- How a lot correlation does GME’s rally and its social quantity have with Bitcoin’s worth traits?

- Influence of the identical was seen on the upper timeframes throughout the earlier cycle

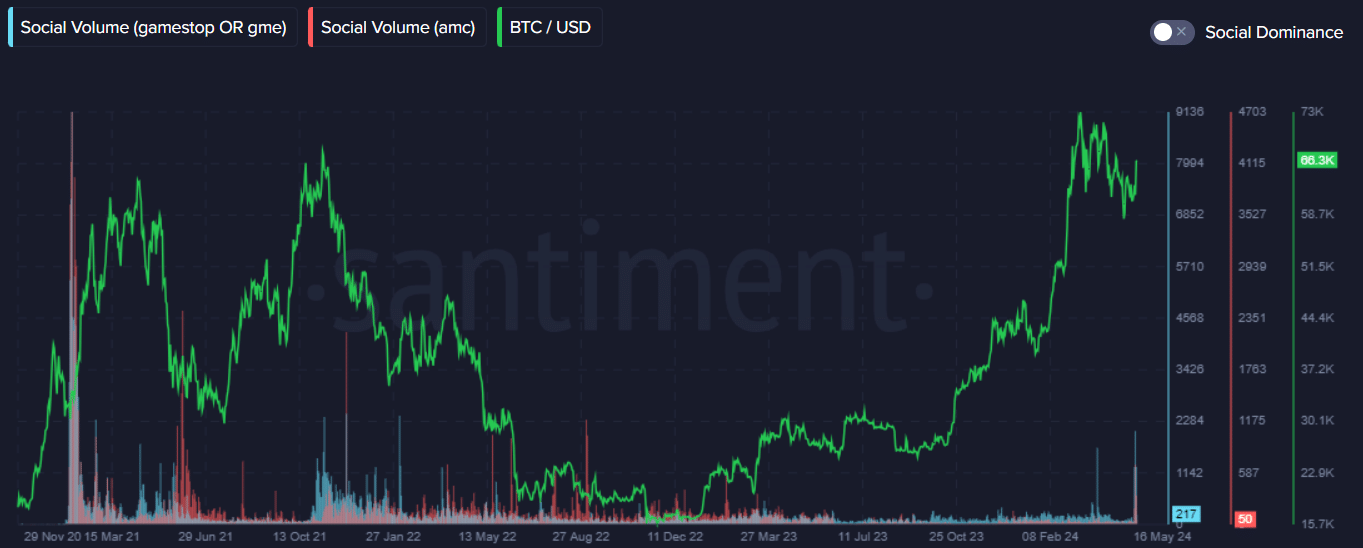

Bitcoin [BTC] climbed above its short-term native resistance at $64.5k on 15 Could, simply two days after GameStop [GME] posted a 284% rally measured from final Friday. In response to a current submit on X (previously Twitter), Santiment claimed that the GME craze had actually bled over into crypto.

Given the speculative nature of the crypto-market, particularly within the memecoin sector, this overlap is smart. To seek out out whether or not crowd sentiment can mark cycle tops and bottoms, AMBCrypto looked for extra parallels.

Brief-term prime and backside coincided with elevated social exercise

Supply: Santiment on X

Within the brief time period, GME/AMC social mentions did mark Bitcoin’s prime and backside over the past three days. And but, it may not be that these social traits foreshadowed a shift in development. It’s extra probably that they merely coincided with them.

13 Could was the Monday after the weekend when Roaring Kitty marked the top of a 3-year hibernation with a meme on X (previously Twitter). On 15 Could, the Client Worth Index and inflation knowledge got here out too, and it got here out decrease than anticipated. This led to larger risk-taking tendencies amongst contributors.

Supply: Santiment

GameStop’s social quantity was terribly excessive in January and November of 2021. In January 2021, Bitcoin costs had simply recovered from a deep retracement to $31k, earlier than resuming its blistering rally.

Then again, November 2021’s social quantity surge marked the highest for the crypto, and BTC costs quickly started to droop. Therefore, despite the fact that the current correlation has a proof, there could also be some substance to Santiment’s newest observations.

Merchants and buyers may need to keep watch over these metrics sooner or later.

What concerning the altcoin market’s capitalization?

The January and November 2021 GME social quantity spikes coincided not simply with Bitcoin’s rally and tops, but additionally with the altcoin market’s capitalization. Nonetheless, the Could 2024 one didn’t. In reality, altcoins’ market cap has been increasing since October 2023.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

In conclusion, the connection seems to be that of a surge in GME social exercise strengthening a prevailing bullish development within the crypto-market. Nonetheless, it won’t essentially manufacture one.