- Holders of Bitcoin would possibly accumulate extra, prompting options of a value enhance.

- An important indicator revealed that BTC would possibly plunge once more earlier than it hits one other all-time excessive.

Investing in crypto might be dangerous. However one factor that Bitcoin [BTC], the cryptocurrency with the most important market cap, has proven, is that selecting the coin can yield rewards that just a few belongings can dream of.

However don’t take AMBCrypto’s phrase as recommendation.

As an alternative, a fast have a look at BTC’s all-time efficiency revealed that that is no fluke. In accordance with information from CoinMarketCap, Bitcoin’s value has elevated by a mind-blogging 103,942,579% since its inception.

Nevertheless, one factor traders can guarantee you is that it isn’t simply glitz and glamour on Bitcoin’s finish.

As an illustration, the market crash of 2022 was proof that “up only” is simply a fantasy, as any Bitcoin funding can go down as soon as the market hits a bear section.

Be careful! The course shouldn’t be at all times north

In 2021, Bitcoin hit an All-Time excessive (ATH) of $69,000. However a yr again, triggered by sure occasions, the coin dropped beneath $16,000, confirming that the asset’s volatility may have an disagreeable influence on traders.

Quick-forward to 2024, the coin surpassed its all-time excessive, reaching $73,750 on the 14th of March. Regardless of the hike, the coin retraced. As of this writing, it modified palms at $64,298.

This worth represented a 5.58% lower within the final 30 days. However is Bitcoin a great funding for you? Properly, sure elements affect the worth of the coin.

As an illustration, the approval of spot Bitcoin ETFs earlier this yr influenced the rally to its new all-time excessive. Nevertheless, the wonderful inflows of the primary quarter are nowhere to be discovered.

As such, traders are left with the basics and key indicators to depend upon. For starters, AMBCrypto checked out Bitcoin’s potential to offer good returns utilizing on-chain metrics.

Extra good points could also be coming

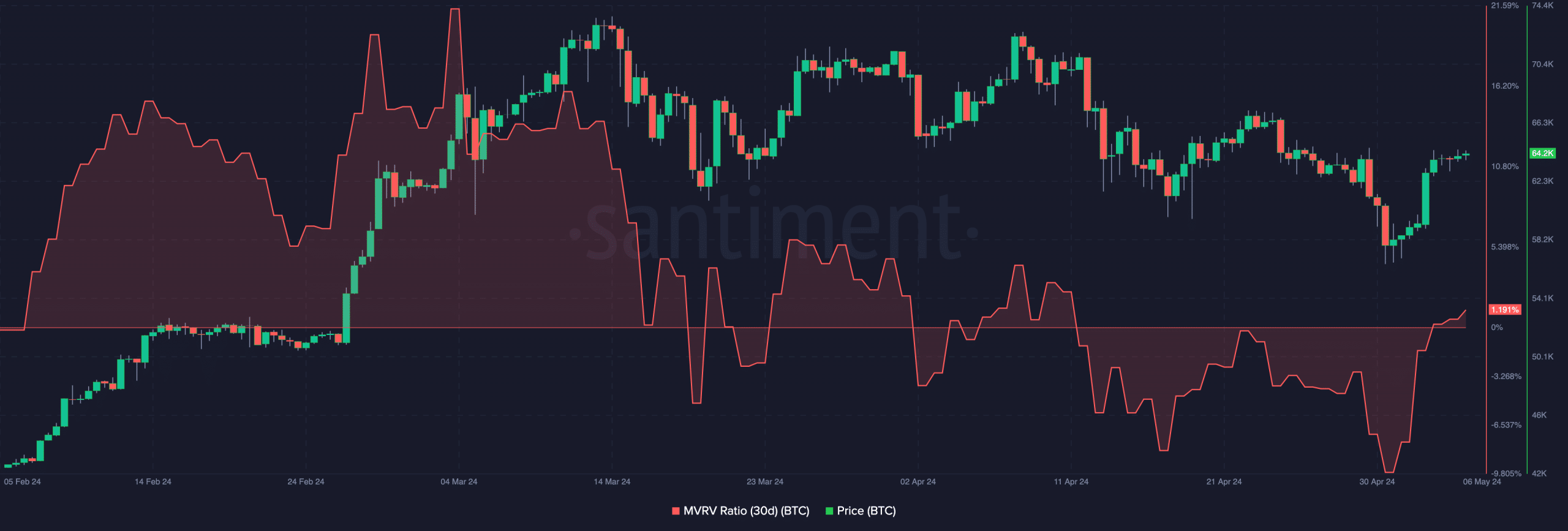

One of many metrics we checked out was the Market Worth to Realized Worth (MVRV) ratio. The MVRV ratio reveals the profitability of BTC holders.

At press time, the 30-day MVRV ratio was 1.1.9%. Which means that if holders of Bitcoin promote their belongings, the common return could be round this share.

However that is unlikely to occur, because the unrealized good points don’t appear engaging sufficient to set off a widespread sell-off. Subsequently, the affordable motion could be for traders to carry to their cash.

Additionally, when the MVRV ratio was 21.30%, Bitcoin’s value was over $71,000. With this information, extra accumulation may happen, and this might lead BTC again to a extra worthwhile area.

Will Bitcoin add an additional 40% enhance?

