When contemplating buying and selling cryptocurrency, many individuals are searching for dependable platforms. Crypto.com is without doubt one of the most secure crypto exchanges. However, is Crypto.com secure to make use of? This information explores the safety measures, the dangers concerned, and what customers can do to guard their investments at Crypto.com.

Key Takeaways:

- The Crypto.com trade is extremely safe with security measures similar to 2FA, chilly storage, anti-phishing code, withdrawal tackle whitelisting, and clear PoR knowledge.

- Crypto.com gives FDIC insurance coverage for U.S. customers’ fiat balances, as much as $250,000.

- They provide a HackerOne Bug Bounty program to constantly strengthen their system by encouraging accountable vulnerability reporting.

Crypto.com Trade Overview

Crypto.com, based in 2016, has quickly grown into one of many largest crypto trade platforms globally, with over 100 million customers. The corporate has positioned itself as a pacesetter in regulatory compliance, holding licenses throughout a number of jurisdictions, together with the UK, Singapore, and France. This broad regulatory footprint is essential to its dedication to consumer security and belief.

Crypto.com’s platform helps a variety of providers, together with cryptocurrency buying and selling, staking, and funds, and has expanded into sectors similar to NFTs and decentralized finance (DeFi). Its each day buying and selling quantity usually exceeds billions, with the platform processing important spot and derivatives trades. It additionally affords margin buying and selling with as much as 5x leverage.

Crypto.com leads in decentralized finance (DeFi) by providing you entry to providers like yield farming, staking, and liquidity swimming pools. Its native token, Cronos (CRO), performs a key function in these actions. Once you maintain CRO, you get advantages similar to incomes rewards and decrease buying and selling charges. Learn our full Crypto.com overview for extra data.

Is Crypto.com Secure: 10 Safety Measures

Sure, Crypto.com is without doubt one of the finest crypto exchanges that employs a variety of safety measures to safeguard your funds and private knowledge. Due to a layered strategy that features every part from offline chilly storage to superior encryption protocols.

Right here’s an in depth have a look at the highest 10 safety measures that Crypto.com makes use of to make sure your peace of thoughts:

Chilly Pockets Storage

Probably the most essential features of Crypto.com’s safety technique is its use of chilly pockets storage for almost all of consumer funds. Protecting chilly wallets offline and disconnected from the web makes them a lot much less prone to hacking assaults. Actually, over 90% of all consumer funds are saved in chilly wallets, a typical apply amongst main cryptocurrency exchanges.

Sizzling wallets, that are used for day-to-day crypto transactions, solely maintain a minimal quantity of belongings obligatory to keep up liquidity. This division between hot and cold wallets ensures that even when the recent pockets is compromised, the impression on consumer belongings is minimal.

The chilly pockets technique is bolstered by multi-signature pockets protocols, which require a number of approvals from completely different events earlier than any transaction will be constituted of these wallets. This minimizes the danger of inside fraud or unauthorized entry.

Moreover, Crypto.com’s chilly pockets storage is secured in institutional-grade vaults. These vaults are situated in geographically dispersed places to scale back the danger of a single level of failure. Even in a bodily assault or a pure catastrophe, the distributed nature of those vaults ensures your funds stay safe.

