- Bitcoin’s lengthy/brief ratio declined sharply on the charts

- A couple of metrics instructed that buyers ought to nonetheless think about shopping for BTC

It’s been fairly a number of days since Bitcoin [BTC] began buying and selling under the $70k-mark. Whereas the market’s situation remained considerably bearish, some large gamers throughout the crypto house selected to exit it. Therefore, the query – Does this imply buyers ought to not think about accumulating BTC? Let’s discover out.

Whales are promoting Bitcoin

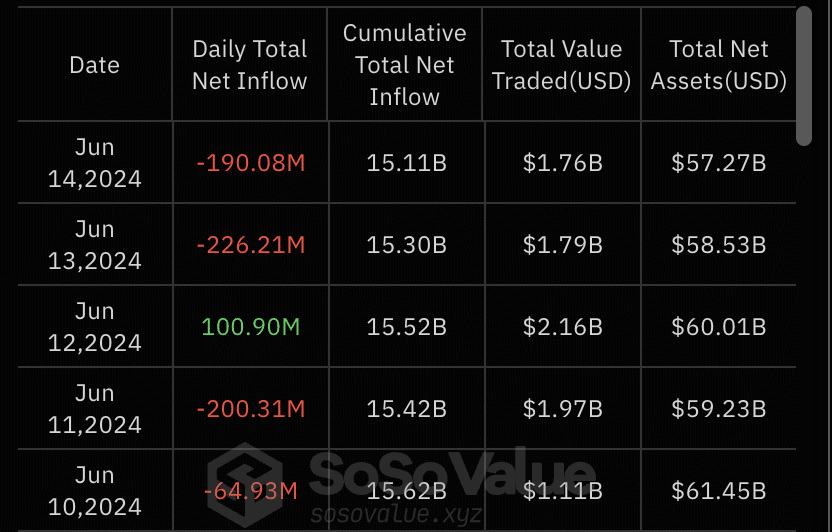

CoinMarketCap’s knowledge revealed that BTC hasn’t managed to climb above $70k since 10 June. In reality, the king of cryptos fell sufferer to an enormous value correction, pushing it underneath $67k. On the time of writing, BTC was buying and selling at $66,196.58 with a market capitalization of over $1.3 billion.

Within the meantime, whales began to scale back their lengthy positions.

AMBCrypto’s evaluation of Coinglass knowledge revealed that BTC’s lengthy/brief ratio declined sharply too. This can be a signal of bearish sentiment, with a larger emphasis on promoting or shorting belongings.

In the meantime, Lookonchain just lately shared a tweet itemizing a number of key metrics that gave a greater image of whether or not buyers ought to nonetheless think about shopping for Bitcoin. For starters, the tweet talked about the Bitcoin Rainbow Chart.

In response to the identical, the rainbow chart revealed that now remains to be a very good time to purchase BTC. Right here, the Bitcoin Rainbow Chart is a device that plots Bitcoin’s long-term value motion on a logarithmic scale.

The Relative Energy Index (RSI) can be a vital indicator. In response to Lookonchain’s knowledge, BTC’s RSI had a price of 69.93. This, when in comparison with historic knowledge, implied that BTC has nonetheless not reached a market high. Other than this, the 200-week shifting common warmth map highlighted that the prevailing value level was blue. Merely put, the worth high has not been reached but, and it’s time to maintain and purchase.

Something bullish within the short-term?

For the reason that aforementioned datasets pointed to BTC’s potential to develop additional, AMBCrypto then analyzed Santiment’s knowledge to look out for some other bullish alerts.

