- MicroStrategy seeks approval for a ten billion MSTR share depend improve.

- MSTR’s 263% YTD features greater than doubled BTC’s 112%.

MicroStrategy, the pioneer of Bitcoin company treasury, plans to extend its MSTR share depend to 10 billion to speed up its BTC acquisition program.

In a submitting with the US regulator, the Securities and Alternate Fee (SEC), the agency notified shareholders of a particular assembly to hunt approval for the share increment.

If the proposals are accredited, the category A typical inventory can be elevated from 330 million to 10.3 billion shares. Equally, the popular inventory can be expanded to 1 billion from the present 5 million shares.

This is able to convey complete share counts to over 11 billion, which the corporate stated would assist obtain its BTC acquisition technique dubbed the ‘21/21 Plan.’

MicroStrategy to purchase extra BTC?

The plan was initially introduced in October 2024. It targets $42 billion in capital raised via fairness issuance ($21B) and $21B debt devices (convertible notes) within the subsequent three years.

A part of the board’s assertion on the latest share depend increment proposal learn,

“We are seeking stockholder approval to increase the number of authorized shares of Preferred Stock so that we may expand the types of securities we offer into the market, to execute on our business strategy, including as part of our 21/21 plan, and/or engage in other strategic activities without using cash or Class A Stock.”

Reacting to the replace, Joe Burnett, director of market analysis at Unchained, claimed that the transfer might push the BTC value greater. He stated,

“MSTR wants to issue 10 billion more shares. At current market prices, that would be $3.3 trillion—or 36 million Bitcoins…I’m guessing the price of Bitcoin will be going much higher.”

Nevertheless, others have been involved the transfer might dilute the present MSTR’s worth.

For the reason that 21/21 Plan announcement, MicroStrategy has acquired 192,042 Bitcoins, together with the most recent bid of 5,262 BTC introduced on the December twenty third. The agency now holds 444 262 BTC, price almost $42 billion per present value.

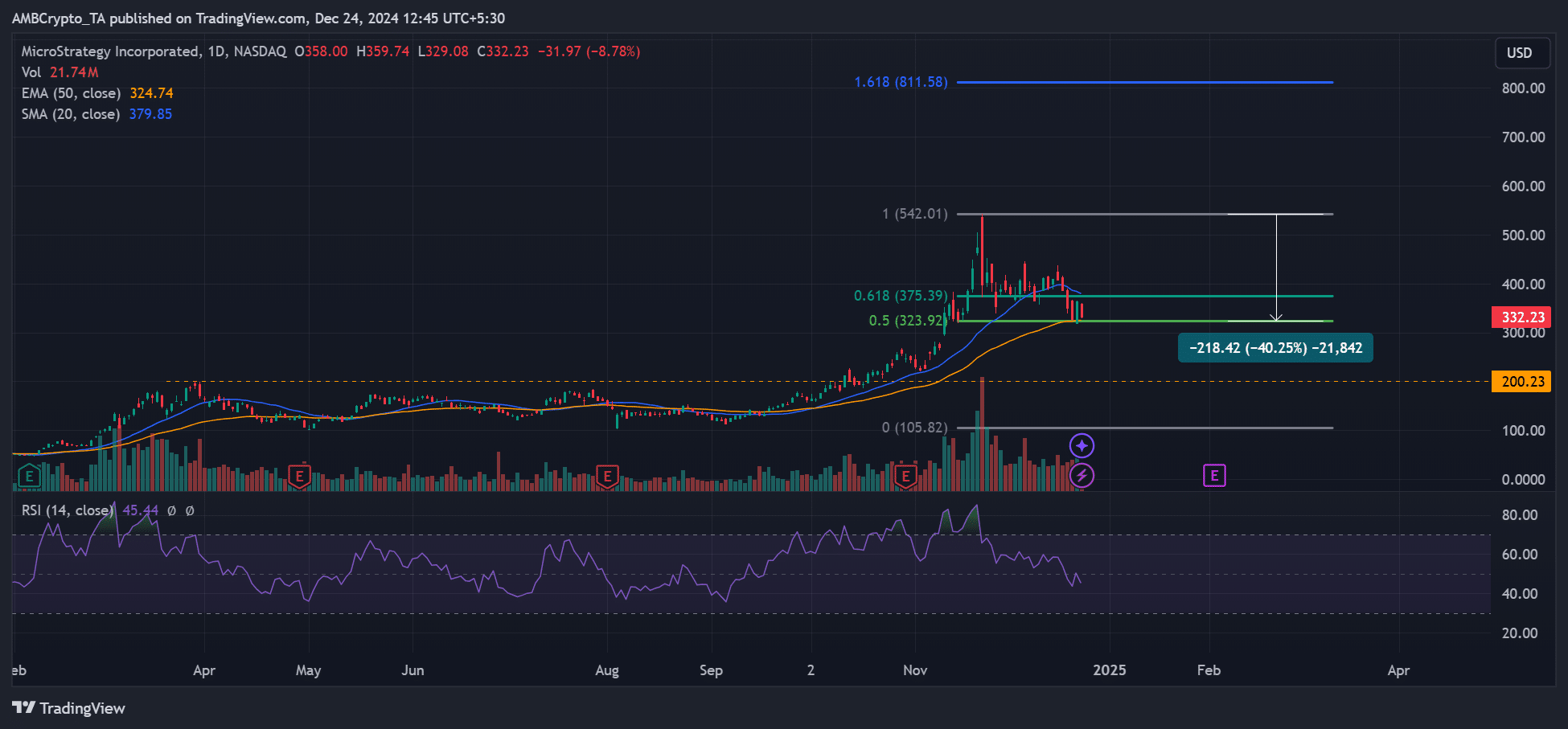

MSTR pumped 11% following MicroStrategy’s newest BTC bid. Nevertheless, the inventory’s value has declined almost 40% amid BTC correction from $108K to a low of $92K. Nevertheless it had 263% features on a year-to-date (YTD) in comparison with BTC’s 112%.

Though MSTR defended the 50% Fib degree and 50-day EMA confluence at press time at $323; any additional BTC correction might decrease the inventory’s worth.