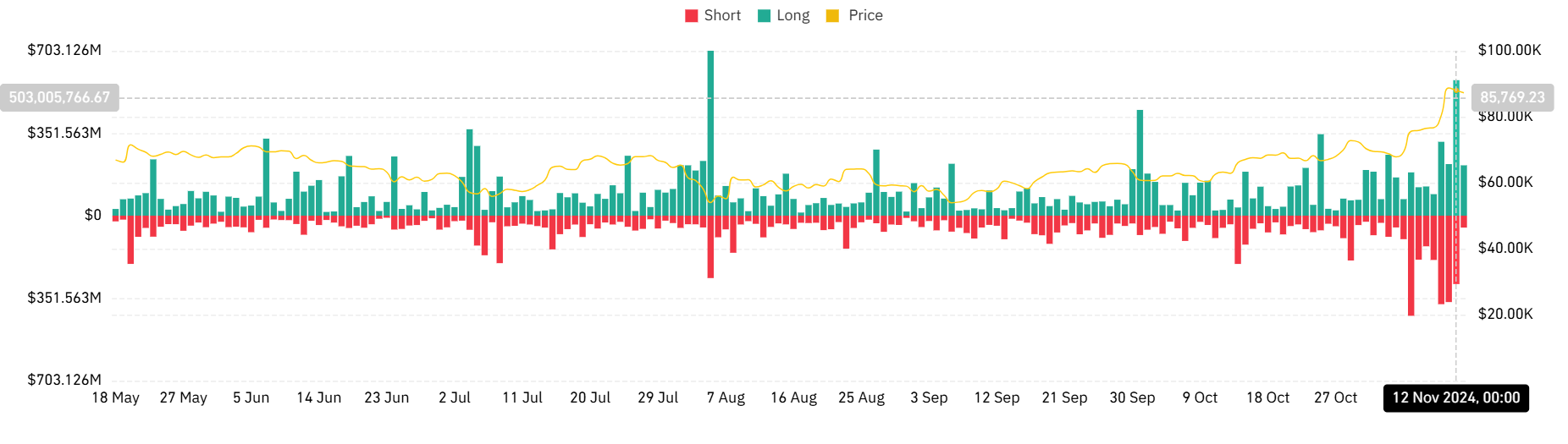

- Lengthy and quick positions noticed a spike in liquidation quantity within the final buying and selling session.

- Bitcoin contributed over $500 million to the liquidation.

The cryptocurrency market has just lately witnessed important liquidation exercise, with Bitcoin [BTC] on the forefront of those actions.

As merchants navigate unstable worth swings, the liquidation of lengthy and quick positions gives essential insights into the market’s present state. The newest knowledge reveals the leverage and threat within the crypto ecosystem.

Longs, shorts hit notable ranges

In line with the liquidation chart on Coinglass, over $503 million in liquidations have been recorded just lately, highlighting the affect of Bitcoin’s fast worth actions.

Additionally, AMBCrypto’s evaluation of the entire liquidation confirmed that it surged to just about $870 million within the final buying and selling session.

This development illustrated the precarious stability of leverage available in the market, the place merchants betting on continued upward momentum have been caught off guard by sudden worth corrections.

Conversely, the rise briefly liquidations prompt that Bitcoin’s current rally pressured bears to cowl positions as belongings broke previous key resistance ranges.

