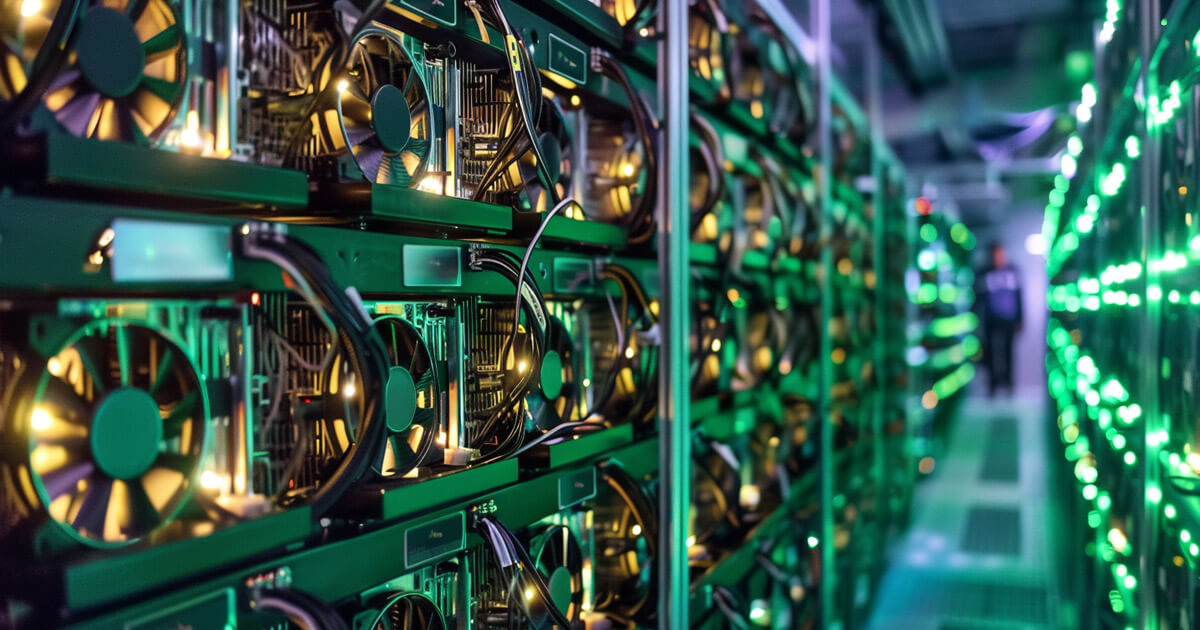

Picture supply: Getty Pictures

As a long-term funding automobile, a Shares and Shares ISA could be a good match for my long-term strategy to investing.

Which may imply focusing on long-term value achieve.

If I had invested in Rolls-Royce a 12 months in the past, for instance, my stake would since have tripled in worth. If I had invested in NVIDIA inventory 5 years in the past, every £1,000 of shares I purchased then would now be value nearly £33,000!

However a variety of the businesses in my Shares and Shares ISA entice me much less for his or her value progress prospects than for the passive revenue streams I hope they’ll pay me within the type of dividends.

Discovering revenue shares to purchase

Think about I made a decision I needed to focus on £10 every day on common in such passive revenue. That may be £3,650 per 12 months in dividends.

Beginning with a £10K Shares and Shares ISA, that may appear inconceivable. In any case, few shares ever have a yield of 37%. Even when they did, such an unusually excessive yield would typically be a pink flag to me as an investor.

So, to start out, I’d neglect about yield. As a substitute, I’d hunt for excellent firms with robust money technology prospects and engaging share costs.

One dividend share I’d purchase

For example, take into account an organization I’d be comfortable to personal in my Shares and Shares ISA if I had spare money to speculate: Phoenix (LSE: PHNX).

The pensions and retirement specialist has a confirmed enterprise mannequin that’s extremely money generative. Final 12 months, for instance, it was focusing on money technology of round £1.8bn and blew previous that by producing over £2bn.

I feel its buyer base within the hundreds of thousands, confirmed experience in managing pensions, and the appropriate to make use of robust manufacturers like Customary Life might assist Phoenix preserve doing properly.

A monetary downturn dangers hurting earnings, particularly if it means the corporate’s valuations for issues like its mortgage e-book change into optimistic.

However bear in mind I’m investing my Shares and Shares ISA for the long run. Phoenix has a progressive dividend coverage and already yields a mouth-watering 10.6%.

Utilizing compounding to my benefit

Meaning it is likely one of the highest-yielding shares within the FTSE 100. Think about I goal a extra modest common yield of seven%, which is nonetheless nonetheless properly above the FTSE 100 common.

At 7%,a £10K Shares and Shares ISA must earn me £700 yearly in dividends.

But when I merely reinvest them quite than take them as money and my ISA compounds at 7% yearly, after 25 years, I must be incomes the equal of barely over £10 per day in passive revenue. Goal achieved.