potential for a nationwide essential Bitcoin deposit and supportive regulation would possibly emerge. These adjustments maintain an opportunity to make Bitcoin an much more vital monetary asset. Extra lax restrictions that might promote innovation and increase utilization within the company and retail sectors are significantly encouraging to traders.

Analysts agree that when the 12 months is over, Bitcoin will hit $100,000. In accordance with some projections, the worth would possibly presumably triple by 2025. The sustained improve is indicative of optimism spurred by optimistic regulatory adjustments, enhanced market liquidity, and institutional adoption. The market turns into extra mature and steady as establishments hold investing a proportion of their portfolios in Bitcoin, drawing in much more gamers.

Swan Bitcoin researcher Sam Callahan identified that a lot of variables contribute to the worth progress of Bitcoin. These embrace improved liquidity, rising institutional funding curiosity, and a supportive regulatory framework. The anxiousness of dropping the best value will increase has additionally fueled the surge of retail traders. These components work collectively to supply a stable foundation for Bitcoin’s future progress, sustaining its momentum within the face of sporadic volatility.

The course of Bitcoin may doubtlessly be impacted by adjustments in financial coverage throughout a second Trump administration. Elevated inflation, wider price range deficits, and adjustments within the greenback’s world function would possibly all present Bitcoin with extra tailwinds. The attract of Bitcoin as a hedge towards standard monetary dangers is enhanced by these attainable outcomes. As considerations about inflation persist, Bitcoin is more and more being acknowledged as “digital gold,” providing stability throughout unsure financial instances.

Having a value achieve of virtually 127% solely this 12 months, Bitcoin has seen huge beneficial properties in 2024. Its exceptional enlargement demonstrates its tenacity and rising recognition as a monetary innovation and asset. The spike underscores the belief of traders from each sectors who understand Bitcoin as an everlasting retailer of worth.

Bitcoin’s upward development continues to attract curiosity, indicating a normal perception in its skill to fully remodel the monetary trade. Its success in 2024 would possibly mark a turning level within the growth of crypto and open the door for much more uptake and incorporation into worldwide banking.

The submit From $95K to $100K: Bitcoin’s Path to a New Period appeared first on NFT Night.