Picture supply: Getty Pictures

With only a few days of the yr left, the S&P 500 seems to be set to publish one other sturdy outcome. However there was a large divergence of outcomes throughout totally different sectors.

On the sector degree, I discovered the outcomes barely stunning – I had anticipated know-how to be the highest performer and actual property to be final. However I used to be improper on each counts…

Winners and losers

Surprisingly, know-how has – to date – underperformed the S&P 500 common this yr. Whereas there have been some excellent outcomes, there are many shares – equivalent to Intel – which have fallen sharply.

Equally, actual property has had blended outcomes. Whereas the sector has a complete has underperformed, corporations which can be concerned in information centres – equivalent to Iron Mountain – have produced wonderful outcomes.

The highest-performing S&P 500 sector from 2024 has been communication providers, the place Netflix has had a powerful yr. Importantly, there have solely been a number of shares which can be really down since January.

On the different finish, it’s a close-run factor. However as I write this, the healthcare sector has lagged all of the others, with Moderna having misplaced virtually two-thirds of its market worth this yr.

Healthcare and actual property

On the whole, I like searching for alternatives in sectors which can be out of trend. And that’s definitely true of healthcare, with the US set to nominate a well being secretary with controversial views about vaccines.

The difficulty is that forecasting the outlook for drug corporations typically takes lots of specialist data. So there’s a excessive threat of discovering a worth entice – one thing that appears low cost however really isn’t.

Nonetheless, the underperformance of pharmaceutical corporations like Moderna offers me a special concept. There’s a inventory that isn’t within the healthcare sector, however is adjoining to it.

A 25% fall within the worth of Alexandria Actual Property Equities (NYSE:ARE) this yr has caught my consideration. The corporate is an actual property funding belief (REIT) that leases life science laboratories.

Please observe that tax remedy depends upon the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is offered for data functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation.

Alexandria Actual Property

The inventory comes with a dividend yield approaching 5.5%. And whereas UK traders needs to be conscious of withholding taxes, I believe this might be an fascinating passive revenue alternative.

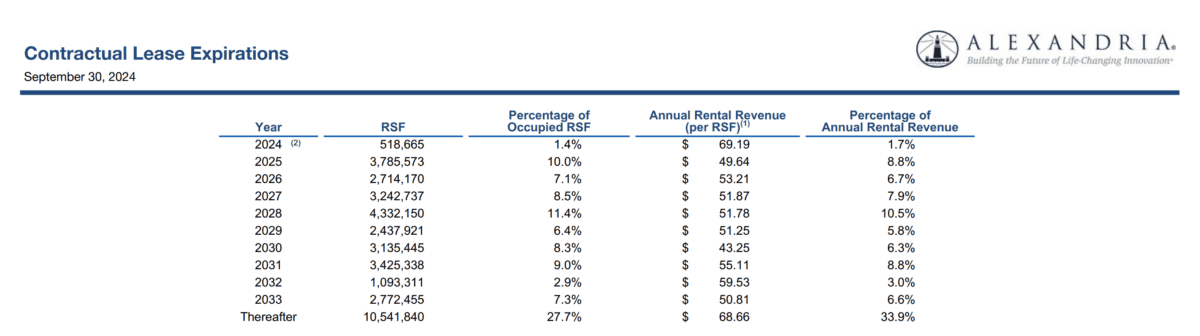

Whereas the common lease nonetheless has virtually eight years to run, the agency does have some expirations developing within the subsequent couple of years. And the danger of vacant durations has led analysts to downgrade the inventory.

Supply: Firm Q3 Earnings Launch & Supplemental Info

Alexandria’s services are pretty generic, although, and this could assist the corporate discover new tenants if it involves it. Importantly, they’re additionally in good places which can be necessary for the trade.

Occupancy ranges and hire assortment metrics have additionally been sturdy for a while. So whereas the danger can’t be ignored, I believe it’s additionally necessary to not overestimate it.

REIT investing

To some extent, Alexandria Actual Property’s shareholders are protected against a downturn within the healthcare sector. Even when its tenants make much less cash, this isn’t an issue so long as they hold paying hire.

The opposite aspect of the coin is that it doesn’t stand to profit immediately from breakthrough therapies. However from a passive revenue perspective, I believe the discounted share worth makes the inventory one to contemplate.