- NDB now working in direction of increasing using native currencies to “de-dollarize”

- Bitcoin could possibly be the subsequent massive reserve forex

120 international nations attended the Worldwide Municipal Discussion board of the BRICS nations just a few days in the past. On the heels of the identical, nevertheless, the New Improvement Financial institution hosted its ninth Annual Assembly. The latter is within the information as we speak after its President Dilma Rousseff claimed that the NDB is working in direction of increasing using native currencies. In different phrases, the NDB is working in direction of de-dollarization.

Therefore, the query – What does this imply for Bitcoin?

Based on Rousseff,

“One of the main focuses of the NDB is to increase the use of local currencies. We have decided that up to 30 per cent of the bank’s total funding will take place in local currencies”

A global motion?

BRICS has been entrance and heart of this de-dollarization motion over the previous few years. In actual fact, through the fifteenth Annual Summit of the BRICS nations final 12 months, there was a lot help for a singular “BRICS currency.” On the time, Brazil’s President Lula Da Silva mentioned,

“It increases our payment options and reduces our vulnerabilities.”

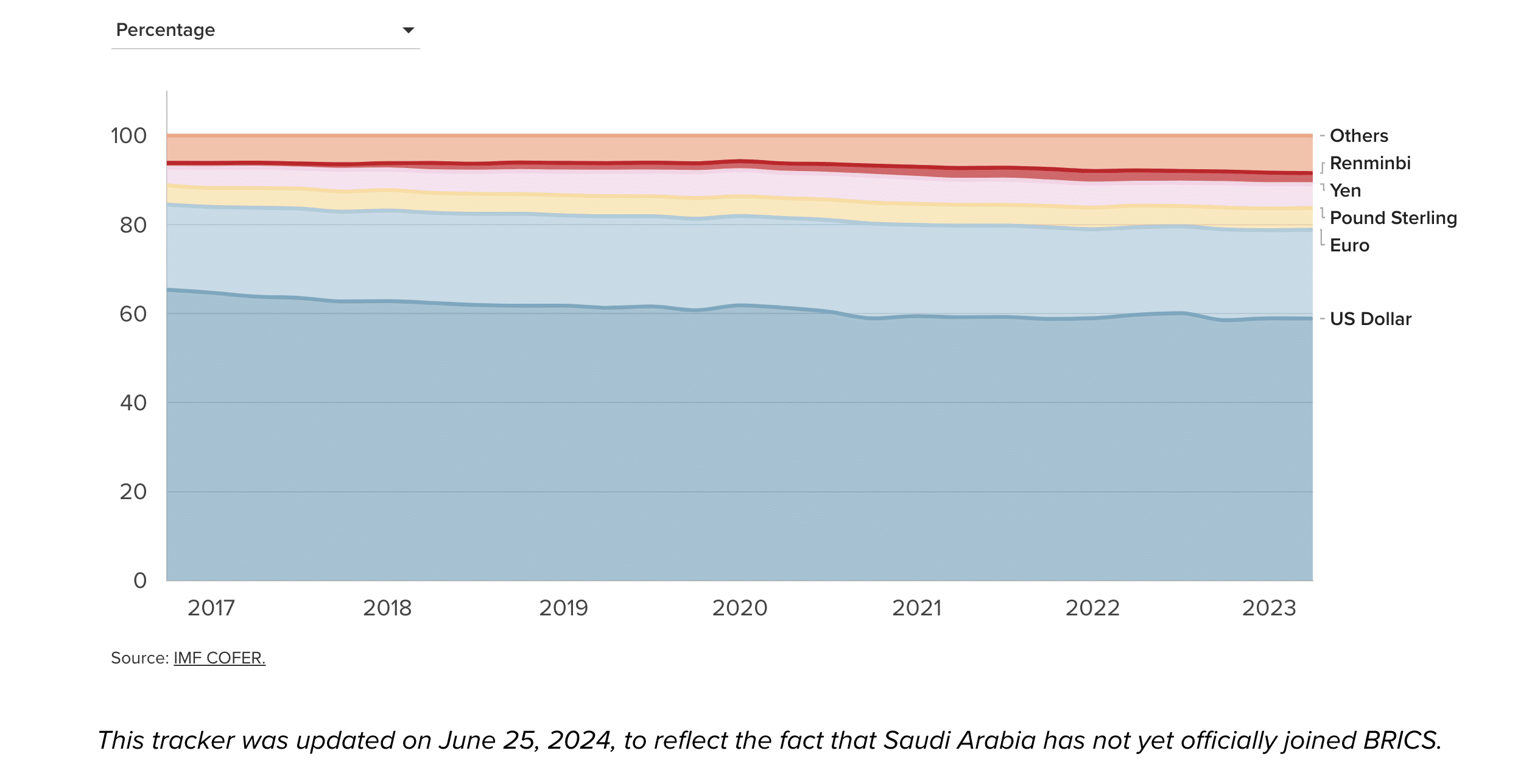

Right here, it’s price declaring that many of the world continues to be removed from de-dollarization. Based on the Atlantic Council’s Greenback Dominance Monitor, as an example, the US Greenback nonetheless accounts for a 58% share of all international foreign exchange reserves. Equally, it has a share of 88% throughout all international trade transactions.

