- Michael Saylor noticed Bitcoin as a safe and secure funding.

- Bitcoin’s RSI has shaped a bullish divergence on a every day time-frame, indicating a development reversal.

Michael Saylor, the Chairman of MicroStrategy has garnered vital consideration from crypto fanatics following his latest Bitcoin [BTC] prediction.

On the tenth of September, throughout an interview with “CNBC Squawk Box,” Saylor made a daring prediction that Bitcoin may attain $13 million by 2045.

Micheal Saylor’s daring prediction

Through the interview, Saylor highlighted that BTC represented solely 0.1% of worldwide capital, however he believed it may develop to 7%. If this massive shift happens, it may push BTC’s worth to $13 million.

Moreover, Saylor identified that Bitcoin is exclusive as a result of it doesn’t depend on any third occasion, which makes it much less dangerous as in comparison with different funding merchandise.

Whereas many view Bitcoin as a high-risk funding resulting from its unstable nature, Saylor argued that it’s truly a protected choice for traders who consider in safe and secure funding.

Bitcoin technical evaluation and key ranges

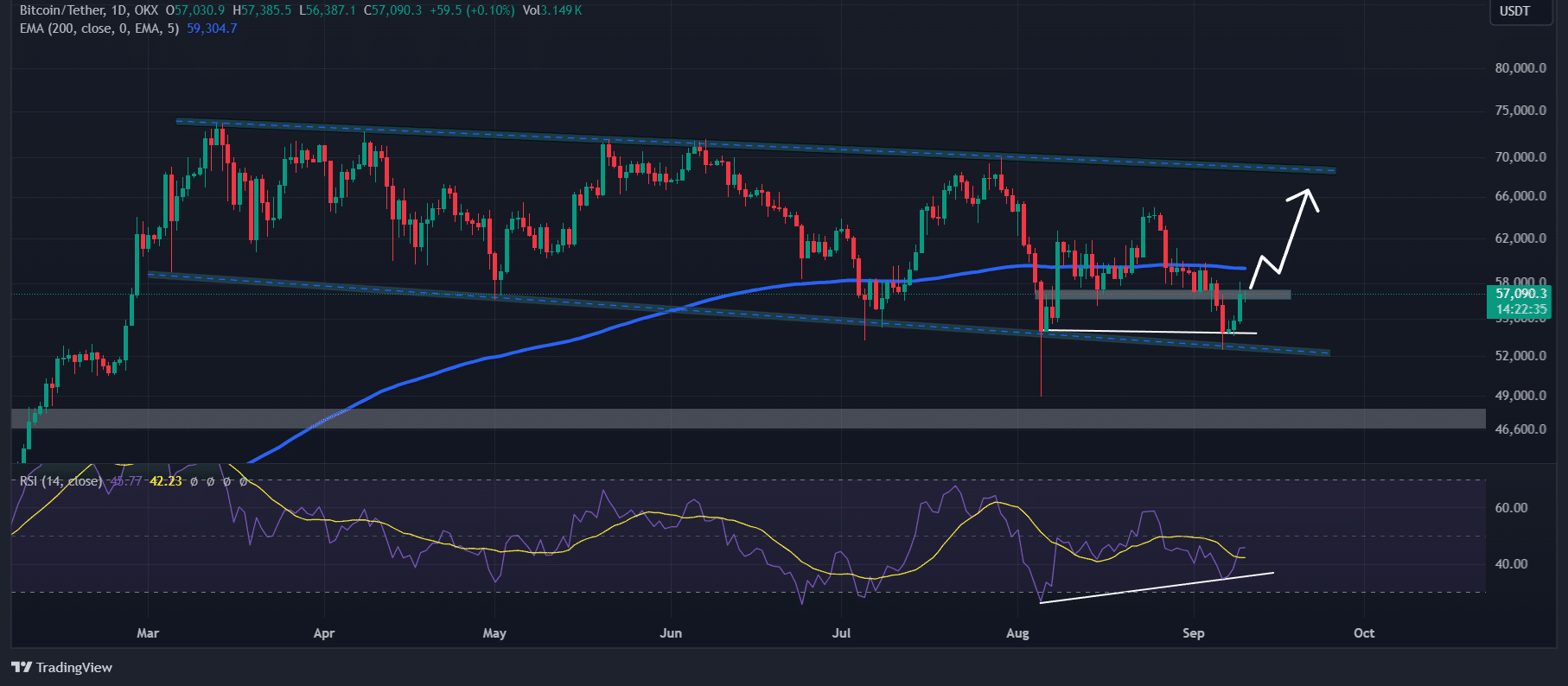

Regardless of Saylor’s predictions, which spans 21 years, AMBCrypto‘s present professional technical evaluation confirmed that Bitcoin appeared bullish, regardless of buying and selling under the 200 Exponential Shifting Common (EMA) on the every day timeframe.

Since March 2024, Bitcoin has been transferring inside a descending parallel channel, and through this era, the BTC worth has touched the decrease channel 5 occasions.

Primarily based on historic information, at any time when BTC reaches the decrease channel, it tends to expertise a worth surge of over 20%. We may even see the same surge this time.

Nonetheless, Bitcoin is at present going through sturdy resistance close to the $57,300 stage.

If it breaks out and closes a every day candle above that stage, there’s a excessive risk BTC may soar considerably, and probably attain $65,000 and $69,000 within the coming days.

In the meantime, Bitcoin’s Relative Power Index (RSI) has shaped a bullish divergence on a every day time-frame, indicating a development reversal from a downtrend to an uptrend.

