- Bitcoin’s worth dropped whereas gold spiked

- Peter Schiff’s advocacy diminished by BTC’s funding surge

Bitcoin [BTC] has as soon as once more dropped on the charts, with its worth falling from over $70,000 to simply over $67,000 at press time. The truth is, BTC misplaced over 5% of its worth in simply 24 hours.

Alternatively, Gold – One of many market’s extra conventional belongings – surged to a brand new ATH on the again of world monetary markets’ uncertainty. The place does that go away Bitcoin?

What’s behind the surge in gold costs?

The aforementioned disparity in worth actions led to numerous Bitcoin skeptics coming ahead and sharing their viewpoints. Peter Schiff, amongst many others, highlighted in his latest podcast that some media tales attribute the rise in gold costs to geopolitical tensions, akin to these in Ukraine or Israel.

Nonetheless, he believes that this rationalization misses the true purpose behind the appreciating in gold costs. He stated,

“People are just buying gold as a hedge, right? I mean in a way they’re right it is a hedge, but it’s not a hedge against geopolitical uncertainty it’s a hedge against inflation.”

Schiff additional famous that though the US Greenback seems robust, in comparison with different currencies, it’s truly weakening, with the identical evidenced by Gold’s rise towards all currencies.

Taking to X (Previously Twitter), he famous,

“It’s a rejection of fiat currencies and a harbinger of the end of the U.S. dollar’s role as the world’s reserve currency.”

It is a signal that the U.S Greenback’s reserve standing is unsure, and its obvious power is simply short-term.

Bitcoin stands robust towards gold

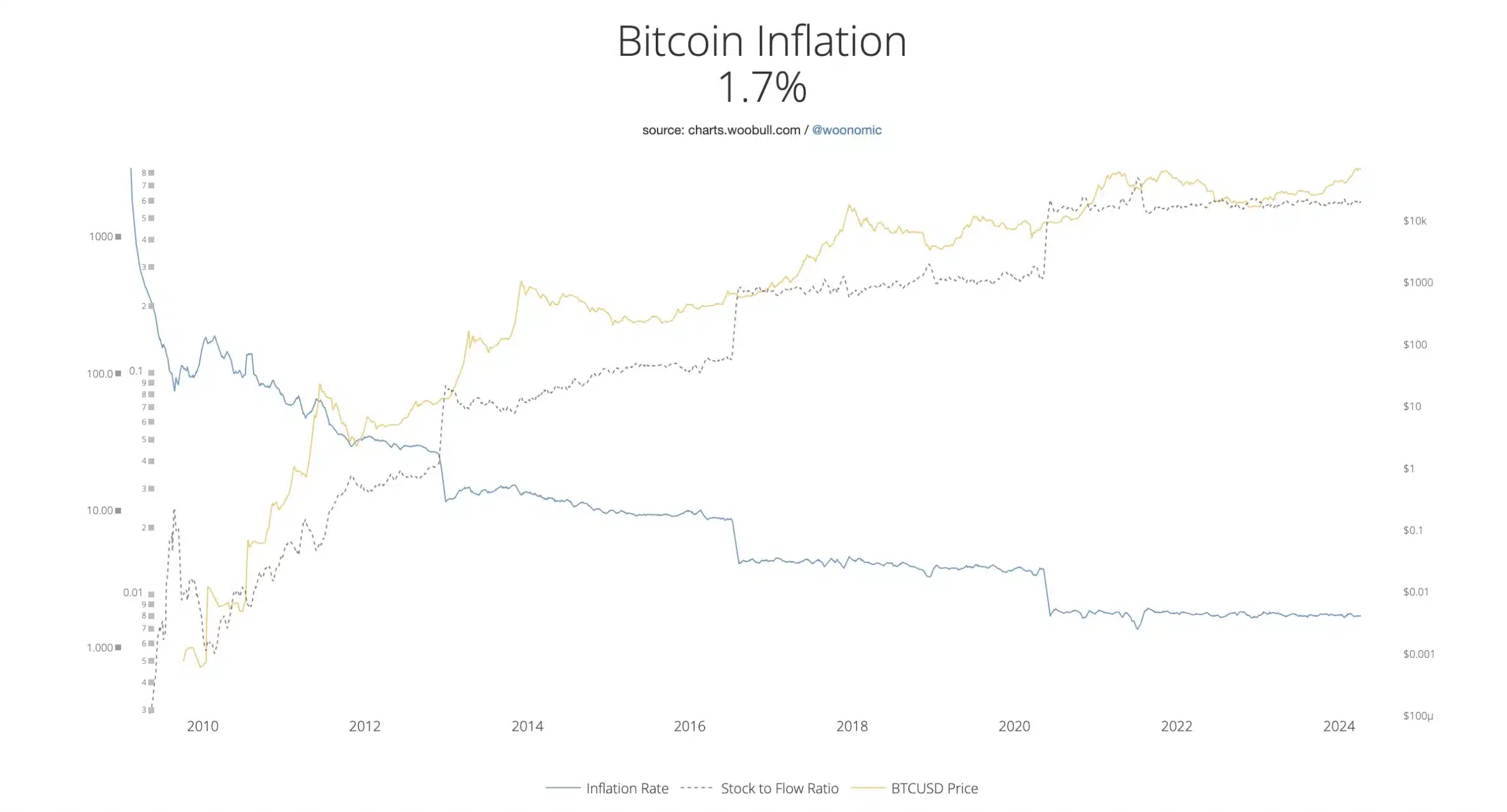

Regardless of Bitcoin’s latest worth volatility, nevertheless, Woodbull Charts highlighted a fall in its inflation over the previous 4 years, dropping from 3.72% in 2020 to 1.7% in 2024. This may be implied as an indication that short-term declines in BTC’s worth are unlikely to immediate widespread promoting of the cryptocurrency.

