- BTC has a silver lining; the sharper pullback could have flushed out weak palms.

- In the meantime, PEPE might nonetheless steal the highlight.

This month, Bitcoin [BTC] has twice tried to interrupt previous the $65K resistance, with each makes an attempt adopted by sharp pullbacks.

The most recent drop, which drove BTC right down to $58K – its lowest in over two weeks – has raised issues a couple of deeper correction.

Buying and selling at $62,662 at press time, AMBCrypto warns that if an identical sample holds, Bitcoin could face additional draw back stress.

Nevertheless, there’s a silver lining. The sharper pullback could have flushed out weak palms, probably sparking renewed curiosity from stronger consumers.

This cleaning impact typically results in contemporary accumulation, setting the stage for a rebound.

Whereas Bitcoin has struggled, memecoins like PEPE have seen a resurgence. PEPE has risen over 5% in per week.

Sometimes, memecoins thrive in periods of market uncertainty as merchants search high-risk, high-reward alternatives.

However PEPE’s efficiency should still be tied to Bitcoin’s worth motion.

BTC is displaying short-term potential

At present, it appears like BTC is heading towards a short-term correction, with longs regaining management available in the market.

This state of affairs units up an excellent short-squeeze situation, the place brief sellers are compelled to purchase again BTC, driving the worth of every token increased.

Nevertheless, this doesn’t assure a rebound robust sufficient to place BTC for a bull run to $70K.

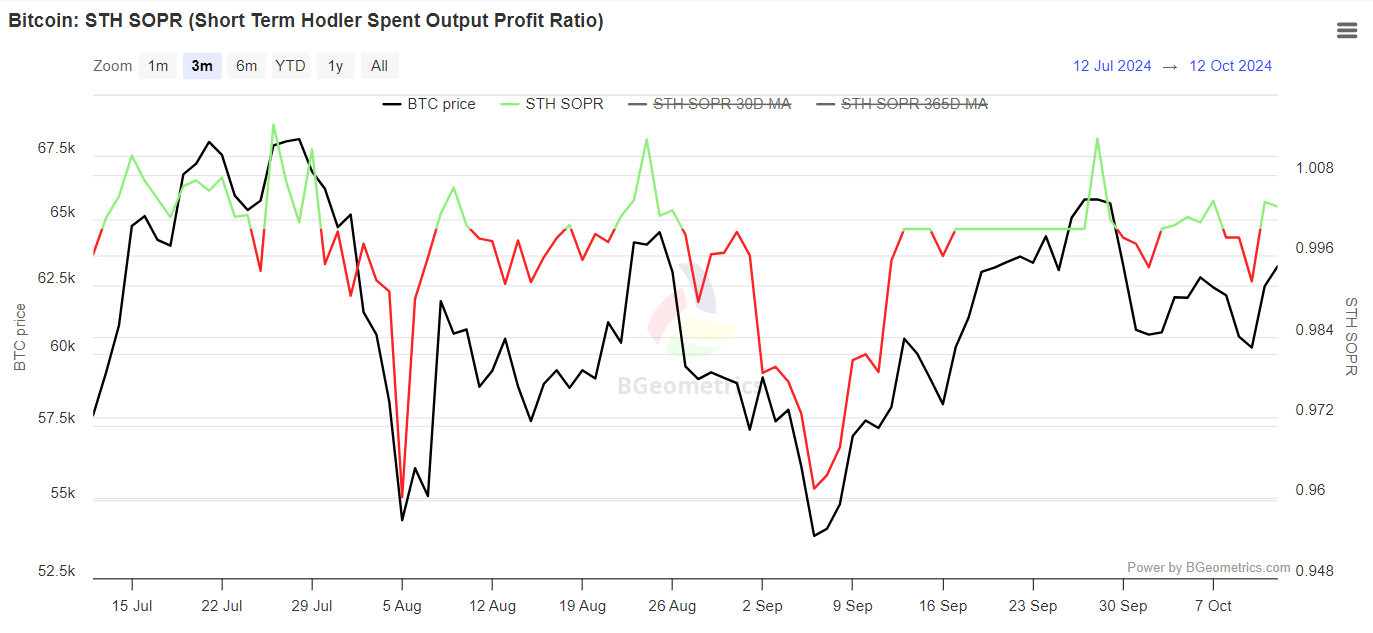

Over the previous week, long-term holders have moved lower than common, whereas sellers holding BTC for lower than 155 days have began to dump their holdings, as indicated by the inexperienced wig.

Within the context of a bull market, elevated promoting typically alerts a possible market high. As extra traders take earnings, issues develop a couple of deeper pullback that would push BTC again under $60K.

Conversely, if $62K proves to be a market backside – with longs dominating, LTHs remaining regular, and others viewing this as a dip to purchase – it might sign the beginning of an accumulation part.

It’s essential to watch these actions carefully; any slight divergence in these tendencies might restrict the probability of a rebound, which at present appears probably.

PEPE may keep within the inexperienced

Traditionally, memecoins have seen dramatic rallies throughout Bitcoin corrections as merchants search high-volatility alternatives in a shaky market.

Nevertheless, they’re additionally extremely delicate to Bitcoin’s broader market path.

