- Bitcoin crossed the $109,000 mark forward of Trump’s inauguration, pushed primarily by Korean market exercise.

- U.S. buyers have but to contribute considerably to this rally, leaving room for additional features.

The market has proven sustained bullish momentum over the previous week, with Bitcoin [BTC] climbing 15.06%. This upward motion intensified within the final 24 hours, gaining 2.68% and reaching its new document excessive.

Korean buyers have performed a pivotal function on this rally, supported by rising market sentiment and a rise in lively Bitcoin addresses.

Insights from AMBCrypto counsel that additional upside potential stays as circumstances evolve.

Bitcoin hits new all-time excessive as on-chain exercise spikes

Bitcoin has reached a brand new all-time excessive, buying and selling at $109,114.88, at press time, on the twentieth of January, in accordance with CoinMarketCap. On the time of writing, BTC’s buying and selling quantity surged by 120.34% to $110 billion. Its market capitalization climbed to $2.13 trillion.

This milestone comes simply forward of Donald Trump’s inauguration as we speak. Market optimism surrounding his perceived pro-crypto stance could also be fueling bullish sentiment.

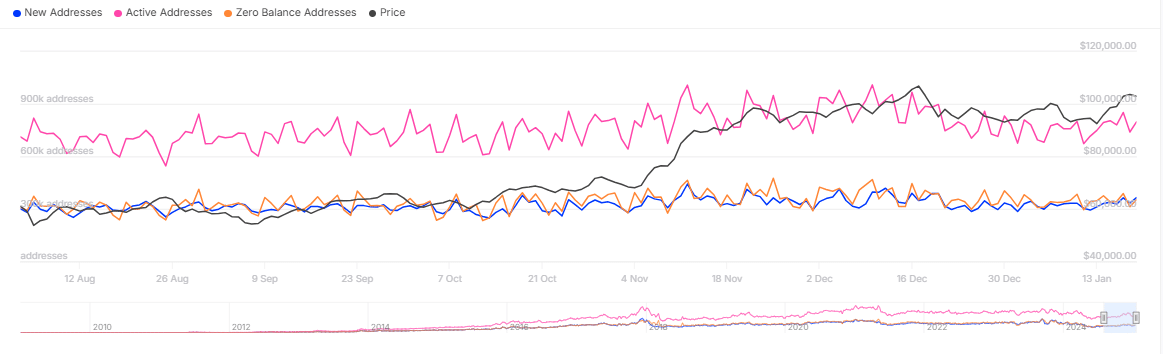

The surge is additional supported by an 11.47% rise in lively Bitcoin addresses over the previous 24 hours. 798,140 addresses had been collaborating in on-chain transactions.

Spikes in exercise, alongside will increase in worth and buying and selling quantity, typically reveals the potential for a sustained market rally. BTC’s momentum might achieve additional traction as buyers reply to market dynamics.

