- Bitcoin’s demand has dropped to its lowest ranges in current weeks as costs consolidated.

- Nonetheless, the decreasing Bitcoin provide on exchanges made the case towards vital value drops.

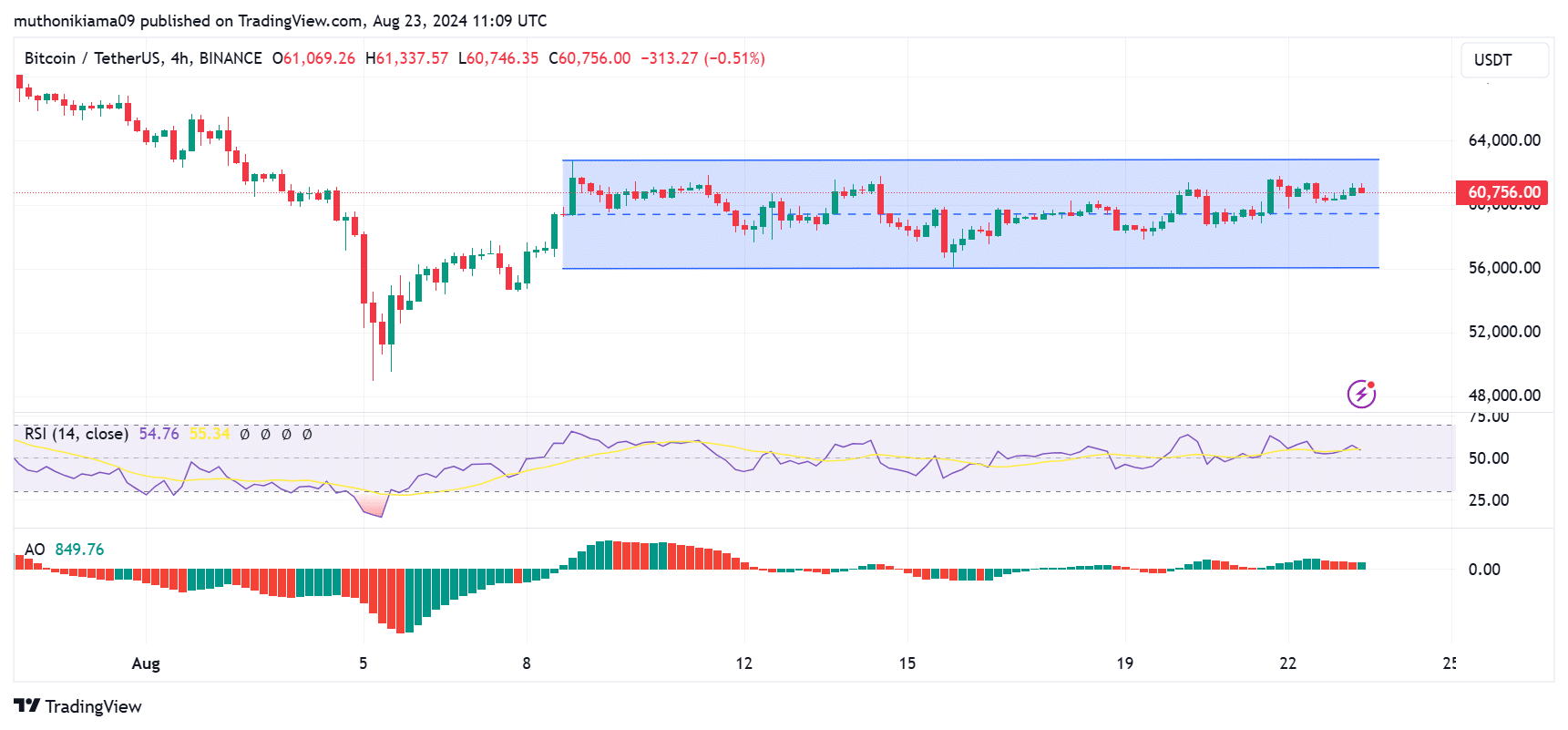

Since recovering from the drop on the fifth of August, Bitcoin [BTC] has traded rangebound between $56K-$62K.

The value has not damaged under or above this vary because the eighth of August, signaling attainable consolidation or market uncertainty.

