- Ethereum ETFs noticed a rebound, bringing aid to the 17 million holders within the purple.

- ETH might want to step as much as keep forward within the aggressive altcoin race.

The New Yr buzz remains to be fairly energetic now, particularly with Bitcoin [BTC] consolidating on the charts. Traditionally, Q1 has been bullish for the crypto market, usually creating an setting well-suited for altcoins to draw capital.

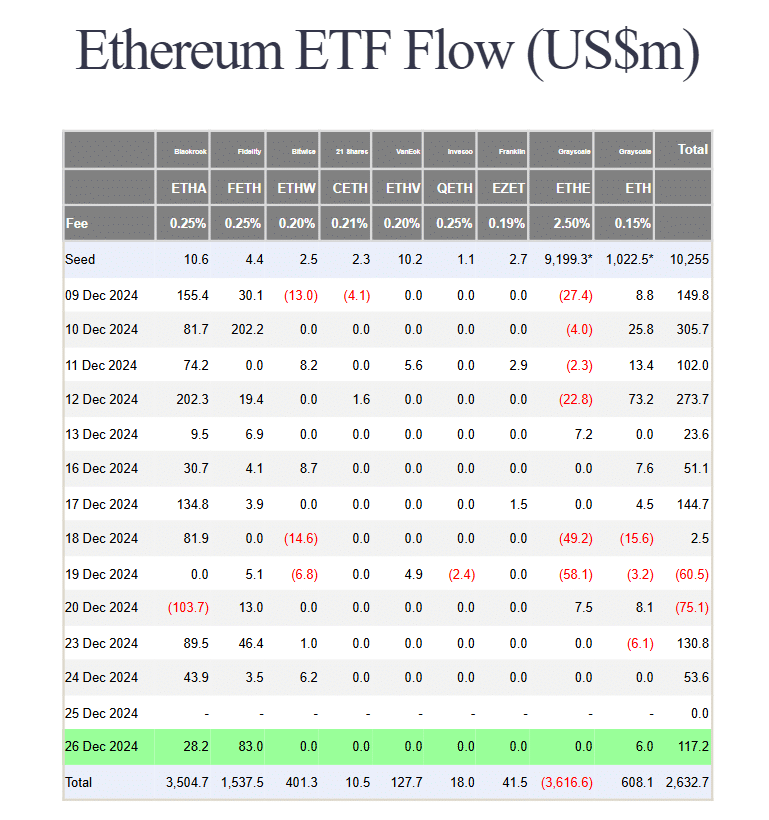

In the meantime, Ethereum [ETH] ETFs are gaining traction too, with spectacular inflows. In reality, Constancy’s Ethereum ETF (FETH) noticed $83 million in web inflows – An indication that traders could also be beginning 2025 with a give attention to diversification.

Whereas it could be too early to attract agency conclusions, Ethereum’s 1.04% value hike appeared to allude to an rising development price keeping track of.

For Ethereum, it’s a protracted street forward

For the reason that “Trump pump,” the market has seen a number of shifts in momentum. What initially appeared like a powerful bull rally, with Bitcoin hitting the $100k milestone on the shut of the 12 months, has since tapered off. Because of this, the “high risk” sentiment is clearly maintaining traders cautious.

Ethereum hasn’t been proof against this shift both. After the preliminary surge, its value fell again to the place it was a month in the past, erasing a lot of its election-induced beneficial properties. With round 17 million Ethereum addresses now within the purple, the stress for a rebound is increase.

And but, amidst the uncertainty, $117 million in web inflows by means of ETH ETFs brings some much-needed aid.

This marks a constructive signal, notably after two consecutive days of reasonable institutional curiosity – An indication that Ethereum might nonetheless be poised for a restoration.

That being stated, a full rebound to $4,000 nonetheless appears a good distance off. Technically, it could require an 18% leap. And, given its latest performances during the last 30 days, this might sound a bit too optimistic within the quick time period.

There are different gamers within the race for dominance

Like Ethereum, different altcoins are enhancing their underlying tech to supply traders compelling long-term prospects. One which stands out specifically is XRP.

Curiously, XRP’s day by day value motion revealed indicators of consolidation at press time, with intense shopping for and promoting stress making a stand-off. This tug-of-war has attracted consideration from huge gamers, who’re betting on XRP for potential huge returns.

With its spectacular triple-digit beneficial properties, real-world use case integrations, and powerful whale backing, XRP is positioning itself to doubtlessly take the highlight from Ethereum because the market rebounds—A development that have to be carefully adopted within the days forward.

Learn Ethereum [ETH] Value Prediction 2025-2026

On the flip aspect, Ethereum’s chart has been extra unstable. After hitting its yearly excessive of $4,106 simply 10 days in the past, ETH dropped a staggering 21% in every week. So, whereas a restoration is feasible, it has been sluggish, indicating a scarcity of quick shopping for curiosity from the market.

Trying forward, the following few days could possibly be make-or-break for Ethereum. Though recent capital might push BTC into consolidation, doubtlessly benefiting altcoins like Ethereum, the present lack of constant assist in ETH’s value means a swift restoration is unlikely.

On prime of that, the competitors amongst altcoins is heating up, and Ethereum should present extra consistency if it desires to remain on the forefront of the pack.