- Bitcoin miners confront uncertainties amidst worth surges previous the fourth halving.

- Strategic selections on Bitcoin holdings and regulatory challenges impression mining profitability.

Amidst the dynamic panorama of the cryptocurrency market, Bitcoin [BTC] miners discover themselves at a crossroads. The fourth halving noticed a departure from the norm as Bitcoin’s worth surged beforehand, sparking hypothesis inside the business.

With Bitcoin hitting new all-time highs even earlier than the halving, there was a looming query: is that this a boon or a bane for miners?

Bitcoin halving impacts miners

Shedding gentle on the identical, Adam Sullivan, the CEO at Core Scientific, one of many largest Bitcoin miners in North America, in a latest dialog with Anthony Pompliano, stated,

“I think one of the big questions is the ETF, the mechanism for Bitcoin to go even more parabolic post having, in a way where it’s allowing more institutional investors, more retail investors access to the market.”

Drawing parallels with the earlier cycles, he added,

“So as we look forward post having, we’re looking at a point where a lot of miners are going to be marginally profitable and they’re going to stay online for kind of three to six months. So, I think we’re going to see a much more drawn-out process unlike 2022.”

This underlines that, the post-halving adjustment interval could also be extended, with miners staying on-line for longer regardless of marginal profitability.

Therefore, this might result in a slower strategy of consolidation and potential failures inside the mining sector, probably extending into 2025.

Bitcoin miners technique

Moreover, speaking concerning the technique regarding Bitcoin holdings for mining operations, the one distinguished query that arises is whether or not one ought to maintain or promote mined Bitcoins amidst market volatility.

In response, Sullivan stated,

“We are currently selling our Bitcoin on a daily basis.”

Along with his remarks he emphasised on minimizing alternative prices and maximizing shareholder worth slightly than accumulating Bitcoin for private sake.

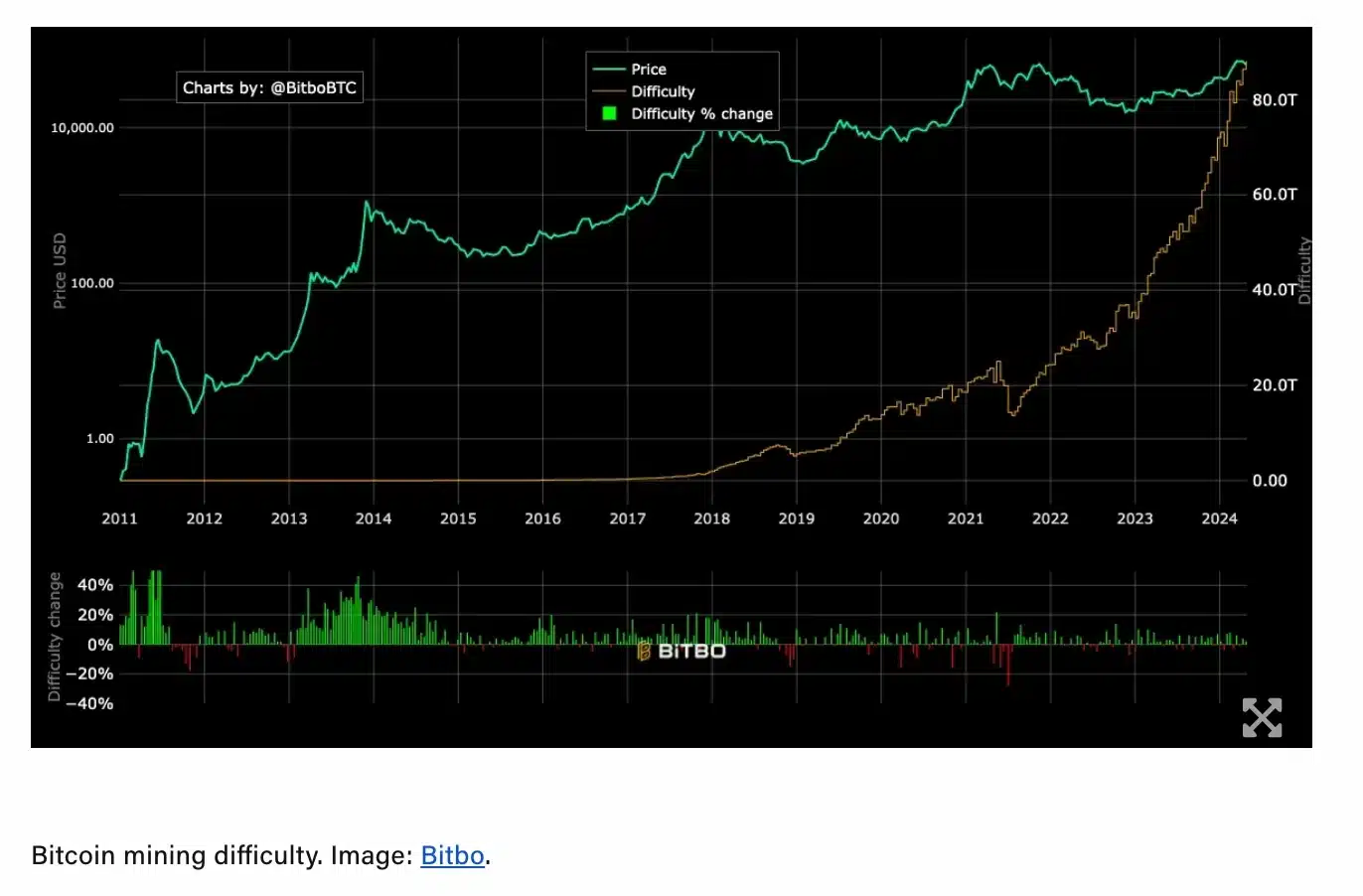

This was additional confirmed by Bitbo information, highlighting a 2% surge in Bitcoin mining problem, reaching a report 88.1 trillion at block peak 840,672.