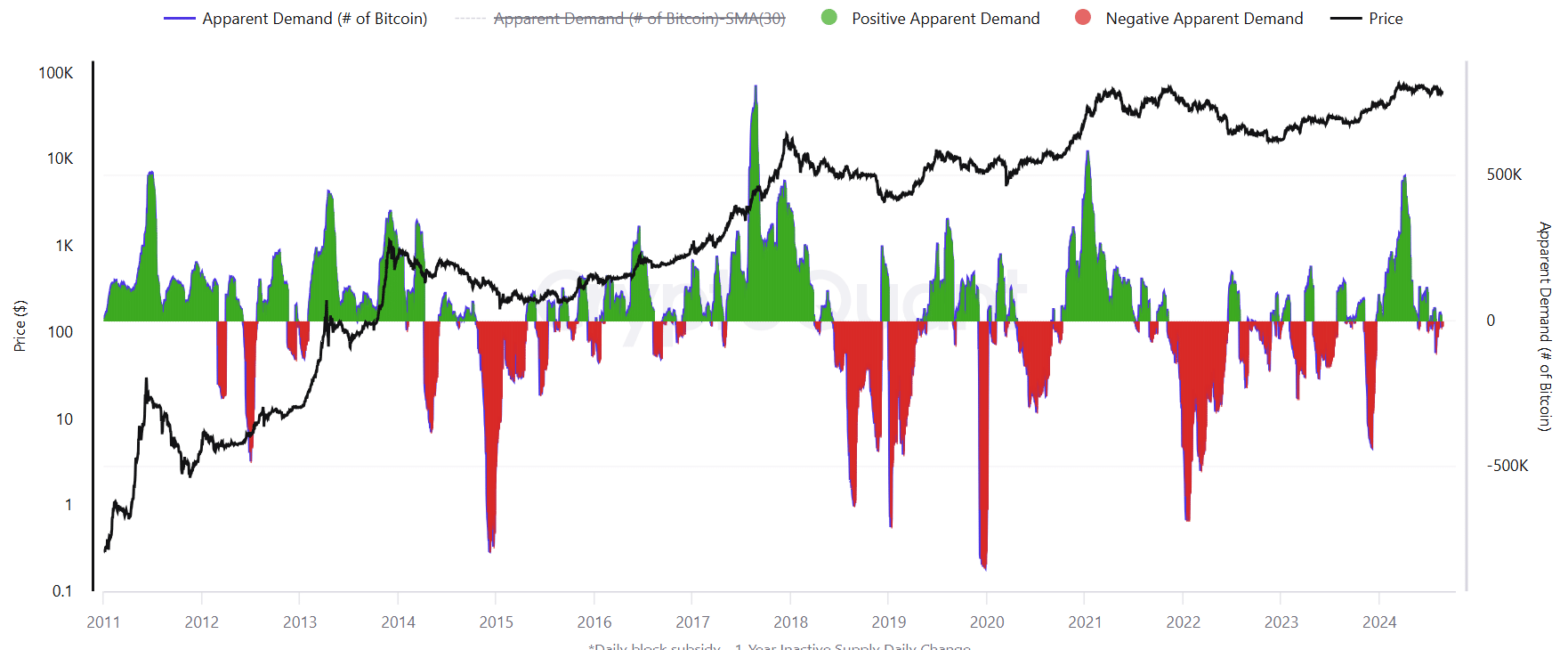

One of many elements stopping main breakouts above this zone is weak Bitcoin demand development, which remained at low ranges, per CryptoQuant. This even turned detrimental in current weeks.

Bitcoin’s demand hit a three-year peak in April 2024 coinciding with the Bitcoin halving occasion. Nonetheless, it has since dropped to the bottom degree this 12 months.

So why is Bitcoin’s demand falling?

Taking a look at ETF and whale exercise

The evaluation identified the drying inflows into spot Bitcoin ETFs. In March, as BTC surged to all-time highs, the common each day purchases into Bitcoin ETFs stood at 12,500 BTC.

This dropped to 1,300 BTC final week.

Complete inflows into spot Bitcoin ETFs have remained under the $100M mark because the ninth of August, as seen on SoSoValue. Whereas these merchandise maintain over $55 billion in web belongings, shopping for exercise is required to spice up the general demand.

Whales additionally seem like decreasing their Bitcoin stake. The 30-day common whale holdings have dropped from 6% in February to 1%. This marks the quickest drop since February 2021 per CryptoQuant.