Excessive leverage concentrations

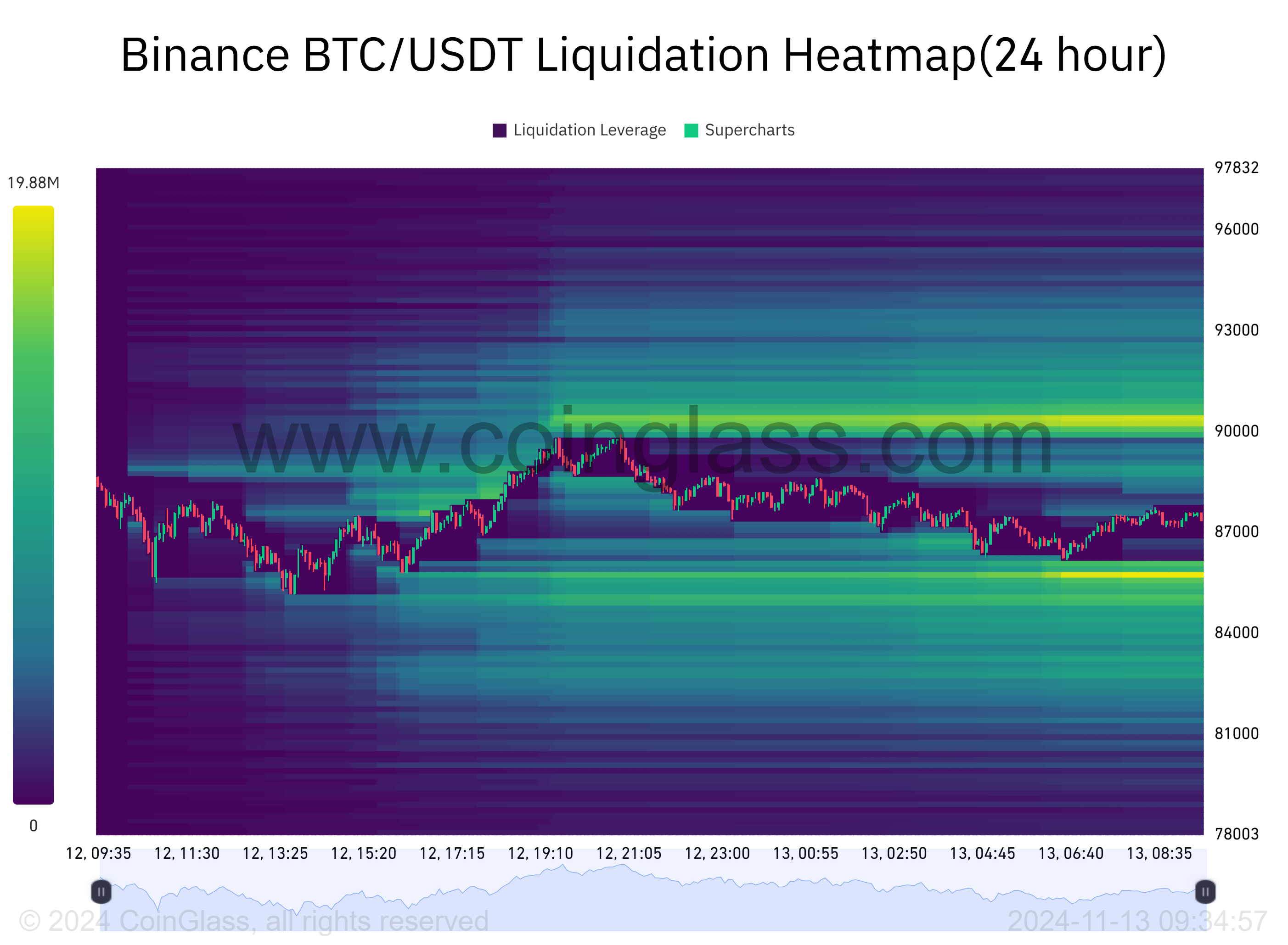

The Binance BTC/USDT Liquidation Heatmap supplied extra context, showcasing areas of concentrated liquidation exercise.

The heatmap highlighted liquidation clusters between $84,000 and $88,000, with darker zones representing increased leverage and extra important liquidations.

This focus round Bitcoin’s psychological resistance ranges underscored the depth of speculative buying and selling available in the market.

The yellow line on the chart indicated Bitcoin’s worth nearing $85,769, correlating with the lengthy and quick liquidations surge.

Notably, long-position liquidation dominated the market as Bitcoin’s worth retraced from current highs, triggering stop-loss orders and margin calls.

Apparently, the liquidation heatmap reveals that leverage merchants have positioned important bets close to present worth ranges, creating each alternatives and dangers.

Whereas these zones can act as liquidity swimming pools to propel worth motion, additionally they sign potential market fragility if liquidations cascade additional.

Market implications

The spike in crypto liquidations, notably on main exchanges like Binance, mirrored the broader market’s heightened volatility.

With Bitcoin persevering with to commerce close to all-time highs, liquidation knowledge highlighted each the passion and vulnerability of market contributors.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Because the market strikes, merchants will intently watch key worth ranges and liquidation knowledge to gauge the following directional transfer.

Whereas liquidations can exacerbate short-term worth swings, additionally they present alternatives for market stabilization and new developments to emerge.