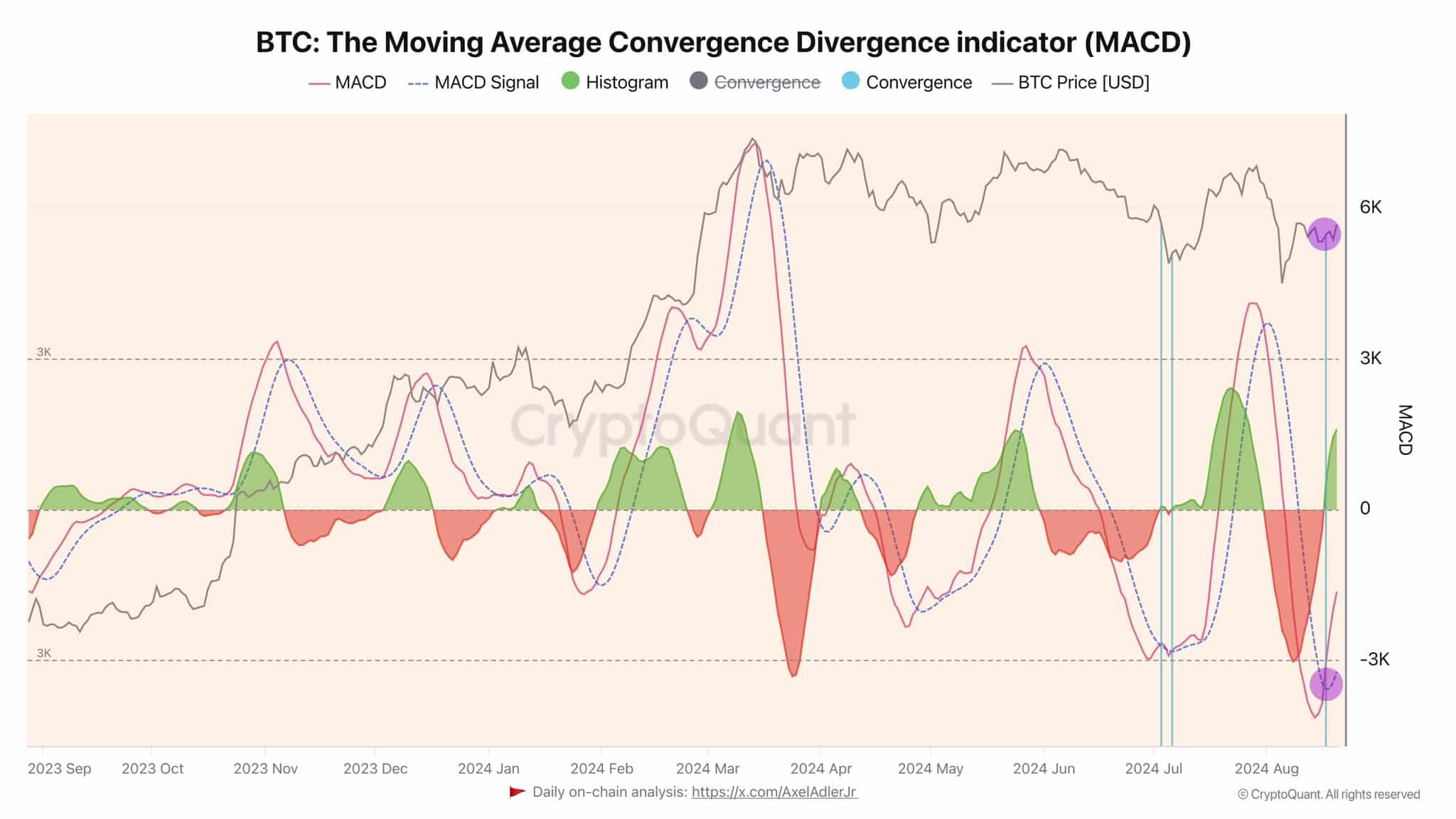

- Michael Saylor’s assertion was according to what the Bitcoin MACD indicator confirmed.

