- Tried value motion under $58k may arrange an opposing transfer

- BTC’s motion throughout Monday – Tuesday may very well be key to crypto’s subsequent transfer

Bitcoin [BTC], at press time, was on a downtrend on the upper timeframe charts. The volatility it noticed within the first half of August has left behind targets on the chart that the value would possible revisit quickly.

Because the highs made on 25 August, Bitcoin has fallen by 10.6% on the charts. Nevertheless, the value drop under $60k may see a short-term reversal. What ought to merchants count on for the approaching week of buying and selling?

Dreaded Monday volatility may very well be stuffed with alternatives

Mondays have loads of significance in conventional markets and the excessive and low made on the day may set the tone for the approaching week of buying and selling. It can be crucial for the crypto markets for related causes.

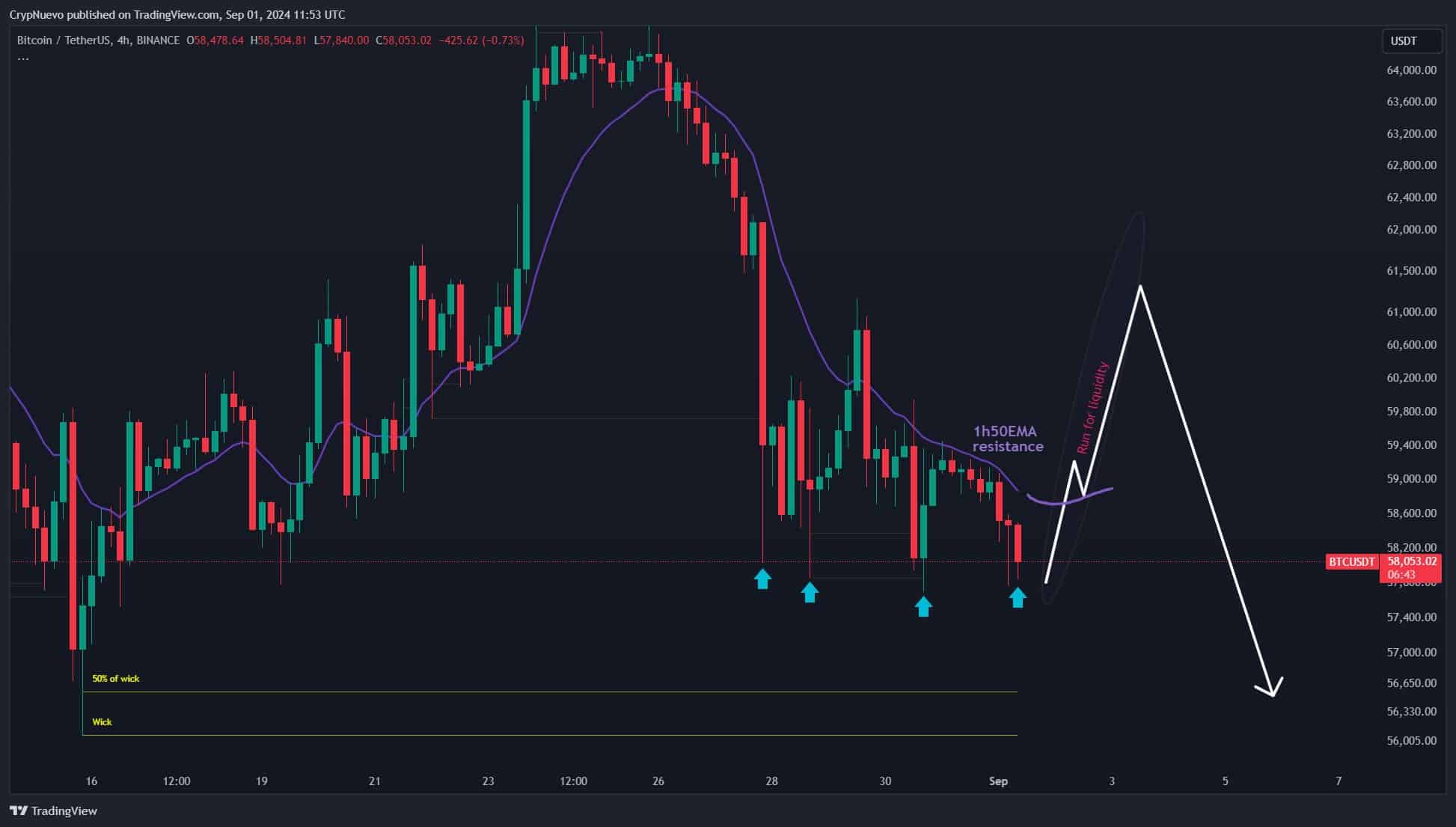

Supply: CrypNuevo on X

Crypto analyst CrypNuevo noticed in a put up on X that there have been fascinating liquidity targets for BTC over the subsequent 24-48 hours. To the south, the $56.3k area, the place the value left a big wick on 15 August, may very well be a sexy goal within the coming days.