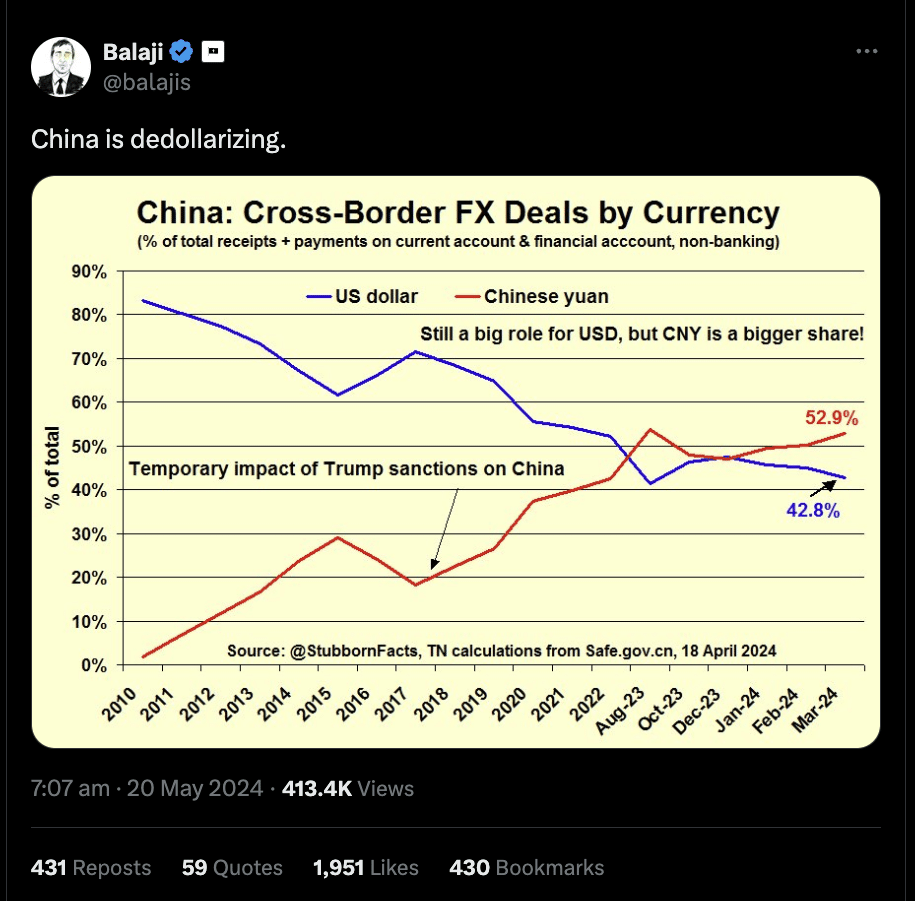

Merely put, de-dollarization gained’t occur within the quick time period or the medium time period. This, although to China’s credit score, it has steadily been de-dollarizing itself.

