- Bitcoin may surge in the direction of $139,000 if it repeats its previous efficiency throughout U.S. election cycles.

- The MVRV ratio additionally hinted at additional upside, because it exhibits that Bitcoin just isn’t but overvalued.

Bitcoin [BTC] is repeating historic worth patterns with its spectacular efficiency for the reason that U.S. Presidential election on the fifth of November. Traditionally, U.S. elections have delivered important good points for BTC, and a repeat of this development may see it lengthen its rally to $139,000.

That is in line with analyst TechDev on X (previously Twitter). He famous that on election day, BTC traded at $69,400. Going by the good points posted throughout the 2012, 2016, and 2020 elections, the worth may submit a 4.51x achieve to $139,180 by 2025.

Bitcoin, at press time, was buying and selling at $98,800, having gained by 42% since election day. Its market capitalization can also be inching nearer to $2 trillion. As bullish sentiment grows, will Bitcoin comply with previous cycles, or will it derail?

Is Bitcoin repeating previous cycles?

An evaluation of Bitcoin’s weekly chart means that the rally, which began throughout the election week, may proceed. After the 2020 November elections, BTC began an uptrend that noticed it surge from round $13,700 to the 2021 ATH of $64,800 in lower than six months.

An analogous rally, that began throughout the 2024 election week is at the moment underway, and if the bullish momentum continues, the worth may surge previous $120,000 by April 2025.

The Relative Power Index (RSI) helps this outlook. This indicator had a price of 77 at press time, suggesting that BTC just isn’t but overbought. Subsequently, Bitcoin is but to search out its prime regardless of the latest surge, paving room for extra development.

