- Bitcoin stays secure above $75K regardless of a 1.7% pullback.

- Rising new handle creation and elevated open curiosity sign sturdy market participation, however warrant cautious commentary.

Bitcoin [BTC] has proven notable resilience by sustaining its place above the $75,000 value degree. This stability comes after the cryptocurrency achieved a brand new all-time excessive of $76,872 on the seventh of November.

Though Bitcoin has since confronted a slight correction, with costs dipping 1.7% from the height, the asset continued to exhibit a powerful footing across the $75,000 mark.

Analysts attributed this growth to a mixture of elevated market confidence, new liquidity, and shifting holder dynamics.

Amid this market efficiency, a CryptoQuant analyst, recognized as Mignolet, supplied perception into the evolving Bitcoin cycle. In accordance with Mignolet, the situations needed for Bitcoin to enter a second part of its present market cycle have been aligning.

“After Phase 1, the Long-Term Holder (LTH) supply, which had been accumulating again, has begun to be distributed,” Mignolet defined.

For Bitcoin to maneuver into Section 2, a notable enhance in Brief-Time period Holder (STH) provide by means of the introduction of latest capital was required. Mignolet identified that this new liquidity inflow was already occurring, mirroring patterns noticed within the 2017 cycle.

The cyclical habits implied that Bitcoin’s market dynamics have been as soon as once more setting the stage for a possible uptrend, pushed by elevated exercise and new entrants into the market.

