- Bitcoin reached a brand new all-time excessive of $106,554, fueling market pleasure and adoption.

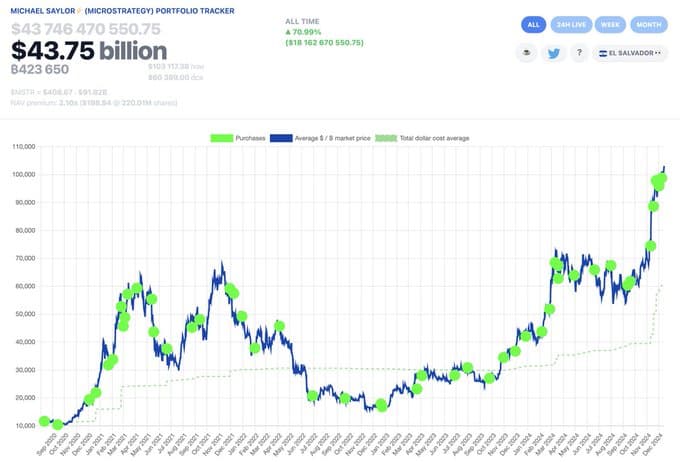

- MicroStrategy nears $50B Bitcoin portfolio as Saylor alerts extra BTC purchases above $100K.

Michael Saylor, government chairman of MicroStrategy, has hinted at one other Bitcoin [BTC] buy, suggesting it may very well be the corporate’s first acquisition at a mean worth above $100,000 per coin.

This improvement comes as Bitcoin reached a brand new all-time excessive, reflecting sturdy momentum within the cryptocurrency market.

Saylor hints at one other Bitcoin buy

Michael Saylor posted on X (previously Twitter), asking if SaylorTracker, a platform that displays MicroStrategy’s Bitcoin holdings, was “missing a green dot.”

This assertion has sparked hypothesis that MicroStrategy bought extra Bitcoin over the weekend.

Saylor has shared related posts on 5 consecutive Sundays for the reason that tenth of November. In every occasion, a confirmed Bitcoin buy by MicroStrategy adopted the subsequent day.

The corporate beforehand acquired Bitcoin at common costs of $97,862, $95,976, and $98,783 on three consecutive Mondays from the twenty fifth of November to the ninth of December, in keeping with SaylorTracker knowledge.

Bitcoin reaches new ATH

The hypothesis surrounding MicroStrategy’s buy comes as Bitcoin achieved a record-breaking worth of $106,554.

As of press time, Bitcoin was buying and selling at $104,958, representing a 3.14% improve up to now 24 hours and a 6.05% rise over the previous week.

With Bitcoin’s circulating provide at 20 million BTC, its market capitalization now stands at over $2 trillion.

Elevated buying and selling volumes and heightened investor curiosity have contributed to the cryptocurrency’s bullish momentum.

Santiment knowledge reveals that for the reason that tenth of October, there was a 9.9% rise in wallets holding not less than 100 BTC, including 1,582 new wallets throughout this era.

MicroStrategy nears $50 billion portfolio

MicroStrategy held 423,650 BTC at press time, valued at over $43.6 billion as of the fifteenth of December. A purchase order at or above $100,000 per coin would mark a significant milestone for the corporate.

Saylor has persistently maintained that MicroStrategy will proceed accumulating Bitcoin, no matter worth ranges.

He beforehand said he’s “sure” the corporate would nonetheless buy Bitcoin even at $1 million per coin.

The agency’s Bitcoin funding technique has contributed to the distinctive efficiency of MicroStrategy’s inventory (MSTR) this 12 months.

In accordance with Google Finance knowledge, MSTR shares have surged 496.4% year-to-date, positioning it as one of many top-performing shares on Nasdaq in 2024.

1.jpg)