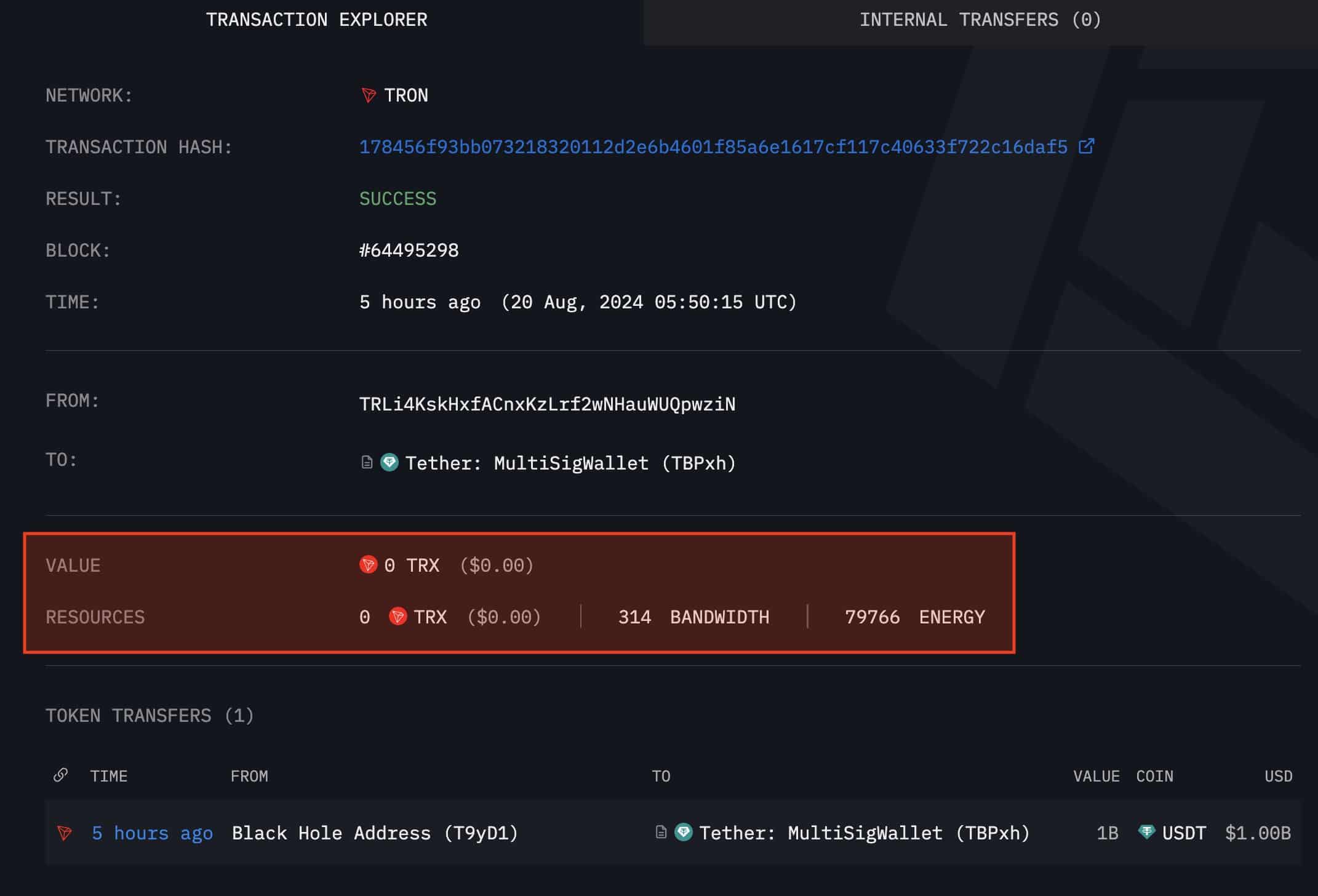

- Tether treasury mints $1B USDT with zero charges.

The founder and former Microstrategy CEO, Michael Saylor’s tweet, “By my calculations, Bitcoin [BTC] is going up forever,” resonated strongly with the crypto group, fueling anticipation for a 2024 bull run.

Saylor’s feedback coincided with 60% of high US hedge funds gaining Bitcoin publicity within the first half of 2024. This surge in institutional curiosity has pushed up Bitcoin ETF costs and Bitcoin itself.

On the charts, Bitcoin has proven intention to go larger after wicking above the 4-hour resistance whereas the 3-day chart exhibits a bullish double backside with a big engulfing candle, indicating a robust upward momentum.

Furthermore, Bitcoin MACD indicator on the day by day timeframe started forming a bullish sample 5 days in the past and has now absolutely flipped bullish.

The market has steadily moved in direction of a bullish convergence on the MACD, signaling potential upward momentum.

This shift within the MACD suggests a strengthening pattern that might result in additional positive aspects, as extra merchants are beginning to discover this bullish sign.

Tether treasury mints one other $1B USDT

Tether, which operates just like the Federal Reserve of crypto, influencing market developments at any time when new USDT is minted. Tether Treasury minted $1 billion USDT on TRON with zero charges.

In the course of the newest Bitcoin correction, Tether’s printers have been extremely lively as Whale Alert famous on X with the full minted USDT distributed as $85 million transferred to Bitfinex and $50 million to an unknown pockets.

