- Hashdex recordsdata S-1 modification for Nasdaq Crypto Index US ETF.

- Bitcoin ETFs report a brand new weekly influx peak.

On twenty fifth November, Hashdex, a crypto asset administration agency, introduced its submission of a second amended S-1 submitting with the U.S. Securities and Trade Fee (SEC) for a Nasdaq Crypto Index US ETF.

Hashdex’s crypto ETF pursuit

The newest modification follows Hashdex’s preliminary S-1 submitting. The submitting was modified in October because the SEC requested extra time for overview.

The ETF goals to initially embody Bitcoin [BTC] and Ethereum [ETH], the 2 belongings presently tracked by the Nasdaq Crypto US Index. Over time, the portfolio might increase to characteristic extra digital currencies, in accordance with the submitting.

Hashdex’s ambitions mirror broader efforts by key gamers like Franklin Templeton and Grayscale. Like Hashdex, Franklin Templeton’s Crypto Index ETF proposed ETF consists of BTC and ETH.

Grayscale’s Digital Giant Cap Fund, nevertheless, seeks to supply a extra diversified expertise. The ETF consists of different cryptocurrencies equivalent to Solana [SOL], Avalanche [AVAX], and Ripple [XRP] in its portfolio.

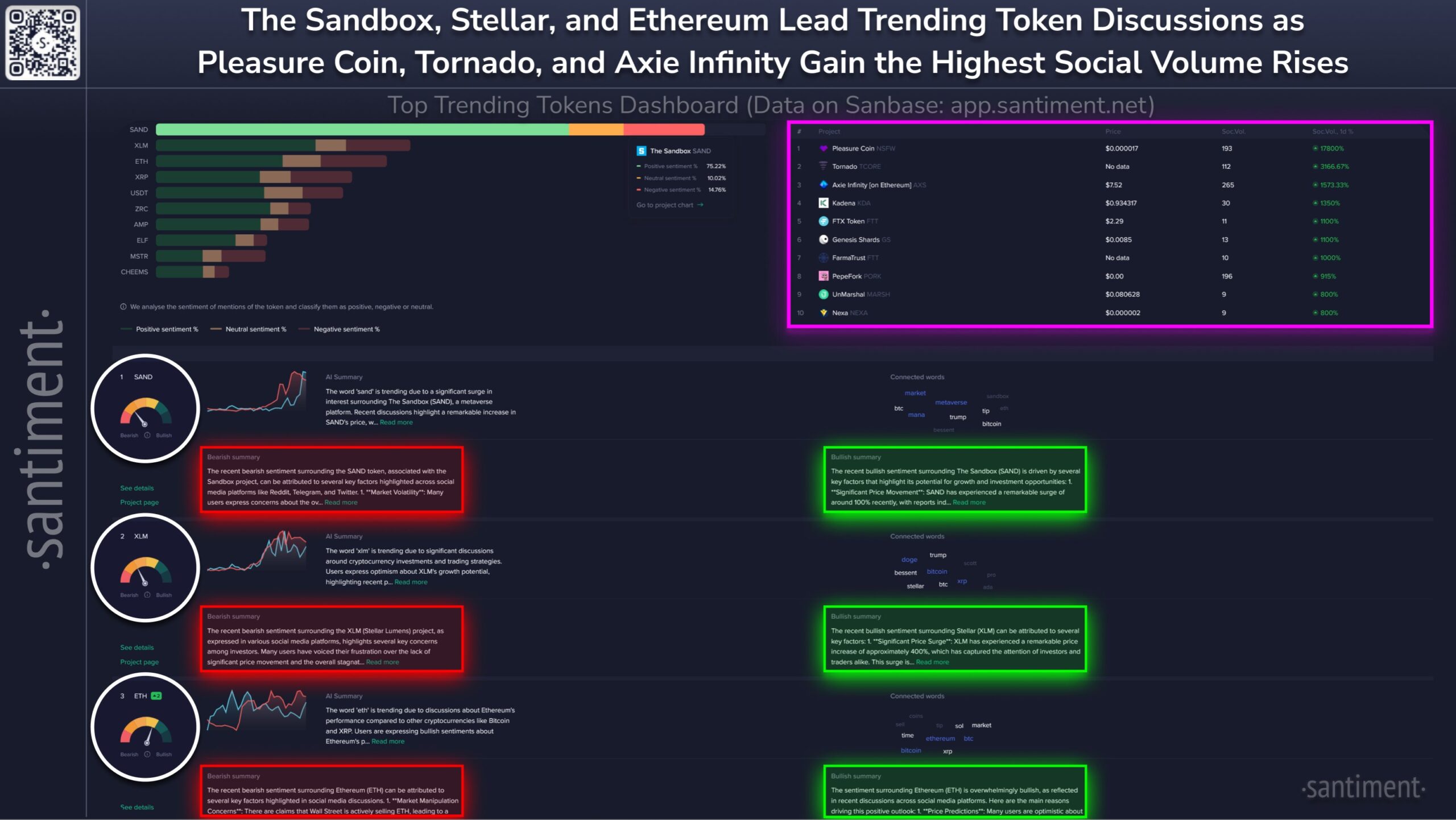

Spot BTC and ETH ETF tendencies

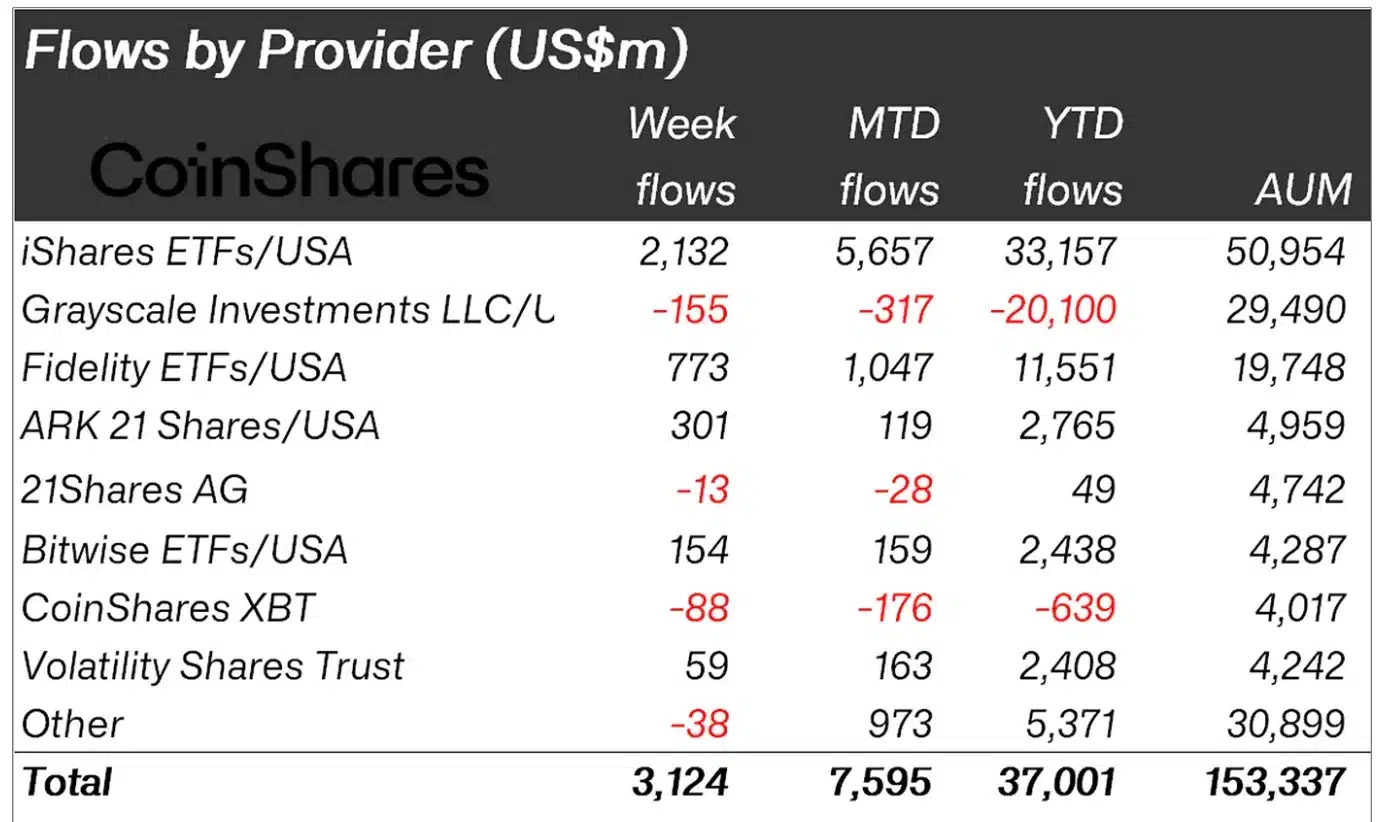

In the meantime, the broader cryptocurrency ETF market continues to attain new milestones. Spot Bitcoin ETFs recorded web inflows of $3.38 billion for the week of 18th–twenty second November—a exceptional 102% improve from the earlier week’s $1.67 billion.

In accordance to SoSo Worth, this marked the most important weekly influx on report and the seventh consecutive week of optimistic flows. In distinction, on twenty fifth November, the overall day by day flows turned destructive because the ETFs noticed $438.38 million transferring out of the funds.

