- Bitcoin’s derivatives metrics appeared optimistic.

- However promoting stress remained dominant out there.

Bitcoin [BTC] has been battling its value motion because it has didn’t fulfill buyers of late. This has sparked concern in all the neighborhood, as prompt by newest datasets.

Nonetheless, this panic out there may have the potential to show issues round for the king coin.

Bitcoin buyers are panicking!

Bitcoin’s value witnessed an over 11% value correction final week, pushing its value beneath $95k. Actually, AMBCrypto reported earlier that as we approached the Santa Claus rally, an occasion that traditionally has pushed the crypto market up, Bitcoin was struggling.

On the time of writing, the king coin was buying and selling at $94,078 with a market capitalization of over $1.86 trillion.

It was fascinating to notice that regardless of the double-digit weekly correction, just one.98 million BTC addresses had been “out of the money,” which accounted for lower than 4% of the full variety of Bitcoin addresses, as per IntoTheBlock’s knowledge.

Amidst all this, Santiment, a knowledge analytics platform, posted a tweet, highlighting a notable growth. In line with the tweet, the crypto markets have opened the week retracing additional, instilling panic towards the retail crowd.

Notably, Bitcoin and Ethereum [ETH] are seeing large FUD from newer merchants who joined markets prior to now 2–3 months.

The tweet talked about,

“Historically, when retail traders begin to sell based on panic and emotion, whales and sharks have opportunities to scoop up more coins with little resistance, creating bounces.”

Subsequently, there’s a excessive risk of a development reversal as we depend the remaining days of this 12 months.

Will BTC register greens quickly?

As per our evaluation of CryptoQuant’s knowledge, promoting sentiment remained dominant out there. This was evident from the rising alternate reserve.

Nonetheless, Santiment’s tweet talked about that if whales scoop up BTC, it may possibly set off a reversal. However that was additionally not taking place.

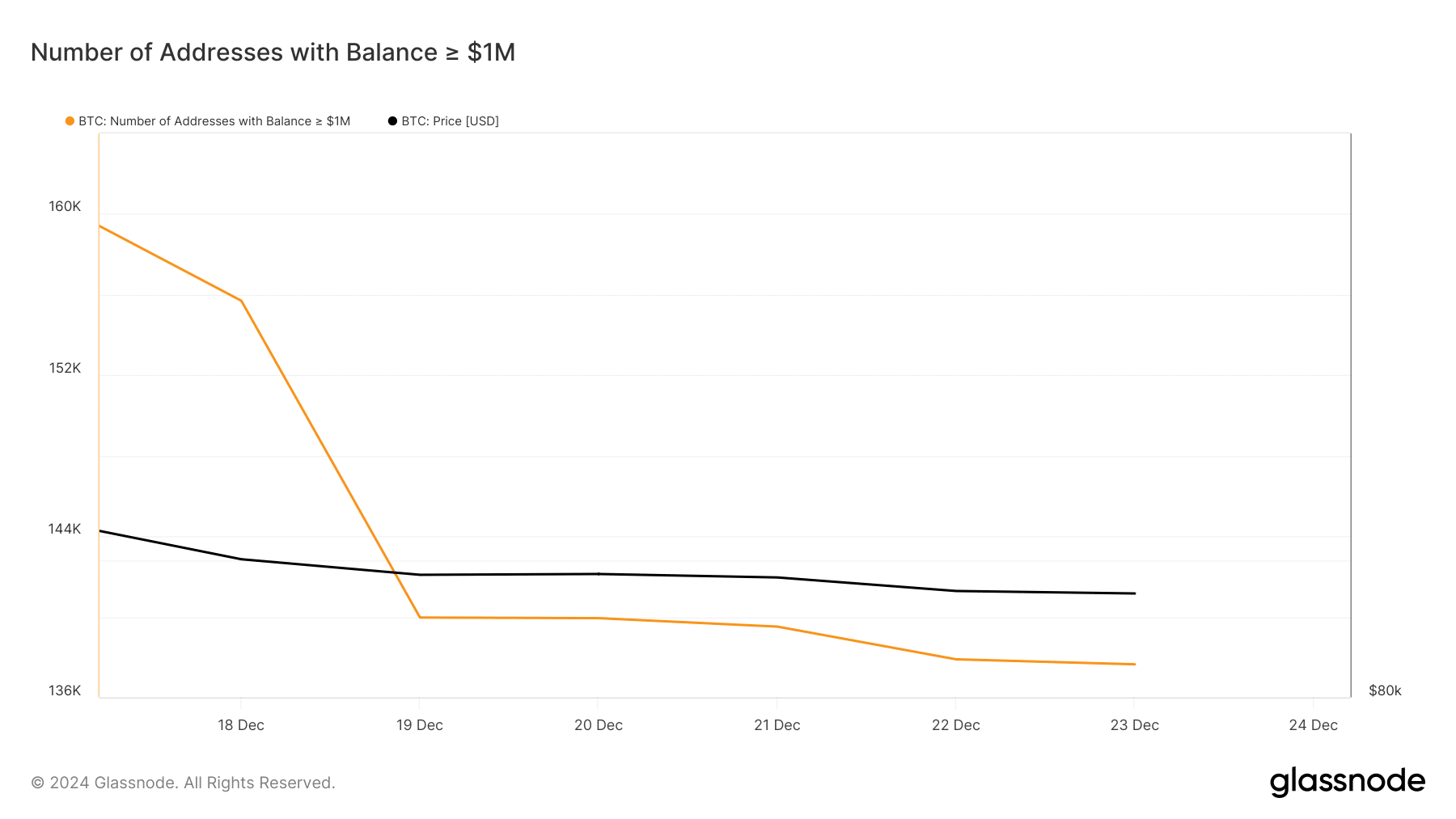

Bitcoin’s variety of addresses with balances of greater than $1million declined sharply final week, indicating that the big-pocketed gamers had been additionally promoting their holdings, which might trigger extra hassle for BTC within the coming days.

Nonetheless, issues within the derivatives market appeared bullish as BTC’s funding fee was rising.

Learn Bitcoin [BTC] Value Prediction 2024-25

A funding fee enhance within the crypto market signifies that the price of holding lengthy positions will increase—an indication of rising bullish sentiment round an asset.

The taker purchase/promote ratio was additionally inexperienced. This meant that purchasing sentiment was dominant within the derivatives market. If these metrics are to be believed, then anticipating a development reversal for BTC isn’t too bold.