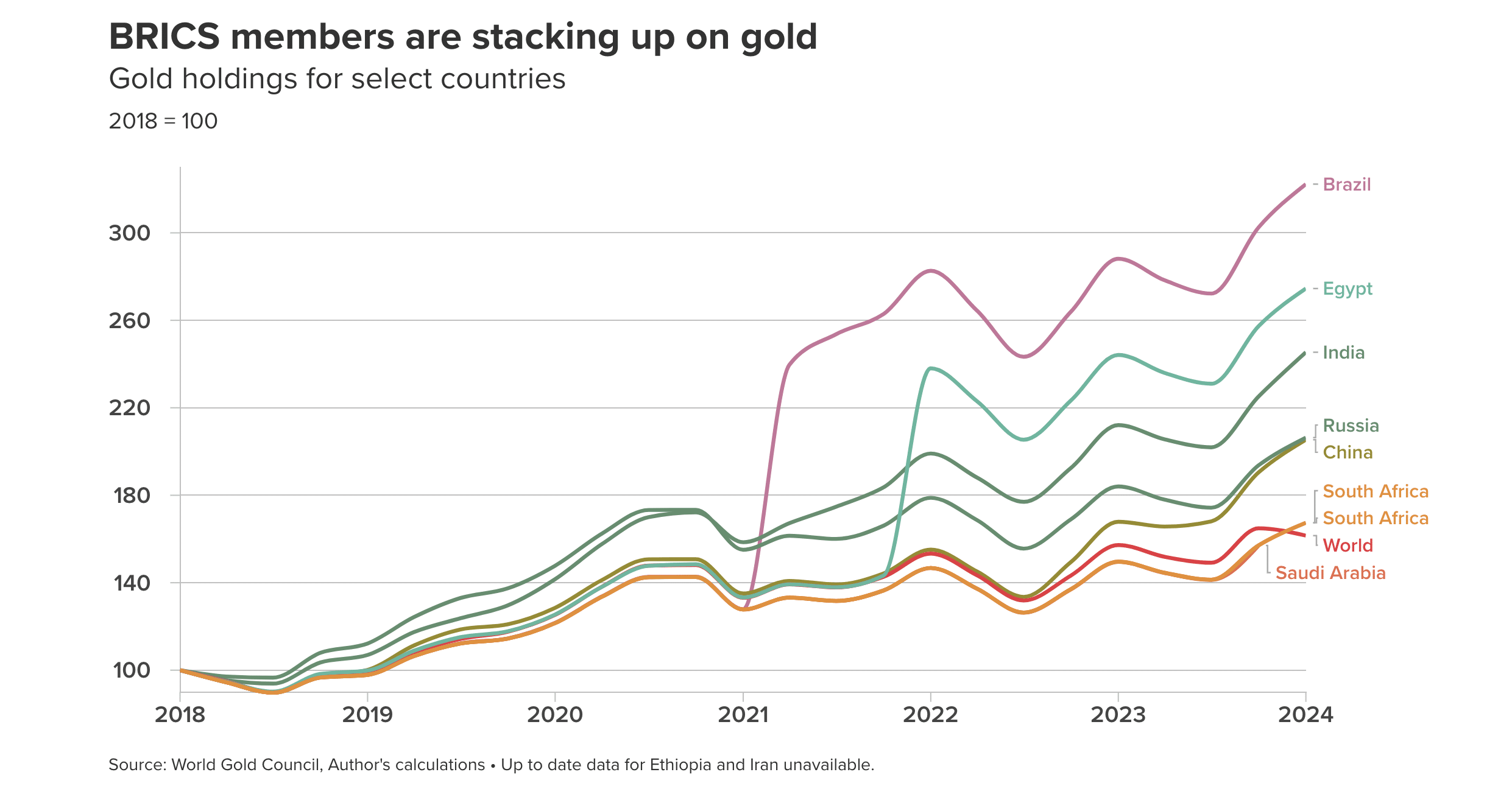

Quite the opposite, it might occur in the long run. Particularly because the USD’s share of all international international reserves has fallen from 65.3% to 58.8% within the final 8 years alone. Equally, many nations, particularly these related to BRICS, have been accumulating gold regardless of rising costs.

Gold’s standing as a reserve and as a retailer of worth has risen since 2019, particularly because the COVID-19 pandemic. Subsequently, there was nice curiosity in different asset lessons which have retailer of worth traits too. Bitcoin and cryptocurrencies usually, are actually seen as one such asset class.

Bitcoin to the rescue?

Russia and Iran, as an example, are already utilizing Bitcoin and Bitcoin mining to mitigate the results of worldwide sanctions imposed towards them. In actual fact, the previous is additionally beta testing cryptocurrency exchanges to evaluate how cross-border crypto transactions will work.

As a company too, BRICS has been eager on launching a gold-backed stablecoin, particularly on the again of its earlier discussions a few “BRICS currency.”

Outdoors of those pursuits, there’s additionally nice curiosity amongst many nations to go El Salvador’s method and accumulate Bitcoin as a treasury asset. President Bukele, when he introduced this step again in 2021, additionally supposed to “de-dollarize” the economic system, regardless of criticism from the World Financial institution and IMF.

2024 is a special world, nevertheless, with main establishments like MicroStrategy and Metaplanet additionally diving into cryptocurrencies. That’s not all both, as Bitcoin and Ethereum ETFs are actually among the many hottest on Wall Avenue – An indication of institutional curiosity on this asset class.

All these developments, collectively, imply that crypto is awaiting the subsequent massive leg up. If BRICS nations are profitable of their effort to de-dollarize and if even a minor proportion of the USD’s liquidity is directed in direction of cryptos, the market may change without end.