He famous that tried value pushes under $58k didn’t materialize and this was possible indicative that the market maker is constructing a place.

What this implies is that we will count on a value transfer upwards to hunt the liquidity that has been constructed within the brief time period. Particularly as market contributors count on an prolonged transfer south. This liquidity run upwards may current a tradable alternative.

What are the probabilities of a brief squeeze?

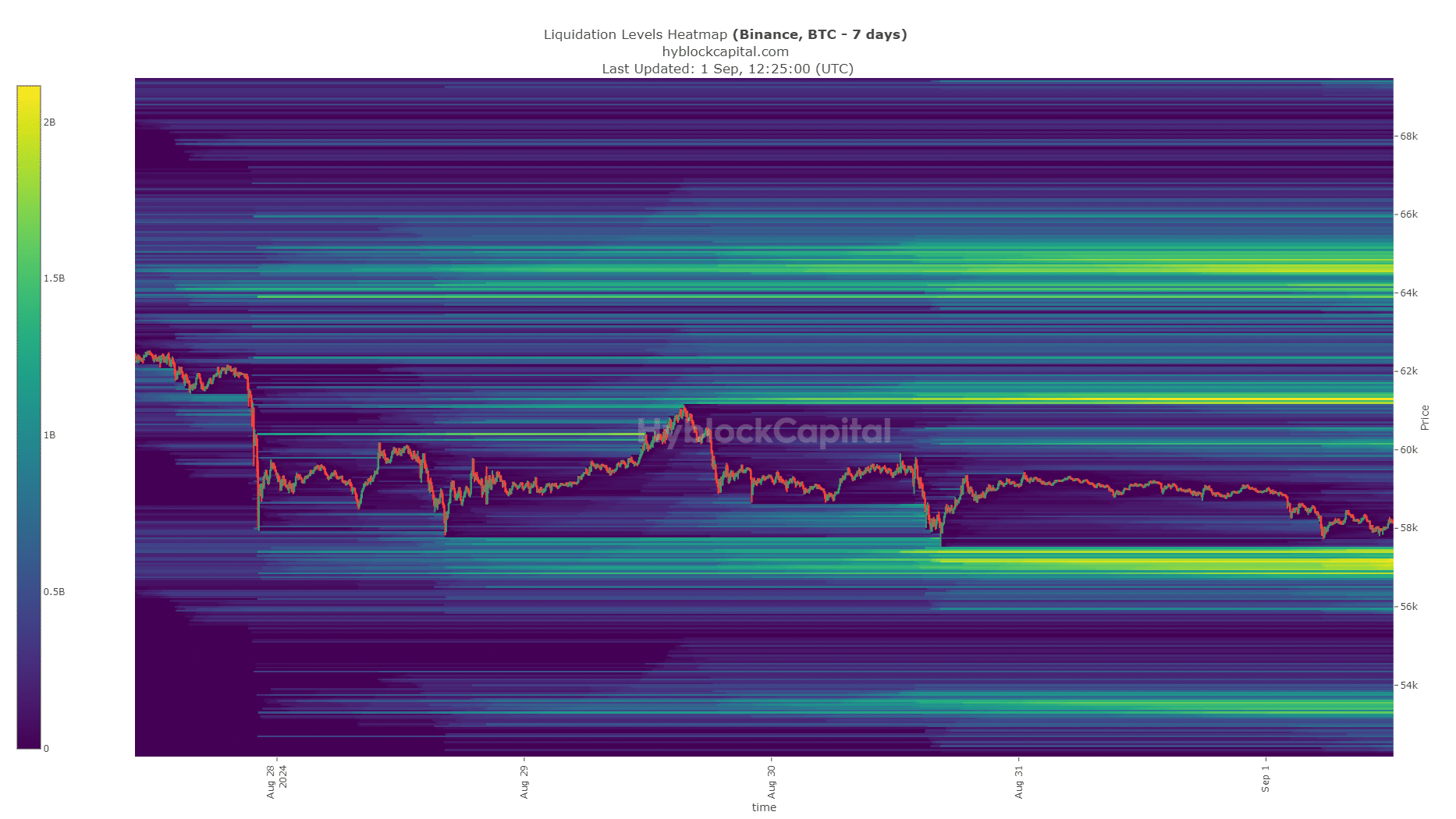

Supply: Hyblock

AMBCrypto discovered that the short-term liquidation ranges had been clustered across the $57.1k and $61.3k area. Given the proximity of the market value to $57.1k, contributors count on a transfer south.

