At any time when I’ve spare money, I put money into corporations inside my Shares and Shares ISA. Finally, I’d prefer to reside off the passive revenue generated from this portfolio.

Nevertheless, this isn’t a get-rich-quick technique. I’m going to should be affected person.

However the excellent news is that small quantities can add as much as a surprisingly great amount, given sufficient time.

Passive investing

One of many easiest methods to construct up a portfolio is thru low-cost exchange-traded funds (ETFs). These permit folks to put money into a number of shares, bonds, property, and extra, in a single fell swoop.

Many UK buyers gravitate towards the FTSE 100, recognized for its stability and beneficiant dividends. The long-term annual common is round 8%.

Nevertheless, it’s a incontrovertible fact that lots of the world-changing corporations are listed throughout the pond. Their merchandise dominate our day-to-day lives, whether or not that’s iPhones (Apple), leisure (Disney and Netflix), Fb and Instagram (Meta Platforms), or Google search (Alphabet).

The S&P 500, with its important publicity to expertise shares, has generated common returns of round 10% (together with dividends).

Passive revenue potential

Let’s assume I make investments passively in each indexes and the historic returns keep broadly the identical (which isn’t assured). In order that’s 9%.

On this situation, I’d find yourself with £1,159,308 after 35 years of investing simply £99 per week (not together with any platforms charges). And that’s ranging from scratch!

At this level, I might make use of the 4% withdrawal rule. This may see me drawing down £46,372 a yr.

Energetic investing

Somewhat than passive investing, although, I’ve determined to take an energetic, stock-picking method. That is riskier and extra time-consuming, however the potential rewards are far higher.

Axon Enterprise (NASDAQ: AXON) is a good instance of this. The inventory is up virtually 1,300% since my preliminary funding in 2017. It’s been an unbelievable long-term winner and is now at a file excessive.

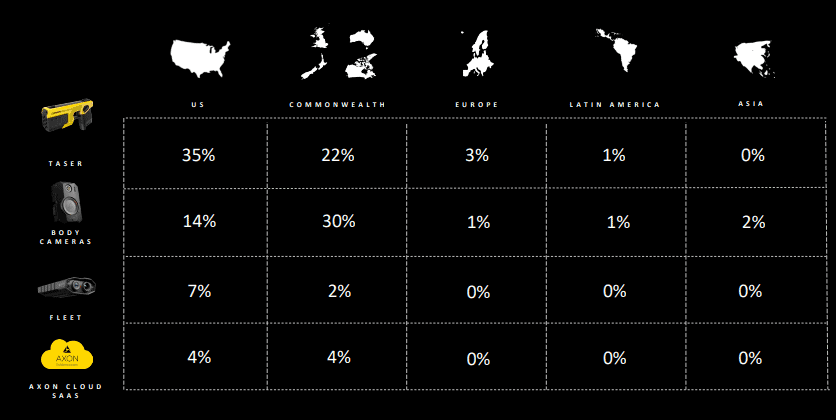

The agency has advanced from promoting simply Tasers right into a mission-critical public security expertise platform. At the moment, its merchandise vary from physique and car cameras to cloud-based AI companies and drones.

Many cops within the US and UK now put on Axon’s body-cams (for accountability and proof gathering) and Tasers (for security and a less-lethal choice than weapons). That is contracted recurring income for Axon.

Nevertheless, the broader worldwide alternative for each merchandise stays completely huge. The market penetration price in Europe, Asia, and Latin America is principally close to 0%!

In Scotland, the police, legal professionals, and the courts all now depend on Axon’s unified proof database. The thoughts boggles on the development potential if different nations (far bigger than Scotland) additionally migrate their total justice methods over to Axon’s platform.

In fact, all this opens up information privateness points, which is a danger. And the inventory is way from low-cost these days.

Aiming for greater

I want all my investments had generated Axon-like returns, however the reality is that I’ve purchased some duds too.

Nevertheless, the maths is skewed in my favour as a result of the potential good points from high shares are theoretically uncapped.

- Axon Enterprise: +1,300% (up to now)

- Most loss from dud: -100%

Even when I solely managed an additional 2% return on the S&P 500 (so, 12%), that’s sufficient for a £2,352,389 portfolio. In passive revenue phrases, it’s equal to £94,095 a yr.