Coinspeaker

GBTC Leads Spot Bitcoin ETFs Third Consecutive Day of Outflows Streak

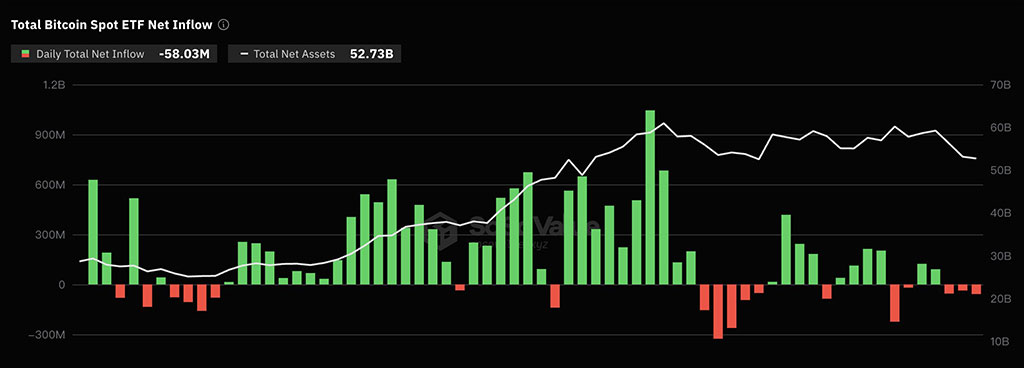

After a interval of regular inflows, Bitcoin exchange-traded funds (ETFs) within the US confronted withdrawals over three consecutive days. The outflow, largely driven by the Grayscale Bitcoin Belief (GBTC), totaled $58 million. This shift alerts to alter investor sentiment amid bitcoin value declining over 8% within the final week.

The overall internet influx for Bitcoin spot ETFs stays constructive at round $12.43 billion, in line with SoSoValue information. However, round $79.4 million exited GBTC yesterday. This development aligns with a decline in GBTC’s holdings, which have dropped by roughly 50% to roughly 309,871 Bitcoin as of April sixteenth disclosures.

Specialists suggest that the substantial 1.5% administration price for the Grayscale Bitcoin Belief considerably discourages investors. This price exceeds the 0.12% price supplied by opponents like BlackRock’s iShares Bitcoin Belief (IBIT), making GBTC comparatively unattractive.

Zero Influx Doesn’t Imply Failure, Analyst Says

Considerations concerning inadequate funds influx US Bitcoin ETFs have been dismissed by Bloomberg analyst James Seyffart. He highlights that the majority ETFs, together with hundreds based mostly within the US, see zero inflows on many days – a typical prevalence. He defined that new inflows solely occur when a considerable imbalance between the provision and demand for ETF shares arises.

“On any given day, the vast majority of ETFs will have a flow number of ZERO – this is very normal. There are ~3,500 ETFs in the US. Yesterday 2,903 of them had a flow of exactly zero,” stated Seyffart.

Whereas BlackRock’s Bitcoin ETF was the one product to experience inflows through the April 12-15 period, Seyffart clarifies that this doesn’t negatively impression the opposite offerings. ETFs commerce in giant creation items, usually blocks hundreds of shares. Solely a major supply-demand imbalance triggers the creation or destruction of recent shares.

Bitcoin ETF Volumes Regular Regardless of March Peak

However, spot Bitcoin exchange-traded funds have seen regular buying and selling quantitys in April after reaching a peak in early March, sustaining stable exercise round $215 billion, as reported by The Block. Moreover, the influx and outflow of funds for bitcoin ETFs have steadinessd since March, suggesting a steadying of investor sentiment.

With the block-reward halving occasion simply three days away estimated for April twentieth, it stays to be seen how this historic occasion will impression investor conduct. Whereas Bitcoin’s value presently sits at $63,557, it has skilled some volatility previously week because of geopolitical tensions. Nonetheless, it stays considerably up year-to-date.

The approaching days can be essential in understanding investor sentiment in the direction of spot bitcoin ETFs. Whereas GBTC faces challenges, the broader market appears to be discovering its footing. The launch of Hong Kong’s ETFs, coupled with the Bitcoin halving occasion, provides intrigue to the close to way forward for the cryptocurrency market.

GBTC Leads Spot Bitcoin ETFs Third Consecutive Day of Outflows Streak