Moreover, there have been predictions that the coin would possibly hit $100,000 this cycle. Whereas some argue in favor of the forecast, others want to be on the conservative facet.

For the bullish ones, the ETF and ATH earlier than halving was proof that Bitcoin would possibly add one other 40% to its value earlier than it hit the highest.

AMBCrypto spoke to Ben Cousens concerning the matter. Cousens is the Chief Technique Officer at ZBD, an organization utilizing the Bitcoin lightning community to energy funds.

Whereas the ZBD chief didn’t give a selected value prediction, he displayed optimism in his remark, saying that,

“Within the Bitcoin ecosystem as a whole, historically, the halving has coincided with rising fiat prices due to the supply shock. his halving came at a time when ETFs were increasing institutional adoption, playing a bigger role with more of an impact. The additional excitement about the halving leads to a new cohort of users who learn how to use Bitcoin.”

Going by Cousens’s opinion, a brand new wave of latest traders would possibly come for Bitcoin. Ought to this be the case, rising demand may result in increased costs, and most investments is perhaps price it.

A brief-term outlook might not lower it

Nevertheless, short-term traders would possibly have to be cautious. As a lot as BTC is usually a good funding, the worth may additionally bear a correction.

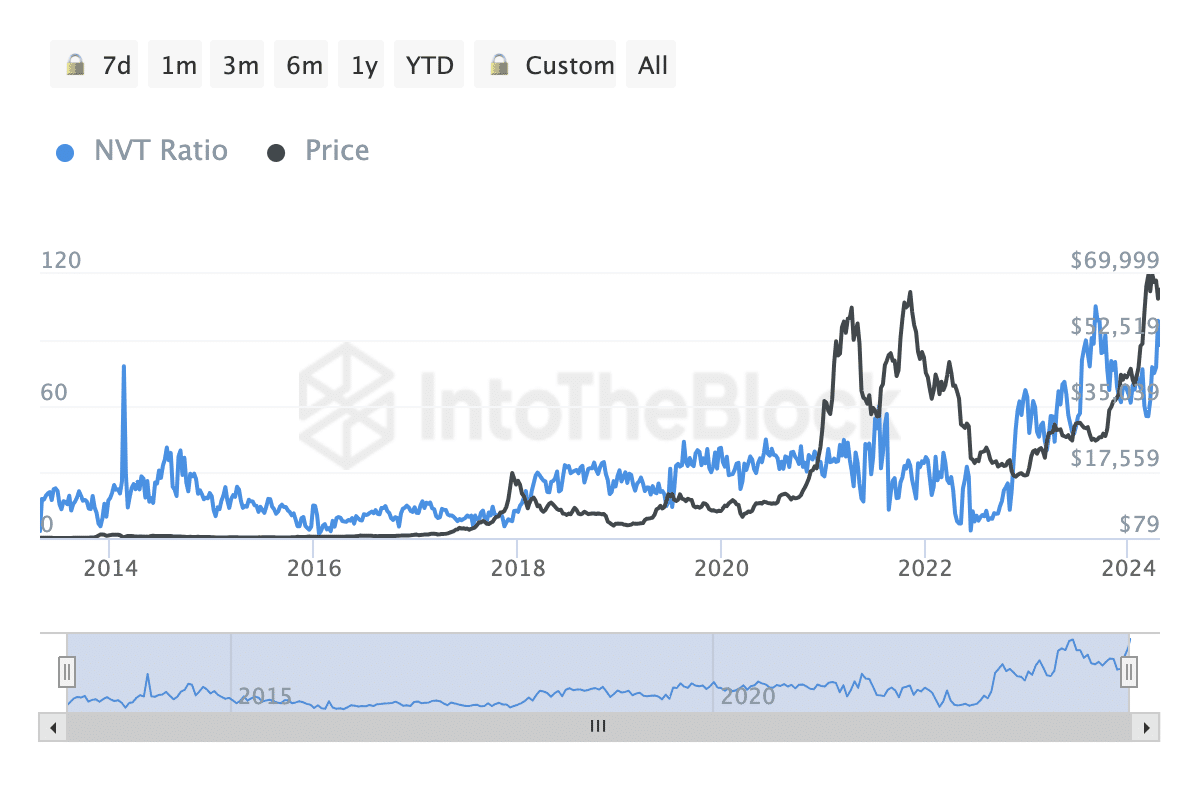

One of many causes for that is the Community Worth to Transaction (NVT) ratio. This metric seems at a coin’s market cap relative to its complete buying and selling quantity.

If the NVT ratio will increase, it implies that the coin could possibly be overvalued within the brief time period. Nevertheless, a low NVT ratio suggests an undervaluation of the present asset worth.

On the time of writing, IntoTheBlock information confirmed that Bitcoin’s NVT ratio had risen to 98.79, implying {that a} return beneath $64,000 could possibly be imminent.

Ought to this be the case, the worth of Bitcoin would possibly collapse to $59,000 once more. However in the long term, Bitcoin is usually a good funding relying on the acquisition value.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

For this cycle, the worth of the coin is predicted to hit between $87,000 and $92,000. Subsequently, shopping for at press time value or ready for one more decline is perhaps a great transfer.

Both manner, traders ought to be looking out for happenings within the ecosystem, as an unfavorable occasion would possibly invalidate this thesis.