Bullish on-chain metrics

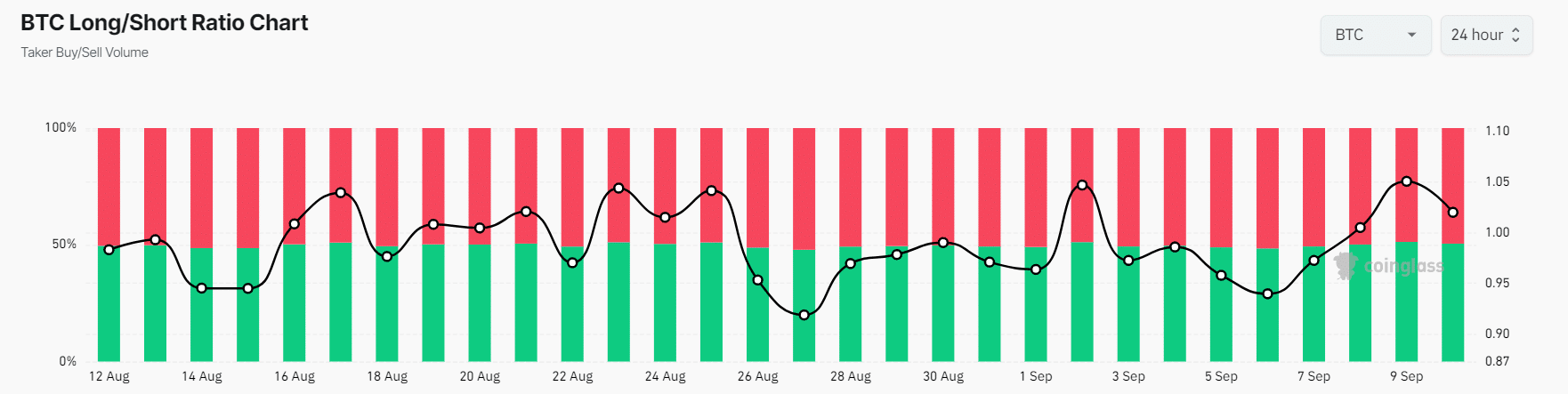

On-chain metrics additionally help this bullish outlook. Coinglass’s BTC Lengthy/Brief ratio stood at +1.039 at press time, reflecting a constructive sentiment amongst bullish merchants during the last 24 hours.

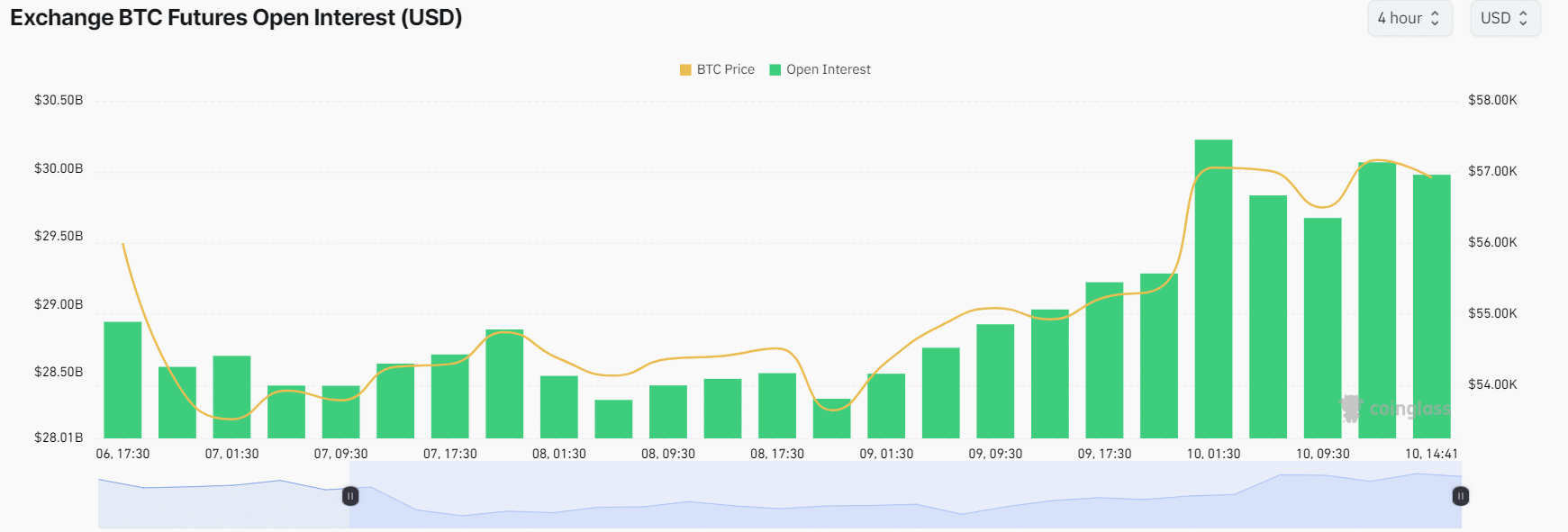

BTC’s Future Open Curiosity has elevated by over 3% throughout the identical interval and has been rising steadily for the previous few days.

A constructive lengthy/quick ratio and excessive Open Curiosity suggests potential shopping for alternatives. Merchants typically use this mixture to construct their positions.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

At press time, BTC was buying and selling close to the $57,000 stage, having skilled a worth surge of over 3% within the final 24 hours.

Its buying and selling quantity has skyrocketed by 46% throughout the identical interval, indicating greater participation from crypto fanatics amid worth restoration.