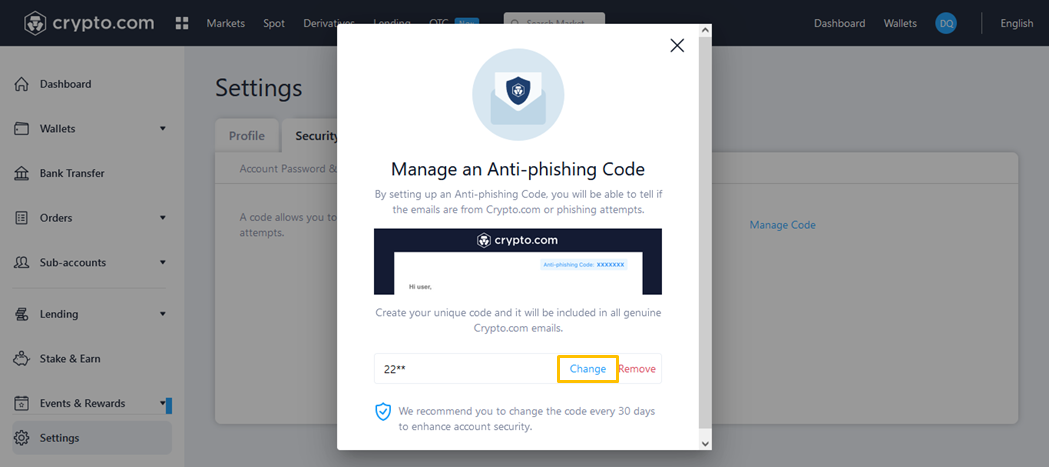

Anti-Phishing Code Set Up

Phishing assaults are a significant risk in crypto, the place attackers usually attempt to impersonate official platforms to steal consumer credentials. To counter this, Crypto.com affords the choice to arrange an anti-phishing code. It is a personalised code that seems in all legit emails from Crypto.com, permitting you to shortly determine whether or not an e mail is from the official platform or a phishing try.

Along with the anti-phishing code, the platform’s e mail and communication protocols are secured utilizing the most recent Transport Layer Safety (TLS) encryption requirements. This ensures that each one communications between the platform and your e mail are encrypted, lowering the danger of interception.

Multi-Issue Authentication (2FA)

Multi-factor authentication (MFA) is one other crucial layer in Crypto.com’s safety framework. By requiring not less than two strategies of verification – similar to a password and a one-time code from an authentication app – MFA considerably reduces the probabilities of unauthorized entry to your account.

Crypto.com goes past the usual MFA. It helps a number of types of verification, together with SMS-based codes, app-based authenticators like Google Authenticator, and even biometric verification by means of fingerprints or facial recognition. This ensures that, even when your password is breached, an intruder can’t enter your account with out the extra authentication technique.

It’s additionally vital to notice that MFA is required for all delicate actions on the platform, not simply login makes an attempt. This contains withdrawals, password adjustments, and the modification of key account settings. For added safety, Crypto.com mandates MFA for the activation of API keys, that are utilized by extra superior customers to automate buying and selling or entry their accounts programmatically.

Safe Software program Improvement Life Cycle

Crypto.com integrates safety from the very starting of its software program growth course of by means of a Safe Software program Improvement Life Cycle (SDLC). This strategy entails safety audits and testing at each stage of growth.

Every new characteristic or replace is peer-reviewed, and each static and dynamic supply code evaluation instruments are used to catch potential vulnerabilities earlier than they are often exploited.

The SDLC course of is just not restricted to inside groups; exterior safety companies are additionally concerned in auditing Crypto.com’s codebase. For instance, Kudelski Safety, a globally acknowledged agency, frequently performs third-party safety assessments. This ensures that Crypto.com’s safety practices are updated with the most recent business requirements.

Furthermore, the platform employs real-time monitoring instruments that observe community visitors and software habits for any indicators of anomalous exercise. Any detected anomalies are flagged and addressed instantly, additional lowering the danger of zero-day exploits or rising threats.

Withdrawal Tackle Whitelisting

Crypto.com has strengthened its withdrawal safety by introducing tackle whitelisting. This characteristic permits customers to limit withdrawals to particular, pre-approved pockets addresses. Right here’s the way it works:

- You possibly can pre-approve particular crypto withdrawal addresses like USDT (BEP20) tackle or Bitcoin (BTC community) in your account settings.

- Funds can solely be withdrawn to those whitelisted addresses.

- Including a brand new withdrawal tackle requires e mail verification and has a 24-hour ready interval.

This 24-hour cooling-off interval gives additional safety, making certain that even when an attacker positive aspects entry to your account, they can not immediately withdraw funds to their very own pockets.

To additional safe your belongings, the platform additionally requires e mail verification for each withdrawal request. Which means you need to verify all transactions through e mail earlier than transferring funds, including yet another safeguard to the method.