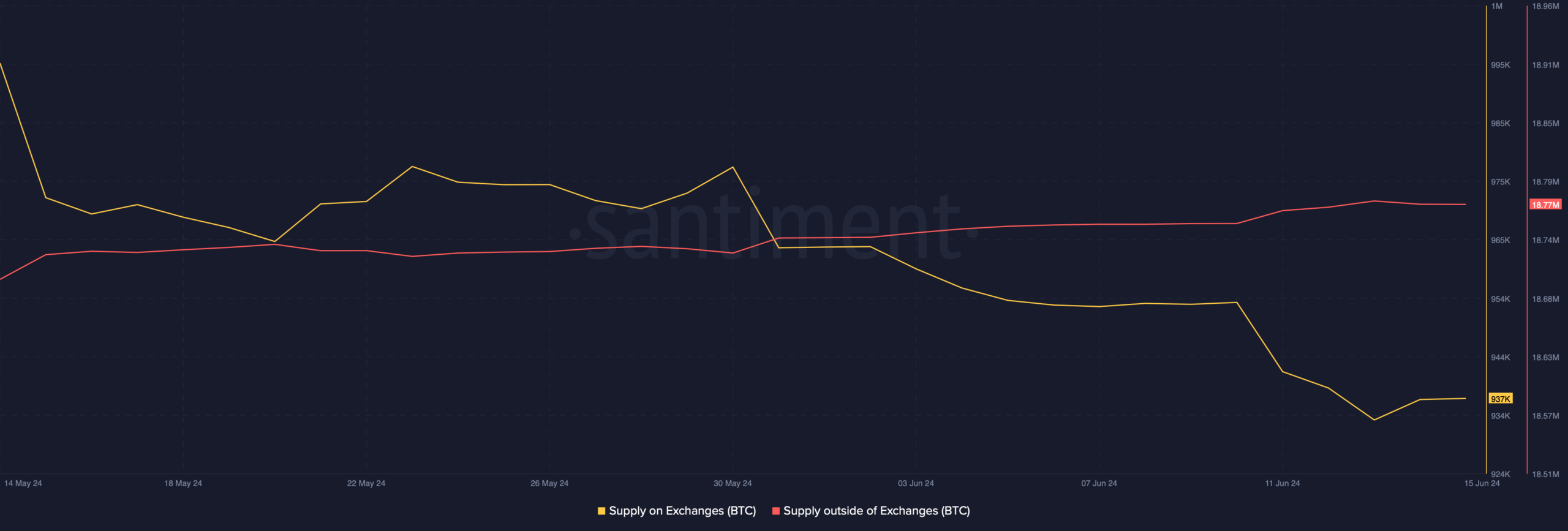

As per the identical, shopping for stress on BTC has continued to stay excessive, which might be inferred as a bullish sign. This was evidenced by the drop in its provide on exchanges and an increase in its provide exterior of exchanges.

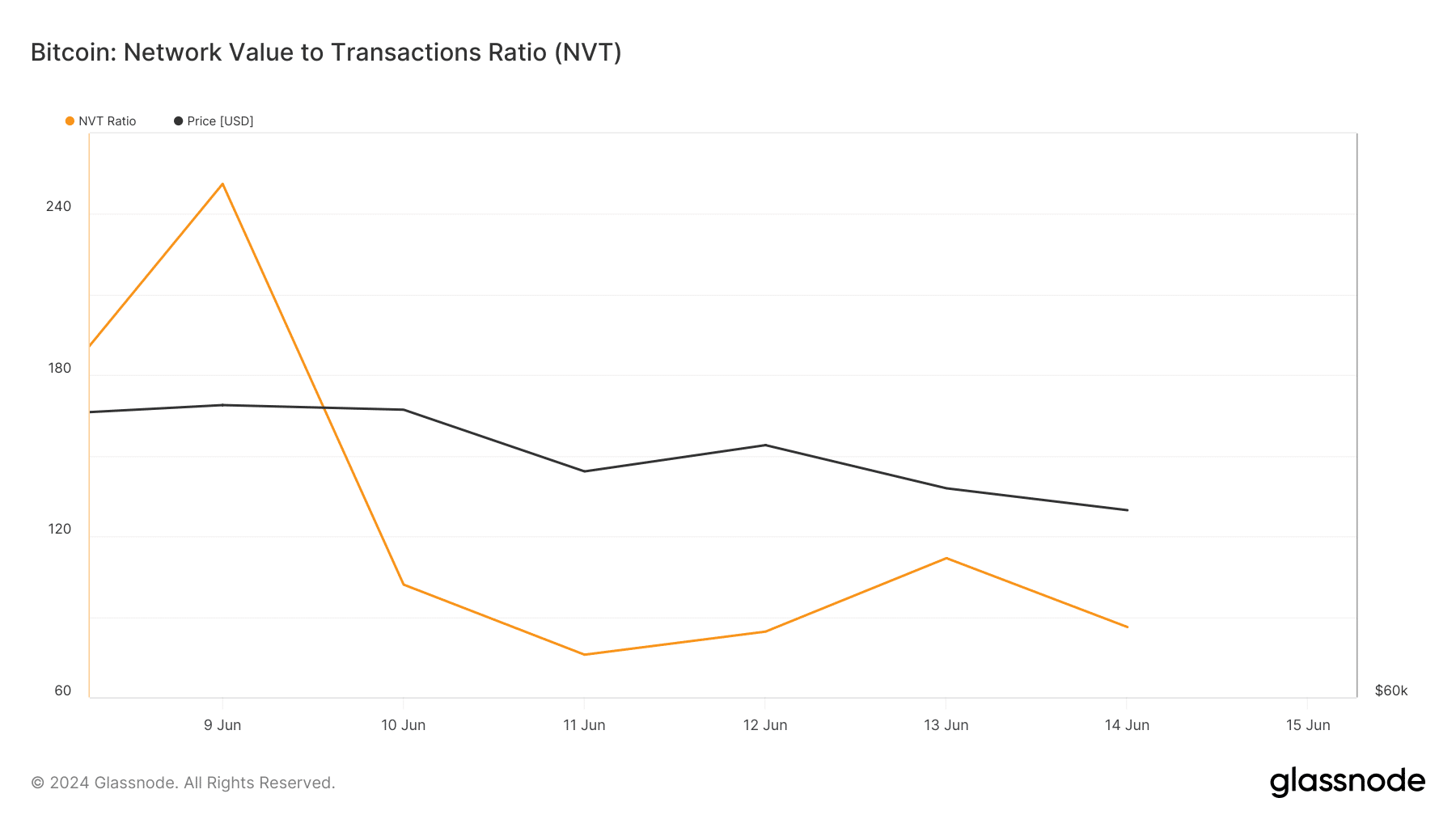

A have a look at Glassnode’s knowledge additionally underlined that BTC’s NVT ratio declined. A drop on this metric often factors to a value uptick sooner or later.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