MVRV indicator exhibits THIS

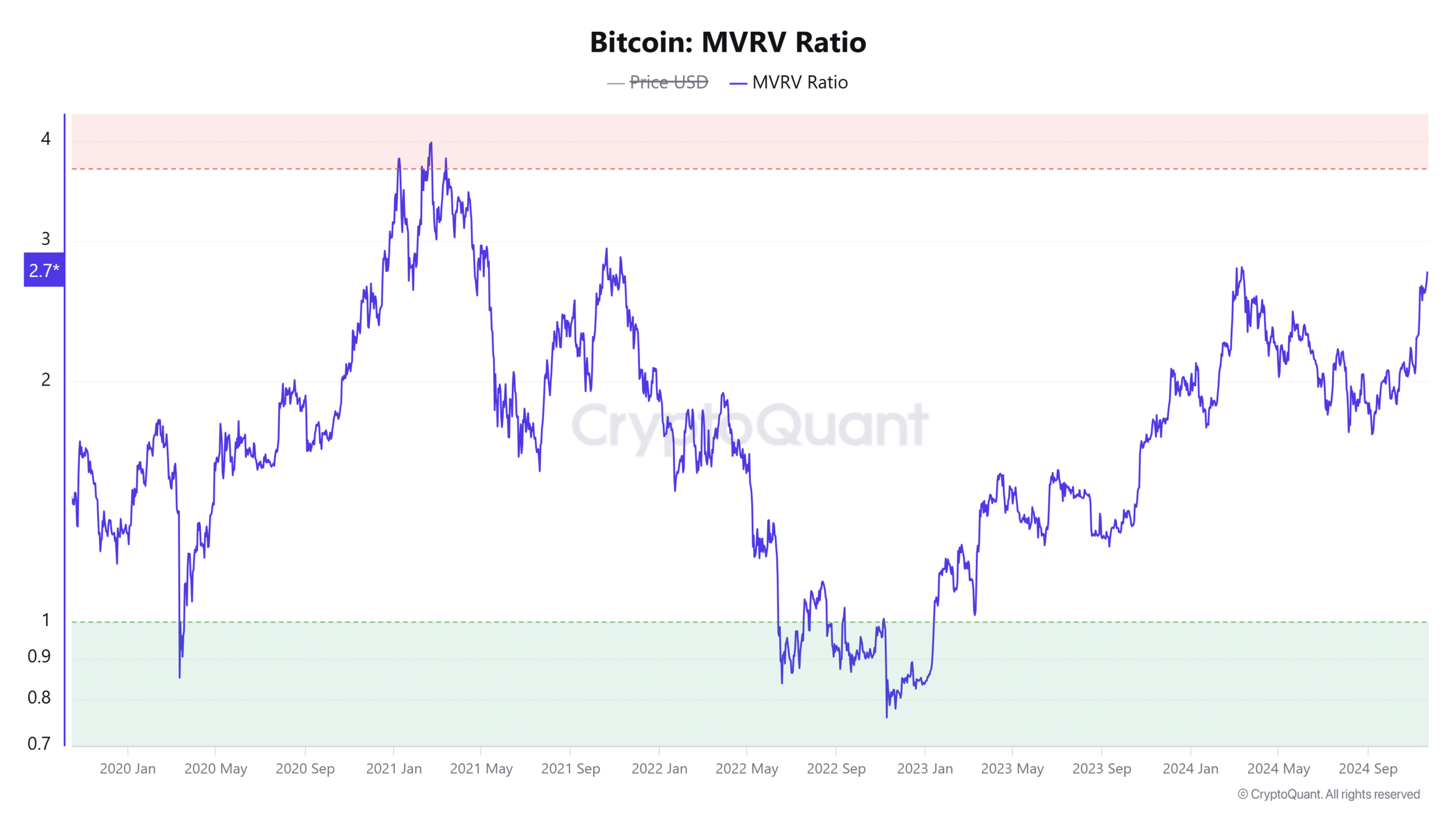

Bitcoin’s Market Worth to Realized Worth (MVRV) ratio additionally hints at additional good points. This metric had a price of two.7 at press time, suggesting that BTC just isn’t but overvalued.

An MVRV ratio of two.7 additionally exhibits that Bitcoin continues to be within the early levels of a bull run and regardless of the successive ATH information, it has but to discover a native prime.

Merchants ought to be careful for an MVRV climb previous 3.7, as it is going to point out that the coin has change into overvalued. The final time that the MVRV ratio confirmed that Bitcoin was overvalued was in early 2021, a couple of months after the 2020 elections.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Google Developments suggests retail FOMO

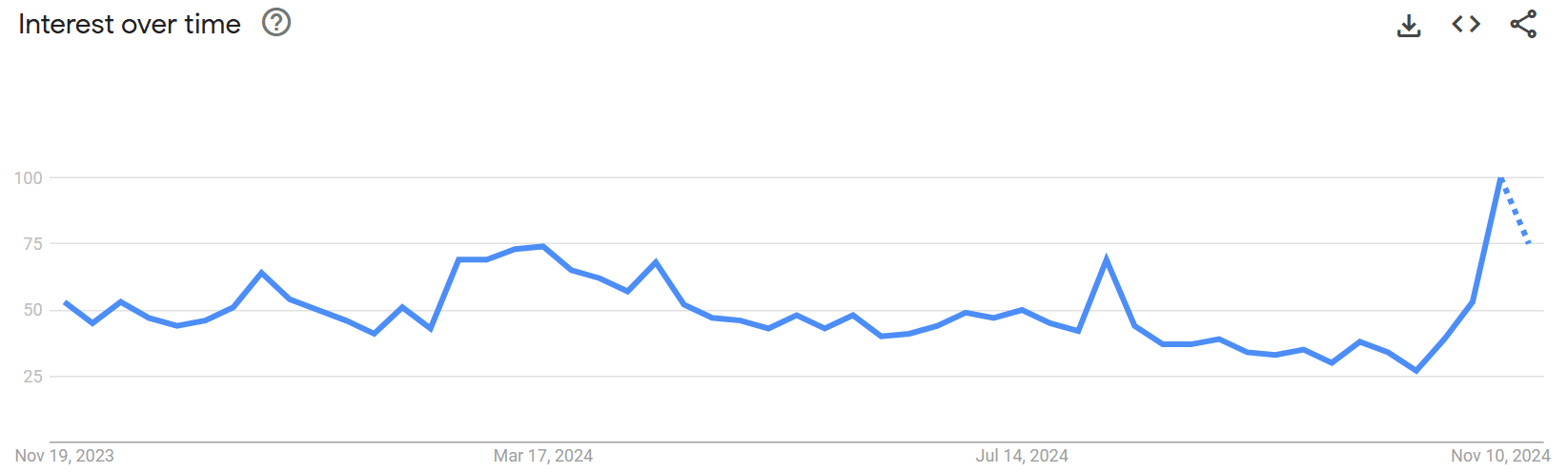

As Bitcoin attracts shut to a different ATH above $100,000, Google Developments exhibits that the worry of lacking out (FOMO) amongst retail merchants is considerably excessive. Search exercise for the time period “Bitcoin” is at its highest degree in multiple yr.

A rating of 100 on Google Developments exhibits curiosity in Bitcoin is at its peak. It may also point out that the retail market is in euphoria.

Nonetheless, with Bitcoin’s rally exhibiting indicators of an early bull market, this rating may level towards rising adoption.