If BTC can maintain its present ranges and begin to rally, PEPE might expertise a short-term correction as merchants shift focus again to BTC and different high-cap property.

On the flip aspect, if Bitcoin continues to falter, PEPE could profit from one other memecoin cycle, probably pushing it to new vary highs.

Whereas many newly launched memecoins have recorded double-digit surges, PEPE may proceed to remain within the inexperienced as effectively.

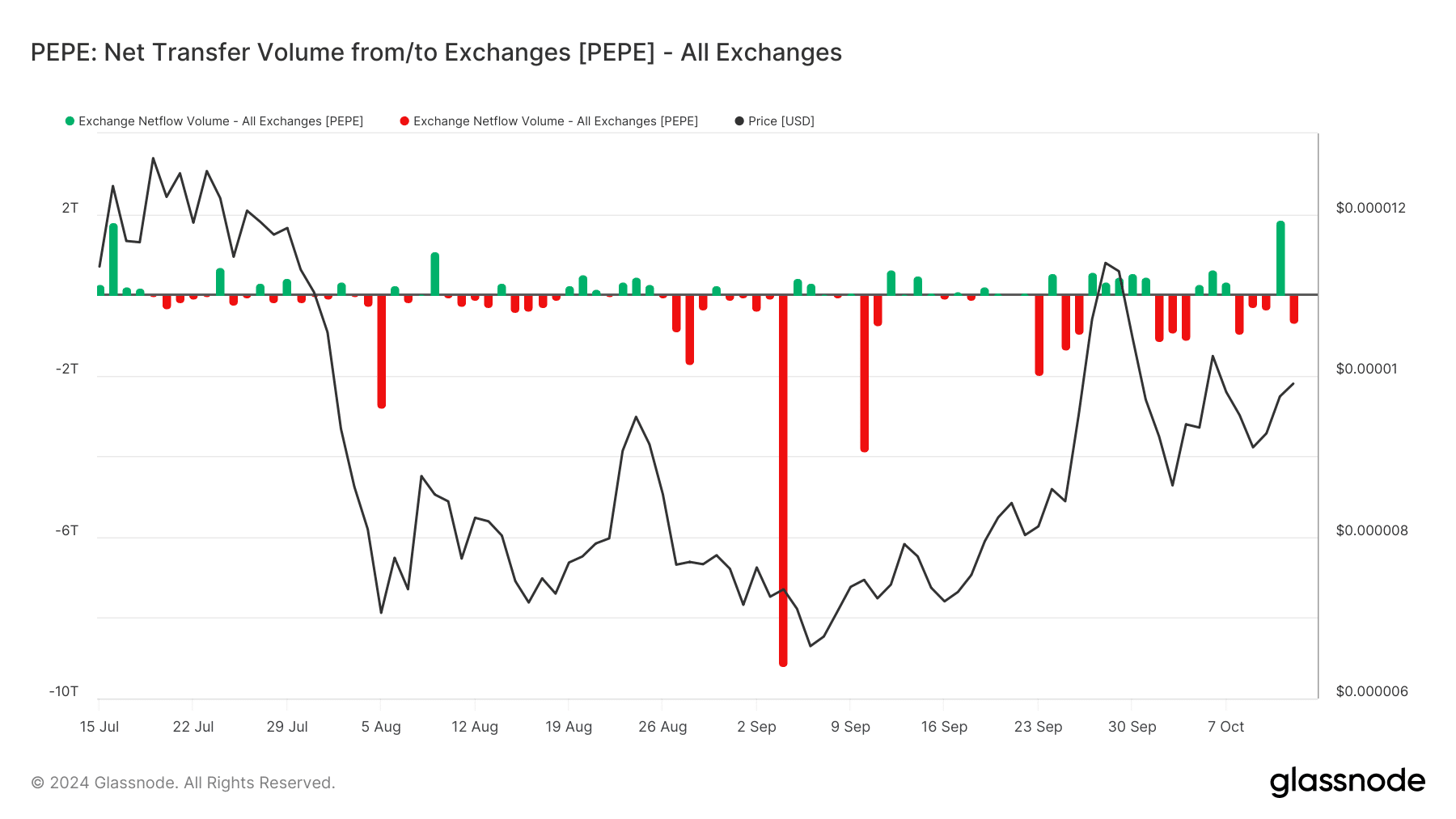

Within the final three days, PEPE surged above $0.000010 however struggled to carry that stage.

An enormous inflow of 1.8 trillion PEPE tokens deposited into exchanges – the best in three months – has made it robust for the bulls to take care of momentum.

This highlights simply how unstable memecoins could be. Curiously, as BTC pulls again, PEPE is once more experiencing a rise in internet withdrawals, which traditionally alerts a market backside.

For a profitable bull run, constant internet outflows are essential. If this development breaks as BTC regains dominance, it might dampen the renewed optimism surrounding PEPE.

Sensible or not, right here’s PEPE’s market cap in BTC’s phrases

General, the market seems to favor memecoins proper now. The following few days can be essential in figuring out whether or not BTC can regain power, or if PEPE will proceed to steal the highlight.

If it does, PEPE may quickly break previous the $0.000010 resistance.