Nevertheless, this expectation has constructed liquidity overhead, as coated beforehand.

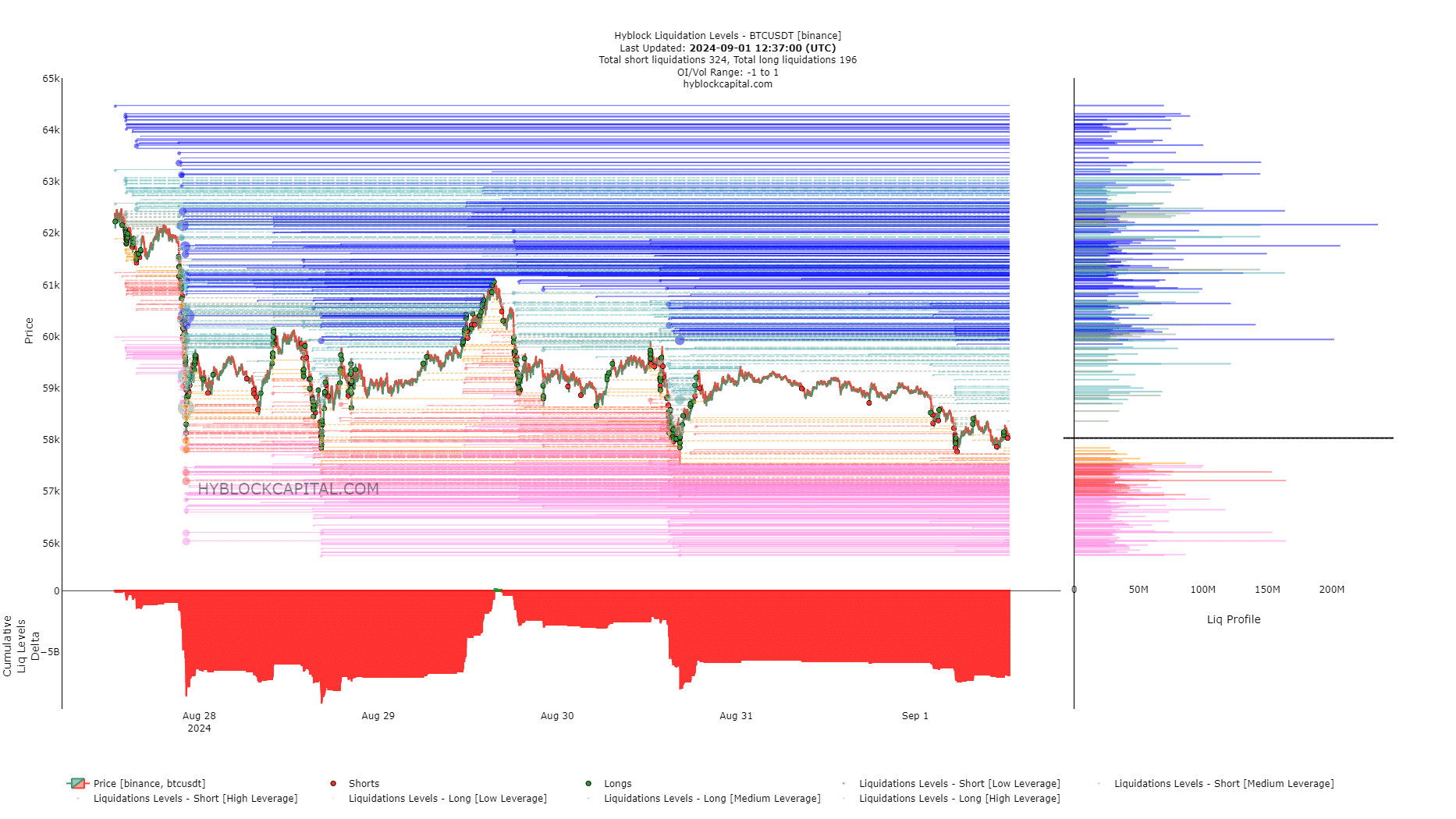

Supply: Hyblock

The cumulative liquidation ranges delta was extremely unfavourable and confirmed that the brief liquidations outweighed the lengthy ones. This might see costs shoot increased in quest of liquidity and steadiness the Futures market’s expectations.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

The liquidity ranges noticed a notable cluster at $59.9k and $61.7k, marking these as short-term targets. Merchants going lengthy earlier than Monday would should be courageous within the face of volatility to earn earnings.