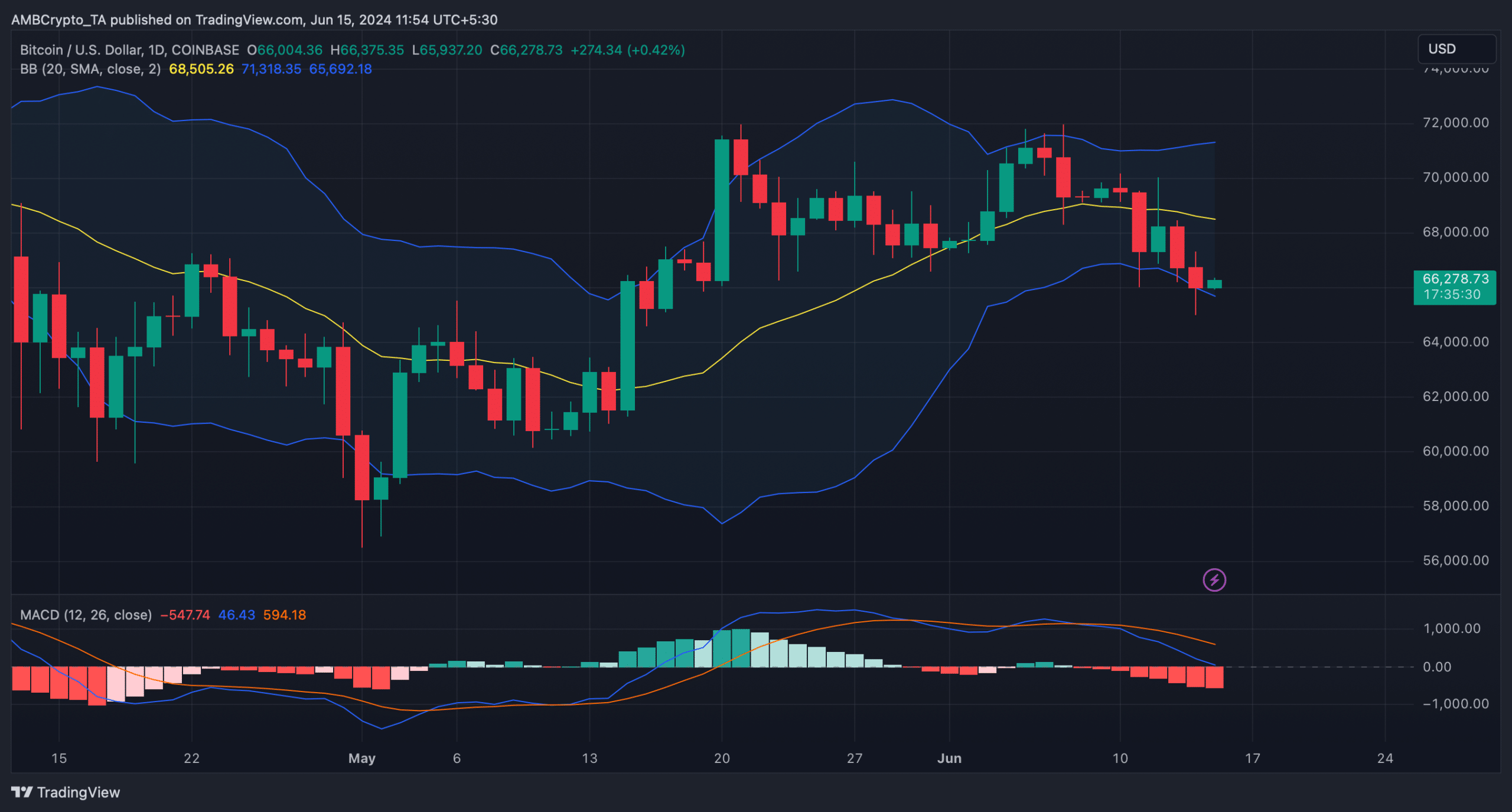

Lastly, AMBCrypto’s evaluation of the cryptocurrency’s every day chart revealed that BTC’s value touched the decrease restrict of the Bollinger Bands, indicating a doable value rebound.

Quite the opposite, the MACD flashed a bearish benefit, which hinted at an extra value decline. Ergo, a point of warning wouldn’t be the worst thought for merchants trying to benefit from Bitcoin’s prevailing market development.