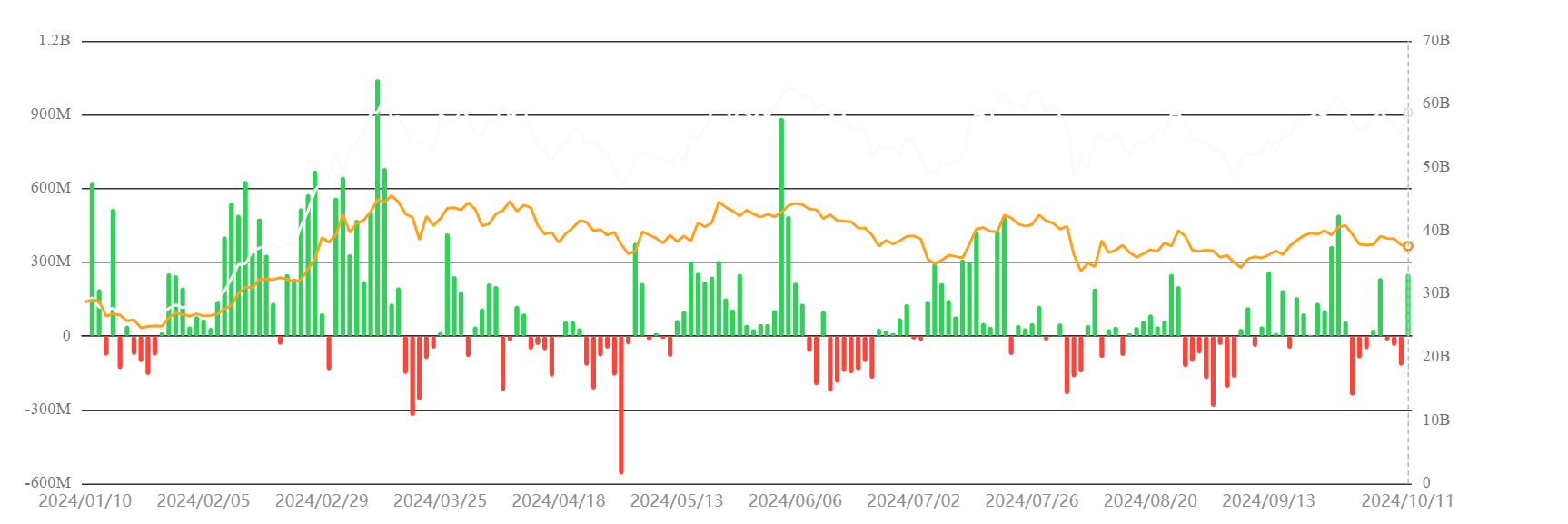

Proof of Reserves (PoR)

Crypto.com makes use of a Proof of Reserves (PoR) system to make sure transparency concerning the platform’s monetary stability. This method helps you to verify that your belongings are absolutely backed by the platform’s reserves, addressing any considerations about the potential of insolvency (just like FTX).

The Proof of Reserves course of is carried out by impartial auditors from the Mazars Group, who frequently verify and confirm Crypto.com’s belongings. They publish experiences to verify that the platform holds sufficient belongings to match all buyer balances. This ensures that your funds are backed 1:1, and you may withdraw them at any time.

To make sure all reserves are correctly accounted for, cryptographic strategies are used throughout the auditing course of, which additional will increase transparency. A key a part of this method is the usage of Merkle Timber. A Merkle Tree is a construction that organizes massive quantities of knowledge, making it simpler to confirm and audit. On this case, it lets you verify that your particular person belongings are included within the whole reserves with out revealing any delicate account data.