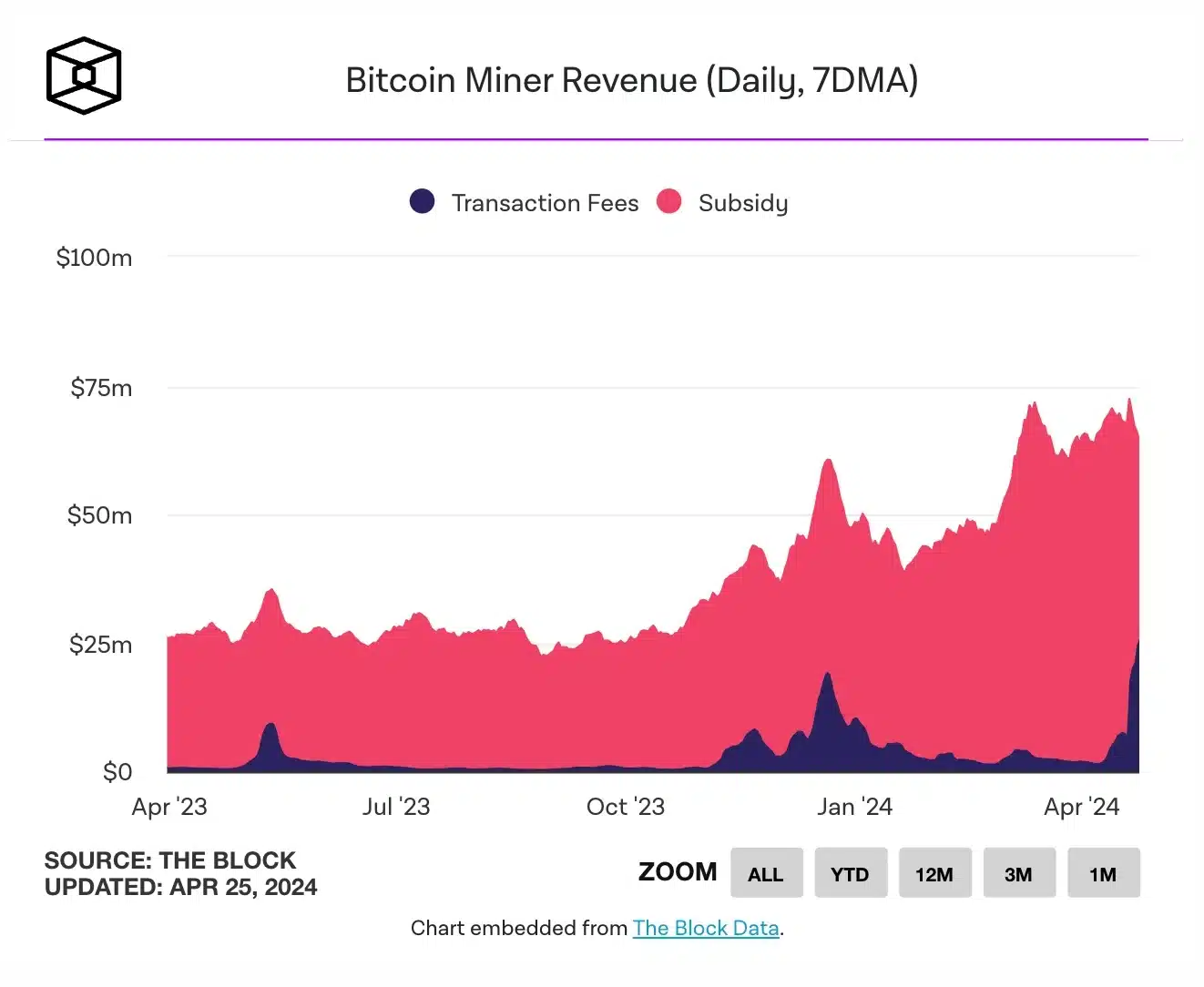

Regardless of this, The Block’s information signifies that miners keep steady income post-halving.

In accordance with the graph, transaction charge rewards now make up 40% of whole block rewards, up from 10% pre-halving, indicating a major shift in income sources for miners.

Joe Biden’s massive transfer

Apparently, Joe Biden additionally imposed a 30% tax on Bitcoin miners, which was additional criticised by Senator Cynthia Lummis.

“It would be a historic mistake to slap Bitcoin miners with a 30% tax that is a de facto ban.”

General, these developments underscore the complicated interaction between market dynamics, regulatory actions, and strategic decision-making inside the Bitcoin mining ecosystem

. Ergo, it could be attention-grabbing to look at how will issues unfold for miners within the coming days, weeks or months.