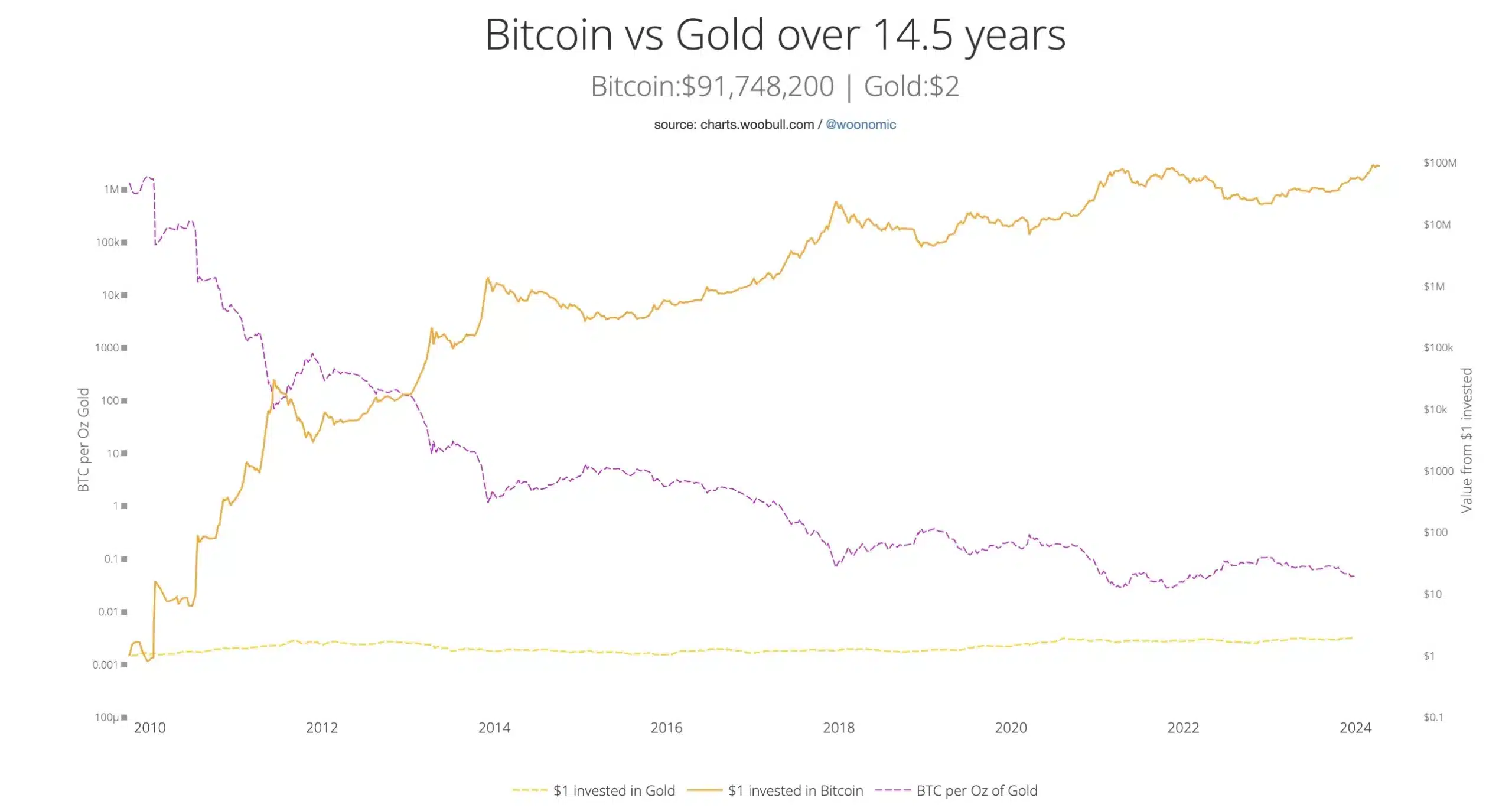

According to these observations, Woodbull charts additionally lately in contrast the efficiency of Bitcoin to gold over a interval of 14.5 years. As of April 2024, Bitcoin’s funding worth stood at $19.83, whereas gold was struggling at $1.97.

Right here, it’s value noting that Woodbull Charts had a degree to make to Peter Schiff and his followers too,

Bitcoin continues to win hearts

Ergo, regardless of its erratic fluctuations in worth, Bitcoin has established itself as a fascinating funding alternative for a lot of. The truth is, many establishments like MicroStrategy has additionally began together with BTC of their portfolios owing to its performances over the previous few years.

Evidently, sentiment round BTC stays as optimistic as ever, with one commentator claiming,

“Repeat after me. They won’t shake me out. 100k, BTC to the moon!”