Right here is the present fund reserve ratio by Crypto.com:

| In-Scope Asset | Reserve Ratio |

| BTC (Bitcoin) | 102% |

| ETH (Ethereum) | 101% |

| USDC (USD Coin) | 102% |

| USDT (Tether) | 106% |

| XRP (Ripple) | 101% |

| DOGE (Dogecoin) | 101% |

| SHIB (Shiba Inu) | 102% |

| LINK (Chainlink) | 101% |

| MANA (Decentraland) | 102% |

(Supply: Mazars Group Audit)

Person Funds Saved in Custodian Financial institution Accounts

Once you maintain fiat currencies on Crypto.com, your funds are saved in regulated custodian financial institution accounts, including an additional layer of safety to your non-crypto belongings. For those who’re a U.S. resident, your cash is positioned with Group Federal Financial savings Financial institution or different FDIC-insured banks.

This provides you protection of as much as $250,000 per depositor in case the financial institution fails. Nonetheless, it’s vital to know that FDIC insurance coverage solely applies to your fiat balances. It doesn’t cowl losses if Crypto.com itself fails or in instances of fraud or theft.

This setup ensures that, even when Crypto.com faces monetary troubles, you have got fiat foreign money safety in place. For these exterior the U.S., Crypto.com works with regulated establishments in numerous areas to adjust to local monetary guidelines.

24/7 Buyer Help

When you have any safety considerations, Crypto.com affords buyer assist 24/7 that will help you instantly. Whether or not you’re having hassle accessing your account, discover suspicious exercise, or need assistance organising additional safety like MFA, the assist crew is all the time there to help.

Crypto.com’s crew is educated to deal with safety points shortly, ensuring any threats to your account are handled quick. This fast assist is particularly useful throughout irritating instances, like a market crash or account lockout, when quick assist can actually make a distinction.

Certifications and Assessments

Crypto.com is among the many most licensed platforms within the cryptocurrency business. It holds certifications for ISO/IEC 27001:2022, ISO/IEC 27701:2019, and PCI DSS v4.0 Degree 1, that are internationally acknowledged requirements for data safety and knowledge privateness administration.

Moreover, Crypto.com has achieved SOC 2 Kind II compliance, demonstrating that it has controls in place to guard consumer knowledge and guarantee privateness.

Hacker One Bug Bounty

Crypto.com runs a HackerOne Bug Bounty Program, inviting moral hackers from all around the world to seek out and report any weaknesses within the platform. By providing rewards for accountable reporting, Crypto.com makes certain even small safety issues are mounted shortly earlier than they are often taken benefit of by unhealthy actors.

Here’s a desk exhibiting the rewards supplied in this system:

| Threat Degree | Rewards |

| Low | $200 – $500 |

| Medium | $500 – $5,000 |

| Excessive | $5,000 – $30,000 |

| Crucial | $30,000 – $80,000 |

Easy methods to Keep Secure Whereas Utilizing Crypto.com?

Though Crypto.com gives quite a few safety measures, listed here are some further tricks to keep away from crypto scams and additional defend your account:

- Allow Multi-Issue Authentication (MFA): At all times allow Multi-Issue Authentication (MFA) in your account. You should utilize an authenticator app or SMS verification to obtain a one-time code everytime you log in or carry out delicate actions.

- Use Sturdy, Distinctive Passwords: Use a robust, distinctive password that mixes letters, numbers, and symbols. Keep away from frequent phrases or simply guessable data, similar to your birthdate or title.

- Usually Monitor Your Account Exercise: Keep watch over your account exercise by checking your transaction historical past frequently. For those who discover something uncommon, report it to Crypto.com’s buyer assist instantly.

- Watch out for Phishing Makes an attempt: Be vigilant about phishing makes an attempt, as scammers usually attempt to impersonate Crypto.com by means of faux emails or web sites. At all times double-check the URL earlier than coming into your credentials, and make sure that the positioning is safe (search for “https://” within the tackle). Crypto.com won’t ever ask you to your password through e mail, so be cautious of any communication that requests delicate data.

- Preserve Your Units Safe: Preserve your working techniques, antivirus software program, and purposes up to date to guard towards malware and different vulnerabilities. Keep away from utilizing public Wi-Fi networks to entry your account. For those who should use a public community, think about using a Digital Personal Community (VPN) to encrypt your web connection and defend your knowledge.