Korean buyers drive BTC surge

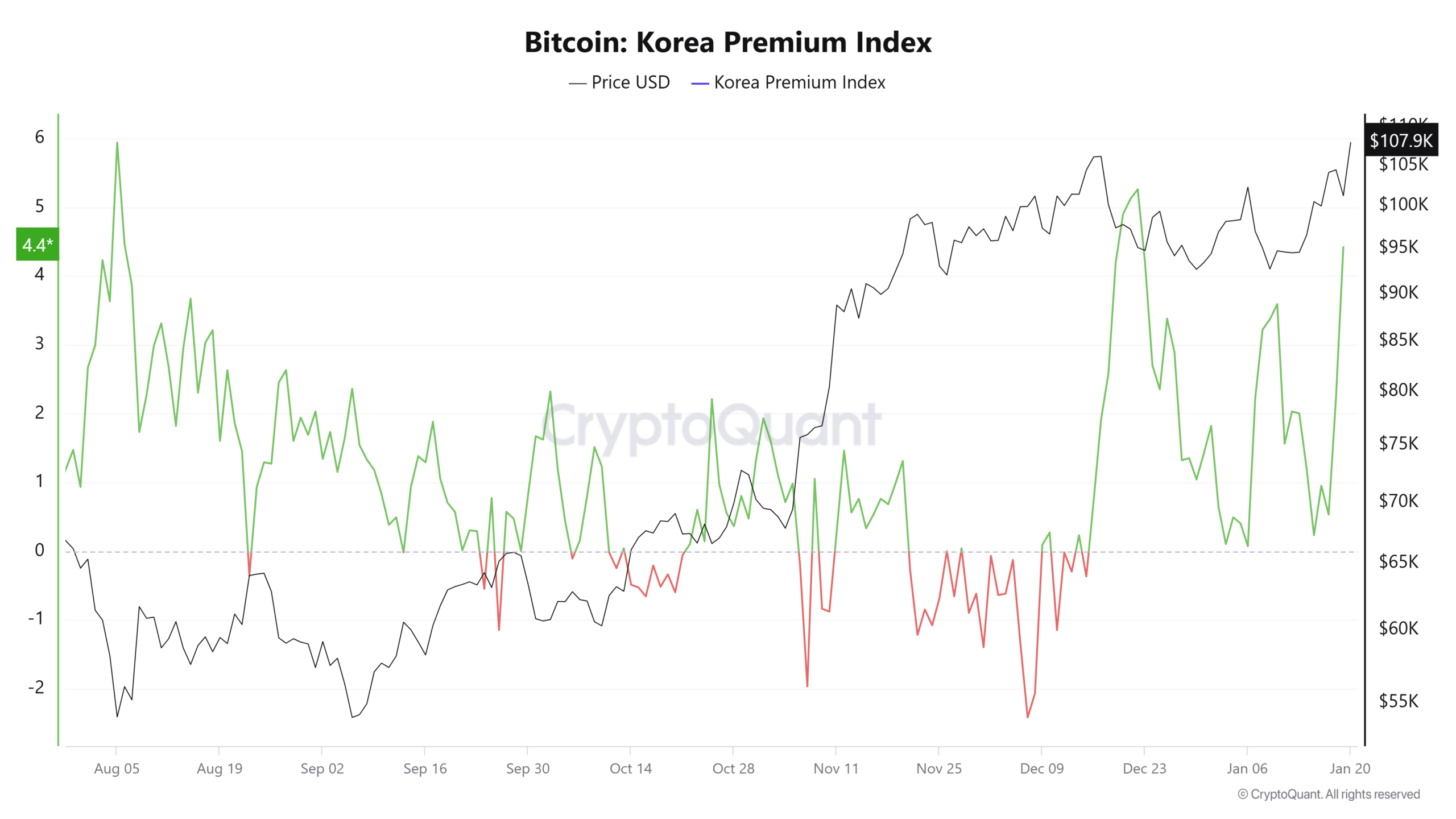

Information from CryptoQuant signifies that BTCs current excessive is carefully linked to an increase within the Bitcoin: Korea Premium Index—a metric that measures the relative energy of Korean retail buyers by monitoring the value hole between South Korean exchanges and others.

The index displays market sentiment, with values above the impartial zone (0) which means bullish, and beneath this zone reveals bearish conduct amongst Korean buyers.

At press time, the index stood at 4.42, indicating a major worth distinction on South Korean exchanges and robust BTC buying exercise.

The U.S. Premium Index, evaluating Coinbase costs to different exchanges, reveals a destructive studying of -0.1189. This means U.S. buyers are at present promoting BTC.

Though this may appear bearish, it highlights a possibility for additional worth features. U.S. buyers, identified for his or her market affect, have but to enter the present rally.

If they start buying BTC following Trump’s inauguration, Bitcoin might expertise one other vital worth bounce.

An identical development occurred on the fifth of November, when elevated U.S. participation drove BTC to its earlier all-time excessive of $108,353, following Trump’s Presidential victory.

BTC and ETH market cap hole hits document excessive

The market capitalization hole between BTC and ETH has reached an unprecedented $1.75 trillion, marking the biggest differential in historical past.

This means a major shift in investor desire towards BTC, which is now attracting extra capital in comparison with ETH, the second-largest cryptocurrency by market cap.

Learn Bitcoin’s [BTC] Value Prediction 2025–2026

The widening hole might open a possibility for buyers to extend their BTC holdings or shift their focus away from ETH.

This development aligns with the prevailing bullish sentiment surrounding BTC, doubtlessly driving its worth greater. Analysts counsel BTC might surpass $110,000 in upcoming market classes if momentum persists.