Whales play a vital position in supporting Bitcoin value development. Decreased whale holdings level to a common bearish sentiment throughout the market.

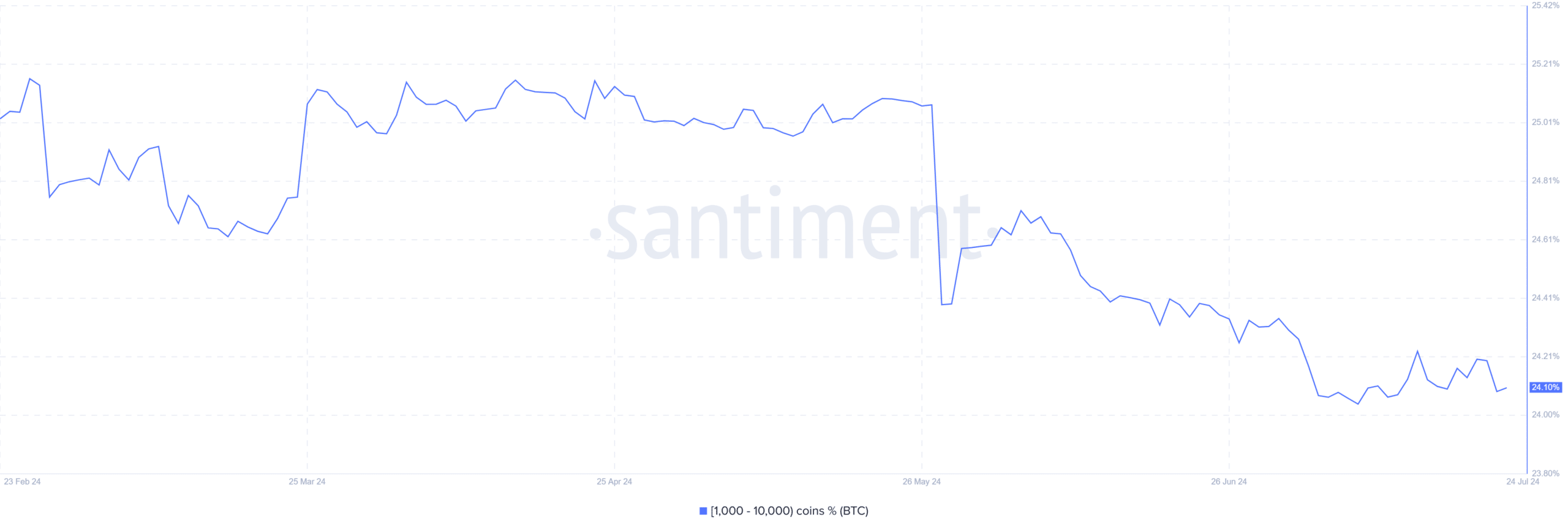

A decline in whale exercise was additional confirmed by information from Santiment, which confirmed that Bitcoin addresses holding between 1,000 and 10,000 cash have dropped considerably since March.

Regardless of slower whale exercise, long-term Bitcoin holders have elevated their positions. These holders have been growing their BTC holdings at a fee of round 391,000 BTC per 30 days.

Will Bitcoin breakout of its vary?

As demand for Bitcoin slows, it begs the query whether or not it is going to escape of the $56K-$62K vary. A deeper look into on-chain information paints a grim image.

In response to IntoTheBlock, over 3 million addresses purchased Bitcoin at this value vary. New buyers who purchased at these costs haven’t made vital income.

Due to this fact, breaking out previous $62K will probably be met with promoting strain as they rush to take income.

Technical indicators additionally fail to make the case for a breakout. The Relative Energy Index (RSI) has additionally remained rangebound with no vital surges in shopping for momentum.

The Superior Oscillator, which was within the constructive area, confirmed an uptrend. Nonetheless, the brief histogram bars pointed in the direction of a probably weakening uptrend.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Nonetheless, the potential for a steep downtrend under the present vary is unlikely within the brief time period, because of the declining provide of Bitcoin on exchanges.

Per CryptoQuant, the Change Provide Ratio has been on a steep decline over the previous 12 months. Due to this fact, regardless of demand being considerably low, change provide can also be low, decreasing the chance of steep corrections.