- Take into account {Hardware} Wallets for Lengthy-Time period Storage: For those who plan to carry massive quantities of cryptocurrency for an prolonged interval, think about using a {hardware} pockets for storage. {Hardware} wallets retailer your non-public keys offline.

- Use the App’s Safety Options: Options like tackle whitelisting for withdrawals add an additional layer of safety, making certain that solely accepted addresses can obtain your funds. You too can set withdrawal limits to scale back the danger of shedding massive quantities in case of unauthorized entry.

Ultimate Thought: Is Crypto.com Secure in 2024?

In a nutshell, Crypto.com has invested closely in safety, providing a spread of protecting measures for its customers. From chilly pockets storage and multi-factor authentication to high-level certifications and exterior audits, the platform is dedicated to safeguarding your funds. Moreover, with their Account Safety Program (APP), eligible customers have as much as $250,000 in protection for unauthorized transactions.

The platform additionally engages top-tier safety auditors and companions with moral hackers to repeatedly assess its safety posture. For 2024, Crypto.com seems to be one of many safer and clear cryptocurrency platforms, making it a sensible choice for anybody seeking to purchase, promote, or maintain digital belongings.

FAQs

Is Crypto.com App Secure?

Sure, the Crypto.com app makes use of best-in-class security measures like MFA, biometric authentication, and HSM ({Hardware} Safety Module) for key administration. Moreover, the app is frequently up to date with safety patches and enhancements to handle any vulnerabilities.

Is Crypto.com regulated and licensed?

Crypto.com is a well-regulated crypto buying and selling platform throughout a number of jurisdictions. It holds an Digital Cash Establishment (EMI) license from the UK’s Monetary Conduct Authority (FCA), which permits it to supply e-money providers in compliance with native rules.

In Singapore, it has a Main Fee Establishment (MPI) license from the MAS. The platform can be registered as a Digital Asset Service Supplier (DASP) in France underneath the Autorité des marchés financiers (AMF).

Moreover, Crypto.com has obtained regulatory approvals in nations like Australia, South Korea, and Italy, making certain compliance with their monetary and anti-money laundering (AML) requirements.

Has crypto.com ever been hacked?

Crypto.com has confronted safety challenges, with probably the most notable incident occurring in January 2022. Throughout this breach, unauthorized withdrawals affected 483 Crypto.com customers, totaling 4,836.26 ETH, 443.93 BTC, and roughly US$66,200 in different cryptocurrencies. In response, Crypto.com took fast motion to boost its safety measures and defend consumer funds. In response, the APP restores funds as much as USD$250,000 for certified customers.

Which is healthier, Crypto.com or Coinbase for consumer security?

When evaluating Crypto.com and Coinbase by way of consumer security, each platforms take robust measures to guard customers. Coinbase is extremely regarded for its strong safety protocols, together with chilly storage of 98% of belongings, insurance coverage towards theft, and powerful two-factor authentication (2FA). Additionally it is one of many few exchanges publicly, offering higher transparency.

Crypto.com, alternatively, emphasizes safety by means of options like {hardware} safety modules (HSMs) and has obtained ISO/IEC 27701:2019 certification for privateness and safety administration. Each exchanges additionally provide insurance coverage protection.

Is crypto.com secure for rookies?

Crypto.com is taken into account a legit crypto app for rookies. It gives a user-friendly interface with a spread of instructional assets that may assist newcomers navigate the crypto area.

With regulatory licenses in key jurisdictions and an easy-to-use cell app, it helps customers from primary crypto purchases to extra superior monetary instruments like staking and crypto debit playing cards. Moreover, its compliance with worldwide safety requirements gives reassurance to new customers in regards to the security of their funds.

Can I safely withdraw cash from Crypto.com to a checking account?

Sure, you may safely withdraw cash from Crypto.com to your checking account. The crypto trade permits customers to switch funds by linking a checking account and initiating a withdrawal by means of the cell app or net platform. The method is easy. The switch time can range relying on financial institution and site, often a number of hours to a few enterprise days. You too can hyperlink your credit score or debit card.