The continued minting of USDT is predicted to drive Bitcoin costs larger within the upcoming bull market.

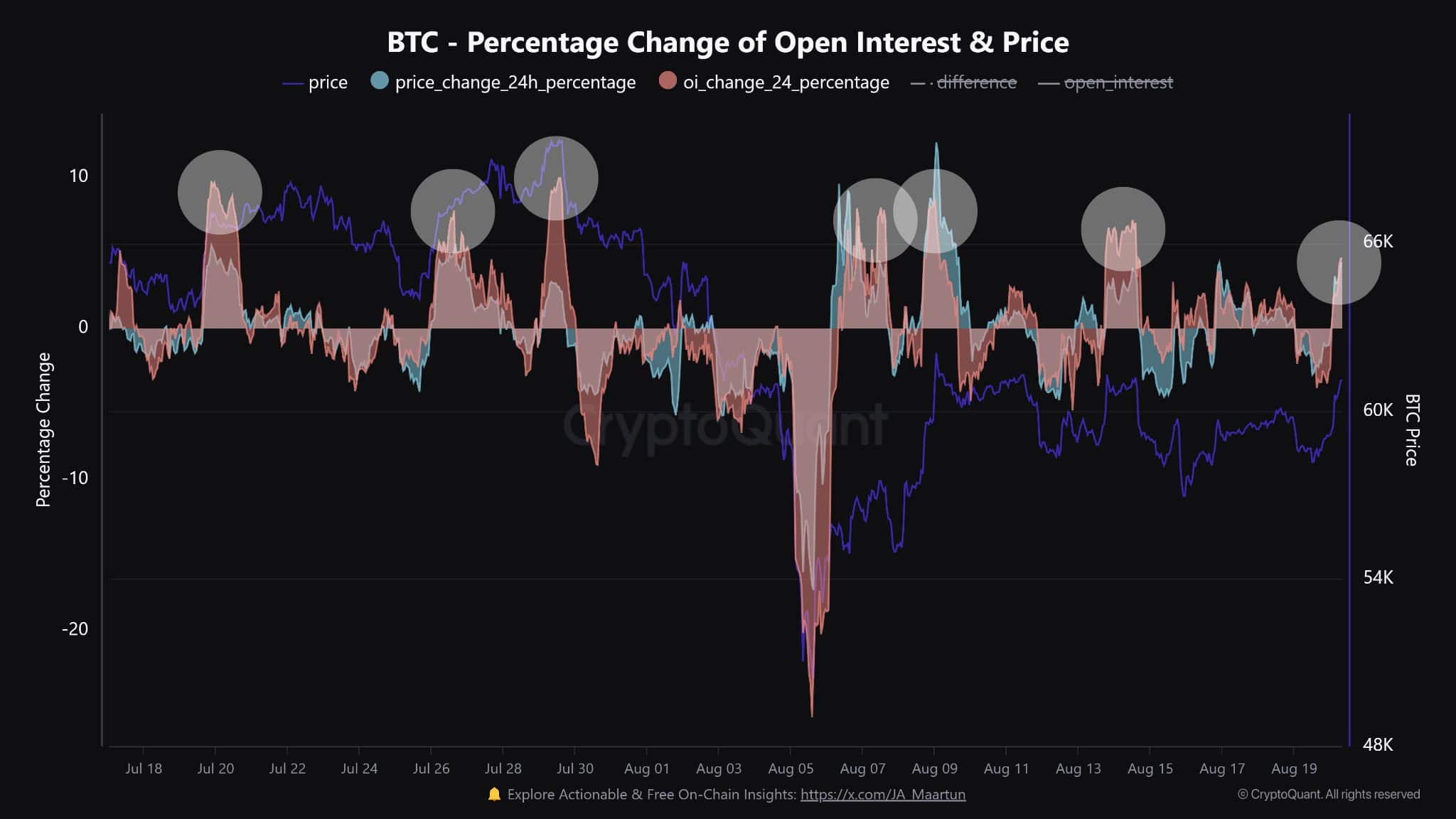

Sturdy accumulation as open curiosity rises

Bitcoin is in a robust accumulation section, with Metaplanet buying 500 million Yen ($3.4 million) value of Bitcoin, elevating its holdings to 360.368 BTC as Karan Singh famous on X.

This transfer, alongside rising institutional confidence, has pushed Metaplanet shares up by 13%. Moreover, Glassnode reviews that the Bitcoin accumulation index has peaked at 1.0, indicating a surge in shopping for exercise.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Buyers are more and more accumulating extra positions following BTC’s open curiosity enhance by 5%, pushed by leverage.

Supply: CryptoQuant

Traditionally, leverage-fueled pumps have typically led to cost reversals, although there’s no certainty it’ll occur once more.