Indicators level to rising momentum in Bitcoin metrics

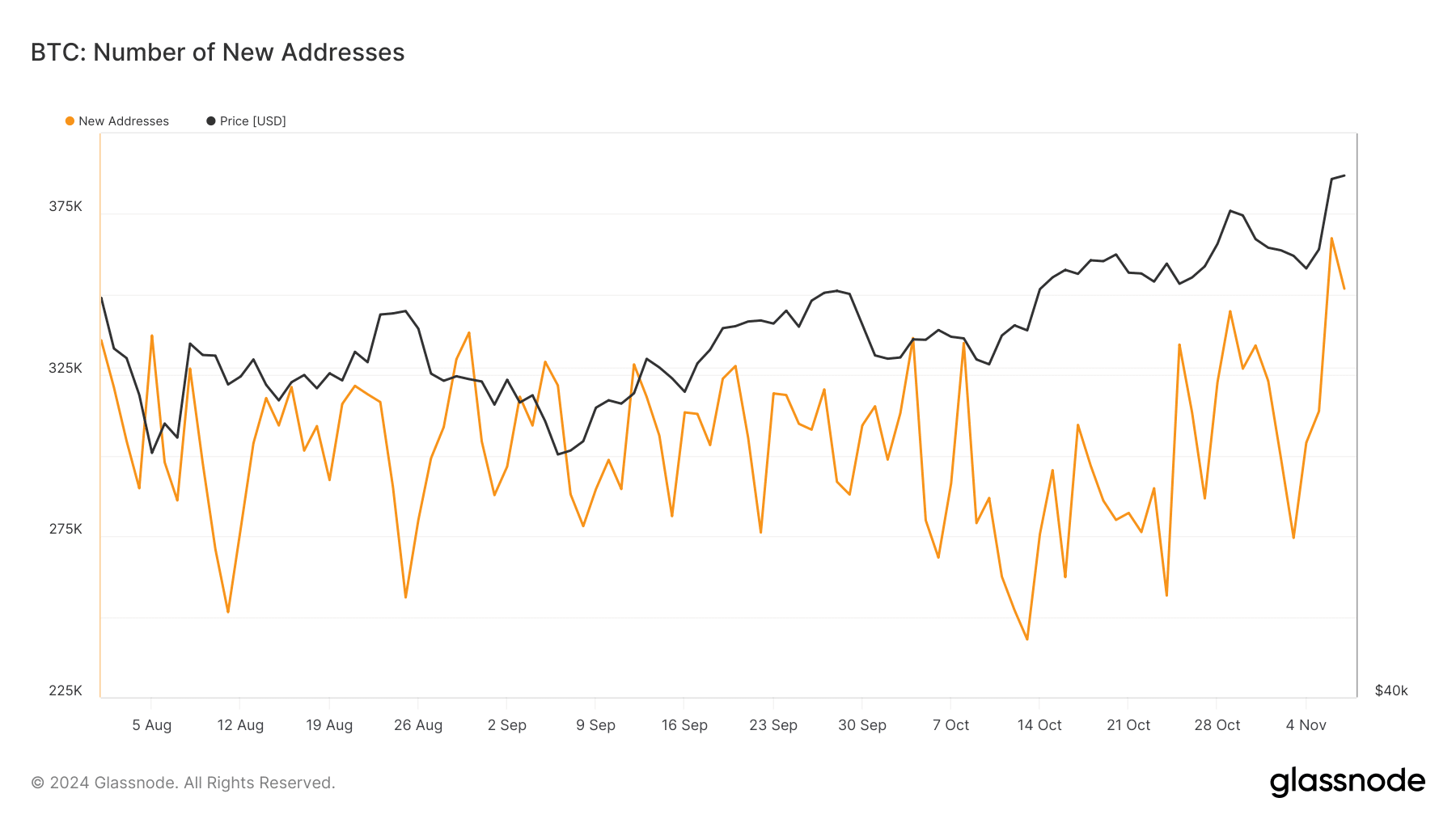

Along with analyzing holder behaviors, a number of key metrics present additional perception into Bitcoin’s market well being. One such indicator was the variety of new Bitcoin addresses. In accordance with Glassnode knowledge, this metric has been on an upward trajectory. Following a mid-October low of 242,000 new addresses, the determine has climbed to over 350,000 new addresses.

This enhance prompt that extra members have been getting into the market, which may bolster demand and supply help for Bitcoin’s value in the long run.

An increase in new addresses sometimes displays rising curiosity and adoption, components that may contribute to sustained upward value momentum if maintained.

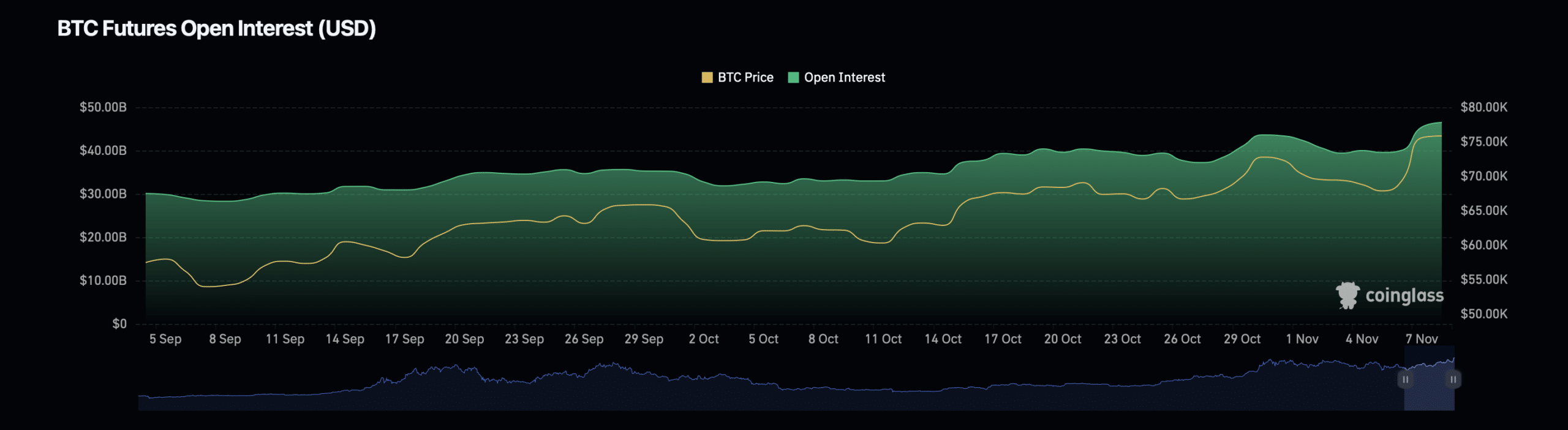

One other noteworthy metric was Bitcoin’s open curiosity in futures contracts, which confirmed a reasonable enhance. Information from Coinglass indicated that open curiosity has risen by 1.32% to a present valuation of $46.59 billion.

This rise signaled that extra merchants have been taking positions available in the market, probably anticipating additional value motion.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Nevertheless, it’s important to notice that Bitcoin’s open curiosity quantity has skilled a notable decline, falling by 41.01% to a present valuation of $69.81 billion.

The decline in open curiosity quantity could point out that some merchants have been closing their positions, probably as a precautionary measure amid the current value correction.