Curiously, ETH ETFs witnessed six consecutive days of outflows earlier than rebounding on twenty second November. At press time, it recorded a day by day web influx of $2.83 million.

Moreover, whole web belongings for ETH ETFs surpassed double digits for the primary time since launch, reaching $10.28 billion on twenty fifth November.

One other ETF for XRP?

The ETF hype isn’t restricted to BTC and ETH because the race is continuous to warmth up. In a notable improvement, WisdomTree, an asset supervisor and world ETF supplier managing over $100 billion in belongings, has registered for an XRP-focused ETF in Delaware.

In keeping with Fox Enterprise reporter Eleanor Terrett, this transfer is anticipated to precede an S-1 submitting with the SEC. WisdomTree joins Bitwise, 21Shares, and Canary Capital in submitting comparable purposes.

Gensler out, crypto ETFs in?

With the SEC’s regulatory panorama evolving, the surge in crypto ETF filings has ignited curiosity about their prospects on this altering surroundings.

Beforehand, AMBCrypto reported that Gary Gensler, the SEC Chair identified for his stringent stance on crypto regulation, will resign efficient twentieth January, 2025.

His departure aligns with the beginning of Donald Trump’s second presidential time period. The president-elect has promised to place the U.S. as a worldwide crypto powerhouse.

This, in flip, might sign a extra welcoming surroundings for crypto ETFs and different digital asset improvements.

Whereas the stage is about for main shifts within the ETF panorama, the query stays: Will the SEC embrace this new period, or will the approval course of proceed to be a roadblock?

Effectively, the approaching months promise to be a defining chapter within the evolution of the crypto market.